Steve Pope

Thesis

On Friday nineteenth August, Warren Buffett’s Berkshire Hathaway (BRK.B, BRK.A) received approval to purchase an fairness stake of as much as 50% in Occidental Petroleum (NYSE:OXY). OXY shares jumped virtually 10% following the announcement and I argue the market’s first response was completely cheap.

Occidental Petroleum is a top quality firm buying and selling at an affordable valuation. The corporate’s inventory is the perfect performer within the S&P 500 (SPY) YTD, being up virtually 130% versus a lack of about 12% for the S&P 500, and I count on after Buffett’s strengthened engagement (which in fact additionally provides shopping for strain), OXY inventory is poised to proceed to outperform.

In search of Alpha

Buffett And OXY

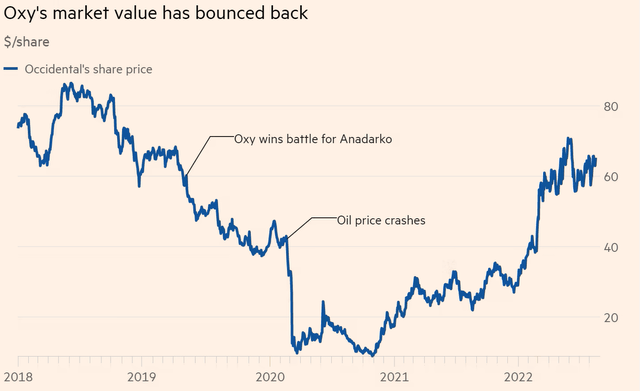

Buffett first engaged with Occidental CEO Vicki Hollub in 2019, when Berkshire had dedicated to speculate $10 billion to assist Occidental finance the takeover of Anadarko–winning a bidding contest towards Chevron (CVX). Berkshire structured the funding by buying 100.000 shares of most popular inventory, which promised to pay an 8% annual most popular dividend. The deal was extremely controversial. Carl Icahn commented:

(Occidental) grossly overpaid for Anadarko and have risked the corporate and stockholders’ cash. Within the military, they might be court-martialed.

However Buffett preferred the deal. He mentioned:

oil costs will decide whether or not virtually any oil inventory is an effective funding over time … If [oil] goes means up, you make some huge cash

Accordingly, OXY shares misplaced greater than 80% of market capitalization when the oil value crashed as a result of Covid-19-induced panic. However with the next power increase, OXY shares recovered and at the moment are focusing on the 2011 ATH.

Monetary Occasions

Buffett Is Shopping for

Profiting from depressed costs, Buffett preferred the chance/reward of constructing a further funding (along with the popular inventory Berkshire owned as a consequence of the Anadarko deal). Reportedly, Buffett had informed Becky Fast that he began making investments after studying the transcript of Occidental’s This autumn 2021 earnings convention name with analysts.

I learn each phrase, and mentioned that is precisely what I’d be doing …

… She (Hollub) is working the corporate the proper means

He added that

and we purchased all we may.

Buffett’s Sec 13F submitting for the June quarter revealed that between April and finish of June, Buffett has elevated his stake in OXY by 16.26%, now being valued at roughly $9.3 billion.

Beforehand, Buffett’s Berkshire Hathaway was licensed to accumulate as much as 25% of Occidental Petroleum, however after approval from the Federal Power Regulatory Fee, the conglomerate can now purchase as much as 50%. In response to Berkshire’s request, which was filed already on July 11, the FERC concluded that

the proposed transaction is per the general public curiosity and is permitted

Sturdy Fundamentals

Occidental’s fundamentals have benefitted enormously from the current rally in power costs. For the trailing twelve months, Occidental generated $33.7 billion of revenues, versus $20.9 billion in 2020. Working revenue jumped from a lack of $8.3 billion in 2020 to a achieve of $11.5 billion for the previous twelve months.

Given the power value tailwind, Occidental additionally managed to rapidly de-lever its steadiness sheet. The corporate’s web debt is now $22.07 billion, lower than x2 the corporate’s TTM money from operations of $14.8 billion.

Arguably, though Occidental has strongly outperformed the S&P 500 YTD, the inventory remains to be lagging fundamentals. Analysts estimate that one-year ahead GAAP P/E of x4.85, which means a reduction to the power sector of about 44%.

Investor Implication

Whereas the FERC submitting doesn’t point out an obligation, however the proper, to accumulate as much as 50% of Occidental, uncertainty stays. We have no idea what Buffett’s exact plans are. Notably, Buffett holds warrants that enable Berkshire to accumulate about 83.9 million OXY shares for roughly $5 billion, or $59.62 every. If exercised, Berkshire’s stake would soar to about 27%.

Personally, nevertheless, I like to take a position that Buffett is planning to purchase 50% of OXY inventory. Actually, I imagine that Buffett is probably going planning to purchase Occidental completely. The percentages are favorable: Occidental suits Buffett’s funding standards, Berkshire has greater than $105 billion of free money available and Buffett clearly likes to work with OXY CEO Vicki Hollub.

Personally, I see Buffett’s engagement with Occidental inventory as a pleasant additional to robust fundamentals. At a P/E of x4.85, I really feel comfy shopping for OXY inventory additionally with out the prospect of a takeover, which I view as a ‘free’ implied name possibility.