Joe Hendrickson

Based mostly in 1963, Portillo’s Inc. (NASDAQ:PTLO) operates consuming locations that serve Chicago-style scorching canine, along with grilled burgers, beef sandwiches, and totally different meals objects. The company has continued rising its restaurant chain nationwide all through america, displaying fastened good earnings improvement.

The company’s post-IPO stock effectivity after the 2021 IPO has been poor, as a result of the stock has misplaced over two thirds of the price from its preliminary shopping for and promoting. After the stock has had such a weak run amid Portillo’s continued nationwide development, activist company Engaged Capital has now taken curiosity inside the restaurant chain to indicate the expansion approach spherical.

Stock Chart From IPO (On the lookout for Alpha)

Portillo’s Is Rising Ambitiously, Nonetheless With Too Heavy Capital Investments

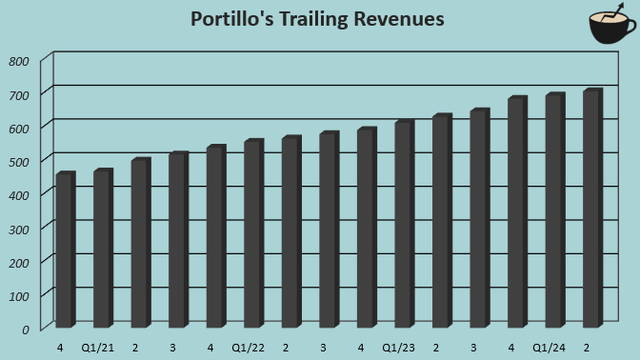

After the IPO, reverse to what the stock price suggests, Portillo’s has continued rising its restaurant footprint with healthful working earnings. After the agency had a whole of 69 areas on the end of 2021, primarily located in Illinois, the company has expanded into a whole of 85 areas on the end of Q2 2024 with new development being primarily exterior of the Illinois market the place Portillo’s was based mostly. Revenues have grown at a CAGR of 8.9% from 2019 to the Q2 2024 trailing revenues of $702.4 million, with healthful same-restaurant product sales improvement.

The enlargement has been achieved with largely healthful profitability, as Portillo’s current working margin trails at 8.1% with working earnings of $56.6 million. The margin stays to be beneath the 2019 working margin of 10.1% totally on account of elevated pre-opening costs at a trailing $9.9 million, nonetheless has expanded healthily from Covid-time margins with slowing inflation and normalized guests.

The not too way back reported Q2 comparable product sales improvement acquired right here in at solely a weak -0.6%, nonetheless seems to be related additional to weak commerce guests instead of Portillo’s-specific factors.

Author’s Calculation Using TIKR Data

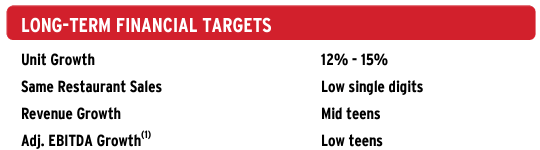

The achieved improvement is barely the start of Portillo’s formidable targets. The company targets 12-15% annual unit improvement with 10+ new gadgets being developed in 2024 alone, totaling for a whole mid-teens annual earnings improvement purpose when combined with the gradual same-restaurant product sales improvement purpose – with solely 85 areas glorious, Portillo’s stays to be pretty a small chain with publicity being largely in Illinois, enabling it for a protracted improvement runway.

PRTO Q2 Investor Presentation

Whereas Portillo’s improvement has been good to this point, the stock hasn’t appreciated with the restaurant neighborhood development. The reason would possibly depend upon Portillo’s capital heavy development the place the company develops its private precise property – capital expenditures reached $87.9 million in 2023 with the identical capital expenditure steering for 2024, pushing cash flows unfavourable no matter healthful earnings. The heavy precise property development has moreover weakened capital effectivity considerably proper into a gift low 6.9% return on equity, not making the current development very accretive to merchants.

The heavy development approach has moreover prompted dilution and compelled Portillo’s to sort out vital debt, with a gift $305.1 million of entire curiosity bearing debt standing on the company’s steadiness sheet. Weighted glorious shares have elevated from 35.8 million in 2021 into in the intervening time trailing 57.5 million.

With the restaurant commerce’s pretty cyclical earnings nature and immense opponents, the current amount of debt is unhealthy, although I do think about that the current precise property portfolio can nonetheless help such debt with potential sale-and-leasebacks.

Engaged Capital Takes a Stake in Portillo’s

Simply recently, activist company Engaged Capital was launched to have taken a stake in Portillo’s, sending the refill moderately. The switch from the activist investor company might very nicely be vital for Portillo’s – typical for activist merchants, Engaged Capital’s approach revolves spherical sustaining an excellent possession of a corporation (in the intervening time nearly 10% of Portillo’s), and pushing for operational changes to in the long run drive shareholder price from a long-term proprietor’s perspective. The company may also be acknowledged for its worthwhile turnaround efforts with Shake Shack (SHAK).

Whereas Engaged Capital isn’t pursuing for administration changes, CNBC’s report on the matter showcases quite a few the operational changes that Engaged Capital has acknowledged with Portillo’s. Most notably, the activist funding company is pushing for a novel development funding approach – comparatively than spending immense portions of capital on creating company-owned precise property, showcased by Portillo’s current $85-88 million capital expenditure steering for 2024, Engaged Capital is pushing for additional agile development. Engaged Capital believes that combined, lighter precise property investments and smaller new location sizes would possibly in the long run double new consuming locations’ cash-on-cash returns from 25% to 50%. With the lighter development model, Engaged Capital is pushing for accelerated nationwide development.

I think about that Engaged Capital’s involvement is excellent for Portillo’s. Whereas I’ve been bearish on Shake Shack on account of its extraordinarily extreme valuation, the activist company’s involvement has pushed enhancements inside the agency’s earnings. The proposed, smaller-location development approach for Portillo’s moreover seems to make sense for an off-the-cuff consuming scorching canine & sandwich restaurant chain, and as capital expenditures have ballooned on account of expensive precise property development. A lighter development approach would possibly moreover put an end to Portillo’s pretty extreme prior dilution.

Portillo’s administration’s and board’s reception of the proposed turnaround stays to be unknown, nonetheless as per CNBC’s sources, Engaged Capital’s and Portillo’s administration’s conversations have to this point been constructive – I think about that Engaged Capital’s engagement must put forward on the very least some changes.

Engaged Capital believes that with its options utilized, the stock might very nicely be worth on the very least 100% better than it’s in the intervening time.

PRTO Stock Valuation

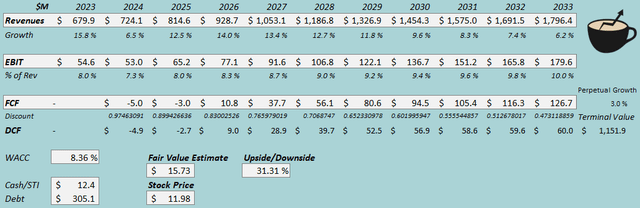

I constructed a diminished cash stream [DCF] model for Portillo’s to estimate a superb price for the stock. Inside the model, I account for changes inside the agency’s development approach as urged by Engaged Capital.

For earnings improvement, I estimate a CAGR of 10.2% from 2023 to 2033 and three.0% perpetual improvement afterwards, nonetheless trailing from Portillo’s private long-term purpose diploma as I think about that some conservatism is due. The earnings estimates would possibly nonetheless successfully develop into too low, notably if Engaged Capital’s accelerated, agile improvement approach is utilized successfully.

I estimate the EBIT margin to slowly climb once more into 10.0%, near the company’s pre-pandemic 10.1% diploma. The margin must, in my opinion, broaden successfully by way of greater mid-term guests with an commerce restoration from an finally greater shopper sentiment, along with good working leverage from greater operations that let for additional atmosphere pleasant promoting and advertising, sourcing, and firm costs. Moreover, the slowing improvement must push down Portillo’s in the intervening time considerably extreme pre-opening worth diploma, most likely allowing for the ten.0% estimate in the long term no matter a lot much less owned precise property development inside the estimates.

By way of the company’s historically good working capital administration, I think about that Portillo’s has the prospect for an excellent cash stream conversion even amid aggressive development, if the company strikes to the additional agile development approach that Engaged Capital suggests – the DCF model comprises the concept Portillo’s strikes additional onto rented properties in its improvement approach in upcoming years, slowly enhancing the conversion.

DCF Model (Author’s Calculation)

The estimates put Portillo’s truthful price estimate at $15.73, 31% above the stock price on the time of writing – I think about that if Engaged Capital’s options endure, the stock would possibly lastly have seen a bottom and will very nicely be a beautiful funding various.

The earnings estimates would possibly moreover develop into too conservative inside the DCF model if Portillo’s improvement approach picks up greater than anticipated.

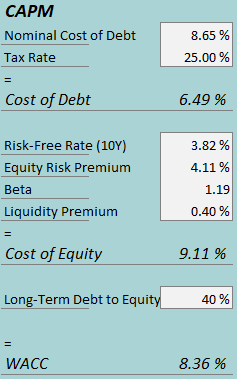

CAPM

A weighted frequent worth of capital of 8.36% is used inside the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Portillo’s had $6.6 million in curiosity payments, making the company’s price of curiosity 8.65% with the current amount of interest-bearing debt. I estimate pretty a extreme 40% long-term debt-to-equity, as Portillo’s leverages pretty a extreme amount of debt.

To estimate the worth of equity, I exploit the 10-year bond yield of three.82% as a result of the risk-free worth. The equity menace premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I exploit Aswath Damodaran’s restaurant commerce beta estimate of 1.19 for Portillo’s. With a liquidity premium of 0.4%, the worth of equity stands at 9.11% and the WACC at 8.36%.

Takeaway

Portillo’s has grown its restaurant footprint at an excellent tempo, nonetheless the stock hasn’t appreciated with the chain’s improvement, as heavy precise property development investments and its required financing have made the expansion weakly accretive to merchants with a poor return on invested capital. Engaged Capital, an activist investor company, has now taken uncover of the underperforming improvement approach and is pushing for changes inside the approach into additional agile development, being a tremendous situation in my opinion. With a lot much less precise property development and smaller unit sizes, the restaurant chain’s underlying price might very nicely be surfaced greater, most likely making the stock a beautiful funding on the in the intervening time low stock price. As such, I provoke Portillo’s with a Buy rating.