Invoice Oxford

Earnings of PennyMac Monetary Providers, Inc. (NYSE:PFSI) will plunge this 12 months principally due to decrease mortgage manufacturing amid a rising interest-rate atmosphere. Nevertheless, the mortgage servicing division will seemingly profit from greater rates of interest. Additional, revenue from the funding administration division will seemingly stay secure, which can provide some help to the underside line. General, I’m anticipating PennyMac Monetary to report earnings of round $6.13 per share for 2022, down 58% year-over-year. The year-end goal value is considerably near the present market value. Therefore, I’m adopting a maintain score on PennyMac Monetary Providers.

Mortgage Banking Trade Making a More durable Touchdown than Anticipated

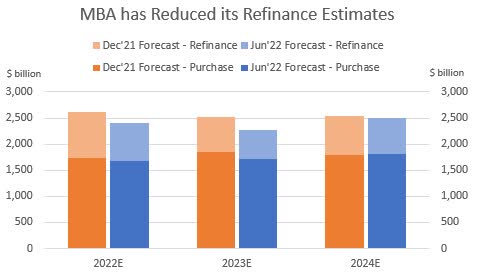

The mortgage refinancing quantity seems on observe for a more durable touchdown than beforehand anticipated. The Mortgage Bankers Affiliation (“MBA”) has materially revised downwards its refinancing expectation for each 2022 and 2023. In June 2022, MBA estimated a refinancing quantity of $1,681 billion for 2022, down 3% from the estimate given in December of 2021.

Mortgage Bankers Affiliation

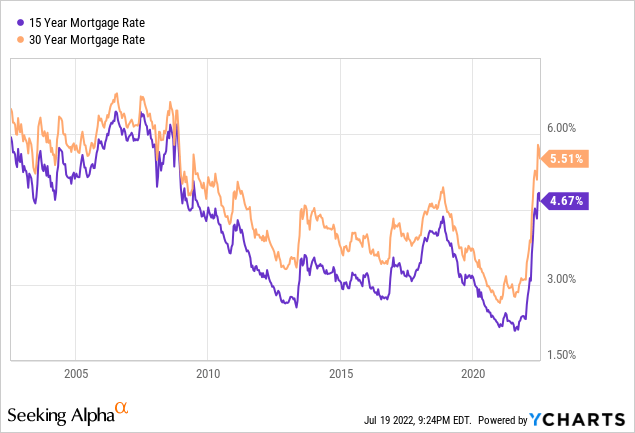

The plunge in refinancing quantity witnessed to this point this 12 months is usually attributable to the earlier and greater-than-expected financial tightening. In December 2021, the Federal Reserve projected the Fed Funds goal charge to be round 0.9% (median) for 2022. As per the newest report, the Fed is now projecting a goal fed funds charge of round 3.4% for 2022. As a result of steep development of the fed funds charge, mortgage charges are at multi-year highs, as proven under.

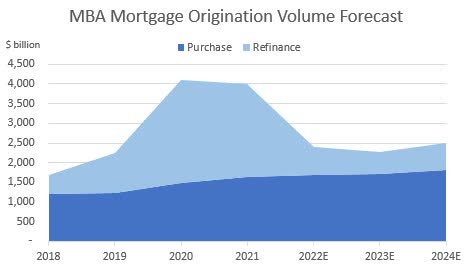

MBA is now projecting the entire mortgage origination quantity, together with refinancing quantity, to say no by a whopping 40% year-over-year in 2022.

Mortgage Bankers Affiliation

Firm-specific Components Present a Brighter Outlook

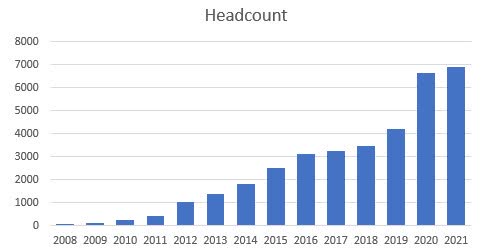

Though refinancing quantity will virtually return to the 2018 degree this 12 months (see chart above), PennyMac Monetary Providers’ share of that refinancing market will likely not return to the 2018 degree. It’s because the corporate has considerably expanded its group measurement since 2018, as proven under. The better human useful resource will assist enhance PennyMac’s share of the mortgage market.

Earnings Displays, SEC Filings

Furthermore, mortgage servicing revenue will profit from greater rates of interest. As will be gleaned from particulars given within the first quarter’s convention name, PennyMac earns curiosity revenue on its custodial deposit balances. Because of this, the upward shift in short-term rates of interest this 12 months will enhance the corporate’s revenues.

Additional, revenues from the funding administration division will seemingly stay secure. Underneath the funding administration division, PennyMac Monetary manages PennyMac Mortgage Funding Belief (NYSE: PMT), a mortgage REIT. The 2022 consensus earnings estimate for PMT will be seen on Looking for Alpha’s earnings web page.

Anticipating Earnings to Dip by 58%

Contemplating the industry-wide and company-specific outlook, I’m anticipating PennyMac’s complete web revenues to say no by 38% year-over-year in 2022. In the meantime, the margin will seemingly proceed to say no, nevertheless it’ll obtain some help from value management efforts, as talked about within the convention name. General, I’m anticipating PennyMac Monetary Providers to report earnings of $6.13 per share, down 58% year-over-year. The next desk reveals my revenue assertion estimates.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022E | |

| Monetary Abstract | ||||||

| Complete Internet Revenues | 955 | 985 | 1,477 | 3,706 | 3,167 | 1,957 |

| Bills | 630 | 717 | 948 | 1,465 | 1,808 | 1,465 |

| Revenue Earlier than Tax | 326 | 268 | 529 | 2,241 | 1,359 | 491 |

| Internet Revenue for Frequent Sh. | 101 | 92 | 393 | 1,647 | 1,003 | 362 |

| EPS – Diluted ($) | 4.0 | 2.6 | 4.9 | 20.9 | 14.7 | 6.1 |

|

Supply: SEC Filings, Creator’s Estimates (In USD million besides per share objects) |

Precise earnings might differ materially from estimates due to the dangers and uncertainties associated to inflation, and consequently the timing and magnitude of rate of interest hikes. Additional, a recession could make individuals postpone their residence purchases, which might make the income fall by greater than my expectation. The brand new Omicron subvariant additionally bears monitoring.

Adopting a Maintain Ranking

In comparison with its friends (chosen by market capitalization), PennyMac Monetary is considerably low-cost on the price-to-earnings and price-to-book multiples. The next desk summarizes knowledge on valuation multiples supplied by Looking for Alpha.

| PFSI | Peer Avg. | WSFS | CLBK | COOP | AX | OTCQB:FMCC | |

| Peer Comparability | |||||||

| Worth-to-Earnings (“TTM”) | 3.9 | 11.3 | 9.9 | 24.7 | 2.1 | 9.6 | 10.2 |

| Worth-to-Earnings (“FWD”) | 7.3 | 10.2 | 12.4 | 25.9 | 3.3 | 9.4 | 0.3 |

| Worth-to-E-book (“TTM”) | 0.8 | 1.4 | 1.0 | 2.2 | 0.7 | 1.4 | NM |

| Supply: Looking for Alpha |

PennyMac Monetary is providing a dividend yield of 1.6% on the present quarterly dividend charge of $0.20 per share. The earnings and dividend estimates recommend a payout ratio of 13% for 2022, which is well sustainable. Subsequently, the earnings outlook presents no threats to the extent of dividend payout.

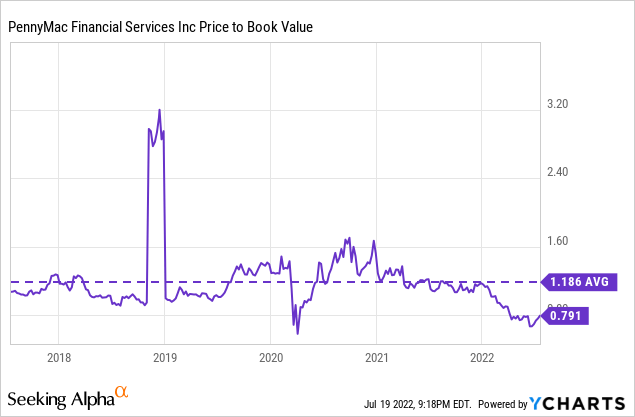

I’m utilizing the historic price-to-book (“P/B”) and price-to-earnings (“P/E”) multiples to worth PennyMac Monetary. The inventory has traded at a mean P/B ratio of 1.186x prior to now, as proven under.

Multiplying the typical P/B a number of with the forecast e-book worth per share of $64.8 offers a goal value of $76.8 for the tip of 2022. (I’ve estimated the e-book worth per share for December 2022 by including the earnings estimate and subtracting the dividend estimate from the December 2021 e-book worth per share.) The value goal implies a 53.7% upside from the July 19 closing value. The next desk reveals the sensitivity of the goal value to the P/B ratio.

| Worth-to-E-book | 0.99 | 1.09 | 1.19 | 1.29 | 1.39 |

| BVPS – Dec 2022 ($) | 64.8 | 64.8 | 64.8 | 64.8 | 64.8 |

| Goal Worth ($) | 63.9 | 70.4 | 76.8 | 83.3 | 89.8 |

| Present Market Worth ($) | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 |

| Upside/(Draw back) | 27.8% | 40.7% | 53.7% | 66.7% | 79.6% |

| Supply: Creator’s Estimates |

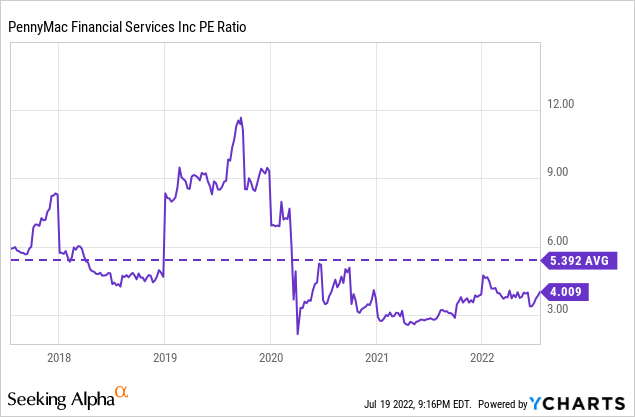

The inventory has traded at a mean P/E ratio of round 5.392x prior to now, as proven under.

Multiplying the typical P/E a number of with the forecast earnings per share of $6.1 offers a goal value of $33.0 for the tip of 2022. This value goal implies a 33.9% draw back from the July 19 closing value. The next desk reveals the sensitivity of the goal value to the P/E ratio.

| Worth-to-Earnings | 3.4 | 4.4 | 5.4 | 6.4 | 7.4 |

| EPS – 2022 ($) | 6.1 | 6.1 | 6.1 | 6.1 | 6.1 |

| Goal Worth ($) | 20.8 | 26.9 | 33.0 | 39.2 | 45.3 |

| Present Market Worth ($) | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 |

| Upside/(Draw back) | (58.4)% | (46.2)% | (33.9)% | (21.6)% | (9.4)% |

| Supply: Creator’s Estimates |

Equally weighting the goal costs from the 2 valuation strategies offers a mixed goal value of $54.9, which suggests a 9.9% upside from the present market value. Including the ahead dividend yield offers a complete anticipated return of 11.5%. As this anticipated return isn’t excessive sufficient for me, I’m adopting a maintain score on PennyMac Monetary Providers.