JimVallee

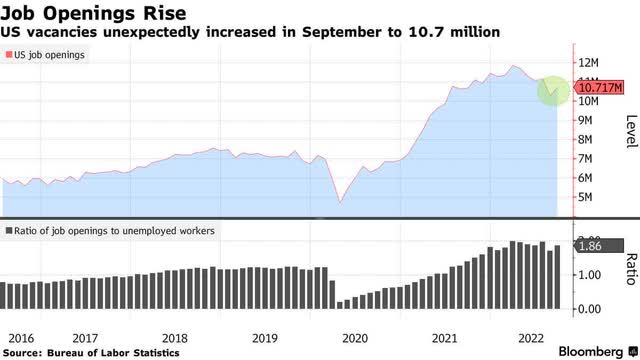

Stocks opened higher yesterday on rumors that China may be phasing out its onerous Covid Zero policy, which continues to weigh on global supply chains and stifle China’s full economic recovery. The rally fizzled rapidly after the release of the Job Openings and Labor Turnover Survey (JOLTS), which showed openings rose some 400,000 to 10.7 million in September. That is moving in the wrong direction for a labor market that is already hot, despite still being well off the peak of 11.9 million openings in March. The fear is that rising demand for labor will put additional upward pressure on wages, which could keep the rate of inflation elevated. This renewed doubts about a dovish pivot from Chairman Powell when he speaks this afternoon after the Fed most assuredly raises short-term interest rates by another 75 basis points.

Finviz

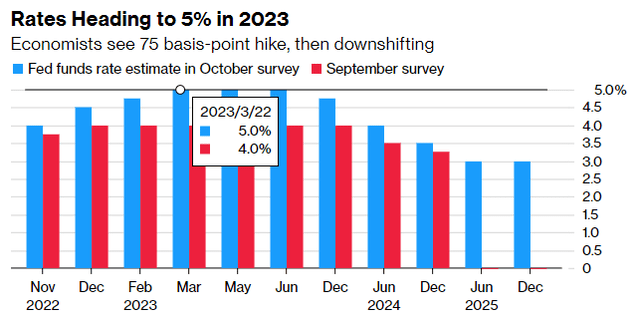

Yet I don’t think the market is looking for Powell to make an outright dovish pivot today. To the contrary, Fed rhetoric is bound to stay hawkish to manage inflation expectations and attempt to limit further enthusiasm for risk assets, which could fuel the wealth effect. I think the rally over the past two weeks was not conditioned on a pivot, but merely an acknowledgement that enough progress has been made to date to reduce the size of rate hikes moving forward. I would call that more of a taper than a pivot. I think the Fed is more likely to hike by 50 basis points in December, marking the end of its rate hike cycle, as it watches for a more discernible downtrend in the rate of inflation, which leading indicators say is coming. The market is rallying in anticipation of that peak.

Bloomberg

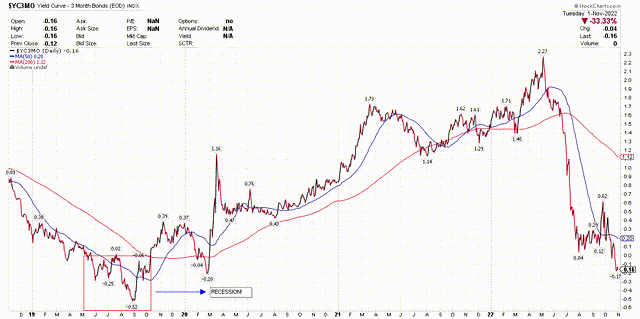

Offsetting the perceived strength of job openings in the service sector yesterday were the ISM and S&P Global purchasing manager surveys (PMI) for the manufacturing sector. Both showed growth stagnating in October, as new orders have fallen in four of the past five months, while the sub-index that measures prices paid has fallen to its lowest level in two years. These surveys reflect a sharp deceleration in price increases, while job openings only indicate the possibility of wage increases that have already started to moderate. This is why the 3-month/10-year Treasury yield curve inverted for the first time last week, whereby the short-term yield has edged higher than the long-term yield, telling the Fed that monetary policy is becoming overly restrictive. I’m not concerned about an inversion that last a week or two, but if it sustains through year end then I’ll grow concerned about the current expansion ending in 2023.

stockcharts

Despite what Powell says today, which is likely to be resolutely hawkish, I think he will listen to the markets. If so, then the peak short-term rate should be well below the 5% that the consensus of economists sees coming in March of next year. The easing in 2-year yields, which indicates the market’s outlook for where short-term rates will be a year from now, agrees with me. It has pulled back from a high of 4.62% to 4.3%, before rebounding to 4.54% yesterday over the near-term uncertainty of Powell’s remarks today.

Bloomberg

The Technicals

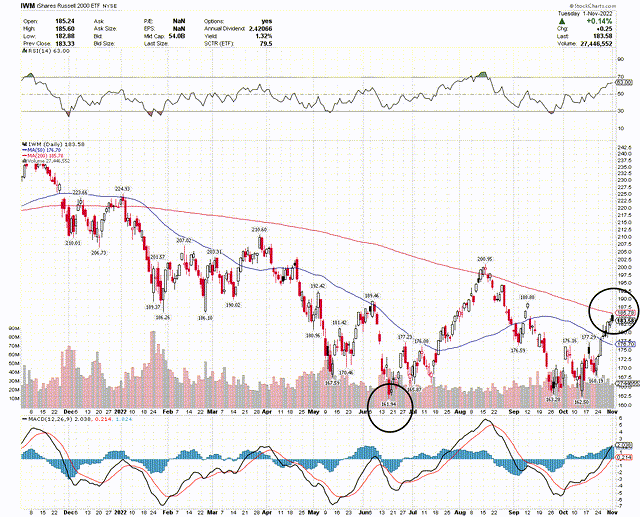

After one of the best performing months for the Dow Jones Industrials since 1915, do not be surprised if we pause or retreat from current levels in the major averages to allow the market to digest the gains. The bears will come out of the woodwork to tag the rebound as a bear market rally, inciting fear in weak shareholders. The more domestically focused Russell 2000 index bottomed in June, well before the S&P 500 and Nasdaq Composite, which I view as a sign of strengthening market breadth. Yet it has now met overhead resistance at its 200-day moving average, which invites a pullback to consolidate for another more powerful run higher. Still, don’t be surprised to see a sharp pullback on Powell’s commentary today.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.