The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the total number of job openings in the economy dropped to 10.053 million in August, down from 11.170 million in July.

The number of open positions in the private sector decreased to 9.037 million in August, down from 10.065 million in July. August was the fourth decline in the last five months and the lowest level since June 2021 (see first chart).

The total job openings rate, openings divided by the sum of jobs plus openings, fell to 6.2 percent in August from 6.8 percent in July while the private-sector job-openings rate fell to 6.5 percent from 7.2 percent in the previous month (see first chart). The August result for the private sector is the lowest since April 2021.

The industries with the highest openings are education and health care (1.885 million), professional and business services (1.872 million), trade, transportation, and utilities (1.638 million), and leisure and hospitality (1.405 million). The highest openings rates were in leisure and hospitality (8.2 percent), professional and business services (7.7 percent), and education and health care (7.1 percent).

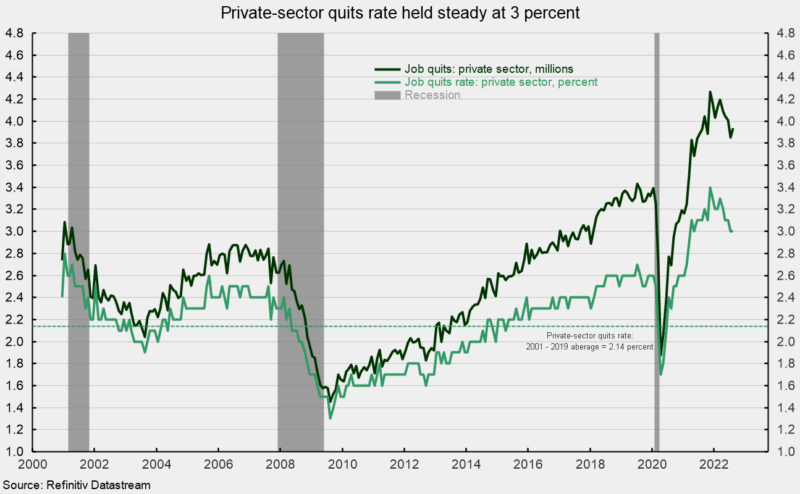

The number of private-sector quits ticked higher in August, coming in at 3.937 million, up from 3.850 million in July (see second chart). Leisure and hospitality led with 956,000 quits followed by trade, transportation, and utilities with 867,000 quits, and by professional and business services with 682,000.

The private-sector quits rate held at 3.0 percent in August. The private-sector quits rates for the last two months are the lowest since May 2021 and 0.4 percentage points below the record high of 3.4 percent in November 2021 (see second chart).

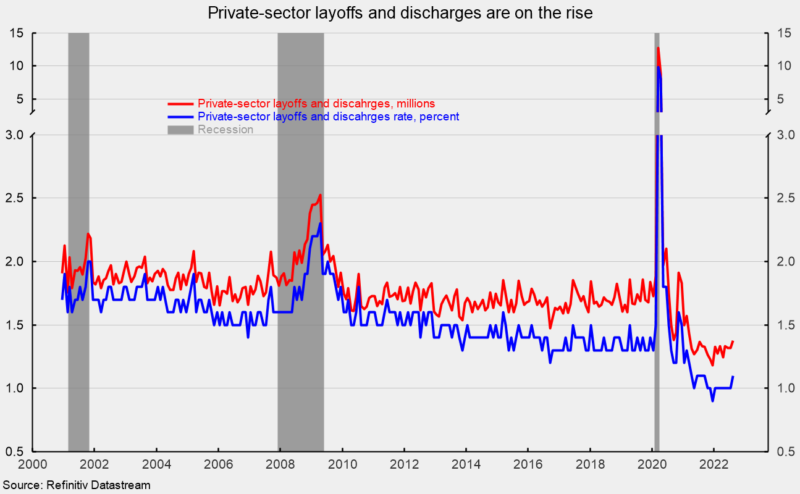

Private-sector layoffs and discharges increased in the latest month, rising to 1.375 million, up from 1.317 million in July. The trend in layoffs and discharges may be higher since hitting a low of 1.183 million in December 2021 (see third chart). The private-sector layoffs and discharge rate also rose in August, coming in at 1.1 percent, the highest since September 2021 (see third chart).

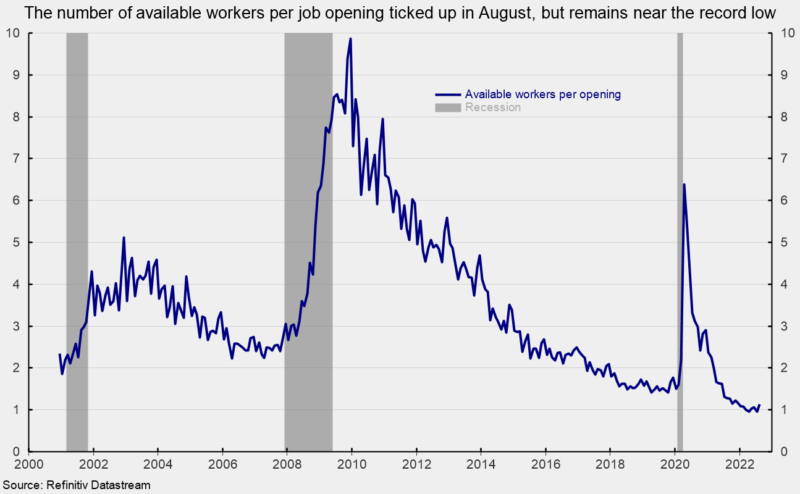

The number of job seekers (unemployed plus those not in the labor force but who want a job) per opening ticked up slightly in August, rising to 1.137 in August from 0.954 in July (a record low). Before the lockdown recession, the low was 1.409 in October 2019 (see fourth chart).

Today’s job openings data provide additional evidence suggesting the economy is weakening. While the low number of available workers per opening implies the labor market remains tight, the deterioration at the margin is a warning sign. Caution is warranted.