Key Factors

Utilized Digital’s newest quarterly report has added extra gas to the inventory’s red-hot rally.

Traders might now be questioning if this knowledge heart specialist has room for extra upside.

A more in-depth take a look at administration’s feedback on the latestearnings callsuggests that Utilized Digital’s phenomenal progress is right here to remain.

- 10 shares we like higher than Utilized Digital ›

Utilized Digital (NASDAQ: APLD) inventory shot up impressively in 2025. Even higher, it’s got off to a flying begin within the new 12 months as properly. Shares of the corporate are up almost 56% already in 2026 as of this writing, and its newest outcomes counsel that they might proceed hovering all year long.

Let’s take a more in-depth take a look at Utilized Digital’s most up-to-date quarterly report and examine why this synthetic intelligence (AI) knowledge heart specialist has room to ship extra beneficial properties to traders within the new 12 months.

The place to take a position $1,000 proper now? Our analyst staff simply revealed what they consider are the 10 finest shares to purchase proper now, if you be a part of Inventory Advisor. See the shares »

Picture supply: Getty Pictures.

Utilized Digital might proceed outpacing the market’s progress expectations

Utilized Digital launched its fiscal 2026 second-quarter outcomes (for the three months ended Nov. 30, 2025) on Jan. 7. The corporate reported a 250% year-over-year improve in income to $126.6 million, crushing the consensus estimate of $88 million by a giant margin.

Utilized Digital designs, builds, and operates devoted AI knowledge facilities for hyperscalers and neocloud suppliers resembling CoreWeave. The corporate is presently constructing two knowledge heart campuses in North Dakota with a mixed energy capability of 600 megawatts (MW). The great half is that it has already offered out this knowledge heart capability to CoreWeave and one other unnamed hyperscaler.

These two prospects are anticipated to generate $16 billion in lease income for Utilized Digital over 15 years. Importantly, the corporate has already began producing lease income from its first 100 MW knowledge heart. Utilized Digital anticipates its lease income to ramp up over the following 18 to 24 months because it readies the remaining capability beneath development for service.

Nevertheless, do not be stunned to see Utilized Digital bringing extra prospects on board throughout this era. As identified by CEO Wes Cummins on the most recent earnings name:

Having secured two hyperscale leases within the area, inbound demand has elevated meaningfully. In consequence, we’re in superior discussions with one other investment-grade hyperscaler throughout a number of areas, together with extra areas within the Dakotas and choose southern U.S. markets.

Cummins added that Utilized Digital is well-positioned to begin the development of extra knowledge heart campuses within the close to time period, if it secures extra contracts. Utilized Digital additionally factors out that it might rapidly construct and deploy knowledge facilities by utilizing prefabricated parts and operating a number of concrete vegetation. The shorter development timelines might finally assist it carry extra purchasers on board because the demand for AI knowledge facilities is about to outpace provide within the U.S. within the coming 12 months.

Goldman Sachs estimates that knowledge heart capability within the U.S. will fall behind demand by a median of 10 GW yearly by means of 2028. So, Utilized Digital might get extra contracts to construct knowledge heart capability in 2026. That might permit it to take care of its terrific progress price as it is going to be in a position to generate extra income from the outfitting of knowledge facilities for its purchasers. On the similar time, the lease income ramp-up within the coming months ought to act as one other catalyst for the corporate.

Traders can anticipate terrific upside from the inventory in 2026

Utilized Digital has a 12-month median value goal of $42.50, in line with 14 analysts masking the inventory, with all of the analysts ranking it as a purchase. That factors to a possible upside of 13% from present ranges, indicating that this AI inventory might nonetheless transfer larger. Nevertheless, Utilized Digital might simply clock greater beneficial properties than that.

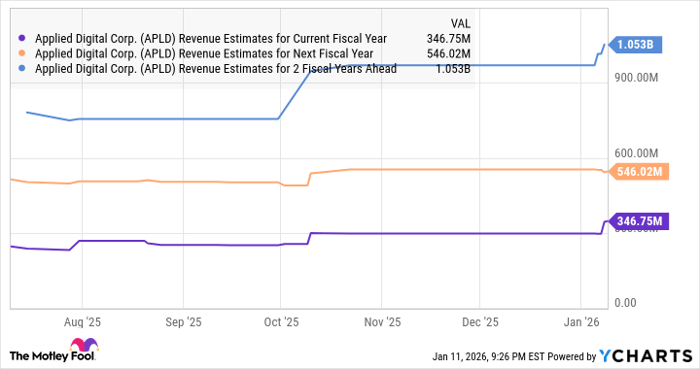

The next chart exhibits how a lot income Utilized Digital is anticipated to ship within the present and the following two fiscal years.

Information by YCharts.

The corporate’s income within the first six months of the present fiscal 12 months stands at nearly $191 million, placing it on monitor to simply exceed the market’s expectations for fiscal 2026. The consensus income estimate for the following fiscal 12 months factors towards a 57% potential bounce in its prime line, a determine that Utilized Digital can simply exceed based mostly on the factors mentioned within the earlier part.

So, do not be stunned to see Utilized Digital inventory exceeding analysts’ median 12-month value goal in 2026 and commerce nearer to the Avenue-high value goal of $99, which is greater than 2.5 instances its present inventory value.

Do you have to purchase inventory in Utilized Digital proper now?

Before you purchase inventory in Utilized Digital, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Utilized Digital wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Netflix made this record on December 17, 2004… in case you invested $1,000 on the time of our advice, you’d have $482,209!* Or when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $1,133,548!*

Now, it’s value noting Inventory Advisor’s complete common return is 968% — a market-crushing outperformance in comparison with 197% for the S&P 500. Do not miss the most recent prime 10 record, out there with Inventory Advisor, and be a part of an investing group constructed by particular person traders for particular person traders.

See the ten shares »

*Inventory Advisor returns as of January 13, 2026.

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Goldman Sachs Group. The Motley Idiot has a disclosure coverage.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.