da-kuk/E+ via Getty Images

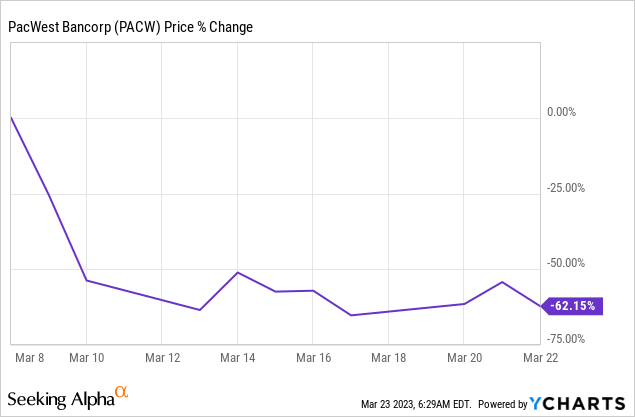

PacWest Bancorp (NASDAQ:PACW) provided an important liquidity and deposit update on March 22, 2023 that plainly stated that the community bank has more than enough liquidity and that it is not planning on doing a dilutive capital raise… which one would expect to be good news in the midst of a minor financial crisis. However, the bank’s shares dropped 17% on Wednesday driven by the FED’s decision to increase rates 25 basis points. By prioritizing the fight against inflation over easing cost and valuation pressures for the financial sector, new selling pressure has emerged for bank stocks. I believe the market is wrong in punishing PacWest Bancorp, especially because of the bank’s positive liquidity disclosure. Therefore, I am reaffirming my Strong Buy rating on PACW and I see the drop as a new buying opportunity for investors with a medium- to high-risk tolerance!

PacWest Bancorp’s liquidity/deposit update and the market’s focus on the FED’s rate decision

Ever since Silicon Valley Bank imploded after a run on its deposits two weeks ago, investors have been on edge. With fears spreading through the financial system, regional banks have not only seen deposit outflows, but also massive declines in their market caps and valuation metrics. One of the most heavily punished community banks so far has been PacWest Bancorp.

You would think that a bank explicitly stating that it has enough liquidity and doesn’t need to raise extra capital through a dilutive equity offering would be rewarded in the stock market, but you are wrong. PacWest Bancorp’s shares slumped 17% on March 22, 2023 and has now lost about 62% of its market cap since March 8, 2023.

PacWest Bancorp issued an important liquidity update on Wednesday that the market ignored and that didn’t do, surprisingly, anything positive for investor sentiment.

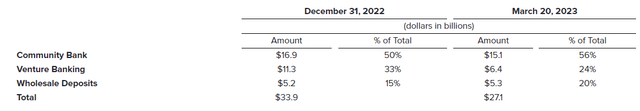

PacWest Bancorp said that $6.8B worth of deposits had been withdrawn from the bank between the end of FY 2022 and March 20, 2023, which represents a decline of 20%. Total deposits held by the bank as of March 20, 2023 were $27.1B. About $4.9B in deposits were lost by the venture banking business which has been a core operating focus for PacWest Bancorp. Venture banking deposit withdrawals alone explain 72% of all withdrawals that occurred lately as these deposits often exceed the FDIC’s $250,000 insurance limit.

PacWest Bancorp also said that its available liquidity pool amounted to $11.4B which exceeds the total amount of uninsured deposits ($9.5B) by 20%. Therefore, even if all uninsured deposits were to be withdrawn from the bank at once, PacWest Bancorp would have more than enough liquidity to fund such withdrawals.

Source: PacWest Bancorp

No need for a capital raise

PacWest Bancorp is said to have initially explored an equity sale, but has decided against it, according to its liquidity update for three reasons: (1) Any raise at this time would have been highly unfavorable to investors due to depressed valuations, (2) PacWest Bancorp successfully tapped a $1.4B senior asset-backed financing facility from private equity investor Atlas SP Partners, and (3) Incremental liquidity has been made available by the FED’s Bank Term Funding Program.

My reading of the liquidity update is that the bank doesn’t need a capital raise at this point and that different sources of cash provide sufficient liquidity to cover more than 100% of all uninsured deposits. In normal times, a bank would be rewarded for such an update as it is clearly positive, and PacWest Bancorp should have been especially rewarded for it considering that the community banking sector has been weighed down by fears over inadequate liquidity and the possibility of a dilute equity raise. This clearly has not been the case as shares of the bank plunged 17% on Wednesday and investors focused more on the FED’s rate decision.

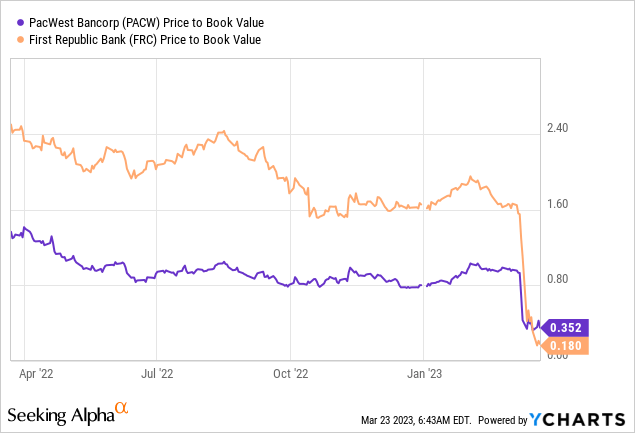

Enormous BV discount still present

Besides raising interest rates by 25 bps on Wednesday, the FED also said that banking system is “strong and resilient” which should have helped bank valuations as well.

The market’s irrational reaction, however, pushed PacWest Bancorp’s share price down to $10 and the book value discount back to a staggering 65%. PacWest Bancorp currently has the second-largest BV discount, after First Republic Bank (FRC).

Considering that PacWest Bancorp has seen a deposit outflow of 20% since the end of FY 2022, the bank is set to report a considerable drop in BV for Q1’23. My guess is that the bank’s book value could decrease by 20-25% compared to the end of December simply due to the withdrawal of deposits (although some of those deposits may flow back to PacWest Bancorp at a later stage).

PacWest Bancorp had a book value of $28.71 at end of the December-quarter. Applying a 20-25% discount to book value due to the mentioned deposit losses, PacWest Bancorp may report a book value per share in a potential range of $21.53-$22.97 for Q1’23. At this book value level, investors would still be able to take advantage of an outsized BV discount of 53-56%. This means that investors, despite recent deposit outflows, are likely to get a considerable discount on PacWest Bancorp’s book valuation.

Risks with PacWest Bancorp

The most obvious risk for PacWest Bancorp is that investors and depositors are losing trust in the bank’s ability to deal with accelerating deposit withdrawals. Given the liquidity available to the community bank and the explicitly stated opinion that a capital raise is not needed at this time, I believe the risk of missing out on potential recovery gains is larger than the incremental downside in the stock.

Final thoughts

PacWest Bancorp’s liquidity update, in my opinion, should have done wonders for investor sentiment and for the bank’s valuation on Wednesday… especially because fears over a deteriorating liquidity situation at community banks like PacWest Bancorp have been the key reason for the recent market panic.

The market clearly lost focus this week as it was more concerned with the FED’s rate decision. Since PacWest Bancorp has its uninsured deposits covered by 120% and doesn’t need to raise capital, I am reaffirming my Strong Buy rating for PacWest Bancorp, but only for investors with a medium- to high-risk tolerance!