Eliminating taxes on suggestions has emerged as a sturdy — and contentious — political speaking level within the final 12 months, and now it is a step nearer to actuality. On Tuesday, the Senate unanimously voted to go the No Tax on Ideas Act, a invoice that largely does what it says on the tin. It now heads to the Home, the place related laws has been into account as a part of the embattled super-bill of tax cuts and the federal funds.

Tipping accounts for a significant portion of many individuals’s incomes, whether or not they work in service, hospitality or elsewhere, and like most different types of revenue, you need to report it to the IRS come tax season. A 2023 survey from the Pew Analysis Middle discovered round 43% of People had expertise working at a job the place they obtained suggestions along with normal hourly wages, particularly youthful respondents, these from lower-income properties and girls.

At this level, eradicating a few of the taxes on tipped revenue looks as if one of the doubtless proposals to make it via the legislative chaos in Congress proper now. Whereas it’d seem to be a simple win irrespective of your political leanings, there are nonetheless loads of causes to be involved about what the knock-on results may be.

For every little thing that you must learn about what this invoice would possibly imply for you — and tips on how to deal with your tipped revenue throughout tax time general — preserve studying. For extra, take a look at our breakdown of what extending the Trump tax cuts would possibly imply for you.

Are taxes on suggestions going away with this invoice?

Casting off federal taxes on tipped revenue emerged as a distinguished political dialogue over the previous 12 months, notably after each main occasion 2024 presidential candidates, Kamala Harris and Donald Trump, supported the thought as a approach to put more cash again within the pockets of working-class folks. Since taking workplace in January, Trump has repeated his pledge to remove taxes on suggestions.

The No Tax on Ideas Act was set forth in Congress earlier with bipartisan help and has simply handed one chamber of Congress with ease. Because it stands, the invoice would create a tax deduction for employees in historically tipped fields for as much as $25,000 per 12 months. It could, nonetheless, exclude tipped employees making over $160,000 and would require the Treasury to create an inventory of jobs the deduction would apply to inside 90 days of the invoice going into impact. That revenue degree may even be reexamined yearly to account for inflation.

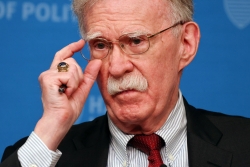

It isn’t all sunshine and unanimous bipartisan help. Writing in a weblog submit for the Tax Basis, a nonprofit advocacy group, Senior Coverage Analyst Alex Muresianu warned that putting off tips about taxes might have unintended harms. It might encourage extra industries, as an illustration, to maneuver towards a gratuity-based cost system, lowering the quantity of general taxes collected. The topic additionally got here up in a current phase on HBO’s Final Week Tonight, wherein host John Oliver echoed a few of these considerations and recommended that, somewhat than a tax exemption for tipped revenue, employees in historically tip-driven industries ought to have their base pay elevated as a substitute.

Do I want to trace my suggestions for my tax return?

Sure. You could report the revenue you constituted of suggestions in your tax return. On its web site, the IRS advises you retain a “every day tip file” to be able to have the complete quantity able to report come tax season. You might be additionally suggested to let your employer understand how a lot you make in suggestions. This permits them to have an correct sense of your revenue degree, in order that they’ll withhold the correct quantity out of your normal paycheck.

Are suggestions taxed in another way than regular revenue?

Normally, no, suggestions will not be taxed at a special fee than your normal wages. Your revenue tax fee would change provided that your revenue from suggestions pushed you into a better revenue bracket, which might change the speed utilized to your general revenue. If the quantity of suggestions you obtained in a given month is lower than $20, nonetheless, you needn’t report that cash as revenue in your taxes.

What if I fail to report my revenue from suggestions?

If you happen to assume you may preserve your tip revenue underneath the desk, assume once more. If the IRS catches you withholding suggestions out of your tax return, you will be hit with a penalty that requires you to pay “equal to 50% of the Social Safety, Medicare, Extra Medicare, or railroad retirement taxes you owe on the unreported suggestions” on high of the quantity you will owe generally, per the IRS web site. The company has quite a lot of strategies used to catch “underreporters” who fail to report all of their revenue, corresponding to monitoring your financial institution statements or e-commerce exercise. Higher secure than sorry. For extra, discover out every little thing it’s best to know about IRS audits.