After a blistering run since early 2023, Nvidia (NASDAQ: NVDA) has hit a wall. The inventory has surged 730% for the reason that begin of final 12 months (as of this writing), however over the previous three months, Nvidia has tread water, down roughly 4%.

Numerous elements have weighed on the inventory. Fears concerning a possible slowdown within the adoption of generative synthetic intelligence (AI), rumors a few delayed launch of Nvidia’s next-generation Blackwell platform, issues a few decline within the firm’s gross margin, and an expensive valuation have some buyers fearing the inventory might have gotten forward of itself.

Nonetheless, a fast have a look at the out there proof means that whereas these issues are comprehensible, they’re additionally largely unfounded. I consider there’s nonetheless loads of room for Nvidia to run, and I predict the inventory will proceed to succeed in new all-time highs into 2025. Here is why.

A pace bump within the adoption of AI?

The accelerating adoption of AI has helped gasoline the run-up in know-how shares for the reason that begin of 2023, however buyers have begun to marvel if that breakneck tempo might proceed. There’s proof that means it may well.

To shut out the calendar second quarter, Alphabet, Microsoft, Amazon, and Meta Platforms all introduced plans to extend capital expenditures (capex) for the rest of 2024, whereas additionally laying out plans for important will increase subsequent 12 months. The overwhelming majority of that spending shall be allotted to outfitting the servers and knowledge facilities wanted to help AI. Since these tech titans are Nvidia’s greatest prospects, this implies the corporate’s progress streak has legs.

Taking a step again and looking out on the huge image may also present context. Generative AI is predicted so as to add between $2.6 trillion and $4.4 trillion to the worldwide economic system within the coming years, in response to estimates offered by administration consulting agency McKinsey & Firm. This implies that the adoption of AI will proceed for the foreseeable future.

Blackwell is on observe

Reviews emerged in early August that Nvidia’s next-generation Blackwell chips could be delayed by as a lot as three months as a result of manufacturing points. The inventory skidded on these experiences as buyers feared the worst.

When Nvidia launched its quarterly ends in late August, CFO Colette Kress put the matter to relaxation:

We shipped buyer samples of our Blackwell structure within the second quarter. We executed a change to the Blackwell GPU masks to enhance manufacturing yield. Blackwell manufacturing ramp is scheduled to start within the fourth quarter and proceed into fiscal 2026. Within the fourth quarter, we count on to ship a number of billion {dollars} in Blackwell income.

This implies the reported delays had been a lot ado about nothing.

Fears concerning slowing progress are myopic

When Nvidia reported the outcomes of its fiscal 2025 second quarter (ended July 28), there was a lot to love. The corporate generated document quarterly income, document quarterly knowledge heart income, and strong income. Nonetheless, there have been two points buyers appeared to deal with in Nvidia’s in any other case stellar outcomes.

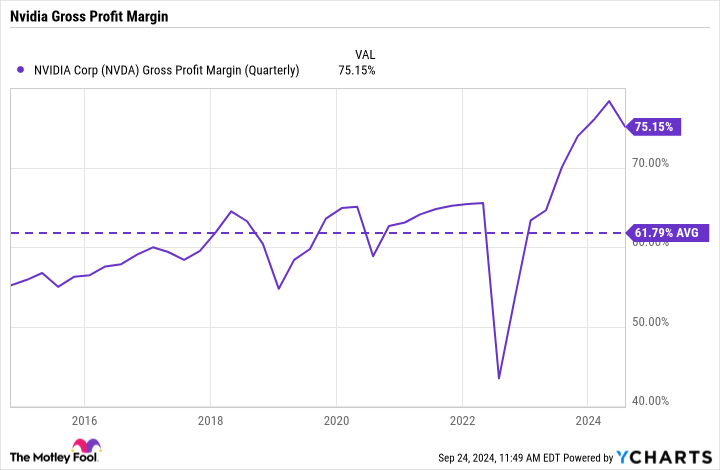

The primary was the corporate’s gross margin, which declined from a document 78.4% in Q1 to 75.1% in Q2. Throughout the earnings convention name, CFO Colette Kress famous {that a} mixture of product combine and stock provisions associated to the rollout of Blackwell had been the culprits.

That mentioned, the corporate is forecasting gross margins for the rest of the 12 months within the mid-70% vary. Whereas that is under the document ends in the primary quarter, it is nonetheless properly forward of Nvidia’s 10-year common gross margin of 62%.

The opposite concern that appeared to spook some buyers was Nvidia’s forecast for its fiscal third quarter, which ends in late October. The corporate is guiding for document income of $32.5 billion, which might characterize progress of 79%. That will mark a deceleration from the triple-digit progress Nvidia has delivered in every of the earlier 5 quarters, however it’s nonetheless a exceptional efficiency nonetheless.

Savvy buyers knew that the corporate’s progress price would ultimately sluggish, significantly as Nvidia faces powerful comps from final 12 months. That mentioned, the corporate’s income progress continues to be distinctive and ought to be seen in that context.

Not as expensive as you may suppose

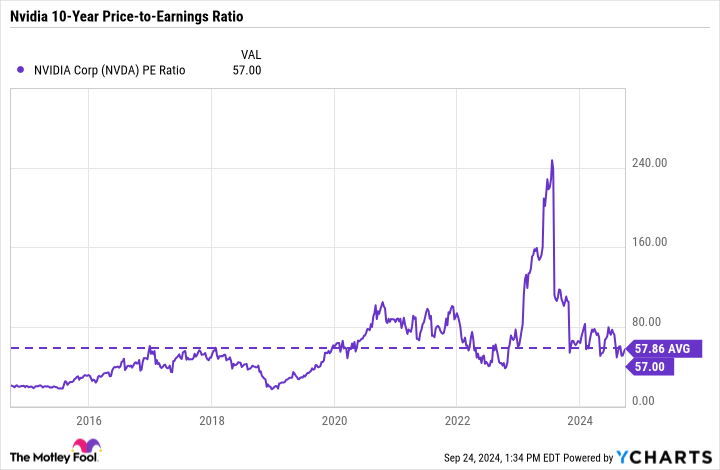

One of many greatest points weighing on Nvidia is the notion that the inventory is exorbitantly costly. That view is definitely comprehensible, provided that the inventory is at the moment promoting for 57 occasions earnings, in comparison with a price-to-earnings ratio of 30 for the S&P 500. Nonetheless, buyers keen to take a step again will see that Nvidia is not as costly as it’d seem at first look.

A fast have a look at the inventory chart reveals that Nvidia is definitely buying and selling barely decrease than its common P/E ratio over the previous decade. It is also value noting that throughout the previous 10 years, Nvidia inventory has gained greater than 25,000%, proof that the inventory has been — and continues to be — deserving of a premium.

Nonetheless, a glance forward suggests the inventory is even cheaper. Wall Road is forecasting earnings per share of $4.02 for the approaching fiscal 12 months, which kicks off in late January. Meaning Nvidia is at the moment buying and selling for lower than 29 occasions ahead earnings (as of this writing), which is a discount, significantly given the corporate’s persevering with progress prospects.

An goal view

Given the run-up of Nvidia inventory since early final 12 months, it is comprehensible that buyers are taking a step again to survey the panorama. But it is clear the elements which have been weighing on the inventory are a lot ado about nothing.

Nvidia’s largest prospects proceed to spend closely on its merchandise, its next-generation platform is on observe, its gross margin stays close to a document excessive, and its valuation is not practically as expensive because it seems at first look.

This all suggests a transparent runway forward for Nvidia, and I predict that the inventory will proceed to succeed in new heights properly into 2025.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Danny Vena has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Prediction: Nvidia Inventory Will Surge Into 2025. Here is Why. was initially revealed by The Motley Idiot