Marko Geber

Overview

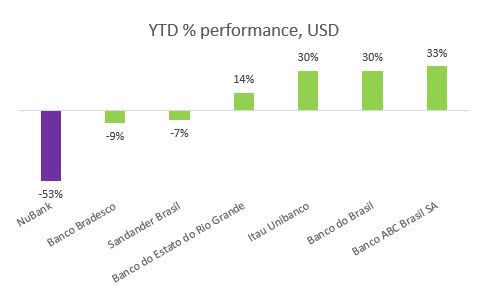

Looking at the year-to-date performance table of major Latin America (“LATAM”) banks, there is one oddity, which is the performance of Nu Holdings Ltd. (NYSE:NU) (“Nubank”). Nubank is Latin America’s largest and most successful fintech, with over 70 million customers as of September 2022. However, since the company went public last year in December, NU has lost over 50% of its value.

This is odd, because LATAM banks, and more specifically Brazilian banks, enjoyed a favorable macro environment in terms of increasing interest rates over the past two years. One of the reasons why Nubank haven’t participated in this rally is that the market still thinks of Nubank as a technology company, which, in general, have had a hard time for the past nine months. With the passage of time, this is going to change, and markets will likely judge Nubank more as a bank and less as a technology company.

More specifically, Nu will be judged by characteristics important for every bank: a) how much in loans it provides; b) what is the asset quality of its portfolio; and c) how much it earns on services provided to clients (ARPAC). In the following paragraphs, I will look at the key performing indicators and try to prove that the current stock price is inadequate to Nubank’s intrinsic value.

Own work

Growing loan portfolio and market share

Nubank’s interest earning portfolio of US $9.7 billion is split between a credit cards portfolio of US $7.8 bil. and personal loans of US $1.9bil. Even though its year-over-year growth of 83% is formidable, its market share is only 8% in credit cards and 5% in personal loans. To see the broader picture, I looked at the loan portfolios of other Brazilian banks. The biggest disparity is probably visible in proportion of Nubank’s clients and size of its portfolio. While Nubank has 70.4 million customers (approximately 39% of the adult Brazilian population) it has only miniscule market share compared to its peers. Its total market share in Brazilian market is approximately 2%.

I think it is reasonable to assume that in coming years the size of Nubank’s portfolio will grow as the company will introduce new products (leasing, mortgage, working capital financing), and at the same time more of its customers will withdraw new loans. This will be reflected in Nubank gaining more market share at the expense of its competitors. Nubank’s asset-light structure along with an easy-to-apply process for new loan should help to win new business.

Annual Reports, Bloomberg data, own work

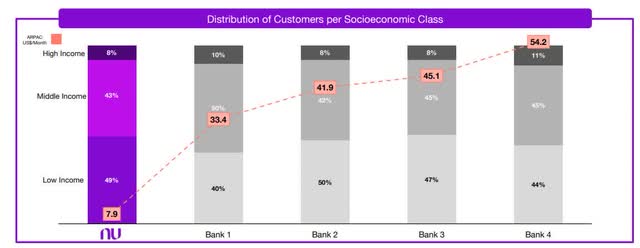

More engagement is driving more revenues

Average revenue per active user (ARPAC) is a good proxy for monitoring usage of bank services among its customers. While Nubank delivered average monthly ARPAC of US $7.9 in 3Q22, mature cohorts of customers, which are with Nubank over 5 years, achieved ARPAC of US $22. This is still much lower than what incumbent banks are earning. The four biggest Brazilian banks are generating monthly ARPAC in the range of US $33 to US $54. Nubank’s main proposition is to deliver cheaper financial services for its customers than the competition, that’s why I don’t think that Nubank will generate monthly ARPAC at the level of its competitors. However, as more customers become mature users, Nubank’s average ARPAC can attack the upper level of the currently achievable US $20. This makes sense in terms of corporate strategy, to stay cheaper than incumbents, as well as in terms of scalability of products.

3Q2022 Nubank presentation

Valuation

There is no doubt that Nubank is a great company. The questions is if it is also a good investment. I would argue that at the IPO price of US $9 per share, a lot of positive developments have been priced in. Since then a major correction has occurred, but external factors changed as well. Higher rates environment and higher CoE (cost of equity) brings lower equity prices. Now the major question is whether the current price is attractive enough given the company’s intrinsic value, or it correctly reflects changed macro environment. The most frequent mistake the market does with good companies is its inability to forecast how long can a good company safeguard its moat. I think this is the case also with Nubank, where the market does not believe that Nubank can achieve long profitable growth for a prolong period.

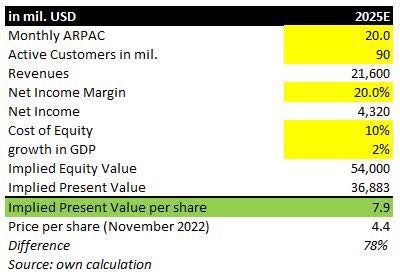

In terms of valuation, more assumptions usually lead to more mistakes. However, we can work with simple inputs we already know. Firstly, we can tell that Nubank can add up to 5 million new customers per quarter. Secondly, mature cohorts of customers deliver ARPAC of over US $20. Finally, we know that the average profitability of Brazilian banks, the net profit margin, is above 20%, and that the Brazilian GDP growth expectation for 2025 is 2%.

Below the cells highlighted in yellow are inputs in my valuation. Based on this calculation, the intrinsic value per share of Nubank is somewhere around $8 USD per share, which is approximately 80% higher than the current market price.

Own work

Potential risks

There are several risks which could alter my valuation and the long-term prospects of Nubank. The main risk is the company’s inability to achieve targeted ARPAC due to lower monetization of clients. Additionally, growing client churn along with a decelerating quality of the interest-earning portfolio could further impact Nubank’s profitability and subsequently its valuation.

At the end of the day, investing is a game of probabilities. At current price, the margin of safety should be sufficient to protect investors even if future developments took a different path. In the worst-case scenario, investors should not lose much at the current price. In a good-case scenario, there would be an attractive return. Nu Holdings Ltd. seems to be a mispriced bet.