[ad_1]

Otter Tail Company (NASDAQ:OTTR) is a regulated electrical utility serving clients in Minnesota and each of the Dakotas. The utility sector is mostly a favourite amongst conservative traders resembling retirees as a result of its basic stability via any form of macroeconomic surroundings. Otter Tail Company is one thing of an oddity amongst utilities although because the firm additionally has a producing arm. This manufacturing arm proved to be one thing of a legal responsibility for the corporate throughout the pandemic as a result of the shut downs had fairly an adversarial impact on the companies that comprise this space. They’ve since recovered in a really massive means, nevertheless, and in the present day the company’s efficiency is basically again to regular. In truth, the corporate’s most up-to-date outcomes present appreciable progress in comparison with 2020, which is basically what I predicted in my final article on the corporate. Otter Tail is positioned to proceed to ship progress over the approaching years and after we mix this with a really affordable valuation, it may be price contemplating on your portfolio.

About Otter Tail Company

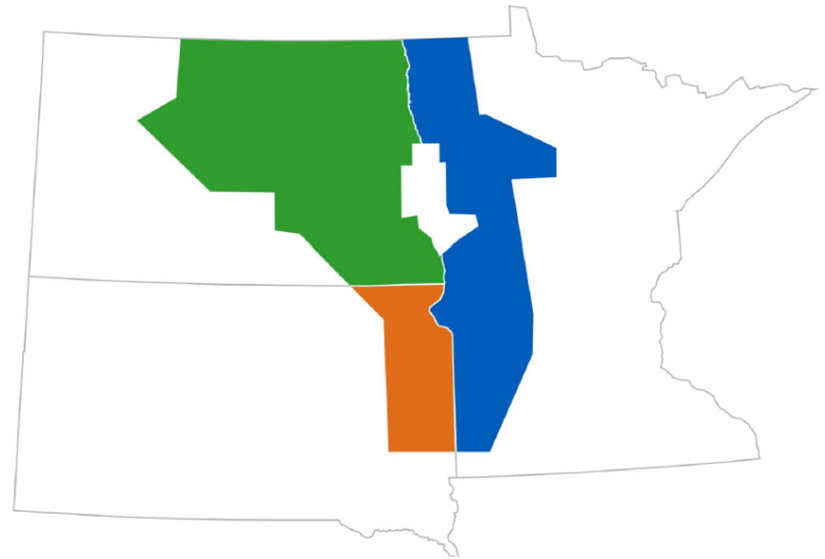

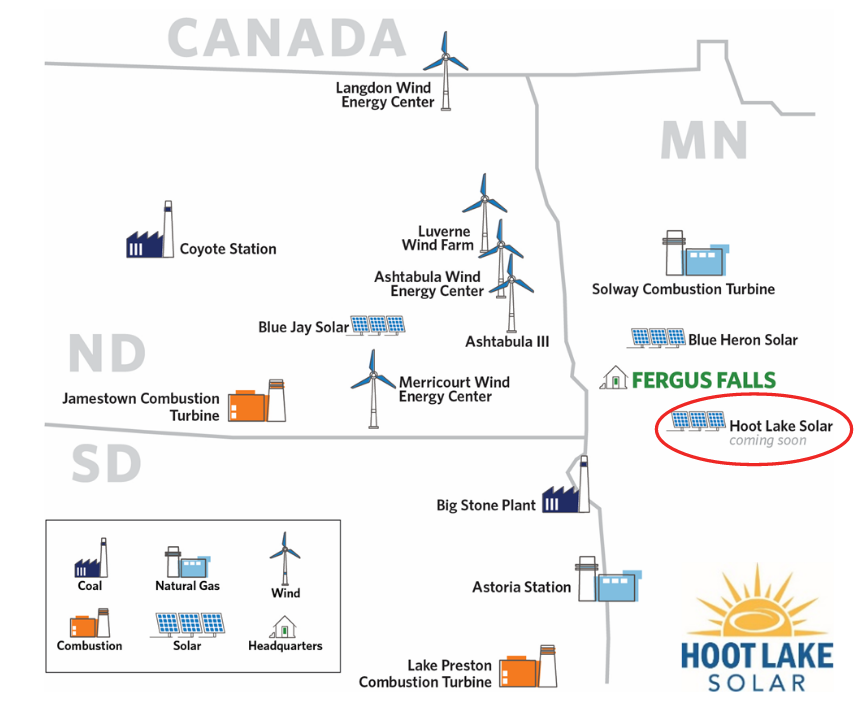

As said within the introduction, Otter Tail Company is primarily a regulated electrical utility serving clients in components of Minnesota and the Dakotas:

Otter Tail Investor Presentation

The corporate additionally has just a few supplies manufacturing companies that will likely be mentioned later on this report. Nevertheless, since 70% of the corporate’s income come from the electrical utility, it must be largely considered on this means. This can be a lucky factor for a sure kind of investor as a result of utility firms are inclined to get pleasure from remarkably secure funds over time and thru any financial circumstances. It’s because utilities present a product that’s usually thought-about to be a necessity for our fashionable lifestyle. In consequence, folks will sometimes prioritize paying their utility payments forward of different extra discretionary bills throughout instances when cash will get tight. This was particularly useful throughout the occasions of 2020 as utilities like Otter Tail Company had been capable of climate via the financial calamities of that yr significantly better than firms in quite a few different industries.

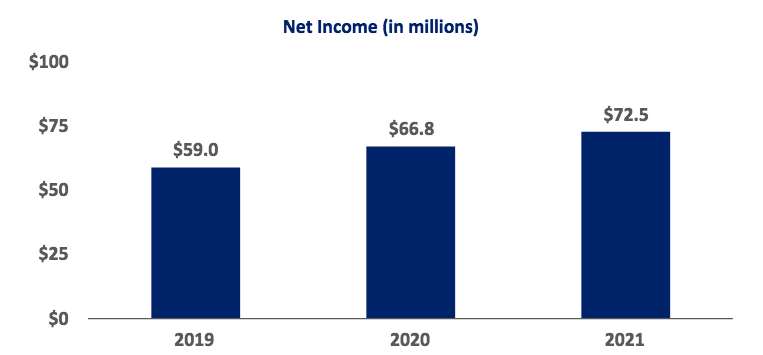

One other defining attribute of utilities is that they sometimes ship sluggish however regular progress. Otter Tail has not been an exception to this because it has grown the online earnings from its utility operations throughout every of the previous three years:

Otter Tail Investor Presentation

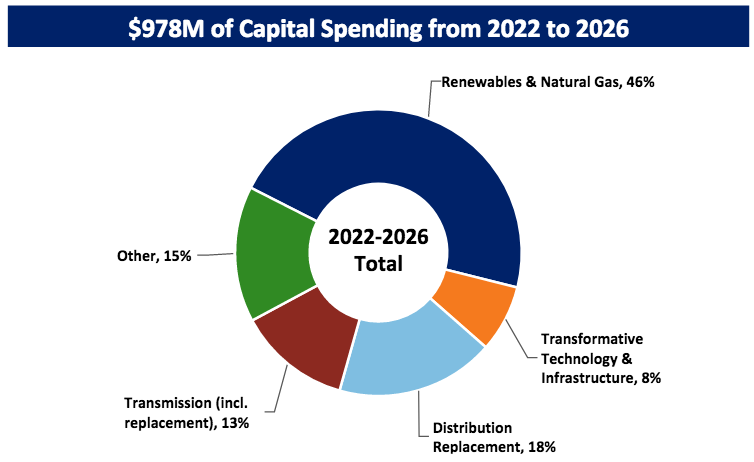

This is because of the truth that these firms are always rising their fee bases. The speed base is the worth of the utility’s belongings upon which regulators permit it to earn a specified fee of return. As this fee of return is a share, any improve to its worth permits the corporate to extend the costs that it expenses its clients as a way to earn that fee of return. The standard means {that a} utility will increase its fee base is by investing cash into upgrading, modernizing, and even increasing its utility infrastructure. That is precisely what Otter Tail Company has been doing, a development that it intends to proceed going ahead. Over the 2022 to 2026 interval, the corporate plans to speculate $978 million into rising its fee base:

Otter Tail Investor Presentation

This could have the impact of rising the corporate’s fee base at a 5.9% compound annual progress fee over the interval, taking it from $1.58 billion in the present day to $2.10 billion by the top of 2026. As some astute readers could level out, it is a decrease worth improve than the amount of cash that the corporate is investing. There are two causes for this. The primary purpose is that among the firm’s spending is earmarked for the acquisition of things that can change belongings being taken out of service. Specifically, Otter Tail is anticipating to close down the Hoot Lake Coal Plant within the close to future. As soon as this plant is retired, its worth will likely be instantly faraway from the corporate’s fee base, which can naturally offset among the spending impacts. The second purpose why the speed base progress is not going to be as nice because the amount of cash that the corporate is investing in it’s depreciation. Principally, the worth of the corporate’s belongings is at all times reducing so one thing that it buys in 2022 at the beginning of this funding program will likely be price far much less in 2026. In brief, the corporate’s fee base would step by step decline if the corporate shouldn’t be always investing cash into it. Whereas this does present some tax advantages, it additionally, sadly, offsets among the firm’s spending, forcing it to speculate greater than it in any other case would. The corporate has guided for midpoint earnings per share of $1.83 from its electrical utility operation in 2022, which might be a 5.78% improve over the determine that it had in 2021. Nevertheless, since 30% of the company’s income come from different sources, we must always not mission an funding return primarily based solely on this determine.

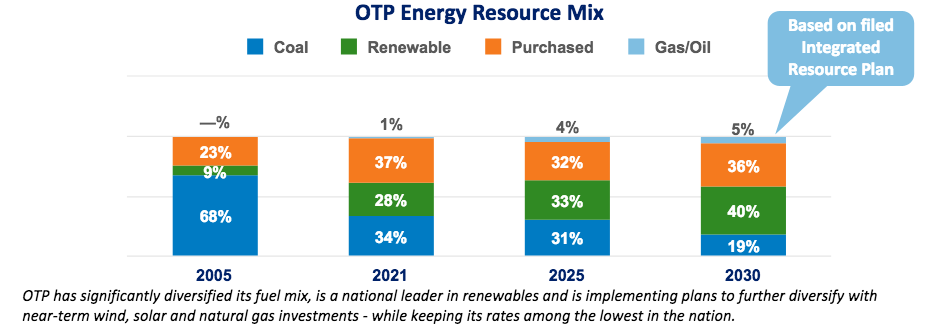

One space the place Otter Tail is investing closely in is the event and deployment of renewables, as we will see within the chart above. That is an space wherein many electrical utilities are investing, which is basically because of the calls for of regulators and clients. Nevertheless, Otter Tail shouldn’t be being as aggressive about its sustainability targets as a few of its friends. As I’ve famous in just a few current articles, there are a number of utilities which have said their intentions to retire all of their remaining operational coal energy vegetation by 2025. That is largely as a result of the truth that coal energy, generally, is rather more closely polluting than some other methodology of producing electrical energy. Otter Tail, in the meantime, is just planning to cut back the proportion of its electrical energy that’s generated by coal however not take away it solely within the close to time period. Certainly, by 2030, the corporate expects 19% of its electrical energy to return from coal as in comparison with 34% in the present day:

Otter Tail Investor Presentation

Sadly, this will likely trigger Otter Tail to underperform among the different electrical utilities within the business. It’s because it is not going to have the benefit of assist from the varied environmental, social, and governance funds which have sprung up over the previous few years. These funds ostensibly put money into these firms which have an emphasis on sustainability and variety of their enterprise fashions, which might usually imply these electrical utilities with a heavy reliance on renewables on the expense of coal. As I mentioned in a current article, the recognition of those funds has grown to the purpose the place they now management 10% of all worldwide mutual fund belongings. That is greater than sufficient cash to push up the inventory worth of any utility and it appears way more doubtless that these funds would decide to put money into one among Otter Tail’s friends that’s not using coal fairly than Otter Tail. In the end, this might trigger Otter Tail to underperform a few of its friends.

Otter Tail is definitely not and not using a portfolio of renewable tasks, nevertheless. One of many firm’s present tasks is the Hoot Lake Photo voltaic Plant, which it’s setting up close to Fergus Falls, Minnesota:

Otter Tail Investor Presentation

The Hoot Lake Photo voltaic Plant is able to producing 49.9 megawatts of electrical energy at full capability, which is admittedly nowhere near what a fossil fuel-driven plant may produce however at the least it’s nonetheless one thing. This facility is predicted to return on-line in 2023 and it’ll assist offset among the misplaced era capability from the retirement of the Hoot Lake Coal Plant.

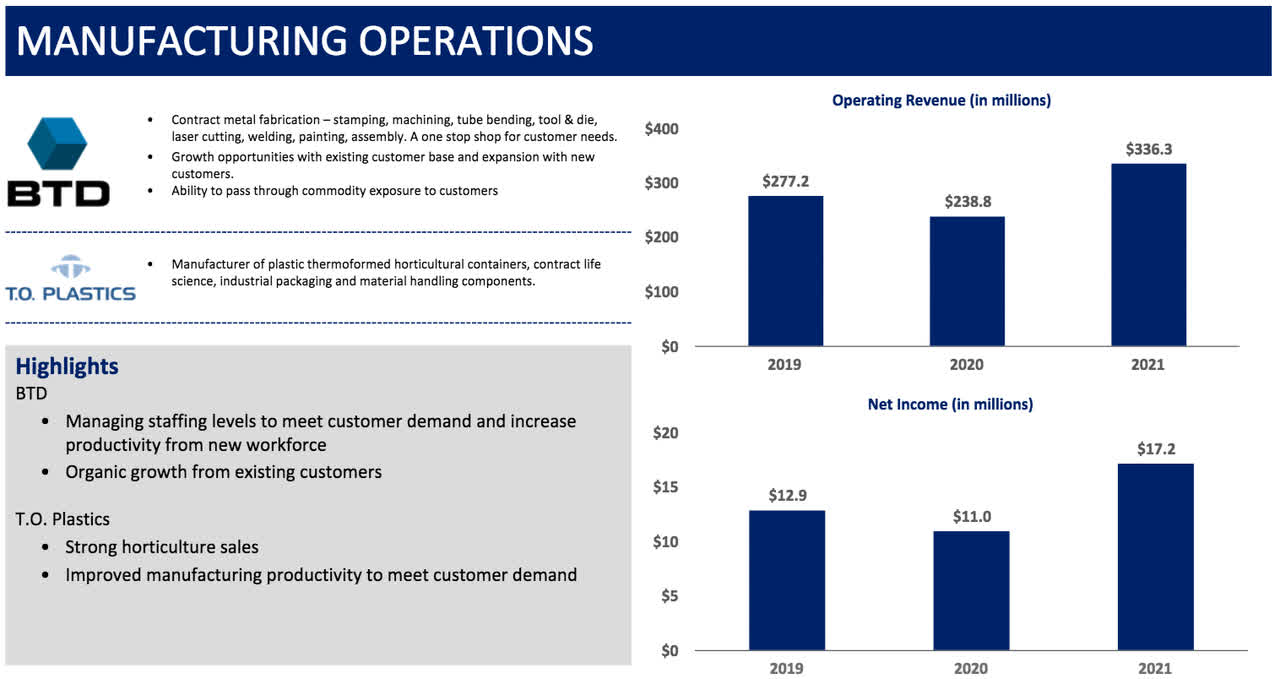

As said earlier, about 30% of Otter Tail’s income come from its numerous manufacturing companies. These companies primarily manufacture issues resembling custom-made plastic objects resembling containers for numerous horticultural merchandise in addition to commodity objects resembling PVC pipes. One of many good issues about many of those merchandise is that the demand for them is considerably recession-resistant, which allowed the company’s manufacturing arm to carry up fairly properly via the coronavirus lockdowns and the next recession. That is definitely to not say that they carried out completely although as the corporate’s metal-stamping enterprise did see income and internet earnings decline in 2020 in comparison with 2019. Nevertheless, it has since recovered and the 2021 numbers got here in significantly better than both 2019 or 2020:

Otter Tail Investor Presentation

That is definitely a superb signal, notably because the demand for these merchandise is unlikely to go away. As such, the corporate’s manufacturing unit may show to be an additional avenue of progress for Otter Tail Company going ahead.

Fundamentals Of Electrical energy

As roughly 70% of Otter Tail’s income come from its electrical utility, we must always check out the basics of those firms. Electrical utilities, generally, have been within the funding media an abnormally great amount currently, which might be because of the electrification development. That is one thing that has been very closely promoted by politicians and progressive futurists and it refers back to the conversion of issues which might be historically powered by fossil fuels to the usage of electrical energy as an alternative. Probably the most generally cited targets for conversion are transportation (electrical automobiles) and house heating however there are definitely different issues that could possibly be transformed as properly. Naturally, as this development progresses, it may be anticipated to considerably improve the consumption of electrical energy and by extension the revenues and income of electrical utilities.

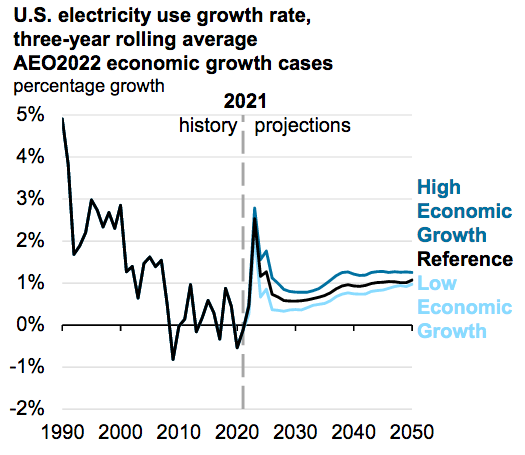

Sadly, the U.S. Vitality Info Administration doesn’t imagine that this development will progress anyplace close to as rapidly as its proponents anticipate. In response to the federal government company, the nationwide consumption of electrical energy will improve at a 1% to 2% fee over the subsequent thirty years:

U.S. EIA 2022 Annual Vitality Outlook

That is nowhere near the expansion fee that may outcome had been extensive swathes of the financial system changing from fossil fuels to electrical energy. Certainly, I mentioned the impression that electrical automobiles alone would have in a current article. The company is probably appropriate that the conversion to an all-electric financial system will likely be a really sluggish course of since constructing out the electrical grid to the purpose the place it might probably really assist the widespread use of electrical energy to the diploma that the proponents of electrification need is extraordinarily cost-prohibitive. Thus, it seems that electrical utilities resembling Otter Tail will doubtless ship the identical sluggish and regular progress that they at all times have.

Monetary Issues

It’s at all times necessary to take a look at the way in which that an organization funds itself earlier than investing into it. It’s because debt is a riskier technique to finance an organization than fairness as a result of debt should be repaid. As few firms have ample money to utterly repay their debt because it matures, this compensation is often achieved by issuing new debt and utilizing the cash from that issuance to repay the maturing debt. Relying in the marketplace circumstances, this will likely outcome within the firm’s curiosity prices rising. Along with this, the corporate should make common funds on its debt whether it is to stay solvent. Thus, a decline in money flows may push it into monetary misery if it has an excessive amount of debt. Though utilities are inclined to get pleasure from remarkably secure money flows, bankruptcies are definitely not unparalleled within the sector.

One metric that we will use to investigate an organization’s monetary construction is the online debt-to-equity ratio. This tells us the diploma to which an organization is financing its operations with debt versus wholly-owned funds. As well as, this ratio tells us how properly the corporate’s fairness can cowl its debt obligations within the occasion of a chapter or liquidation occasion, which is arguably extra necessary.

As of December 31, 2021, Otter Tail Company had $873.1 million in internet debt in opposition to $990.8 million in shareholders’ fairness. This provides the corporate a internet debt-to-equity ratio of 0.88. This can be a remarkably low ratio for an electrical utility, as we will see right here:

|

Firm |

Web Debt-to-Fairness Ratio |

|

Otter Tail Company |

0.88 |

|

NextEra Vitality (NEE) |

1.19 |

|

Exelon Company (EXC) |

1.22 |

|

DTE Vitality (DTE) |

2.09 |

|

CMS Vitality (CMS) |

1.68 |

|

AES Company (AES) |

3.68 |

As we will see, Otter Tail Company is considerably much less leveraged than its friends, which might be because of the firm’s manufacturing arm. It’s because manufacturing is inherently a considerably riskier exercise than working a utility so producers will not be capable of assist as a lot leverage. Both means although, we will clearly see that Otter Tail’s debt load shouldn’t pose a very outsized danger to traders.

Dividend Evaluation

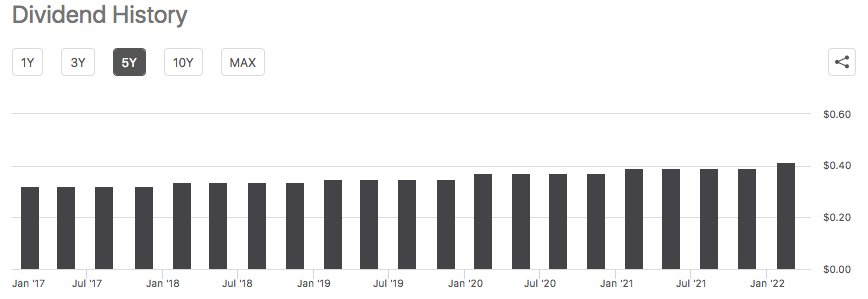

One of many largest the explanation why traders buy shares of utility firms is as a result of they sometimes have the next dividend yield than firms in lots of different industries. That is because of the usually sluggish progress of the sector, which ends up in them returning the next proportion of their complete return within the type of direct funds to traders than firms in lots of different sectors. Otter Tail Company is definitely no exception to this as the corporate yields 2.70% on the present inventory worth, which is sort of a bit larger than the 1.31% yield on the S&P 500 index (SPY). As can be typically the case with utilities, Otter Tail Company has an extended historical past of steadily elevating its dividend over time:

In search of Alpha

This historical past of dividend will increase is one thing that’s fairly enticing, notably in in the present day’s inflationary surroundings. It’s because inflation is continually lowering the variety of issues that we will buy with the dividend. As such then, the truth that the corporate is giving us a bigger amount of cash yearly helps to offset this impact and keep the buying energy of the dividend within the face of rising costs. Naturally, although, it’s at all times vital that we be certain that the corporate can really afford the dividend that it pays out. In any case, we don’t want it to be compelled to reverse course and reduce the dividend since that may each scale back our incomes and sure trigger the share worth to say no.

The standard means that we analyze an organization’s capability to pay its dividend is by its free money movement. The free money movement is the amount of cash that’s generated by the corporate’s extraordinary operations that’s left over after it pays all its payments and makes all vital capital expenditures. That is the cash that’s obtainable to do issues resembling scale back debt, purchase again inventory, or pay a dividend. Within the fourth quarter of 2021, Otter Tail Company had a adverse levered free money movement of $6.3 million. That is clearly not sufficient to pay any dividend, not to mention the $16.2 million that the corporate really paid out.

Nevertheless, it’s pretty frequent for utilities to finance their capital expenditures via the issuance of debt and fairness and pay their dividend out of working money movement. That is principally because of the extremely excessive price of setting up and sustaining utility-grade infrastructure over a large geographic space. Through the fourth quarter, Otter Tail Company had an working money movement of $76.5 million. That is simply sufficient to cowl the corporate’s dividend with cash left over for different functions. General then, it does seem that Otter Tail Company’s dividend is sort of sustainable. There doesn’t seem like something to fret about right here.

Valuation

It’s at all times vital that we don’t overpay for any asset in our portfolios. It’s because overpaying for any asset is a surefire technique to generate a suboptimal return off that asset. Within the case of a utility like Otter Tail Company, a technique that we will worth it’s by trying on the ahead price-to-earnings ratio. This tells us how a lot we’re paying in the present day for every greenback of earnings that the corporate will generate over the subsequent yr. General, the decrease the quantity, the higher the worth that the inventory at the moment has. Thus, after we evaluate the inventory to that of the peer firms, the corporate with the bottom ahead price-to-earnings may characterize the most effective worth.

In response to Zacks Funding Analysis, Otter Tail Company at the moment has a ahead price-to-earnings ratio of 15.63. Right here is how that compares to the corporate’s peer group:

|

Firm |

Ahead Value-to-Earnings |

|

Otter Tail Company |

15.63 |

|

NextEra Vitality |

29.54 |

|

Exelon Company |

17.76 |

|

DTE Vitality |

21.23 |

|

CMS Vitality |

23.02 |

|

AES Company |

14.58 |

As we will see right here, Otter Tail Company seems to supply a extra enticing valuation than any of its friends apart from AES Company. Nevertheless, as we noticed earlier in our dialogue concerning the firm’s monetary construction, AES has a considerably larger debt load so it’s doubtless cheaper for an excellent purpose. Thus, we will conclude that Otter Tail is pretty attractively valued relative to its friends.

Conclusion

In conclusion, Otter Tail is a considerably distinctive electrical utility in that it derives a major proportion of its income from actions apart from utility operations. The corporate nonetheless has the identical qualities that traders have a tendency to understand with utilities, nevertheless, notably their secure money flows. After we mix this with the corporate’s very strong stability sheet and its enticing valuation, we will see that the corporate has a terrific deal to supply. General, traders could wish to contemplate this firm for his or her portfolios.

[ad_2]

Source link