metamorworks/iStock through Getty Pictures

Pitney Bowes Inc. (NYSE:PBI) stories recurrent income and ties with giant established companions. In my opinion, Pitney’s technological enhancements and extra partnerships will seemingly indicate a considerably larger inventory valuation. Even contemplating the dangers from regulators, I do not see why Pitney is buying and selling on the present value mark. Beneath my low cost money circulate fashions, the truthful valuation might be price $8, and even $14 relying on a number of assumptions made.

Pitney’s Recurrent Income

Pitney is a tech firm providing digital, bodily, and financing options to assist purchasers ship mails and parcels.

Sidoti & Firm – Small Cap Convention

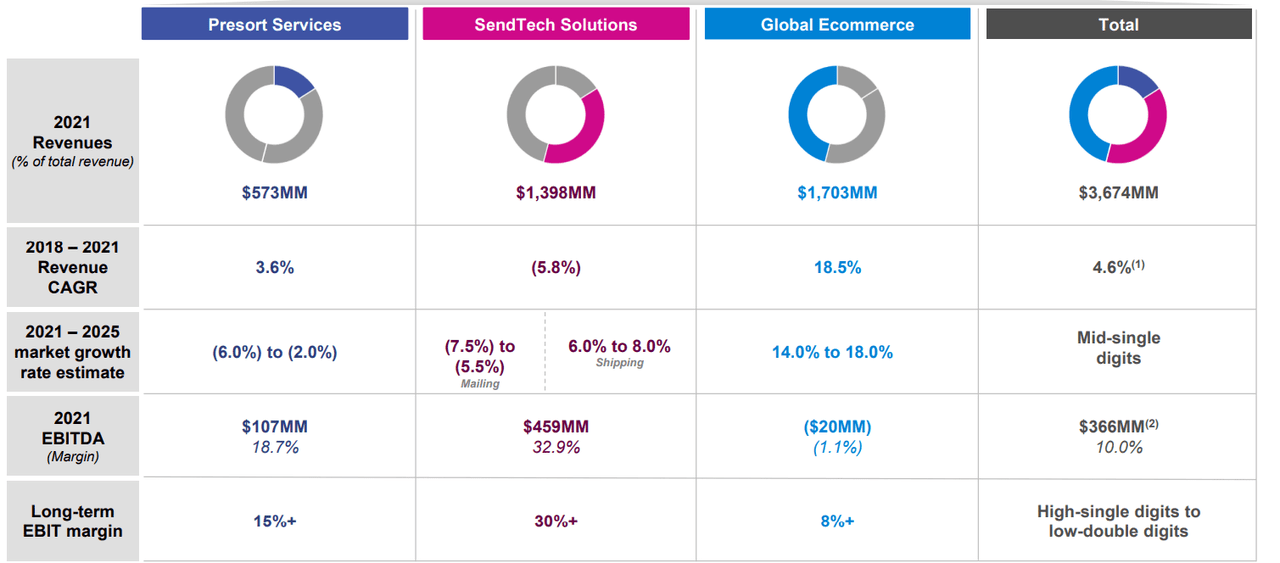

Among the many firm’s enterprise divisions, I imagine that essentially the most attention-grabbing proper now could be the 65%-70% recurrent income reported from SendTech. It signifies that 65% of the income reported by SendTech’s division seems to be recurrent. With this in thoughts, making a DCF mannequin seems fairly handy. Needless to say future EBITDA will most definitely be not very risky:

Sidoti & Firm – Small Cap Convention

Analysts Are Anticipating Gross sales Development And Optimistic Free Money Movement In 2022 And 2023

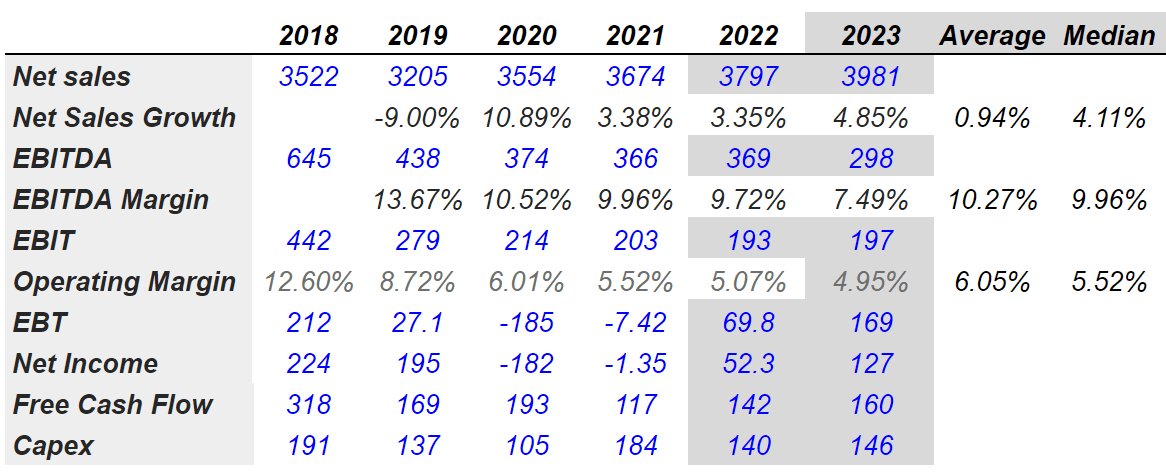

I made an evaluation of earlier and anticipated gross sales development, EBITDA margin, and working margin, which I later utilized in my monetary modeling. Beneath my numbers and that of different analysts, Pitney’s gross sales development could be seemingly near 4.11%, the median EBITDA margin might be near 9.96%, and the working margin might be shut to five.52%. Lastly, most funding advisors predict free money circulate development near $142-$160 million:

Marketscreener.com

The steerage given by administration can be aligned to that of analysts. The corporate expects the goal market to develop at mid-single digits, so in my opinion, gross sales development will seemingly keep near 4%-7%. Pitney’s long-term EBIT margin can be anticipated to be equal to high-single digits to low-double digits.

Sidoti & Firm – Small Cap Convention

Assuming That Extra Purchasers Will Discover Pitney’s APIs, The Inventory Worth May Be Price $8 To $14

With the worldwide ecommerce sector poised for profitability, underneath regular circumstances, I imagine that Pitney will most definitely report gross sales development. I’m additionally optimistic about Pitney due to its delivery utility programming interfaces or APIs. If purchasers will not be reluctant to run their very own coding packages, they might expertise vital effectivity. As extra purchasers study concerning the firm’s digital capabilities, Pitney’s gross sales will seemingly pattern north:

Powered by our delivery APIs, purchasers should buy postage, print delivery labels and entry delivery and monitoring providers from a number of carriers that may be simply built-in into any net utility similar to on-line purchasing carts or ecommerce websites and supply assured supply occasions and versatile cost choices. Supply: 10-Okay

Beneath this base case state of affairs, I’d additionally anticipate extra companions to make use of the corporate’s capabilities. In consequence, the corporate will seemingly get pleasure from sure economies of scale as the amount of labor will improve. In sum, I’d anticipate the corporate’s free money circulate margins to enlarge:

We’re a workshare accomplice of the USPS and nationwide outsource supplier of mail sortation providers that enable purchasers to qualify giant volumes of First-Class Mail, Advertising and marketing Mail and Advertising and marketing Mail Flats and Sure Printed Matter for postal workshare reductions. Our community of working facilities all through the USA and fully-customized proprietary know-how offers purchasers with end-to-end options from choose as much as supply into the postal system community, expedited mail supply and optimum postage financial savings. Supply: 10-Okay

Lastly, on this case, I’m additionally assuming that The Pitney Bowes Financial institution will function with increasingly purchasers. Needless to say the corporate presents revolving credit score options, that are additionally fairly worthwhile for Pitney.

Via our wholly owned subsidiary, The Pitney Bowes Financial institution (the Financial institution), we provide our purchasers in the USA a revolving credit score resolution that permits purchasers to make meter rental funds and buy postage, providers and provides and an interest-bearing deposit resolution to purchasers preferring to prepay postage. Supply: 10-Okay

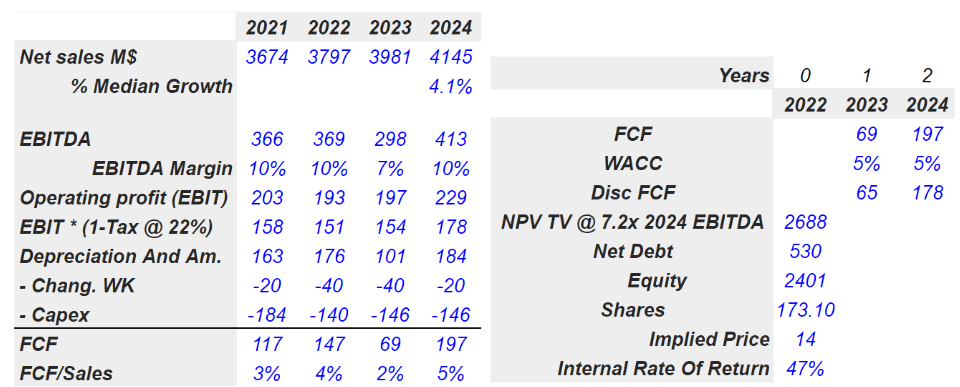

I’m a bit much less optimistic than different analysts, however my numbers will not be removed from these of different analysts. Beneath regular circumstances, I imagine that Pitney may ship as a lot as $4.14 billion in gross sales in 2024.

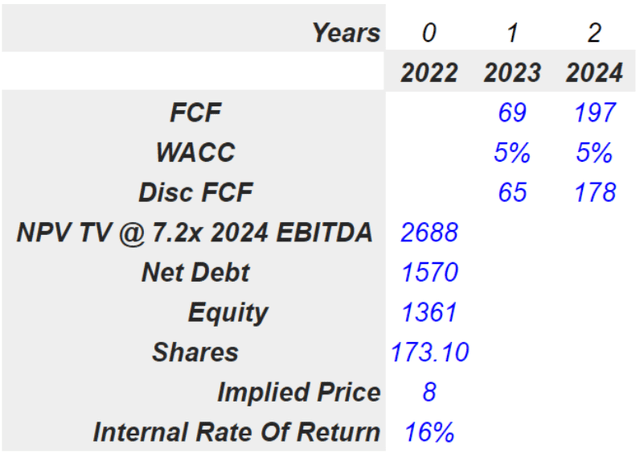

If we additionally use an EBITDA margin starting from 9.9% to 7%, conservative depreciation and amortization, and capital bills round $146 million, 2024 free money circulate would stand at $197 million. If we low cost 2023 and 2024 free money circulate for 2023 and use a terminal EBITDA of seven.2x, the implied fairness could be $2.4 billion. Lastly, the truthful value could be $14:

Writer’s Compilations

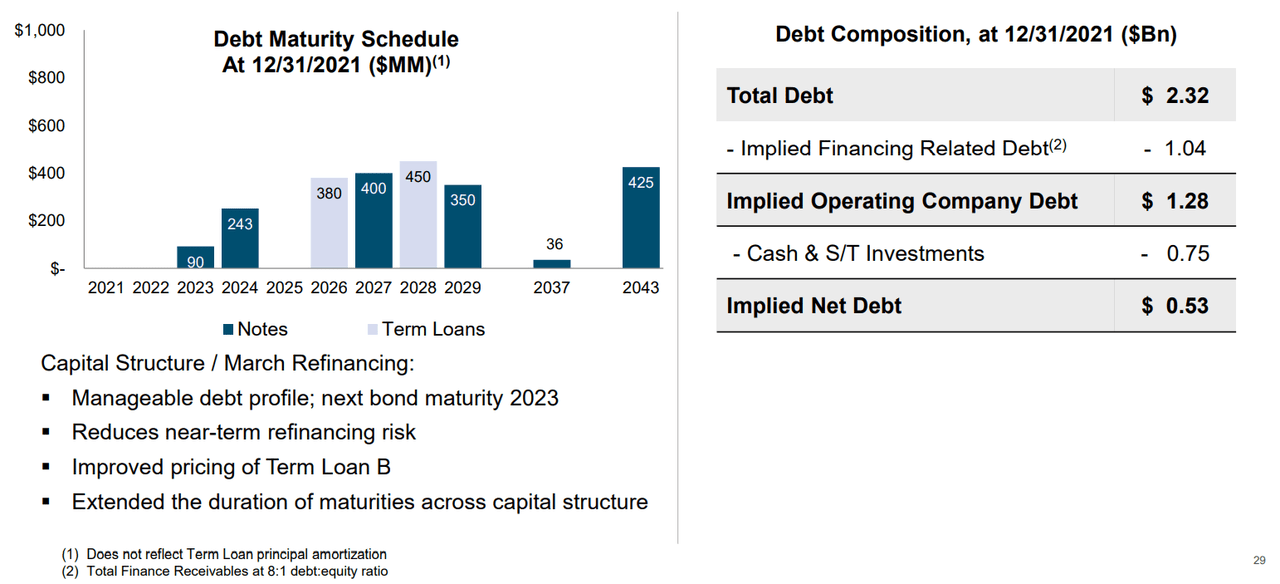

Word that I’m utilizing a web debt of $530 million, which doesn’t embody the corporate’s financing-related debt. If we add the implied financing associated to debt, the corporate’s truthful value would stand at $8 per share:

Strategic Replace Writer’s Compilations

New Laws And Failed Partnerships May Lead To $4.5 Per Share Or Decrease

Pitney relies on a number of partnerships with giant conglomerates that supply supply providers. If, for no matter motive, Pitney doesn’t keep its relationships with these giant companions, future web income would most definitely decline. In consequence, if journalists notice the decline, the truthful valuation of Pitney and its inventory value may decline:

We’re depending on financially viable nationwide posts within the geographic markets the place we function, notably in the USA. A good portion of our income relies upon upon the power of those posts, particularly the USPS, to offer aggressive mail and package deal supply providers to our purchasers and the standard of the providers they supply. Their skill to offer top quality service at inexpensive charges in flip relies upon upon their ongoing monetary power. If the posts are unable to proceed to offer these providers into the longer term, our monetary efficiency might be adversely affected. Supply: 10-Okay

Pitney may endure considerably from modifications within the post-regulation in the USA. Let’s notice that Pitney wants approval from regulators to launch a brand new product. If the corporate doesn’t acquire approval from authorities, gross sales development will most definitely decline. In consequence, the truthful value could also be decrease than what I depicted within the earlier monetary mannequin:

A good portion of our enterprise is topic to regulation and oversight by the USPS and posts in different main markets. These postal authorities have the ability to control a few of our present services. Additionally they should approve a lot of our new or future product and repair choices earlier than we will deliver them to market. If our new or future product and repair choices will not be authorised, there are vital circumstances to approval, laws on our present services or products are modified or, we fall out of compliance with these laws, our monetary efficiency might be adversely affected. Supply: 10-Okay

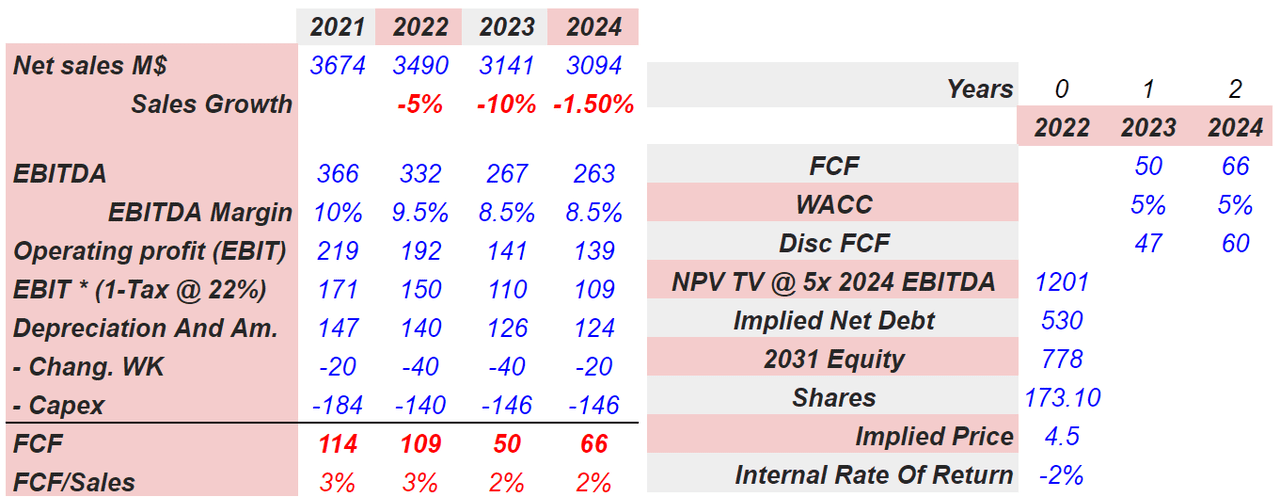

I additionally modeled a pessimistic free money circulate mannequin with gross sales development of -10%, 5%, and -1.5% in addition to an EBITDA margin shut to eight.5%. My outcomes embody a decline in free money circulate from round $115 million in 2021 to nearly $65 million in 2024. If we sum the whole lot with a weighted common value of capital of 5% and EV/EBITDA a number of of 5x, the implied fairness could be nearly $775 million. Lastly, the implied value could be $4.5. If we additionally assume the implied financing associated to debt, the implied inventory value could be a lot decrease than $1.

Writer’s Compilations

Pitney’s Stability Sheet

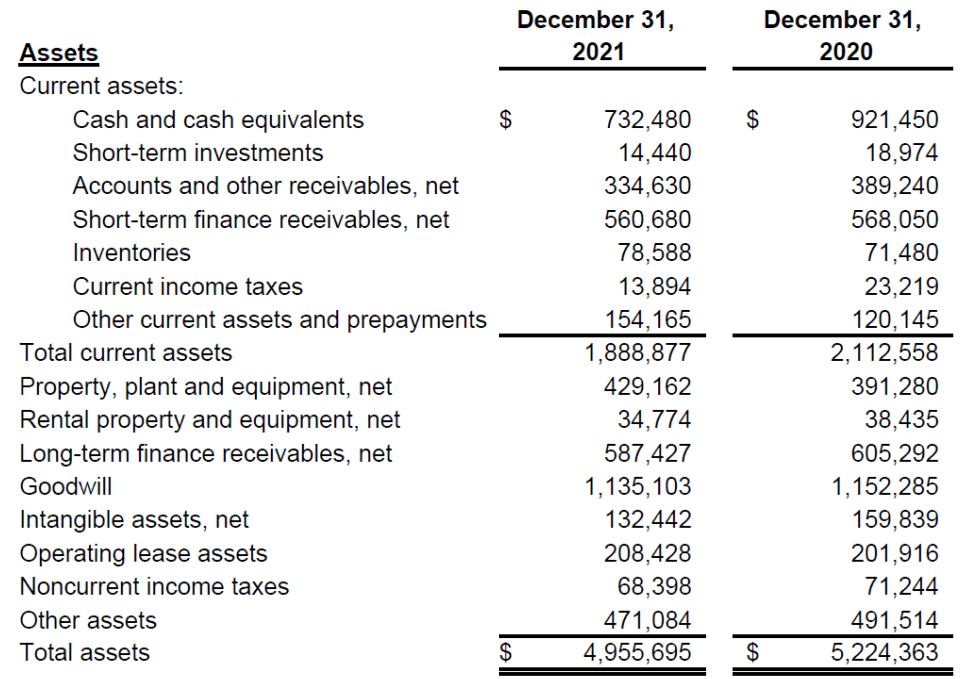

As of December 31, 2021, the stability sheet contains $732 million in money, $4.95 billion in whole belongings, and goodwill price $1.13 billion. Given the entire quantity of goodwill, it is vitally related that traders will want to pay attention to potential goodwill impairment dangers.

10-Okay

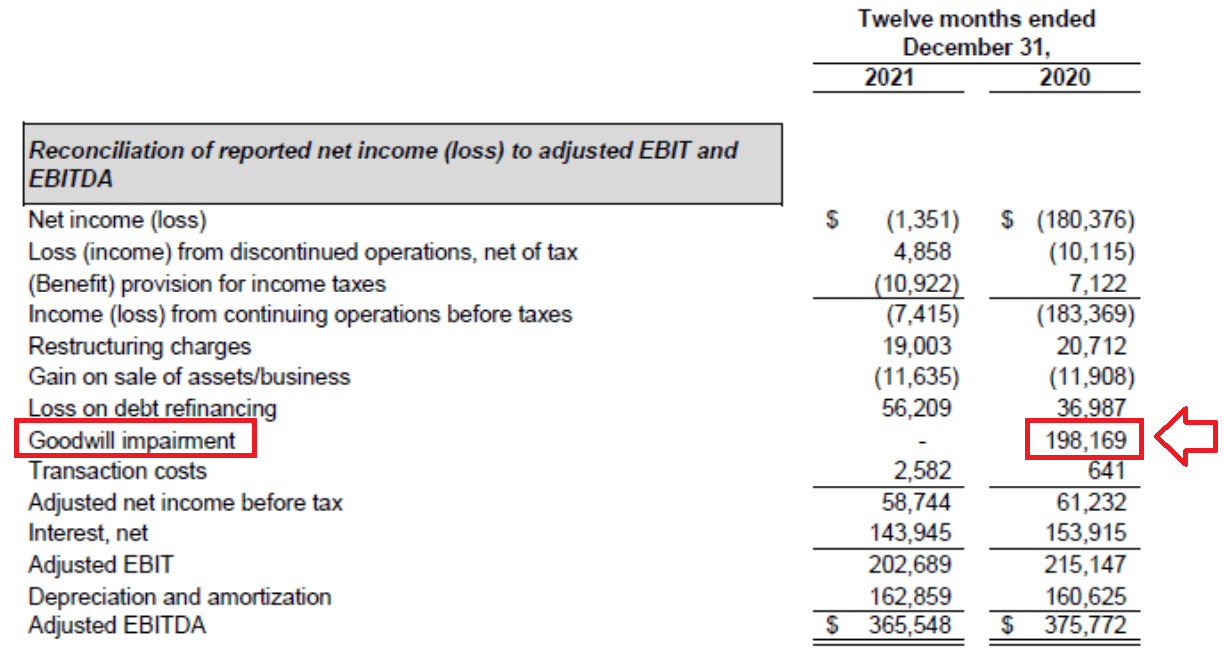

In 2020, the corporate reported an impairment of $198 million. In consequence, the adjusted EBITDA was equal to $375 million whereas it might have been a lot decrease. With out the impairment, the EBITDA would look equal to $177 million.

10-Okay

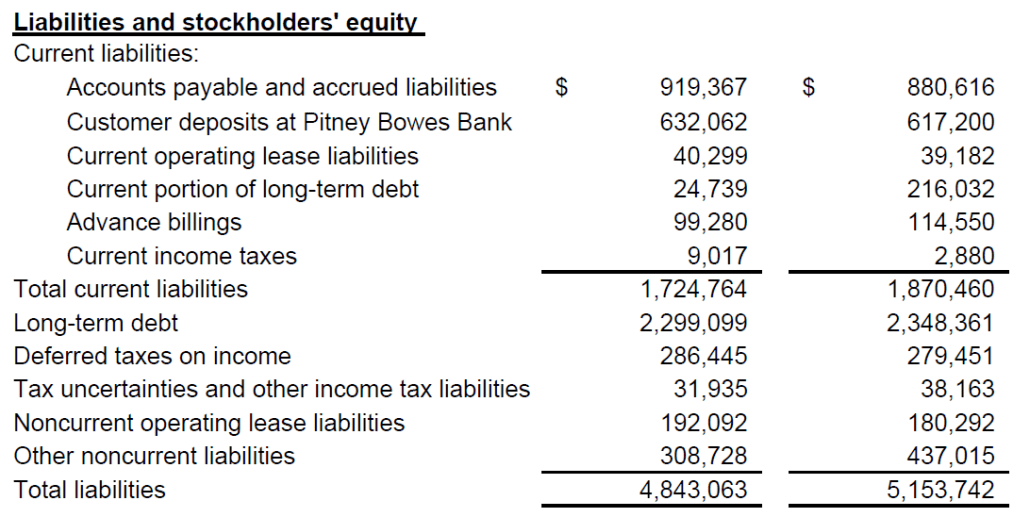

As of December 31, 2021, the entire quantity of liabilities is the same as $4.8 billion, so the asset/legal responsibility ratio is the same as 1x. Whereas traders will most definitely examine rigorously the corporate’s contractual obligations, as of at present, the stability sheet appears to be like wholesome.

10-Okay

Conclusion

With recurrent income, partnerships signed with giant conglomerates, and a digital technique, Pitney is kind of attention-grabbing proper now. In my opinion, if administration retains delivering the identical EBITDA margin, we’ll most definitely see additional inventory demand available in the market. I do imagine that there are some dangers associated to the entire quantity of debt and a few regulatory dangers. With that, in my opinion, the present inventory value fails to symbolize the true worth of the inventory. I imagine that there’s vital upside potential in Pitney’s valuation.