In line with the Treasury Division’s month-to-month report for September, the finances deficit turned optimistic final month, with tax receipts coming in at $197 billion above federal outlays. This sizable one-month surplus was because of a big month-to-month drop in federal spending for the month. Opposite to what some protectionists and Trump advocates have claimed, nonetheless, the excess was not considerably pushed by tariff revenues.

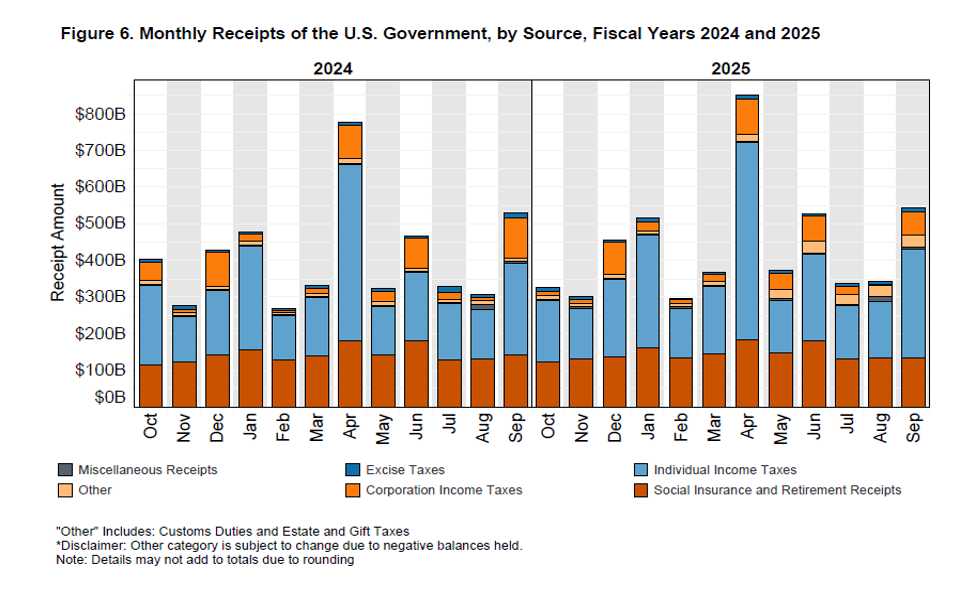

In line with the report, whole tax receipts for September amounted to $543 billion, a month-to-month enhance of 57 %, or $199 billion. In enhance in receipts from August to September is an anticipated seasonal change, and tax income has elevated from August to September in yearly for greater than a decade. Certainly, final months’ enhance in income was not even notably giant. Over the previous decade, the August-September enhance in tax income has been bigger in yearly—besides 2017 and 2018—in comparison with this 12 months’s enhance:

In different phrases, there’s nothing about current income development that’s exceptional.

In current months, nonetheless, Trump and administration spokesmen have repeatedly made grandiose claims about tariff income. Early in his administration, for instance, Trump claimed that tariff income would substitute the revenue tax. It’s now abundantly clear that the revenue tax will not be going wherever. As I confirmed earlier this 12 months right here on mises.org, tariff income is simply a tiny a part of whole federal income. There may be just about no strategy to enhance tariff income to a degree that Trump would even be capable of fund his army spending, not to mention the favored welfare packages—like Social Safety and Medicare—that Trump has pledged to not minimize.

Nonetheless, the administration has been crowing about how tariff income elevated to $31 billion throughout August and September, as if this could put any kind of vital dent in fiscal coverage. For instance, September’s tariff “haul” of $31 billion quantities to a mere 5.7 % of all income ($543 bln) for the month. Trying on the Treasury’s income report, we are able to see that the true sources of the rise in September income have been particular person revenue taxes and company revenue taxes. Tariff revenues are so insignificant within the graph that they’ve been included beneath “different.”

Supply: Treasury Dept.

After all, an bizarre particular person may very well be forgiven for considering that tariff income is gigantic. In August, for instance, Trump repeatedly claimed that tariff income totaled trillions of {dollars}. Forbes experiences:

“With out tariffs, and the entire TRILLIONS OF DOLLARS we’ve got already taken in, our Nation can be utterly destroyed, and our army energy can be immediately obliterated,” Trump wrote on Reality Social.

Trump claimed earlier this month that “trillions of {dollars} are being taken in on tariffs” and his levies have “not prompted inflation, or another issues for America, aside from large quantities of CASH pouring into our Treasury’s coffers.”

In fact, since Trump took workplace, whole tariff revenues have totaled about $120 billion or solely 12 % of a single trillion. It’s a good distance from “TRILLIONS.”

So, when bragging about elevated tax income in September and August, trump is actually bragging about fleecing People of a whole bunch of billions of {dollars} collected by means of revenue taxes.

It’s not true that solely foreigners pay tariffs, however, for the sake of argument, let’s say it’s true. Even then, the overwhelming majority of tax income would nonetheless be coming from company and particular person revenue taxes—assuming that Trump continues along with his present coverage of constructing no sustained spending cuts. Some Trump supporters might declare that tariffs are rising and so will quickly “substitute” revenue taxes, however even when tariff income quadruples into fiscal 12 months 2026, tariffs will nonetheless come up greater than $3 trillion in need of changing revenue taxes. So, given the whole lot we learn about Trump’s big-spending fiscal coverage, there may be just about no likelihood of the revenue tax going away. Trump wants that income to pander to Medicare recipients, to fund company welfare queens like Raytheon, and to lavish Israeli struggle criminals with American tax {dollars}.

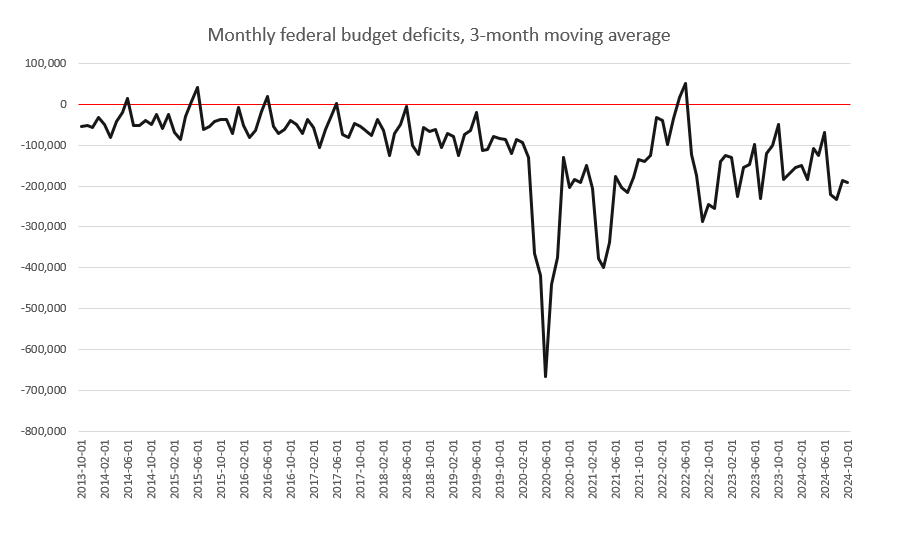

Nor will tariff revenues do a lot to get rid of federal deficits. A month-to-month tariff income whole of $30 billion—and even $50 billion—is a good distance from erasing month-to-month deficits.

Whereas it’s true that September’s surplus was unusually giant, this may be attributed to a surprisingly huge drop in federal outlays for the month. In line with the Treasury report, whole outlays dropped from $689 billion in August to $345 billion in September. Whole outlays normally fall from August to September, with spending falling in the course of the interval throughout seven of the previous ten years. Nonetheless, this September’s drop was an enormous one, with federal spending falling by 49.8 % dung the interval. The one comparable 12 months previously decade was 2018 when spending fell by 48.2 % from August to September.

It is a good factor, in fact, though it’s unlikely to be the beginning of any vital change in development. Sadly, federal spending tends to extend from September to October, and September’s drop off in spending is more likely to be an outlier. (I’d be completely happy to be confirmed mistaken on this.)

Furthermore, tax income tends to fall from September to October, so we’re possible taking a look at one other sizable deficit for October. If that occurs, Septembers surplus shall be nothing greater than blip within the development in deficits. In any case, the three-month shifting common in month-to-month deficits exhibits the development is getting worse, not higher:

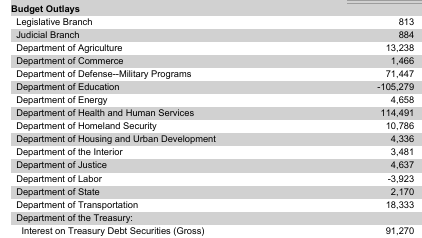

These deficits will proceed to drive ever bigger quantities of federal debt, and this itself will drive extra federal spending on curiosity. For instance, the September Treasury report additionally exhibits that greater than $91 billion of the month’s $543 billion in income was spent on “curiosity on Treasury debt securities.” In different phrases, almost one greenback for each six {dollars} collected in taxes goes simply to pay debt service. That’s the biggest single class of federal spending outdoors the main welfare packages like Social Safety.

Yr-to-date, whole federal spending on curiosity on the nationwide debt exceeded $1.22 trillion. That’s up from $1.13 trillion throughout the identical interval of final 12 months. Debt service is quickly consuming ever bigger quantities of the federal finances. Opposite to what People have lengthy instructed themselves, the federal debt does include a value.

The one excellent news on this month-to-month Treasury report is the truth that spending went down final month. In the meantime, federal income went up considerably—with most of it coming from revenue taxes. However, until one thing adjustments considerably by way of army spending and massive packages like Medicare, and so forth., the Treasury will rapidly return to working huge deficits.