johnemac72/iStock via Getty Images

PBF Energy (NYSE:PBF) is a $5.2 billion market cap oil refining and logistics company with six refineries, five of them coastal. At the end of November, PBF Energy acquired all of the limited partnership units of PBF Logistics it did not already own, thus simplifying its structure.

The company recently replaced its CFO with an interim CFO while it seeks a permanent hire.

Four of its six refineries are in coastal states that are discouraging thermal fuel (here gasoline and diesel) use, particularly California. This is a mixed blessing as such policies increase costs but raise the barriers to entry even further for new or expanded refining capacity, a sort of regulatorily-induced monopoly assist.

At the same time, the importance of this capacity can be seen from a) the high cost of and demand for heating oil on the US East Coast, b) the high cost of gasoline on the US West Coast, and c) the need for PBF’s capacity in Toledo, Ohio, to backstop the temporarily closed BP-Cenovus Ohio refinery.

The refining sector has seen extraordinary margins, first for gasoline and now diesel. These are expected to tighten given ordinary mean reversion and potentially smaller available supplies of crude oil feedstock (Russian oil redirection, OPEC not increasing supply, Biden administration permitting moratoria and SPR drawdown). Not coincidentally, PBF’s short interest is higher, as it is for all refiners.

Nonetheless, refining product demand has rebounded, and new refineries are not coming online. Competitive US East Coast imports are smaller because Russian distillate is no longer flowing into Europe and European refineries themselves face extremely high costs for gas and electricity. Chinese and Asian refineries may increase exports although their gasoline does not meet California specifications.

So, while PBF Energy may see a more substantial drop in profits in the next few quarters than its non-coastal peers, pays only a small dividend, and its management is looking for a new permanent CFO, I consider the company a “hold,” (rather than “sell”) given its solid asset position in an oil refining sector that, contrary to claims, is likely to be around for decades.

California Regulation

Many energy companies have pulled back in California. Some have shuttered small refineries; others are converting oil refineries to renewable diesel. This is due not just to existing regulations and specs, or even those in the future, but also to plans. For example, the California Air Resources Board Scoping Plan describes the cessation of most California oil refining by 2045.

The California’s Governor Newsom is seeking to cap refiner profitability and even to oversee scheduling of refinery maintenance in an article that also cites a PBF executive discussing uncertainty about long-term capex for the Torrance refinery.

California already has one of the highest retail gasoline tax burdens for consumers in the US at $0.505/gallon.

Macro

Demand and supply issues range from EV penetration (now only 6.5% of new car sales) to US economic recession with GDP growth for 2023 estimated at 0.1% to higher-cost crude supply as capex limits, Biden limits, OPEC limits, and SPR limits (and even saltwater disposal well volume limits) take their tolls on availability.

Product Demand and Refining Margins

The US Energy Information Administration (EIA) forecasts US consumption of liquid hydrocarbons of 20.36 million barrels per day for 2022 and 20.51 million BPD for 2023.

The following futures prices are for January 2023 delivery.

The December 19, 2022, NYMEX oil price is $75.53/barrel for WTI at Cushing. Natural gas at Henry Hub, Louisiana, is $5.84/MMBTU. (However, on the US west coast, where two of PBF’s refineries are located, natural gas has been as high as $50-$90/MMBTU due to transportation bottlenecks.) According to Tudor Pickering Holt analysts, every $1/MMBTU increase in natural gas costs reduces refiner EBITDA by -$0.25/barrel due to higher energy and hydrogen costs.

The RBOB gasoline futures closing price is $2.19/gallon. RBOB stands for “reformulated gasoline blendstock for oxygen blending.” The heating oil futures price is $3.08/gallon.

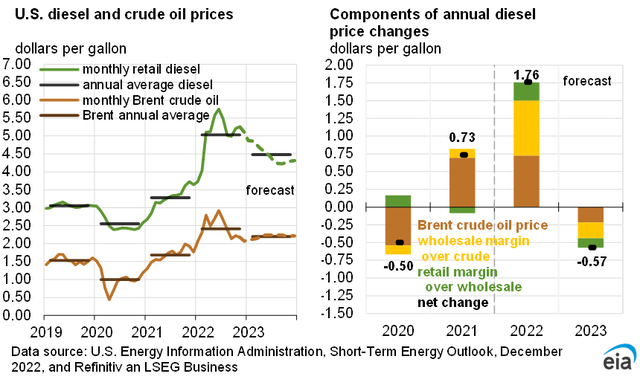

Crack spreads refer to the difference between crude oil feedstock cost and the value of refined products, usually gasoline, distillate (like truck diesel) or some combination of the two. As crack spreads decrease from their highs, so does refining profitability. Fitch Ratings has estimated overall refining crack spreads will fall in 2023 by 30-50% from current levels.

For example, diesel prices are at historical highs (retail of $5/gallon or more) but the EIA expects lower diesel crack spreads (by -19%) next year.

Energy Information Administration

PBF Third Quarter 2022 Results

PBF Energy had a stellar 3Q22 and excellent first nine months of 2022. In 3Q22 operating earnings were $1.4 billion. Net income was $1.06 billion or $8.40/diluted share, compared to $59 MM and $0.49/diluted share for 3Q21.

For the first nine months of 2022, PBF earned $2.24 billion in net income or $18.03/diluted share compared to $66 million or $0.54/diluted share for the same period in 2021.

The company’s CEO, Tom Nimbley, noted PBF had been able to “reduce consolidated debt by over $2.6 billion including the July 11, 2022, redemption of the 9.25% Senior Secured Notes due 2025.”

The company reinstituted its dividend at $0.20/quarter.

Refining Operations and Competitors

PBF Energy is headquartered in Parsippany, New Jersey. Among its six refineries the company has total crude capacity of 973,000 BPD, or 5.4% of the US total of 17.9 million BPD.

None is a mega-refinery (500,000 BPD or more): all are between 105,000 BPD and 185,000 BPD.

Locations, crude oil feedstock volumes, and PADDs (Petroleum Administration for Defense Districts) are:

*Delaware City, DE at 180,000 BPD (PADD 1)

*Paulsboro, NJ 105,000 BPD (PADD 1)

*Toledo, OH 180,000 (PADD 2)

*New Orleans, LA 185,000 (PADD 3)

*Torrance, CA 166,000 (PADD 5)

*Martinez, CA 157,000 (PADD 5)

PBF competes with most US refiners. Downstream-focused competitors include Delek (DK), Marathon Petroleum (MPC), HF Sinclair (DINO), Phillips 66 (PSX), and Valero (VLO). Integrated companies with refineries include Exxon Mobil (XOM), BP (BP), Chevron (CVX), and Shell (SHEL).

PBF has announced it will add a pretreatment unit and convert an unused hydrocracker at its New Orleans (Chalmette) refinery to make up to 840,000 gallons (20,000 barrels) per day of renewable diesel.

In the renewable diesel segment of the fuels market—primarily California—PBF has considerable competition from more-established players, notably Valero in its Diamond Green renewable diesel joint venture with Darling Ingredients (DAR). Several other refiners including HF Sinclair, Phillips 66, and Marathon Petroleum have refinery conversions to renewable diesel underway.

Logistics

PBF Energy’s logistics assets comprise marine vessels, trucks, and rail for delivery of finished products to wholesale customers and dealers (the company does not have retail outlets).

Effective November 30, 2022, PBF Energy completed the acquisition of the 52% of PBF Logistics limited partnership units it did not already own.

Governance

On November 30, 2022, 14.1% of floated PBF stock was shorted. (Short interest is higher for all refiners.) Insiders hold 9.35% of the stock.

The company’s beta is 1.98, well above the market average of but in line with highly changeable oil refining economics, particularly during the last two years.

On December 1, 2022, Institutional Shareholder Services ranked PBF Energy’s overall governance as a 4. Sub-scores were audit (7), board (5), shareholder rights (4), and compensation (2). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

On September 29, 2022, much of PBF Energy’s stock was held by institutions, some of which represents index fund investments that match the overall market. The five largest institutional holders were BlackRock (15.0%), Vanguard (10.8%), State Street (5.4%), Dimensional Fund Advisors (5.2%), and Bank of New York Mellon (3.3%).

BlackRock and State Street are signatories to the Net Zero Asset Managers Initiative, a group that, as of November 9, 2022, manages $66 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Note that Vanguard was also originally a signatory but has recently withdrawn. Neither Dimensional Fund Advisors nor Bank of New York Mellon are signatories.

BlackRock is experiencing fund withdrawals from state treasurers in Arkansas, Arizona, Florida Louisiana, South Carolina, Texas, and Utah contending its anti-hydrocarbon activism is hurting primary businesses in their states and/or leading to unacceptably low investment returns.

Potential investors should be aware PBF just experienced a sudden change in chief financial officers. Former CFO Erik Young’s departure was announced November 29, 2022, to be effective December 20, 2022. Karen Davis, a financially experienced outside PBF board member, has stepped in as interim CFO (and stepped down from PBF’s board for now) while a search for a new CFO is conducted.

Financial and Stock Highlights

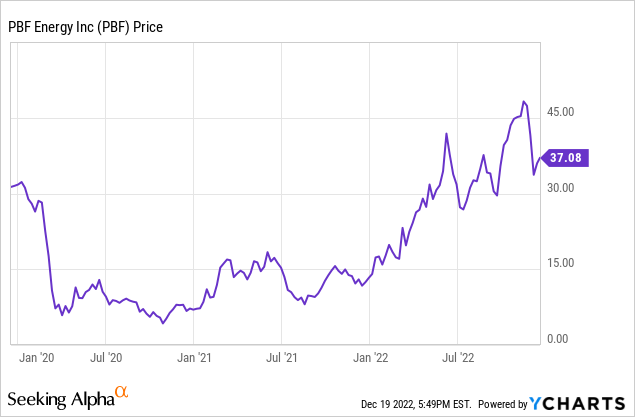

Market capitalization is $5.2 billion at a December 19, 2022, stock closing price of $37.08/share, or 78% of the one-year target price of $47.64.

The company’s 52-week price range is $10.58-$49.00 per share, so the closing price is 76% of the high.

PBF pays a dividend of $0.80/share for a yield of 2.2%. As noted, it has also just implemented a $500 million share buyback program.

Trailing twelve months’ earnings per share (EPS) is $19.50 for an extreme bargain price/earnings ratio of 1.9. The averages of analysts’ 2022 and 2023 EPS estimates are $23.69 and $9.71, respectively, giving a forward price-earnings ratio of 1.6 for 2022 and 3.8 for 2023.

Virtually all refiners have experienced many profitable months, including PBF Energy. The company’s trailing twelve-month return on assets was 18.1% and return on equity was a large 69.6%.

On September 30, 2022, PBF had $7.65 billion in liabilities, including $1.45 billion of long-term debt and $4.92 billion in current liabilities and $12.89 billion in assets giving PBF a somewhat restrictive liability-to-asset ratio of 59%.

The company’s ratio of debt to EBITDA is a healthy 0.68. The ratio of enterprise value to EBITDA is 1.5, far below the maximum of 10.0, suggesting an extreme bargain.

Trailing twelve-months’ operating cash flow is $3.8 billion and levered free cash flow is $2.3 billion.

Mean analyst rating is a 2.5, or between “buy” and “hold,” from seventeen analysts.

Notes on Valuation and Risks

The company’s book value per share of $34.49 is near the market price, signaling neutral investor sentiment.

PBF is more exposed than some refiners to governance concerns due to the sudden and apparently unexpected replacement of its CFO in November 2022. The company is now operating with an interim CFO, a board member who stepped down to take the position.

Big exposures for PBF Energy are California regulations discouraging hydrocarbon use—especially gasoline—and recessionary declining demand generally. Temporary extremely high West Coast natural gas costs have increased operating costs in PBF’s two California refineries.

Higher oil (feedstock) prices may result from a decline in Russian output, tighter OPEC supplies, the Biden administration’s anti-hydrocarbon policies, and the decline in available oil stored at the Strategic Petroleum Reserve.

Recommendations for PBF Energy

Due to the very strong refining environment, PBF has seen a sharp turnaround, paying down $2.6 billion of expensive debt in the last eighteen months.

However, with a third of its refineries in hydrocarbon-negative California, it will face considerable regulatory and cost challenges, most recently high-cost natural gas that will squeeze margins, and policy makers who want to impose a profits tax and schedule refinery maintenance.

PBF has made a great comeback but is unlikely to appeal to dividend investors. Investors seeking capital appreciation should be aware not only of the company’s California issues but also simply the likely mean reversion of refining margins. For these reasons I rate PBF Energy as a hold.

pbfenergy.com