Justin Sullivan

Article Thesis

Oracle (NYSE:ORCL) will report its first-quarter (fiscal 2023) earnings outcomes on Monday, September 12. We’ll check out what buyers can count on and can consider whether or not Oracle appears like a pretty funding at present costs.

Oracle Is A Serial Earnings Beat Producer

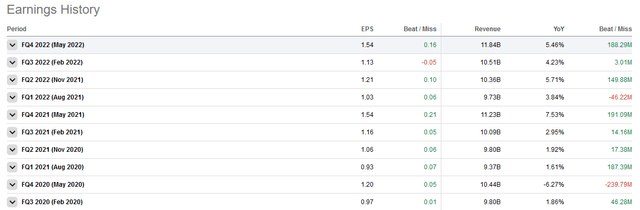

Oracle has a fairly clear historical past of beating Wall Avenue’s expectations, as we will see within the following screencap:

Looking for Alpha

As we will see, Oracle has overwhelmed earnings per share estimates in 9 out of the final 10 quarters, whereas income estimates have been overwhelmed in 8 out of the final 10 quarters. The typical earnings per share beat have been within the 10% vary, which is kind of significant – it isn’t like Oracle has overwhelmed estimates by $0.01, on common. Income beats have been much less significant, on common. However that implies that Wall Avenue is comparatively good at forecasting Oracle’s gross sales, whereas analysts appear to perpetually underestimate its profitability.

Regardless of its historical past of beating estimates, the market response was diversified, on common. In some quarters, Oracle’s share value declined following the earnings launch whilst estimates have been overwhelmed, with the most certainly cause for that being that the market was not proud of Oracle’s ahead steerage. That occurred in September 2021, for instance, when a 6% EPS beat was greeted by a significant inventory value decline.

Oracle’s Current Efficiency

Oracle’s gross sales efficiency was stable however not spectacular in current quarters, as revenues rose at a mid-single digits tempo during the last yr. Income rose quicker, as Oracle stored price controls tight, whereas the influence of share repurchases additionally performed a job within the quicker earnings per share progress charge, relative to the gross sales efficiency.

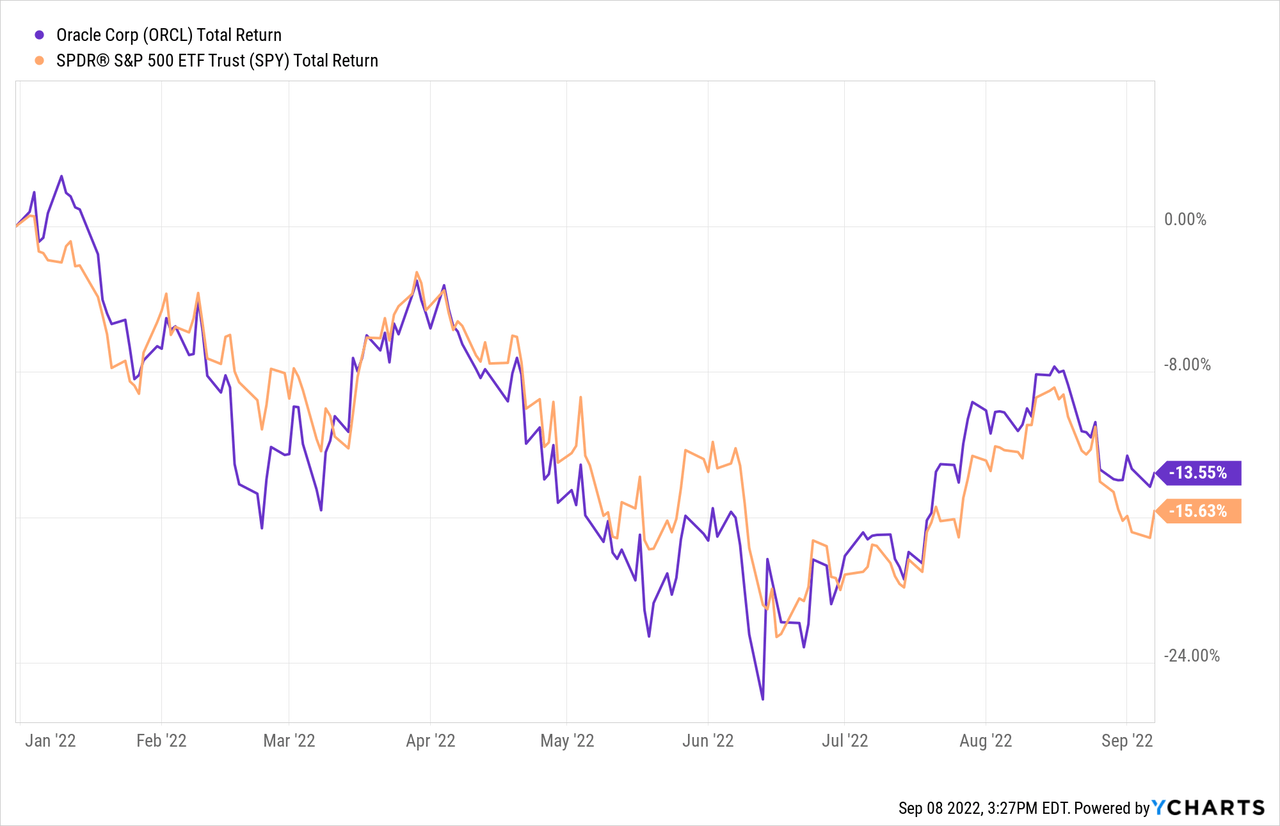

On the subject of Oracle’s share value, the efficiency is not nice, nonetheless:

This yr, Oracle is down 14% to this point. However when one doesn’t take a look at the share value efficiency in a vacuum, that is nonetheless fairly cheap, because the broad market has pulled again barely extra up to now in 2022. Typically, Oracle has moved comparatively in step with the broad market, as may be seen within the above chart. Throughout sell-offs, Oracle dropped as effectively, whereas it additionally took half in market recoveries. That is not too shocking, as Oracle’s beta of 0.9 suggests that there’s a sturdy correlation between the inventory’s strikes and the broad market’s strikes, no less than within the current previous. Taking a look at an extended time-frame of 5 years, Oracle has underperformed the broad market, because it rose by 40% whereas the S&P 500 climbed by 60% in the identical interval.

What To Count on From Oracle’s Q1

Since Oracle’s fiscal yr is shifted versus the calendar yr, the upcoming report is for Oracle’s fiscal Q1 2023, which ended August 31, 2022.

Forecasting Oracle’s outcomes for the interval is extra sophisticated this time because of the influence of the Cerner acquisition that closed in June. Q1 is the primary quarter that may embody Cerner’s outcomes, and there doubtless are appreciable one-time objects within the report, corresponding to extra bills for integrating the corporate or letting go of former Cerner workers or managers that weren’t wanted any longer as soon as Cerner was built-in into Oracle.

The gross sales improve needs to be larger than it was, on common, within the current previous. Cerner generated gross sales of $6 billion in 2021, thus quarterly gross sales of round $1.5 billion will probably be added to Oracle’s outcomes going ahead. Including in some natural progress at Oracle, it appears doubtless that revenues will are available round $1.5 billion to $2 billion larger than throughout the earlier yr’s interval, which interprets right into a progress charge of 15%-20%. That aligns with the analyst consensus, which forecasts an 18% income improve on a year-over-year foundation.

After all, as soon as the closing of the Cerner acquisition has been lapped, income progress will decelerate once more, thus buyers mustn’t assume that this takeover has resulted in a completely larger income progress charge for Oracle.

Analysts count on that earnings per share will are available at $1.08 for the primary quarter, which might be up barely versus the earlier yr’s interval. Since many of the synergies is not going to be captured but, and since integrating an organization comes with some one-time upfront bills, it isn’t too shocking that Oracle’s income will doubtless have grown lower than the corporate’s income. Over time that ought to change, as price synergies are captured, whereas upfront closing prices is not going to seem in future earnings reviews past Q1.

The Cerner acquisition was an all-cash deal, thus there was no dilutive influence in relation to Oracle’s share rely. However, much less money available and a bigger debt load result in larger web curiosity bills, which has a (small) unfavourable influence on Oracle’s web income. The money outlay additionally implies that share repurchases may be subdued for some time, as Oracle will doubtless deal with deleveraging for a while, which might imply a decrease buyback tempo for the foreseeable future.

That being stated, Oracle’s steadiness sheet is not weak, thus buyers haven’t got to fret concerning the debt influence of the Cerner acquisition an excessive amount of. On the finish of the earlier quarter, Oracle had $39 billion in money on its steadiness sheet, whereas its debt load totaled $83 billion. That made for a $44 billion web debt place. Including the $28 billion for the Cerner deal will get us to a web debt estimate of $72 billion. In actuality, the quantity is probably going somewhat smaller, as Oracle has generated some money throughout Q1 to offset the debt improve, so web debt needs to be within the $70 billion vary. That is the same as round 3x this yr’s anticipated EBITDA of $23 billion, which isn’t a low leverage ratio, however which is not dramatic, both. Over time, Oracle ought to be capable to deleverage meaningfully, as its free money flows can be utilized to pay down some debt, whereas EBITDA progress will end in a declining leverage ratio as effectively because of the denominator growing.

Is Oracle Inventory A Good Funding In the present day?

Oracle will not be the fastest-growing main tech firm in any respect. Microsoft (MSFT) and plenty of others have extra constant enterprise and revenue progress. That being stated, Oracle has nonetheless delivered stable shareholder worth through the years. Over the past ten years, earnings per share have roughly doubled, which pencils out to a high-single-digits annual progress charge. Mixed with the dividend funds that Oracle has made, this supplies very stable returns in concept.

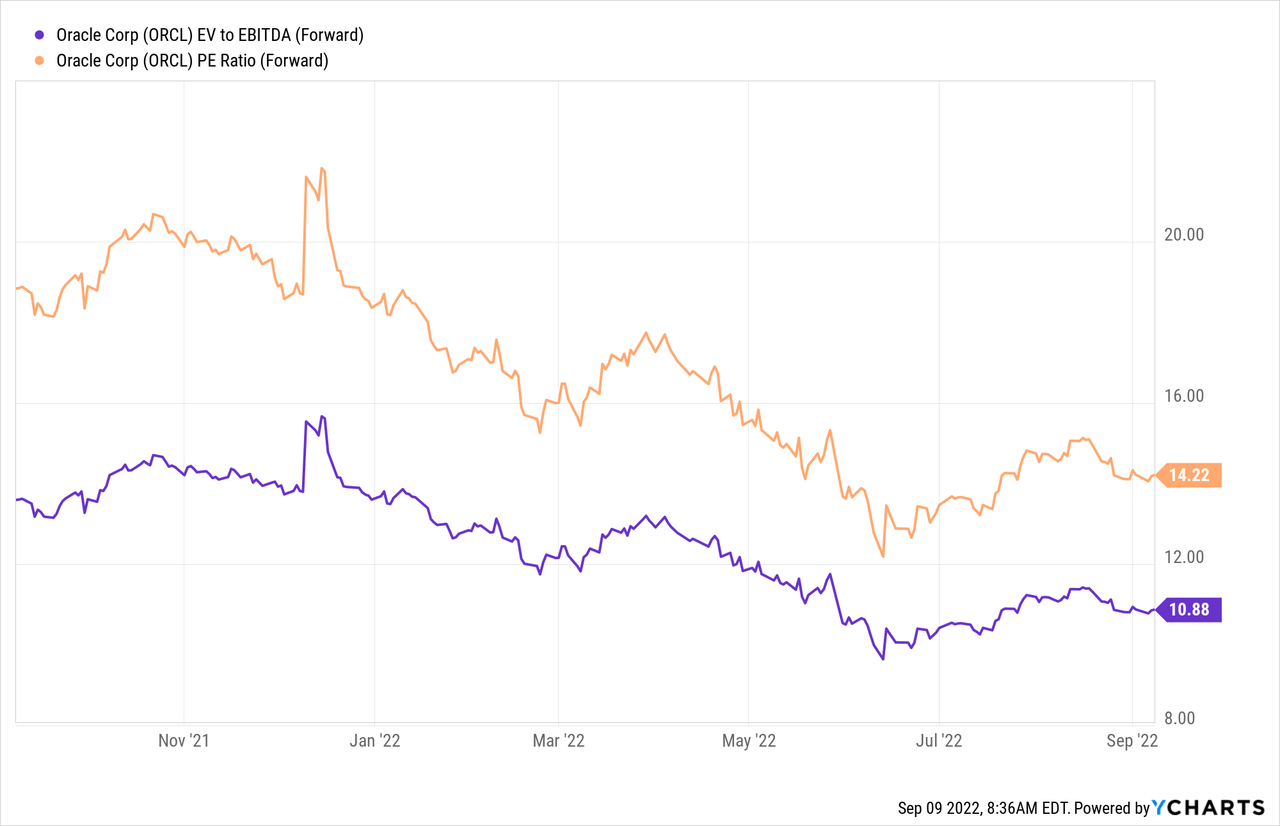

And earlier than buyers neglect Oracle versus faster-growing software program gamers, they need to additionally think about valuations:

Oracle is comparatively cheap, buying and selling at an 11x EBITDA a number of, whereas its web revenue a number of is 14 in the present day. That is on the decrease finish of the vary Oracle has traded at during the last yr, and it additionally represents a reduction versus how Oracle was valued during the last decade, because the 10-year median earnings a number of is eighteen, or round 30% larger than the present valuation. We are able to thus say that Oracle may be a greater worth in the present day, relative to how the corporate was valued up to now. On the opposite aspect, its steadiness sheet employs extra leverage than it used to, following the closing of the Cerner acquisition, which arguably warrants a little bit of a reduction versus the historic valuation norm. It doesn’t matter what, Oracle to me looks like an equally good funding in the present day, relative to the final couple of years.

Oracle’s dividend yield is 1.7% proper now, which is kind of in step with the broad market’s yield. The dividend progress charge has been compelling, because it averaged 13% during the last 5 years. If Oracle was in a position to preserve that dividend progress charge in place for an extended time period, buyers would see their yield on price rise very meaningfully through the years. Since analysts are forecasting a long-term earnings per share progress charge of 9% for Oracle, and because the payout ratio is fairly low at simply 24%, there may be lots of potential for additional dividend will increase, I consider.

Oracle will not be the highest-quality or highest-growth software program participant. But it surely generates stable enterprise progress and its cloud enterprise is performing effectively. With an undemanding valuation, potential for synergies following the Cerner acquisition, and regular dividend progress, Oracle could possibly be a stable choose on the present value, though it doesn’t look like a must-own inventory.