Smederevac

Investment Summary

NOV Inc (NYSE:NOV), is a company that gets exposure to the oil and gas industry by selling systems and components to companies focused on the drilling and production part of those commodities. The last few years have been a roller coaster for the industry and we saw oil prices rapidly increase to around $120. Since then the prices have come down, but NOV has been able to grow revenues nonetheless, despite the less favorable commodity prices in the industry. The company doesn’t hold a significant portion of the market share, but that leaves room instead for growth. The current valuation doesn’t scream a buy though when comparing it to the rest of the sector even when taking the earnings estimates into account. I think buying around 7 – 8x earnings is a more fair number and until it reaches that I will be rating NOV a hold.

Quarterly Result

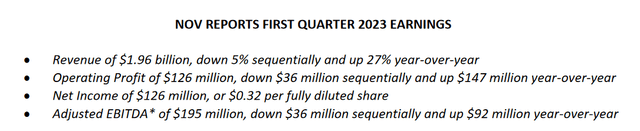

Start of 2023 NOV had an impressive quarter with YoY growth signaling a good outlook for the company. The CEO Clay Williams had some interesting remarks too, “On a consolidated basis, revenue increased 27 percent compared to the first quarter of 2022, and our orders for capital equipment exceeded our shipments out of backlog by 9 percent. While the decline in North American natural gas prices may be a near-term headwind, the recovery in offshore and international activity is continuing to build strong momentum”. I think this comment highlights that perhaps the focus shouldn’t solely be on the American market, but also on areas like Asia and South America. Brazil seems to have a promising future with their oil production and that might present an interesting market to be a part of too.

As NOV generates about 61% of revenues from international endeavors keeping an eye on the development here will be important going forward.

Earnings Highlights (Earnings Report)

Comparing the bottom line QoQ it’s impressive to see the company still manages to improve margins. They had a fantastic first quarter, but revenues did drop slightly. But that didn’t stop the EPS from growing by nearly 18%. Looking closer though, the last quarter did result in $40 million of other expenses, net which did drag down the bottom line. Neglecting that, the company had pretty much the same result as the quarter before. Where there is some worry for me though is the shares are still being diluted, especially on a yearly basis. The company hasn’t been able to get back to previous cash flow levels, like in 2020 when they had nearly $900 million in levered FCF.

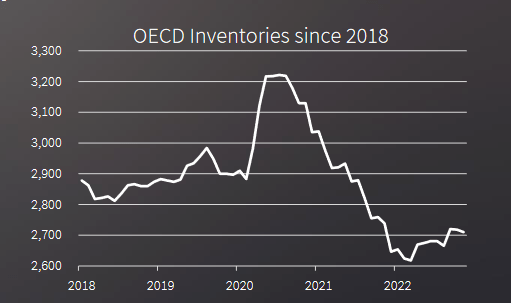

OECD Inventories (Investor Presentation)

Fueling growth in the coming years should be the lower inventories of oil the US has compared to some years ago. The necessity to replenish this is vital according to many. If that comes from other countries or the US itself is another question. Given the global presence, NOV holds they should be able to benefit from either scenario. Demand for oil fuels the need for the products and components that NOV makes.

Risks

Risks facing NOV are perhaps long-term rather than short-term. In many many decades from now I think it’s clear to most that oil and gas will be of less importance to our societies as we phase them out in favor of renewables. But until then there is still plenty of capital in the industry and the possibility to benefit greatly for companies making buybacks and distributing cash flows as dividends.

With NOV though, they don’t seem to be buying back shares at all, instead, they are diluting shares on a yearly basis. Between 2018 and 2022 the shares rose by around 4.7%, which isn’t excessive perhaps, but it’s not going in the right direction. What worries me further is the cash flows remaining negative which doesn’t help the case that shares could stop being diluted. Instead, I see a much more probable scenario of them continuously being diluted. The dividends aren’t either that impressive anymore as the company doesn’t have sufficient cash flows to support and raise them at a steady rate it seems.

Financials

Moving over to the financials of the company, they seem to be in a sound position right now. The cash position has seen a QoQ decrease of about $300 million, representing 30% which doesn’t sound too good. But even though the company has a lower cash position they keep a somewhat solid net debt/EBITDA ratio of 1.94 right now. It’s neither good nor bad, but I don’t think the debts will become an issue at least in the near future.

The company has managed so far at least to keep a solid relationship between the assets and liabilities with at least 2x as many assets compared to liabilities.

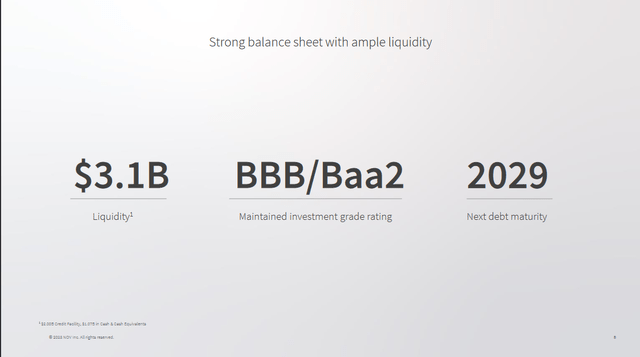

Company Debt (Investor Presentation)

The company itself keeps a positive view of its financials, noting they have $3.1 billion in liquidity. This is great to keep in mind as it could pay off the entire long-term debts the company has. But that shouldn’t really be necessary as seen above, the next debt maturity isn’t in 2029. Leaving the company with years to help improve their margins and hopefully build up a business generating strong cash flows once again to help tackle debt payments.

All in all, I find the balance sheet to be solid, but a dip in the margins could make the debt a bigger concern and increase the risk of further dilution to help raise capital. Going forward increasing margins would help ease any concerns and increasing the cash position would be icing on the cake.

Valuation & Wrap Up

I think NOV Inc offers an interesting way for investors to gain exposure to the oil and gas industry. As a supplier of components here, the company will see revenues go up and down as it follows the cyclical nature of the commodity industry. But they are advancing outwards and making a name for themselves in the industrial and renewable energy sectors too, which should help them in the long term as we will eventually phase out oil and gas. But to be fair, that is decades away.

Stock Chart (Seeking Alpha)

The company has decent margins and they seem to be climbing upward so positive FCF might be here soon least. But as mentioned at the beginning of the article, I don’t think paying nearly 12x forward earnings for a company in this sector is too much. I don’t think the growth justifies it. But given the quality of the business, I think a hold rating is fair for now.