[ad_1]

courtneyk

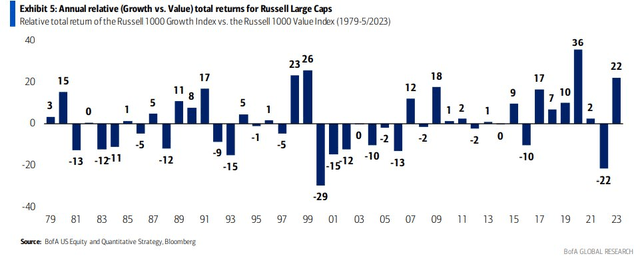

The value trade has taken it on the chin in 2023. The cyclical and yield-heavy style is underperforming growth by 22 percentage points year-to-date. The AI boom overshadows rising interest rates, reversing price action trends seen last year. Amid that macro-technical trend, I see mixed risks in one Financials sector name that does business in South America. I reiterate a hold rating on Patria Investments (NASDAQ:PAX).

Growth > Value In 2023

BofA Global Research

According to Bank of America Global Research, PAX is the largest private markets asset manager across LatAm with Brazil and Chile being its two largest markets. The firm invests across private equity, credit, infrastructure, and real estate. While the firm is focused on private investing in LatAm, it raises most of its capital from large limited partners in North America, Asia, and Europe.

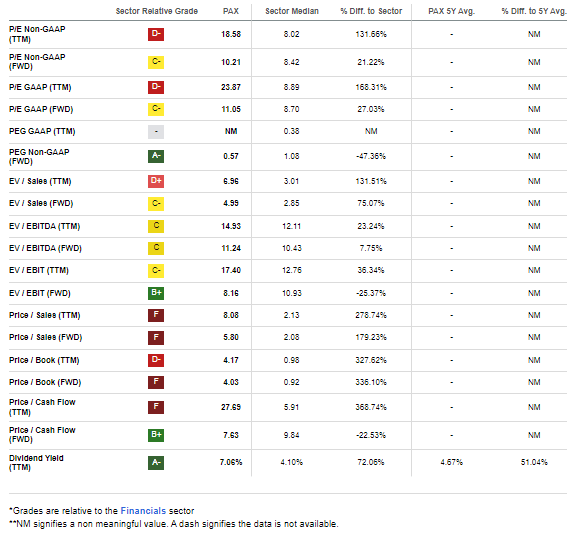

The Cayman Islands-based $2.0 billion market cap Asset Management and Custody Banks industry company within the Financials sector trades at a high 24.3 trailing 12-month GAAP price-to-earnings ratio and pays an also high 7.1% dividend yield, according to The Wall Street Journal. The dividend rate was recently slashed, but its payout policy is flexible unlike how many American companies focus on dividend consistency. So this is not cause for much concern, in my view.

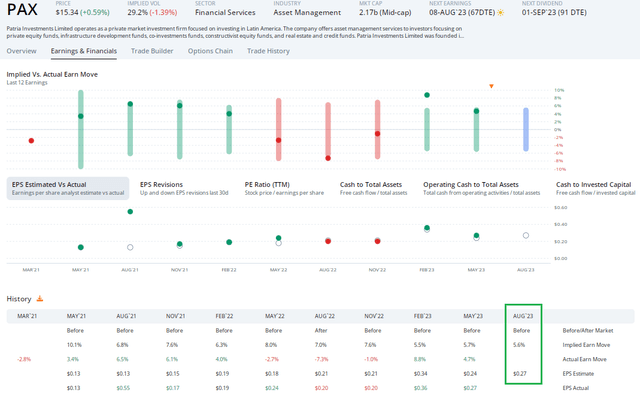

Good news came in late May when it was announced that Patria would be included in the Russell 2000 and 3000 indexes. That creates natural buying pressure as index funds are then required to own the company to meet their benchmark allocations. Before that sanguine story hit the tape, Patria reported $0.27 of Q1 GAAP earnings on May 4. Revenue for the quarter grew by more than 34%, though fee-related earnings fell slightly from 1Q22.

PAX stock rose on generally upbeat numbers even with the slight drop in the dividend distribution. The multi-year growth outlook still appears decent with its organic and M&A-led opportunities but the valuation may remain capped due to geopolitical risks. As time goes on, I see upside potential to earnings, but uncertainty remains.

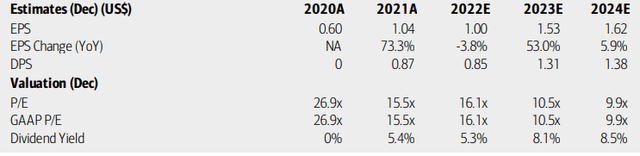

On valuation, analysts at BofA see earnings rising sharply this year after EPS hovered near $1 in 2021 and 2022. With per-share profits rising toward $1.60 in the out year, the stock sports low earnings multiples. The current forward operating P/E is 11.1, though that’s at a slight premium to the sector median and on the high end of where it has registered so far this year. Still, the yield remains high, and more consistent earnings should allow for dividend stability in the coming quarters.

Patria: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

Overall, if we assume $1.55 in next-12-month EPS and apply a 10 P/E, then the stock should be near $15.50 – close to where shares trade today. I am a hold on valuation, though this is a name income investors may like.

PAX: Fairly Valued Relative To Sector Norms

Seeking Alpha

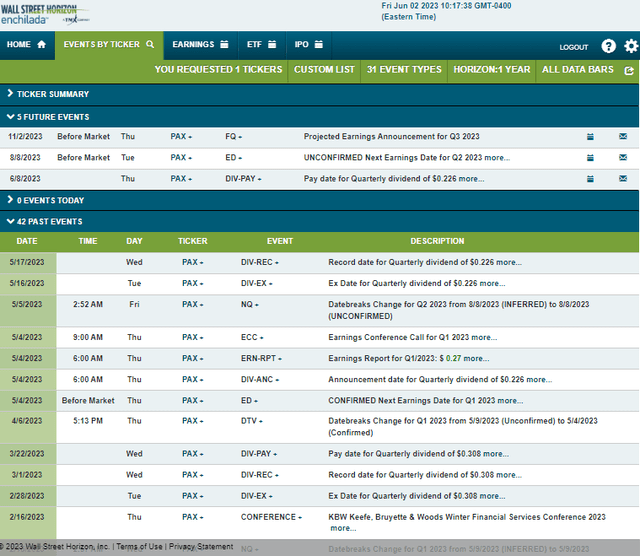

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Tuesday, August 8 BMO. Before that, PAX has a dividend pay date of Thursday, June 8.

Corporate Event Risk Calendar

Wall Street Horizon

The Options Angle

Ahead of the August earnings release, data from Option Research & Technology Services (ORATS) show $0.27 of EPS expected by analysts. That would be a strong 35% increase from just $0.20 of per-share profits earned in the same period a year ago. Coming off back-to-back beats in which shares traded up, there is some bullish sentiment around Patria.

For the Q2 report, the options market has priced in a 5.8% earnings-related stock price move when analyzing the at-the-money straddle expiring soonest after the August report. That appears fair to me given recent volatility trends around reporting dates. With 29% implied volatility in this small Financials sector firm, options pricing looks rightly priced.

PAX: Modest Volatility Seen In Advance of Q2 Earnings

ORATS

The Technical Take

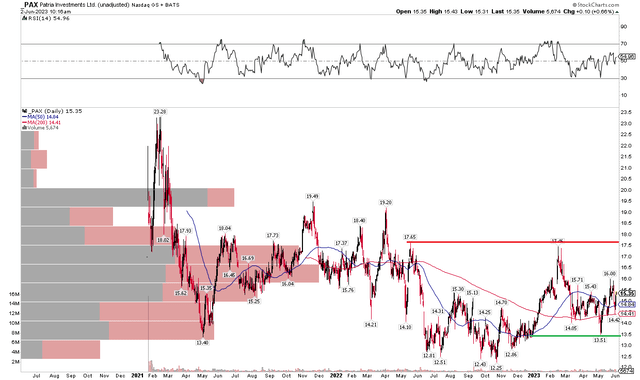

With a lukewarm valuation, the chart is likewise unimpressive. Notice in the graph below that PAX has been meandering over recent weeks. I see modest support in the $13.50 to $14 zone while the $17 to $18 area is resistance. With the long-term 200-day moving average basically flat in its slope, there is no clear control by either the bulls or the bears.

What’s more, the RSI momentum indicator at the top of the chart shows that PAX is neither overbought nor oversold. I am encouraged, however, that the downbeat news of the dividend dip a month ago was initially met with selling pressure, but then the bulls stepped up post-earnings.

PAX: Trendless Action Heading Into Summer

Seeking Alpha

The Bottom Line

I reiterate my hold rating on PAX. Shares appear fairly valued while the technical situation is mixed. With a high yield, income investors can consider this but should keep it to a small portfolio position.

[ad_2]

Source link