Yves right here. I hope readers in Europe and the UK and people in any other case educated about EU politics and governance will pipe up about this piece. At a naked minimal, it’s an excellent essential pondering train, however members of our commentariat can hopefully present extra perception into regional political and financial dynamics that feed Euroskepticism.

This text makes a daring declare, that Euroskepticism really results in (or at the least correlates with) decrease development. Its authors contend that the causality runs within the route reverse of the one described by most economists and analysts: that financial stagnation produces “throw the bums out” voter responses, which in lots of circumstances means Euroskepticism.

Some reactions from a non-European, so take this with ample salt.

First, in opposing the traditional “falling behind economically results in anti-establishment voting” the authors appear to be getting in an “either-or” route. I believe that there’s more likely to be a really complicated interplay. If an space of a rustic falls behind, a few of those that can, primarily the younger, will depart. So those that stay will likely be older and extra conservative. Buyers do are likely to want areas with extra demographic development and youthful employees as a result of cheaper. This dynamic would look like necessary and I might contend extra necessary than voting preferences.

Second, typically selecting to be retrograde pays off over the long run. Portland, Maine, turned down the chance to change into a significant Ford web site, IIRC within the Nineteen Thirties. The arguably small-minded city fathers wished to maintain their tradition. So Maine remained largely rural and poor. However it’s not laborious to argue that Portland is now higher located that auto business darling Detroit, as soon as the wealthiest metropolis within the US that has taken an enormous fall.

Third, I’m wondering about their classification of Euroskeptic. The publish particularly mentions Greece’s Syriza for instance. The get together has seemingly modified its messaging, however I recall nicely when it took energy. It campaigned on not being an institution participant and due to this fact uniquely in a position to break with present alliances and negotiate a greater bailout bundle than incumbents might. This may increasingly appear to be a distinction and not using a distinction to some readers, but it surely was the IMF, not the EU, than devised and ran the “applications”: recall that features numerous non-EU nations, resembling Russia, Argentina, South Korea, Indonesia, Thailand, and the UK earlier than it was a part of the EU. The Financial institution reported in 2020 that greater than half the world’s nation had requested for help. Sure, for Greece, the majority of the funds really got here from EU member states, however they very a lot deferred to the IMF and trusted the IMF to watch progress and devise and implement “reforms” as in austerity.

I chronicled these negotiations virtually each day; there was on the time and nonetheless is quite a lot of misreporting of what went down. Virtually nobody who was Greece-sympathetic (save one MP, whose title I can not recall) acknowledged that the gig was up a mere three weeks after Syriza took energy. It signed a “memorandum” to get an important mini-bailout that dedicated it to a yet one more IMF program, superb factors to be labored out.

Much more necessary, neither Syriza nor Greeks in 2015 have been anti the EU. They have been anti the IMF. From a July 2015 publish (this was after the Alex Tsipras stunt of a referendum on a bailout bundle that had expired):

But fairly a couple of pundits who declare they help self-determination for Greece advocate a Grexit regardless of the clear choice of Syriza management and the Greek public in any other case. A Bloomberg ballot final week discovered that 81% wished to Greece to stay within the Eurozone. That demonstrates that Greek residents admire that as dangerous as issues are below austerity, a Grexit might tip Greece into being a failed state. What’s beginning to occur now, the lack of corporations to import, constrained entry to worldwide cost methods like debit and bank card networks, is a pale shadow of what Greece would expertise with a Grexit.

Now to the principle occasion.

By Andrés Rodríguez-Pose, Princesa de Asturias Chair and Professor of Financial Geography London Faculty Of Economics And Political Science, Lewis Dijkstra, City and Head of the Territorial Evaluation Crew, Joint Analysis Centre European Fee, and Chiara Dorati. Initially revealed at VoxEU

Help for Euroskeptic events has surged from the political fringes to embody almost a 3rd of European voters. These actions promise a ‘free lunch’: prosperity via much less integration and extra nationwide management. This column affords new proof from throughout 1,166 European areas from 2004 to 2023 that Euroskepticism carries a big financial price. The extra Euroskeptic areas have seen slower GDP per capita, productiveness, and employment development, notably for the reason that euro space disaster. Removed from liberating native economies, Euroskepticism imposes measurable financial penalties on the very locations embracing it, making a vicious cycle of discontent and decline.

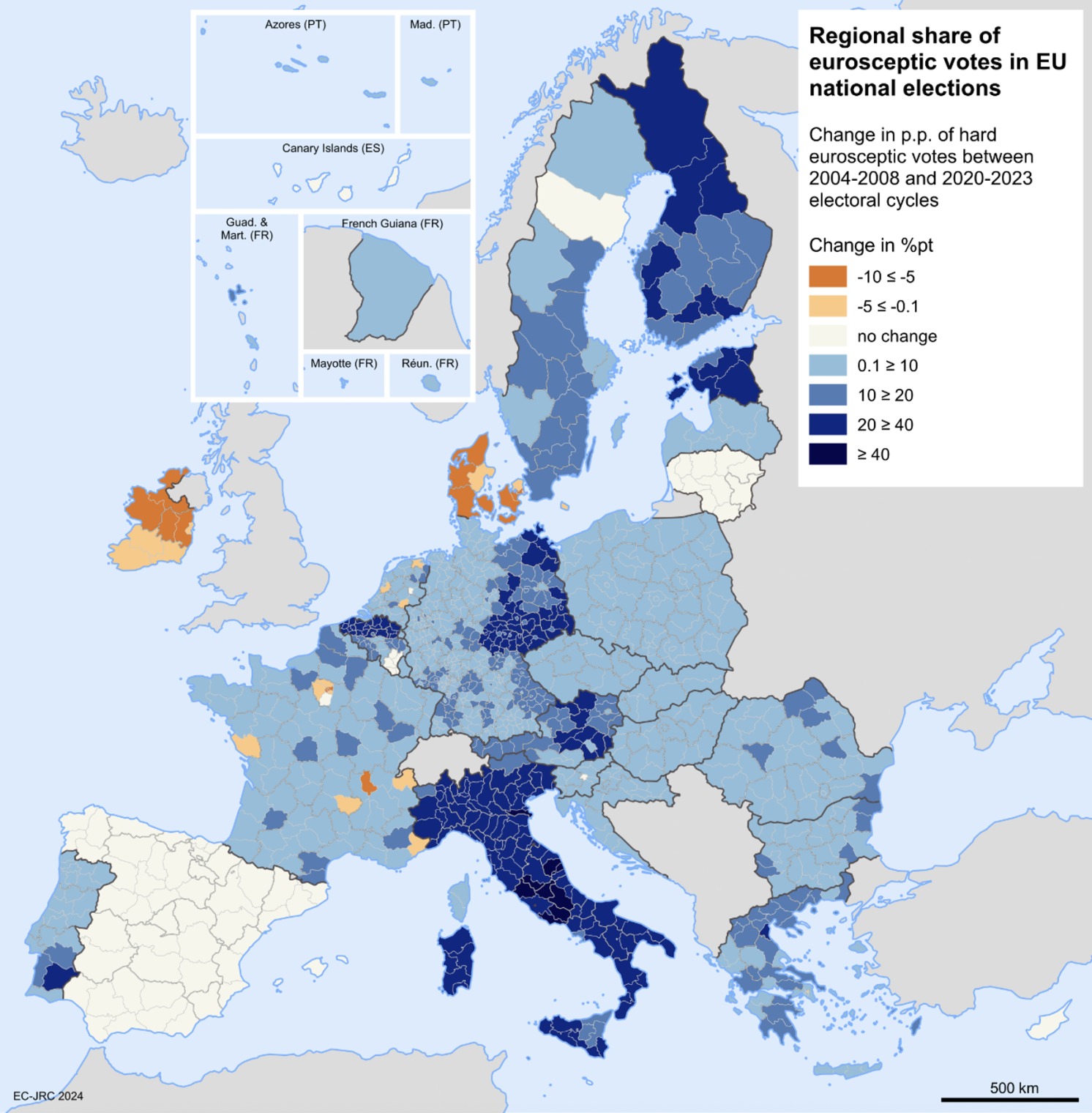

In lower than 20 years, Euroskepticism has moved from the margins of protest to the centre of European politics. As soon as confined to populist outliers – within the mid-2000s it represented a mere 3.7% of votes in nationwide legislative elections – events promising to ‘take again management’ now command as a lot as a 3rd of the vote throughout EU member states. In some areas, greater than half of voters now again Euroskeptic forces. The rise of such events has reshaped electoral maps from the Po Valley to jap Germany, from northern France to rural Sweden (Determine 1). The story being informed is seductively easy: European integration has shackled prosperity. Solely by reclaiming ‘sovereignty’ will prosperity be let loose.

Determine 1 Change within the regional share of votes for laborious Euroskeptic events in EU nationwide legislative elections, 2004–2008 vs 2020–2023 electoral cycles

Supply: Authors’ elaboration.

Our analysis (Rodríguez-Pose et al. 2025) examines the implications of the rise of Euroskcepticism and challenges this assumption head-on. Drawing on regional information for all 27 EU member states between 2004 and 2023, we ask what occurs to locations that flip towards European integration. The evaluation exhibits that locations that yield to the temptation of Euroskepticism have, over time, grown extra slowly, created fewer jobs, and misplaced floor in productiveness relative to their extra Europhile friends. In different phrases, Euroskepticism isn’t any free lunch and seems not merely as a symptom of financial malaise however as a contributor to it.

Going Past the Causes of Euroskepticism

Most financial analysis thus far has targeted on the causes of Euroskepticism, treating it as a consequence of financial misery. The argument that long-term financial ache breeds political backlash (Rodríguez-Pose 2018) has been central to understanding its rise. The geography of EU discontent intently mirrors that of long-term stagnation (Dijkstra et al. 2020). There additionally seems to be a robust hyperlink between exterior financial threats, such because the rise of import competitors from China, and anti-EU voting (Stanig and Colantone 2017).

But this analysis solely covers one aspect of the story. What occurs to economies after voters embrace Euroskeptic events, even when these events will not be in authorities? Can political discontent itself change into an financial legal responsibility, even earlier than Euroskeptic forces can implement coverage?

There was no earlier analysis straight on the implications of Euroskepticism. The closest is figure on the implications of populism, which exhibits that anti-system leaders worldwide usually ship worse financial outcomes, with GDP per capita roughly 10% decrease 15 years after they take workplace (Funke et al. 2023). In accordance with this analysis, populist leaders systematically undermine efficiency via institutional degradation and coverage mismanagement (Funke et al. 2023).

However populism will not be equal to Euroskepticism, and most Euroskeptic events in Europe have hardly ever ruled. Though some, resembling Fratelli d’Italia in Italy or Fidesz in Hungary, management the levers of energy, many others – resembling Rassemblement Nationwide in France or Different für Deutschland in Germany – have remained in opposition. The query thus turns into: does merely signalling widespread Euroskepticism harm regional financial prospects?

The ‘Free Lunch’ Phantasm

Euroskeptic events throughout the political spectrum promise renewal via liberation from Brussels. On the far proper, this implies nationwide competitiveness unburdened by EU guidelines; on the far left, freedom from austerity and monetary constraint. Each traditions share a perception that regaining sovereignty will translate into renewed prosperity.

Has that been the case? We draw on a complete dataset overlaying 1,166 European areas throughout all EU-27 international locations from 2004 to 2023. We measure Euroskeptic help utilizing the vote shares of events that consultants classify versus European integration (scoring 2.5 or beneath on the Chapel Hill Professional Survey’s 1–7 scale). We then monitor how areas with completely different ranges of Euroskeptic voting subsequently carry out on 4 key growth indicators: GDP per capita development, productiveness development, employment development, and inhabitants change.

The findings reveal {that a} area with a ten proportion factors greater Euroskeptic vote share experiences roughly 0.35 proportion factors slower annual GDP per capita development. This may increasingly sound modest, however compounded over a number of electoral cycles, it interprets into substantial divergence. Over 12 years – three electoral cycles – such a area might discover itself roughly 4%–5% poorer than an in any other case comparable however much less Euroskeptic neighbour.

Productiveness tells the same story. Every extra 10 factors of Euroskeptic help is related to decrease annual productiveness development by about 0.10–0.14 proportion factors. Employment creation lags by roughly 0.25 proportion factors yearly, cumulating to about 3% fewer jobs over the identical interval. Inhabitants results are, against this, extra muted, though Euroskeptic areas battle to retain or entice residents. The connection between Euroskeptic sentiment and subsequent financial underperformance seems sturdy and substantial.

The Disaster as a Catalyst

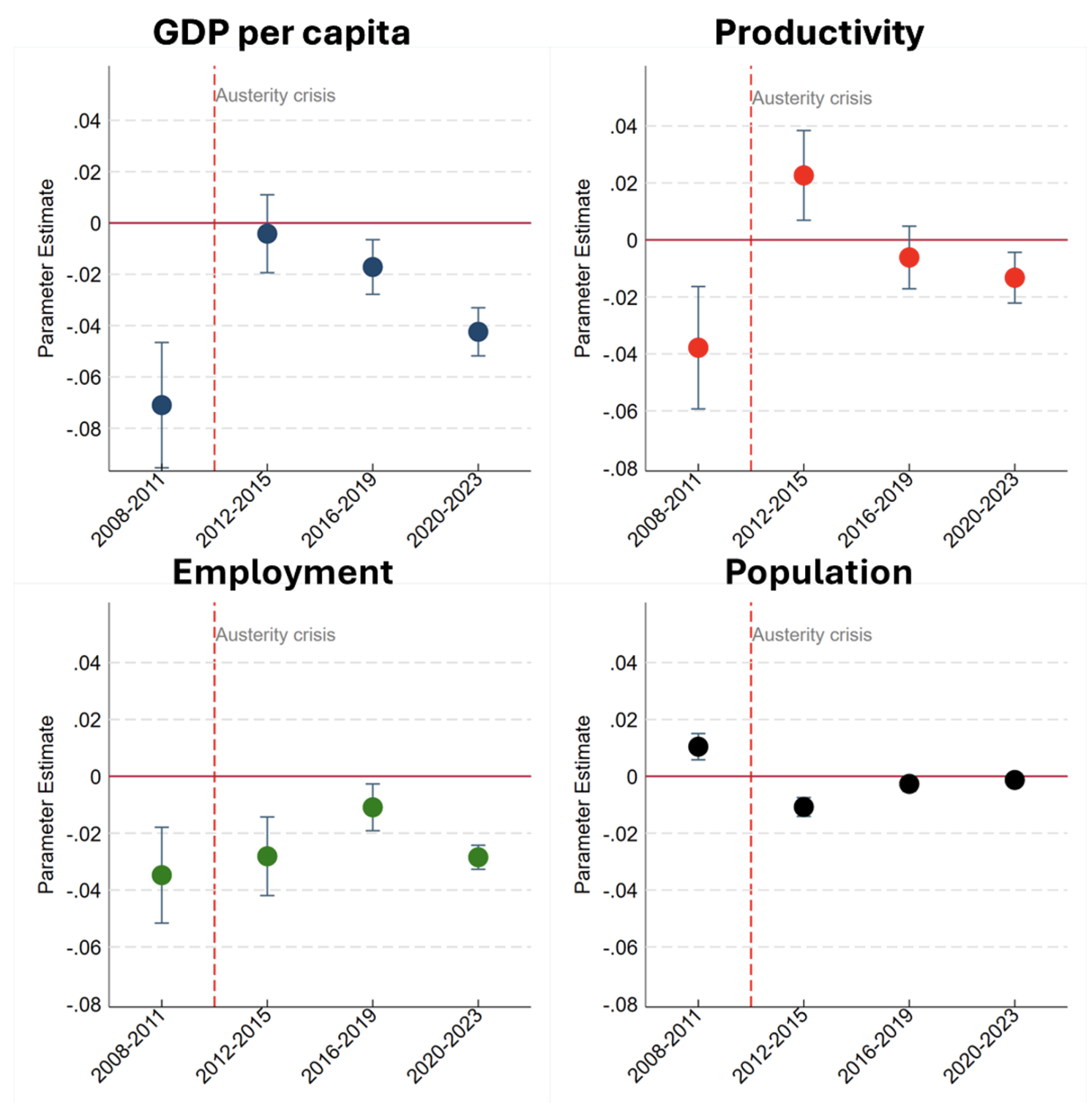

The 2012–2013 euro space disaster and subsequent austerity acted as a essential juncture. Earlier than the disaster, the financial penalty related to Euroskepticism was current however muted. The disaster modified all the things: residents of areas with excessive Euroskeptic sentiment suffered disproportionately throughout and particularly after this era.

For GDP per capita, the post-2012 penalty almost doubled in contrast with the pre-crisis interval. A area that’s to factors extra Euroskeptic noticed annual development charges fall by an extra 0.16 proportion factors after 2012, bringing the full impact to roughly 0.38 proportion factors yearly. By 2023, this translated right into a cumulative earnings shortfall approaching 5.5% (Determine 2).

Determine 2 Improvement implications of Eurokceptic help and the disaster (occasion examine evaluation)

Be aware: The interval on the horizontal axis refers back to the interval after the electoral cycle.

Why did the disaster amplify Euroskepticism’s financial influence? A number of mechanisms seemingly operated concurrently. First, areas vocally against the EU might show much less efficient at securing or deploying European funds. As Crescenzi et al. (2020) have proven, EU funds can mitigate relatively than gasoline Euroskepticism when correctly deployed. However attaining this requires institutional capability and a willingness to interact with EU mechanisms, exactly what Euroskeptic areas typically lack (Rodríguez-Pose et al. 2024). Buyers confronting scarce capital post-crisis might keep away from areas perceived as politically unstable or doubtlessly hostile to EU frameworks. The disaster additionally heightened regional polarisation. Areas with sturdy Euroskeptic sentiment might have skilled lowered social cohesion and institutional belief exactly when cooperation was most wanted for restoration.

Not Only a Story About Attaining Energy

Crucially, these results materialise largely with out Euroskeptic events really holding energy. Regardless of their current speedy rise, most such events have remained in opposition, with notable exceptions resembling Greece’s Syriza, Hungary’s extended Fidesz rule, or varied Euroskeptic events in Italy. The financial penalty due to this fact operates via channels past direct coverage implementation.

Excessive Euroskeptic vote shares might sign deep institutional mistrust and political uncertainty to companies and buyers. When buyers understand hostility in the direction of the EU or uncertainty about future relations with Brussels, capital flows gradual, companies hesitate to take a position, and nationwide funding and structural funds could also be underused or diverted.

The political act of repudiating integration seems to hold financial penalties even earlier than it interprets into coverage. Corporations contemplating investments might hesitate when native electorates exhibit hostility in the direction of the EU frameworks that underpin the only market. Even with out coverage modifications, widespread Euroskepticism can deter exterior funding and lift perceived threat. The Brexit expertise, the place enterprise funding stalled nicely earlier than precise withdrawal, affords a vivid illustration of how political uncertainty alone can chill financial exercise (van Oort et al. 2017). Uncertainty can ripple via regional economies lengthy earlier than Euroskeptics attain energy.

Regional leaders in extremely Euroskeptic areas can also regulate their agendas in response to sturdy anti-EU sentiment, resulting in decrease or completely different engagement in EU programmes, European cooperation initiatives, or enterprise growth methods, even when these leaders will not be from Euroskeptic events themselves. The cumulative impact of such micro-decisions, multiplied throughout corporations, governments, and people, can considerably alter development trajectories.

A Vicious Cycle

These findings expose a troubling suggestions loop. Financial stagnation and regional decline gasoline Euroskeptic voting, as demonstrated by analysis on Europe’s ‘growth entice’ (Diemer et al. 2022, Rodríguez-Pose et al. 2024). Many European areas have change into trapped in persistent low development, unable to adapt to structural financial change (Iammarino et al. 2020). As our evaluation exhibits, Euroskeptic sentiment then turns into a part of the issue, not only a symptom. Areas embracing Euroskeptic events expertise slower financial dynamism and prosperity, which seemingly additional intensifies discontent, doubtlessly driving even stronger Euroskeptic help in subsequent elections.

This dynamic creates a very pernicious type of path dependence. Voters in struggling areas flip to Euroskeptic events in search of change and prosperity. But their selection – nevertheless comprehensible given their frustrations – seems to worsen their financial prospects, deepening the very stagnation that motivated the protest vote initially. The promised ‘free lunch’ of lowered EU integration delivering financial revival proves illusory. As an alternative, residents in Euroskeptic areas successfully pay for his or her political discontent via foregone development and missed alternatives.

Breaking the Cycle

The coverage implications are profound. The answer is to not disparage Euroskeptic voters, whose grievances are sometimes actual, however to recognise the financial price of channelling them via anti-European politics. Labelling the inhabitants of those areas as “deplorables”, as Hillary Clinton did in her failed 2016 presidential marketing campaign, or treating their areas as misplaced causes will solely reinforce alienation (Rodríguez-Pose 2018). Nor will easy fiscal transfers suffice (Borin et al. 2021). Cash with out engagement might soothe signs however not the underlying malaise. Left-behind folks and left-behind locations want trustworthy political re-engagement alongside focused financial reinvestment.

A twin technique seems crucial. Politically, the EU and nationwide governments should hear and reply to considerations about equity, visibility, and native voice that drive Euroskepticism. Economically, focused initiatives selling regional growth, schooling, entry to capital, and financial diversification are important. Current EU initiatives such because the joint restoration fund and the emphasis on a ‘simply transition’ in local weather coverage signify constructive steps, however these should demonstrably goal susceptible areas to succeed.

Above all, humility is required. Many citizens embraced Euroskeptic events as a result of mainstream politics failed them for too lengthy. But their selection seemingly worsened their financial prospects; an irony that ought to give everybody pause. The issue resides not solely with voters or establishments however of their fractured relationship. Rebuilding belief in democratic establishments, together with the EU’s capability to ship broad-based prosperity, stays paramount.

Crucially, governance and institutional high quality matter. Enhancements in regional establishments are sometimes extra decisive for development than bodily capital alone (Rodríguez-Pose and Ketterer 2019). The place native governments are clear, accountable, and efficient, EU funds translate into real growth; the place they aren’t, cynicism festers. The vicious cycle of discontent can solely be damaged by a virtuous one among competence.

Conclusion

Euroskepticism isn’t any free lunch. Its rise exacts an financial toll that disproportionately impacts those that anticipated to profit from it. Europe’s future is determined by guaranteeing that Euroskepticism doesn’t change into a everlasting barrier to financial growth throughout the continent. This requires greater than platitudes about European unity or technocratic changes to cohesion coverage. It calls for responsive governance that helps remodel right this moment’s Euroskeptic strongholds into tomorrow’s success tales, reintegrating disenfranchised residents right into a extra affluent and unified Europe. The choice – permitting the vicious cycle of discontent and decline to proceed – dangers fragmenting the European challenge from inside, area by area, vote by vote.

See authentic publish for references