Davizro

Summary

I recommend waiting for a cheaper share price before buying Petco Health and Wellness Company (NASDAQ:WOOF).

What I like about WOOF is that it is a company specializing in pet health and wellness with a strong presence in the pet care industry, which is a large and attractive market. Multiple secular trends, including the humanization of pets and the consistent growth in the pet population, are contributing to the expansion of the pet care sector in the United States. WOOF is the only vertically integrated, all-encompassing pet care provider in the industry, offering a wide range of premium owned and partner brands as well as services such as grooming, training, and veterinary care. This fully integrated product offering is supported by WOOF’s strong digital and physical presence, including a nationwide network of physical locations and a digital ecosystem with advanced capabilities.

Company overview

WOOF is a company that specializes in pet health and wellness. Pet health services, such as veterinary care, grooming, and training, are provided by the company, as are pet nutrition products and supplies.

Pet care industry is a large and attractive market

Multiple secular trends are contributing to the expansion of the pet care sector in the United States. With a TAM of more than $100 billion, the pet sector caters to more than 90.5 million pet-owning homes, or nearly 70% of all US households. Strong tailwinds connected with the humanization of pets, in my opinion, have contributed significantly to the long-term growth alongside the constant, foreseeable expansion in pet population. In spite of economic ups and downs, I believe the pet care sector has proven resilient due to the necessity and consumable nature of its products (similar to people going to pharmacies). And within the overall industry, WOOF is making a concerted effort to increase its profile in the services, online retail, and veterinary sectors of the industry, as these three represent the fastest-growing subsets of the overall market.

According to the WOOF S-1 filing, pet population is expected to grow 5% historically to 7% through 2024, which underpins the long-term reoccurring need for pet care products, as we continue to see positive shifts in the pet humanization trend. WOOF is the only vertically integrated, all-encompassing pet care provider in the business, thus I expect it to take a large share of the growing pet care market.

WOOF’s fully integrated product offering

Considering that no other firm offers such a vast variety of pet supplies and services on a global scale as WOOF does, I think they have a winning business model (according to management in the S-1).

WOOF’s approach to product development is grounded in the belief that the company can best serve the needs of its many customers by providing a huge selection of premium owned and partner brands. Along with food, WOOF also stocks a huge variety of pet products to suit demands of concerned pet owners. WOOF’s premium product offering is, in my opinion, the result of the company’s unique food and supplies strategy, which features proprietary and exclusive brands and makes them available to customers in quantities that are far greater than those offered by competitors (source: S-1). The fact that WOOF also offers things like grooming, coaching, and vet services is another reason why I like this tactic. In addition to being a cost-efficient way to acquire new customers, all of this helps to keep and extend the lifetime value of customers.

The interconnectedness of WOOF’s multi-channel ecosystem also allows them to provide a full range of products and services through all available channels. The S-1 shows that cross-channel shoppers spend 6 times as much as single-channel shoppers, thus I think this is a major factor in why people use WOOF so often.

Strong digital and physical presence

Through its years in business, WOOF has established a nationwide physical network and a digital ecosystem with cutting-edge capabilities. On the physical front, WOOF has the infrastructure to store, pack, and ship a wide range of items and services to customers quickly and easily. Compared to competitors, I believe that WOOF has a large advantage due to its proximity to clients on two levels: (1) a cost advantage from delivery route density, and (2) a lower cost of transportation (Brand awareness). WOOF has expanded its physical presence by establishing itself as the industry leader in pet grooming and training through the use of its extensive physical network. From what I’ve seen, these must-have amenities encourage clients to return to WOOF’s pet care centers, which ultimately benefits the business (customers tend to spend 2x as much with WOOF compared to non-service customers, according to the S-1). The context of the pet training is worth mentioning. This service is a powerful customer acquisition technique for fostering long-term loyalty among new pet parents, as training is often done when the pet is still young.

On the digital front, WOOF makes using Petco.com and the Petco app a fantastic online experience. In my opinion, WOOF can offer its users a superior omni-channel experience because of its robust digital and physical presence. Even more crucially, I believe that WOOF’s investment in establishing its digital portfolio of products and services has greatly increased its reach and growth runway. Online grooming appointment scheduling and mobile grooming are just two examples of the kinds of low-incremental-cost innovations that WOOF can make possible because of its strong digital capabilities.

When taken as a whole, the omni-channel perspective offered by this interconnected ecosystem is the driving force behind WOOF’s highly efficient marketing strategy, which in turn boosts client lifetime value and encourages repeat visits.

WOOF’s veterinary hospital is a competitive advantage

Just like with people, the cost of veterinary care is an expensive burden. WOOF has transformed this challenge into an opportunity by creating a comprehensive network of veterinary hospitals, clinics, and televeterinary services that are uniquely positioned, highly scalable, and cost-effective. As far as I’m concerned, WOOF has a big structural advantage over competing veterinary care providers since it can provide clients with a more cost-effective alternative by incorporating these clinics within existing pet care centers. Having a strong internet presence allows WOOF to provide advantageous services, such as online booking.

This technique makes sense, in my opinion, because it allows clients to buy wellness products at the time of visit, when they are already there. Incredible as it may sound, WOOF has traditionally required around $600,000 in build-out costs and achieved breakeven by the second year.

WOOF should continue to reinvest in its digital strategy

In my opinion, WOOF would benefit from maintaining its focus on digital marketing in light of the pet industry’s sustained significant development in e-commerce. I expect WOOF to considerably expand e-commerce sales because of the company’s dedication to developing its Buy Online, Pick Up in Store (BOPUS) and curbside pick-up offerings. WOOF’s ability to integrate its online platform with its in-person services, such as grooming and training, generates a virtuous cycle that increases the frequency with which its website is visited and, by extension, the frequency with which it can cross-sell additional items and services.

I am confident that WOOF, by capitalizing on its technological and operational strengths, will maintain its tradition of providing cutting-edge, novel multi-channel products and services while also expanding its presence in the e-commerce market.

Valuation

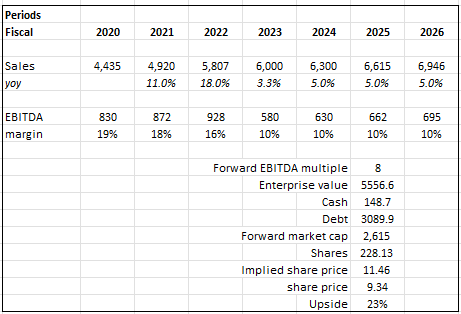

According to my model, investors can expect a 23% return over 3 years, which is not the best as it implies ~8% IRR.

My model assumptions for WOOF are based on management’s FY23 revenue guidance and my belief that the company will revert to a long-term mid-single digits growth afterwards. Due to the highly levered balance sheet, I believe valuing WOOF on an EV/EBITDA basis would be more appropriate as we can comp against peers.

Own calculations

Risks

Competitive landscape

Competition in the pet industry is high due to the prevalence of numerous different retail formats, including national chains like Walmart (WMT) and Target (TGT) as well as local, regional, and online marketplaces like PetSmart. Petco’s sales and margins may also be threatened by ecommerce and rising competition, especially from online-only competitors like Chewy (CHWY) and BarkBox.

Gross margin may decline due to mix shift

As more sales are made online and to Veterans, who typically have reduced purchasing power, the overall gross margin could decrease. While there will be no change to underlying profit in absolute terms, falling margins are not a healthy sign.

Leverage

WOOF’s balance sheet is quite leveraged (7x net debt/EBITDA). While there has been no indication of liquidity issues thus far, investors should be aware that this could quickly escalate into a major issue.

Conclusion

I recommend staying neutral on WOOF. On the business end, what appeals to me about WOOF is that it is a market leader in the pet care industry, which is a sizable and promising sector, and that it focuses on pet health and wellness. The pet care industry in the United States is growing as a result of a number of secular trends. These trends include the increasing popularity of owning pets and the humanization of animals.