Mohamad Faizal Bin Ramli

By Christina Siegel Malbon

2Q25 Portfolio Exercise and Attribution

Fund Highlights

In the course of the second quarter of 2025, the Affected person Alternative Fairness Technique generated a complete return of 15.3% internet of charges. As compared, the technique’s unmanaged benchmark, the S&P 500 Index, returned 10.9%.

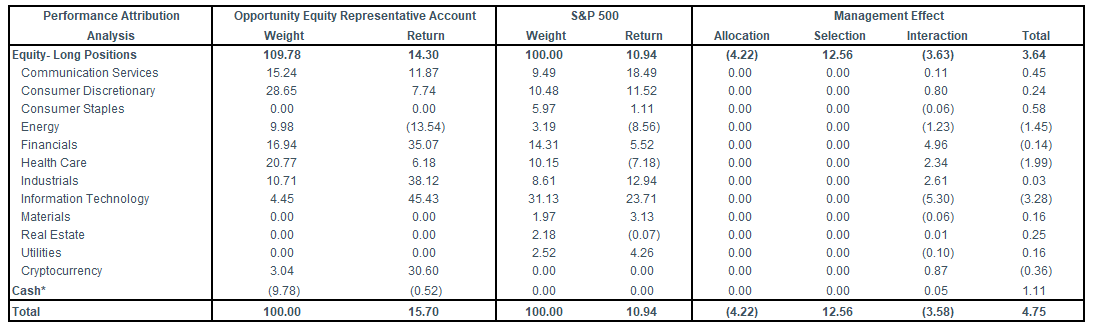

Utilizing a three-factor efficiency attribution mannequin, choice impact contributed to the portfolio’s outperformance which was partially offset by each allocation and interplay results. QXO Inc. (QXO), Coinbase World Inc. (COIN), Nvidia Corp. (NVDA), Dave & Buster’s Leisure Inc. (PLAY), and Meta Platforms Inc. (META) have been the most important contributors to efficiency, whereas New Fortress Power Inc. (NFE), Kosmos Power Ltd (KOS), Alibaba Group Holdings (BABA)(OTCPK:BABAF), JD.com (JD), and Biogen Inc. (BIIB) have been the most important detractors.

Relative to the index, the technique was obese the Client Discretionary, Communication Providers, Financials, Power, Industrials, and Well being Care sectors on common in the course of the quarter. With zero allocation to Actual Property, Utilities, Supplies, and Client Staples, the portfolio was underweight these sectors together with Info Expertise.

The portfolio added 5 positions, Noble Company (NE), Tempus AI Inc. (TEM), UnitedHealth Group Inc. (UNH), Clear Safe (YOU), and Costco Wholesale Company Put Choices (COST 1/16/26 P960) within the quarter. We eradicated three positions, Carvana Co. (CVNA), New Fortress Power Inc. (NFE) and closed the lengthy leg of our name unfold in Nvidia Inc. (NVDA 9/19/2025 C118) in the course of the quarter.

The portfolio ended the quarter with 41 holdings the place the highest 10 shares represented 51.0% of complete belongings in comparison with 36.6% for the index, highlighting the portfolio’s significant energetic share of round 93.6%.

Portfolio Overview

Following the sharp sell-off at the beginning of the second quarter, the inventory market staged a V-shaped restoration, rallying 30% intraday trough-to-peak and in the end surpassing the all-time excessive set in February. Early fears over aggressive tariff coverage regularly pale because the market believed the ultimate measures can be far much less extreme than initially anticipated.

As some positions approached our estimate of intrinsic worth earlier within the 12 months, we took down our publicity. Nevertheless, the next market decline created compelling alternatives, and we used the dislocation so as to add to severely depressed names.

By the tip of the quarter, lots of our holdings had rebounded sharply, significantly inside our cyclical publicity, which was among the many hardest hit earlier within the 12 months.

Bitcoin ETFs (FBTC) and crypto-exposed names like Coinbase World Inc. (COIN) rebounded sharply in the course of the quarter following the Trump administration’s passing of the GENIUS Act in June together with Trump’s April government order launching a Strategic Bitcoin Reserve, marking a pivotal shift towards a crypto-friendlier regulatory framework.

Turnaround names akin to Dave & Buster’s Leisure (PLAY) and Canada Goose Holdings Inc. (GOOS) had spectacular rebounds, pushed by better-than-expected earnings outcomes and resilient client spending knowledge. Each corporations profit from idiosyncratic catalysts that we imagine can proceed to drive improved efficiency outdoors of macro traits.

Lastly, we continued so as to add to positions in Healthcare and Power, two sectors which have broadly disillusioned however the place we see long-term alternative.

In Power, we hunt down idiosyncratic alternatives with robust return potential. We added publicity to offshore drillers by means of Seadrill Restricted (SDRL) and Noble Corp. (NE), which we imagine are nicely positioned as onshore manufacturing contracts and offshore turns into the marginal supply of provide over time. On the identical time, the rig provide has tightened, creating a good long-term provide/demand dynamic. Kosmos Power (KOS), alternatively, is nearing a key inflection level. As its Tortue LNG challenge ramps to full capability, manufacturing and free money move are anticipated to extend considerably. From 2025 to 2029, we imagine Kosmos will generate greater than twice its present market cap in free money move.

In Healthcare, we see a sector buying and selling at enticing historic valuations with vital long-term potential. UnitedHealth Group (UNH), a long-time market favourite, noticed its inventory fall over 50% from peak to trough following disappointing ends in its Medicare Benefit enterprise. Regardless of near-term challenges, we imagine United stays a class chief with a sturdy platform and powerful aggressive positioning. Now we have confidence of their capability to enhance earnings energy and revenue margins. Firms like Tempus AI (TEM) are embedding AI throughout their huge molecular datasets, enabling extra personalised and exact diagnostics, ushering in a brand new period of clever, data-driven healthcare.

New and Eradicated

This quarter we entered 5 new positions, whereas exiting three. We initiated a place in UnitedHealth Group Integrated (UNH), one of many largest healthcare corporations in america, after the inventory declined greater than 50% from its 2025 highs, reaching multi-year lows. The drop adopted a uncommon misstep in its Medicare Benefit enterprise, the place higher-than-expected prices drove margin compression, a reduce to EPS and in the end, the withdrawal of ahead steering. In response, the corporate introduced a management change, bringing again former CEO and present Chairman Stephen Hemsley. UNH has lengthy been a market favourite for its consistency in development, earnings and return on capital. The frustration led traders to flee. Whereas the short-term outlook stays murky, over the long-term we’ve confidence the corporate can enhance underwriting margins. With all opponents centered on underwriting to margins, future pricing ought to be extra rational and consistent with present utilization traits. Rebuilding investor confidence might take time, however we imagine UNH’s built-in platform and distinctive asset combine place it to stay a class chief and return to robust returns over time. Following the sell-off, a number of insiders stepped in to purchase inventory, most notably Stephen Hemsley with a $25M buy and the CFO, John Rex, with $5M. The corporate additionally has an $8.4B buyback authorization (roughly 3% of shares) and a sturdy 10% free money move yield. Administration stays assured in its capability to compound EPS at a 13–16% price over the long run. We view the latest dislocation as a chance to personal a high-quality compounder at a compelling valuation.

We initiated a place in Noble Company PLC (NE) within the quarter. Noble is a number one offshore drilling contractor. We predict the offshore drilling market is enticing long-term, significantly as development in land-based oil manufacturing slows. Business dynamics have steadily improved since 2019, with vital consolidation lowering the variety of main gamers to only 4. On the identical time, practically half of all deepwater rigs have been scrapped over the previous decade, and with minimal present capital funding, provide development is anticipated to stay constrained for years to return. Regardless of latest price pressures, Noble’s fundamentals stay sound. Their 2025 steering is absolutely backed by its contracted backlog, and the corporate’s continued concentrate on price self-discipline ought to assist margin growth and powerful free money technology. Administration has dedicated to returning 100% of free money move to shareholders, by means of each a dividend (7% yield) and share repurchases (representing 8% of shares excellent). We imagine Noble is nicely positioned to additional consolidate the sector and profit from enhancing offshore market situations over the long-term.

Tempus AI Inc. (TEM), is a number one precision drugs platform centered on reworking most cancers care by means of knowledge and synthetic intelligence (AI). The enterprise operates throughout three synergistic segments – genomics, knowledge and providers, and AI functions – that collectively reinforce its aggressive moat. These segments feed into each other, enabling Tempus to construct one of many world’s largest molecular databases of most cancers sufferers. Leveraging this library, the corporate is embedding AI into diagnostic workflows to drive extra personalised, data-driven remedy choices. Although nonetheless early in its lifecycle, Tempus is on monitor to surpass $1B in income inside its first decade and expects to realize EBITDA profitability this 12 months, an vital milestone. Whereas oncology stays its core market right this moment, the corporate is increasing into different areas like cardiology, neuropsychology, and radiology. We imagine healthcare is primed for disruption by means of AI and Tempus is nicely positioned to take benefit. Now we have excessive conviction in its capability to proceed profitable new enterprise, increasing its database, and reaching profitability.

We initiated an choices place in Costco Wholesale Company (COST 1/16/26 P960) in the course of the quarter, buying at-the-money places with a 2026 expiration. We’ve persistently highlighted the danger lurking within the “overpriced compounder” section of the market, and we view Costco as a first-rate instance. The inventory is at present buying and selling at 54x earnings regardless of rising solely at a mid-single-digit price. Whereas Costco is undoubtedly a well-run enterprise, we imagine paying greater than twice the market a number of for a low-growth, low-margin retailer is troublesome to justify. In some unspecified time in the future, we anticipate the market to reassess the premium valuation being positioned on Costco’s fundamentals. When it does, we imagine the inventory might face significant draw back from its present all-time excessive a number of.

We entered Clear Safe Inc. (YOU), a number one safe id verification supplier. The corporate is finest identified for serving to prospects bypass TSA strains at airports however additionally they present related safety providers at skilled sports activities occasions and live shows. Their line-skipping enterprise delivers spectacular profitability with double-digit free money move yields and excessive margins. Longer-term the chance lies in increasing their id verification expertise into Healthcare and Monetary Providers. We haven’t discovered one other firm that has a ten% free money move yield, no debt on the stability sheet, file earnings, enhancing margins, wonderful administration, shopping for again shares and is outperforming the market YTD and over 1-year.

We exited a number of smaller positions in the course of the quarter to reallocate capital towards new alternatives and focus additional in our highest-conviction names. We offered Carvana Co. (CVNA) and closed the lengthy leg of our name unfold in Nvidia Inc. (NVDA 9/19/2025 C118). We exited New Fortress Power Inc. (NFE) following deteriorating fundamentals and an more and more strained stability sheet.

Prime Contributors and Prime Detractors

| Prime Contributors | Ticker | Web Contribution (BPs) |

| QXO Inc. | QXO | 287 |

| Coinbase World Inc. | COIN | 235 |

| Nvidia Corp. | NVDA | 184 |

| Dave & Buster’s Leisure Inc. | PLAY | 150 |

| Meta Platforms Inc. | META | 137 |

| Prime Detractors | Ticker | Web Contribution (BPs) |

| New Fortress Power Inc. | NFE | -107 |

| Kosmos Power Ltd. | KOS | -63 |

| Alibaba Group Holdings Ltd. | BABA | -49 |

| JD.com Inc. | JD | -40 |

| Biogen Inc. | BIIB | -38 |

*Contribution illustrated above are offered internet of charges and consists of money.

Prime Contributors

QXO Inc. (QXO) was the highest contributor to efficiency in the course of the quarter following the completion of its $11B acquisition of Beacon Roofing in April. This marks the primary of what’s anticipated to be a collection of acquisitions, as the corporate pursues a roll-up technique within the extremely fragmented constructing merchandise distribution trade. QXO is leveraging a confirmed playbook that its administration group has efficiently executed throughout different sectors. With a powerful monitor file and investor confidence, the corporate advantages from the flexibility to lift capital on enticing phrases, giving it a aggressive edge vs friends. Moreover, administration has confirmed their worth self-discipline strolling away from a bidding battle for GMS Inc., which was in the end acquired by Dwelling Depot. We view this disciplined method as a testomony to administration’s long-term focus. Over the subsequent decade, QXO is focusing on greater than $50B in annual income. Now we have excessive conviction in Brad Jacobs’ management and imagine the corporate is nicely positioned to grow to be a long-term compounder.

Coinbase World Inc. (COIN) rebounded within the second quarter, monitoring power in each Bitcoin and the broader cryptocurrency market. We imagine it stays early innings for institutional adoption and publicity to digital belongings, and Coinbase is steadily solidifying its place because the platform of alternative inside the crypto ecosystem. Current enhancements to its pockets, Base platform, and USD Coin might assist set off broader uptake. Moreover, the Trump administration’s passage of the GENIUS Act in June together with Trump’s April government order launching a Strategic Bitcoin Reserve, marks a pivotal shift towards a crypto-friendlier regulatory framework. We’re inspired by Coinbase’s continued funding in innovation, which we imagine will additional widen its aggressive moat over time.

Nvidia Corp. (NVDA) recovered strongly within the second quarter, climbing again from earlier declines to finish the quarter at an all-time excessive. Because the undisputed chief in Graphics Processing Models (GPUs), Nvidia continues to profit from surging demand for AI coaching and inference. Regardless of issues over competitors from TPUs and rivals like AMD, Nvidia stays within the lead. The corporate is quickly releasing next-gen merchandise, with the Blackwell line-up, its quickest structure but, hitting the market simply 2 years after its predecessor. Furthermore, Nvidia is aggressively increasing into adjoining areas together with robotics, edge AI, AI cloud leasing, and AI software program placing them in direct competitors with a few of their largest prospects. CEO Jensen Huang describes Nvidia as a “full-stack, accelerated computing platform”, reflecting its mix of cutting-edge {hardware}, software program (CUDA), and AI infrastructure. With modern tech, a shortening innovation cycle, and strong money move, we imagine Nvidia is nicely positioned to trip the accelerating wave of AI adoption.

Prime Detractors

New Fortress Power (NFE) declined in the course of the quarter following a disappointing first quarter earnings report and rising issues over its liquidity place. The corporate, a vertically built-in LNG infrastructure supplier with strategic import terminals in growing markets, was initially anticipated to profit from elevated LNG adoption as a transitional gasoline. Nevertheless, reported volumes in its core terminal enterprise fell nicely in need of administration’s expectations, and shifting provide dynamics left the corporate uncovered to commodity worth threat. With deteriorating fundamentals, a excessive debt load and near-term maturities, we selected to exit the place given the risking threat of potential default. Our issues have been additional bolstered by the corporate’s delayed 10-Okay submitting, which included new language expressing “substantial doubt” about its capability to proceed as a going concern.

Kosmos Power (KOS) traded decrease in the course of the quarter, consistent with broader vitality worth declines. The corporate is approaching a key inflection level, with manufacturing and free money move anticipated to extend meaningfully as its Tortue LNG challenge ramps to full capability. Whereas 2025 has been disappointing, marked by delays in manufacturing timelines and price overruns, we’re now seeing constructive momentum, with Tortue coming on-line and volumes steadily growing. Kosmos stays centered on maximizing money technology and deleveraging its stability sheet. At present commodity costs, the corporate is positioned to generate free money move equal to just about 2x its market cap between 2025 and 2029. With gas-heavy reserves, a ramping money move profile, and a strategic asset base, we imagine Kosmos is considerably undervalued—and could possibly be a compelling acquisition goal in a consolidating vitality setting.

Alibaba Group Holdings (BABA) offered off early within the quarter following President Trump’s “Liberation Day” tariff announcement, which imposed ~50% tariffs on Chinese language items. Because the US and China moved towards tentative agreements, the inventory started to recuperate. Basically, we proceed to see a gorgeous setup. Alibaba is benefiting from accelerating AI initiatives, renewed momentum in its Tmall platform, and speedy development in on the spot buying and native providers. These traits assist a broader turnaround in core commerce and digital providers. Regardless of these tailwinds, the corporate trades at simply 11.2x earnings, nicely under historic averages, and continues to return capital to shareholders by means of a 1% dividend yield and a sturdy buyback program. We imagine Alibaba stays considerably undervalued relative to its sum-of-the-parts, and see significant upside as fundamentals stabilize and sentiment improves.

|

Market Proxy is S&P 500. Returns higher than 1 12 months are annualized. Supply: Bloomberg and Affected person Capital Administration The info offered is from APX and Affected person Capital Administration, LLC and is believed to be dependable, however isn’t assured as to its timeliness or accuracy. Percentages and returns might not sum to 100% as a consequence of rounding results. A 3-factor attribution consists of the allocation impact, choice impact, and the interplay impact, which sum to the portfolio’s efficiency relative to the benchmark. • Allocation. The allocation impact represents the portion of the portfolio’s extra return attributable to variations in sector weights between the portfolio and the benchmark index. • Choice. The choice impact represents the portion of the portfolio’s extra return attributable to variations within the weights of particular person securities inside every sector between the portfolio and the benchmark index. • Interplay. Most complicated and typically counterintuitive, the interplay impact represents the portion of the portfolio’s extra return attributable to combining sector allocation choices with safety choice choices, and is usually regarded as measuring the accuracy of supervisor’s convictions. Please word that the methodology utilized by our unbiased third-party attribution software program vendor will at instances current sector allocation results which might be counterintuitive. For instance, the software program might calculate a detrimental sector impact even when the portfolio, on a weighted common foundation for the interval, was obese an outperforming sector. Below the seller’s methodology, allocation results in latest months might overwhelm the allocation results from earlier within the interval, significantly over longer time frames. Returns illustrated above are offered internet of charges and embrace money. Whole portfolio return figures offered above replicate the sum of the returns of the holdings within the consultant account portfolio as a consequence of worth actions and dividend funds or different sources of revenue. |

|

For Institutional Traders Solely. This data doesn’t represent, and shouldn’t be construed as, funding recommendation or suggestions with respect to the securities and sectors listed. All investments are topic to threat, together with the potential lack of principal. There isn’t a assure funding targets might be met. Neither Affected person Capital Administration, LLC, nor its data suppliers are liable for any damages or losses arising from any use of this data. The Alternative Fairness composite efficiency figures mirrored above embrace the deduction of a mannequin funding administration price of 1% (the very best price for separate accounts beneath our price schedule), paid quarterly and sure different bills. For vital details about Alternative Fairness Technique efficiency, please click on on the Alternative Fairness Technique Composite Efficiency Disclosure. Previous efficiency is not any assure of future outcomes. All holdings and portfolio knowledge are reflective of a consultant Alternative Fairness account. Efficiency in attribution desk isn’t official technique returns. The return is sourced from APX and is internet of charges primarily based on the technique’s consultant account. Contributors detailed above signify the highest 5 securities that contributed positively to efficiency in the course of the quarter. Detractors detailed above signify the highest 5 securities that detracted from efficiency in the course of the quarter. Info detailed above is offered internet of charges, consists of money, and relies on a consultant Alternative Fairness account. Contribution listed above represents the interval when the safety was held in the course of the quarter. For added data on how Prime Contributors and Prime Detractors have been decided and/or to acquire a listing displaying each holding’s contribution to the consultant Alternative Fairness account efficiency contact us. The knowledge offered shouldn’t be thought of a suggestion to buy or promote any safety and shouldn’t be relied upon as funding recommendation. It shouldn’t be assumed that any buy or sale choices might be worthwhile or will equal the efficiency of any safety talked about. References to particular securities are for illustrative functions solely. Portfolio composition is proven as of a cut-off date and is topic to alter with out discover. The views expressed on this commentary replicate these of Affected person Capital Administration portfolio managers and analysts as of the date of the commentary. Any views are topic to alter at any time primarily based on market or different situations, and Affected person Capital Administration disclaims any accountability to replace such views. The knowledge offered shouldn’t be thought of a suggestion to buy or promote any safety and shouldn’t be relied upon as funding recommendation. It shouldn’t be assumed that any buy or sale choices might be worthwhile or will equal the efficiency of any safety talked about. Previous efficiency is not any assure of future outcomes. Click on for the Alternative Fairness Technique Composite Efficiency Disclosure. ©2025 Affected person Capital Administration, LLC |

Authentic Put up

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.