Friday 4 Play: The “His Utilized Supplies” Version

Nice Ones, it’s no secret that the tech sector is in shambles proper now. A shadow of its former market-domineering self. Even semiconductor shares — the linchpins of the tech sector — are taking an enormous beating.

However as Douglas Adams as soon as wrote: “Don’t Panic!”

In spite of everything, you’re a Nice One. You might be one hoopy frood who at all times is aware of the place your towel is! You don’t panic. You maintain these essential semiconductor shares as a result of you realize they’re coming again robust.

Living proof: Nice Stuff Picks holding Utilized Supplies (Nasdaq: AMAT).

For those who purchased in approach again in July 2020 after I really helpful the inventory, you’re sitting on a achieve of almost 70%.

And sure, you might be in all probability lamenting not taking income again when the positive factors have been within the triple digits … however you additionally know that AMAT is headed again to these lofty heights after which some.

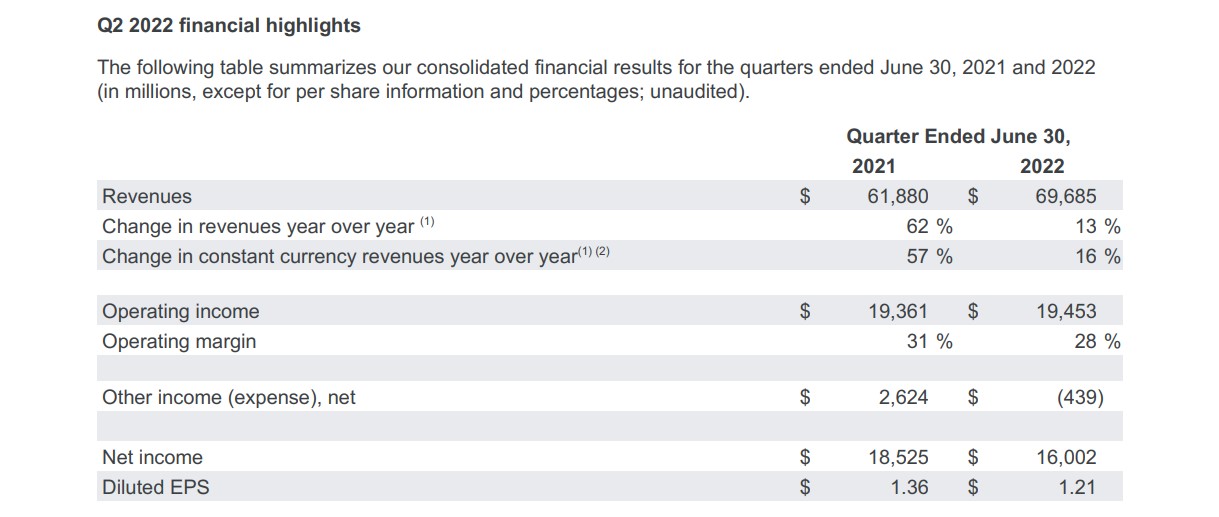

I imply, I do know this … particularly after Utilized Supplies let free with a massively constructive quarterly monetary report. Let’s take a fast have a look at the numbers:

- Earnings per share: $1.94 versus $1.79 anticipated.

- Income: $6.52 billion versus $6.3 billion anticipated.

A stable efficiency, to make sure. However what about steering? What in regards to the future?!

Nicely, Utilized Supplies has that lined as nicely. The corporate mentioned it expects This autumn earnings to reach in a variety between $1.82 per share and $2.18 per share, with income rising to $6.65 billion. Each figures simply bested Wall Road’s expectations.

Now, you’d assume with numbers like that, AMAT inventory would surge. However nope. Uh-uh. AMAT dropped greater than 3% right this moment. Why? As a result of CEO Gary Dickerson mentioned the quiet half out loud:

We really feel assured in our means to navigate macroeconomic headwinds and stay very constructive in regards to the long-term power of the semiconductor market and our outsized development alternatives.

By no means thoughts the boldness. By no means thoughts the robust This autumn steering. By no means thoughts that Utilized Supplies is working easily, rising income, funding R&D applications and making ready for international financial headwinds.

The mere undeniable fact that Utilized Supplies acknowledged the truth of “macroeconomic headwinds” threw Wall Road for a loop. I suppose realism is a bit an excessive amount of for buyers drunk on straightforward cash to deal with proper now.

Suffice it to say that Utilized Supplies will likely be simply high-quality. The corporate makes specialised tools to fabricate semiconductors, in any case. And semiconductors are in actually every little thing. Lengthy-term demand isn’t going anyplace.

So my recommendation to you, Nice Ones, is that in the event you haven’t already added AMAT inventory to your portfolio — regardless that it’s been a Nice Stuff Choose for some time — do your self a favor and purchase AMAT now.

In spite of everything, a inventory falling in value after displaying stable company management with robust earnings and income development is strictly the kinda funding you wish to bounce on earlier than Wall Road involves its senses.

However in the event you’re already in on AMAT, fret not — hey, hey, I mentioned no fretting!

There’s … one other.

A tiny Silicon Valley firm is utilizing synthetic intelligence to unleash the most important untapped power supply on this planet.

Why are they at all times so tiny? Drink extra milk, little tech firms!

I’m not speaking about oil, fuel, wind, photo voltaic, hydro, nuclear … or something you’ve possible heard about earlier than. But this breakthrough is ready to assist launch an period of low-cost, considerable electrical energy the likes of which the world has by no means seen.

To get the entire story, together with particulars of the corporate accountable, click on right here now…

And now for one thing utterly completely different … it’s time for Friday 4 Play!

No. 1: Deere In The Headlights

(Spoiler alert: It doesn’t finish nicely for the Deere.)

Bear in mind just a few weeks again once we talked about Caterpillar’s (NYSE: CAT) considerably combined tools gross sales, and everybody was like: “Oh noes, persons are like, by no means going to construct something once more!” And CAT inventory fell 4%?

Yeah, think about how Deere (NYSE: DE) felt getting into the earnings confessional to report on its tools gross sales.

From cats to deer, actually? Spit it out, Jack Hanna.

The maker of every little thing from tractors to forestry equipment to weed whackers, John Deere simply reported disappointing earnings … and worse … disappointing steering! Oh, the Deere-manity.

Income over at Deere totaled $13 billion and met expectations, however per-share earnings of $6.16 missed estimates for $6.65.

Going ahead doesn’t look an excessive amount of brighter both: Deere particularly talked about that it expects slower development for development tools gross sales … and I suppose that’s the place Wall Road stopped studying.

DE inventory was already down 6% earlier than buyers realized: “Hey, wait a sec. Slower development continues to be development. What’s the deal?” And because it seems, Deere’s tools gross sales are nonetheless anticipated to rise about 20% yr over yr, due to the buyer market publicity that CAT doesn’t have.

After all, you want solely point out “slower development” and “greater prices,” and also you’re done-zo so far as analysts are involved.

No. 2: Dividend Depot

Identify a greater duo than share buybacks and dividend hikes? I’ll wait … identical to I at all times wait for somebody to return to the paint counter at Dwelling Depot (NYSE: HD).

What’s a blue chip to do after posting sensible, expectations-destroying earnings? Why, you go to Disneyland … or purchase again some shares. Whichever floats your goat.

For those who’re Dwelling Depot, you’re shopping for again $15 billion in HD shares. That’s proper: $15. Billion.

I imply, c’mon: Everyone knows that share buybacks are what an organization does when administration has no higher approach to spend cash. (There are solely so many “firm retreats” to Hawaii you may take, in any case.)

Dwelling Depot can also be maintaining its $1.90-per-share dividend in place — as a result of it may well.

Paradoxically, all these investor-pleasing strikes didn’t fairly sway the Road right this moment nonetheless, sending Dwelling Depot inventory down about 1%.

No. 3: Blue Chips Gonna Blue Chip

By no means one to be overlooked of the occasion, Normal Motors (NYSE: GM) confirmed up in right this moment’s headlines to report its personal share buyback program — to the tune of $5 billion. Certain, that’s solely a 3rd as a lot dough as Dwelling Depot’s buyback program (and nowhere close to as spectacular), however we’re evaluating apples, oranges and DIY shops right here.

See, GM is attempting so laborious to show to buyers that it’s previous its pandemic precipice — that it’s a complete new EV-making machine, albeit with just a few blue-chip tendencies right here and there.

The share buybacks are one factor, however dividends? Oh, now you’re talking buyers’ value-seeking language.

GM is formally reinstating the dividend that it dropped in April 2020 … actually ages in the past. Nonetheless, GM buyers are solely getting about 24% of that unique dividend — $0.09 per share in comparison with the earlier $0.38 per share.

Not like HD, GM shot up 1% on the buybacks-plus-dividend information.

However which blue chips are secure? Which blue chips are … much less secure? And which Dow stalwarts are gonna be subsequent to fade into obscurity? Ian King has the main points right here.

No. 4: One Extra Retailer For The Highway?

Ohhh, why not!

One retailer after one other has reported earnings this week — to various levels of success, thoughts you — so we higher depart off with one of the best of the bunch.

Which might be … what?

Foot Locker (NYSE: FL) … yeah, I’m as shocked as you might be. Foot Locker’s earnings got here in at a wholesome $1.10 per share for the quarter, a lot greater than the $0.80 analysts anticipated, whereas income matched estimates.

A retailer that isn’t failing? Is it altering its title to “Meals Locker?”

Humorous, however apparently meals, gasoline and sneakers are all persons are shopping for proper now. It’s all very fairytale-esque.

There as soon as was an investor who lived in a shoe?

However wait, it will get higher!

Whereas CFO Andrew Web page mentioned full-year gross sales figures can be on the decrease facet of Foot Locker’s steering … he didn’t outright revoke mentioned steering. And in comparison with actually everybody that is reducing their income expectations, that’s commendable.

So is Foot Locker actually doing that nicely? Did analysts simply have low expectations?

Meh … Wall Road wasn’t all that bothered by the high-quality particulars: There’s greater information over at Foot Locker right this moment. Once more, for a inventory we’ve barely ever talked about earlier than … I’m as shocked as you might be.

CEO Richard Johnson is retiring, to get replaced by Ulta Magnificence’s former CEO, Mary Dillon. I don’t find out about you, however in my psychological strip-mall hierarchy … Ulta is approach forward of ol’ Foot Locker, and I can see why buyers have excessive hopes with Mary Dillon approaching.

FL inventory ran up 21% right this moment on the report.

The Excellent Shares For Inflation & Fee Hikes

Federal Reserve fee hikes. Hovering inflation. Plunging markets.

Oh my!

Simply wait till they launch the lions and tigers…

Most buyers are hiding beneath their beds as of late. However not Charles Mizrahi … as a result of he is aware of the proper shares for beating fee hikes and inflation.

Click on right here now to see them.

And that’s a wrap, Nice Ones! What do you consider right this moment’s madness? Bought any weekend plans? Trades in your sights? Rants and tirades you gotta get off your chest?

Let me hear all of it! (Although be suggested: For those who go off detailing all of your unlawful misadventures, we’re kinda perhaps in all probability purported to report it. Allegedly. I feel.)

Let know what you consider right this moment’s madness and write to us at [email protected].

Within the meantime, right here’s the place you will discover our different junk — erm, I imply the place you may try some extra Greatness:

Regards,

Joseph Hargett

Editor, Nice Stuff