bjdlzx

The Neuberger Berman Power Infrastructure and Earnings Fund Inc (NYSE:NML) is a closed-end fund, or CEF, that income-seeking traders can use as a manner of including high-yielding grasp restricted partnerships, midstream firms, and related power infrastructure corporations to their portfolios. The benefit is they will do that with out the effort of coping with unrelated enterprise taxable revenue or Okay-1 varieties. This fund is usually thought of one of many higher ones on this section, because it dealt with the 2020 trade collapse fairly nicely and its shares are literally up since 2019:

In search of Alpha

The fund can also be one of many highest-yielding ones within the sector, as this fund yields 8.75% at the moment worth. That is fairly a bit greater than the 7.72% yield of the Alerian MLP ETF (AMLP) and is greater than most friends. We are able to see that right here:

Fund Identify | Morningstar Classification | Present Yield |

Neuberger Berman Power Infrastructure and Earnings Fund | Fairness-MLP | 8.75% |

ClearBridge Power Midstream Alternative Fund (EMO) | Fairness-MLP | 6.64% |

Kayne Anderson Power Infrastructure Fund (KYN) | Fairness-MLP | 8.22% |

NXG Cushing Midstream Power Fund (SRV) | Fairness-MLP | 12.60% |

Tortoise Power Infrastructure Corp. (TYG) | Fairness-MLP | 8.60% |

As we will clearly see, the NXG Cushing Midstream Power Fund is the one power infrastructure closed-end fund that manages to beat this one when it comes to yield. That is one thing that may undoubtedly be engaging to any investor who’s even contemplating a place in one among these funds. In spite of everything, most individuals who spend money on grasp restricted partnerships within the first place achieve this due to the excessive yields which might be obtainable within the sector. Thus, it is sensible that these identical traders would gravitate towards the funds with the very best yields. The fund’s excessive yield additionally signifies that traders obtain the next degree of revenue from a given financial funding, and all of us wish to have greater incomes in an inflationary surroundings.

As common readers may keep in mind, we beforehand mentioned the Neuberger Berman Power Infrastructure and Earnings Fund in mid-June of this yr. The fairness market has usually been robust since that point, together with with regards to midstream corporations. The previous two years or so have confirmed to be a really totally different surroundings for these corporations than the one which we grew to become accustomed to earlier than the COVID-19 pandemic. Many traders look like extra interested by high-yielding corporations than previously, and this has been proven of their market efficiency. As such, we would count on that the fund’s efficiency has been pretty stable since our earlier dialogue.

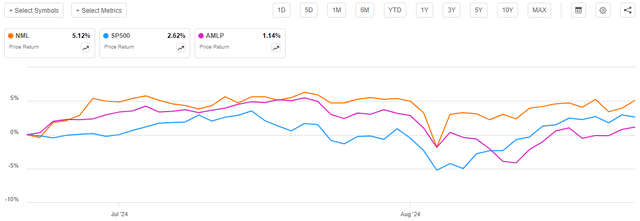

That is certainly the case, as shares of the Neuberger Berman Power Infrastructure and Earnings Fund have appreciated by 5.12% since our earlier dialogue. This was much better than what the S&P 500 Index (SP500) or the Alerian MLP Index delivered over the identical interval:

In search of Alpha

This may undoubtedly be engaging to only about any potential investor. In spite of everything, all of us wish to outperform the market and general, this fund has carried out a reasonably good job at conducting this. Nonetheless, there might be some concern that the fund’s shares have gotten forward of themselves, because the decrease efficiency of the Alerian MLP Index might recommend that the fund’s portfolio was unable to match this efficiency.

As I famous in my final article on this fund, nevertheless:

A easy have a look at a closed-end fund’s worth efficiency doesn’t essentially present an correct image of how traders within the fund did throughout a given interval. It is because these funds are inclined to pay out all of their internet funding earnings to the shareholders, reasonably than counting on the capital appreciation of their share worth to supply a return. That is the rationale why the yields of those funds are typically a lot greater than the yield of index funds or most different market property.

Alongside these traces, it’s usually finest to contemplate the distributions {that a} closed-end fund pays out when analyzing its efficiency. It is because these distributions signify very actual returns to the shareholders that aren’t going to be mirrored within the worth efficiency.

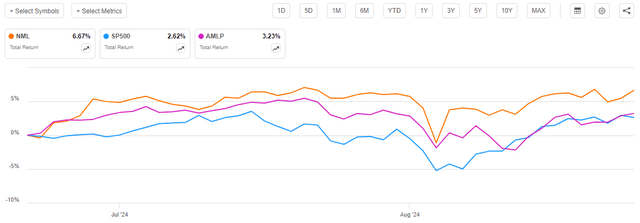

After we embrace the distributions that the Neuberger Berman Power Infrastructure and Earnings Fund paid out since our earlier dialogue, we get this various chart:

In search of Alpha

As we will clearly see, the fund’s distribution lifted its complete return over the two-month interval by 150 foundation factors or so. The excessive yield of the Alerian MLP Index additionally lifted its complete return up a bit, however to not the identical extent, for the reason that index has a decrease yield than the Neuberger Berman Power Infrastructure and Earnings Fund. The worst performer right here when it comes to complete return was truly the S&P 500 Index, which represents a stark departure from the pre-pandemic market surroundings. General, it definitely seems that we’re in one thing of a brand new actuality now with regards to the attractiveness of high-yielding power infrastructure performs, as these property have been performing very nicely in comparison with large-cap shares for some time. In any case, traders on this fund seemingly have little to complain about with regards to its efficiency.

As two months have handed since our earlier dialogue, it’s logical to imagine that a couple of issues have modified. Particularly, the Neuberger Berman Power Infrastructure and Earnings Fund launched an up to date monetary report that particulars its efficiency throughout the first half of its fiscal yr. We can pay shut consideration to that as we proceed our dialogue as we speak, as it might reveal whether or not we have to replace our thesis on this fund.

About The Fund

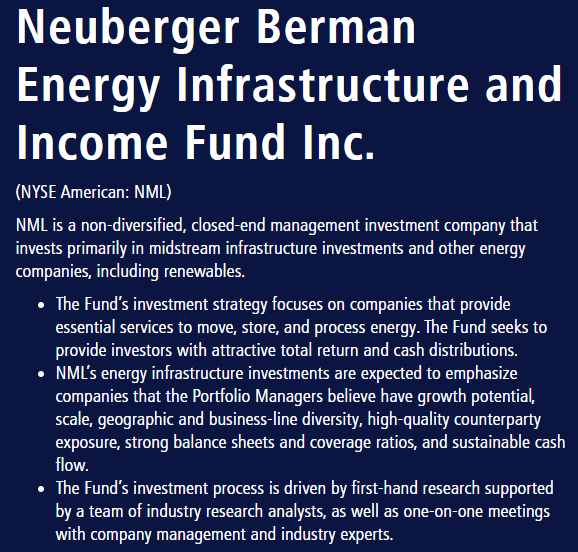

In keeping with the fund’s web site, the Neuberger Berman Power Infrastructure and Earnings Fund has the first goal of offering its traders with a excessive degree of complete return. Right here is the complete description from the webpage:

Neuberger Berman

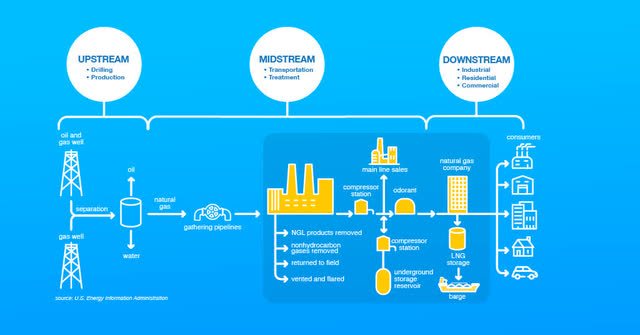

This merely tells us that the Neuberger Berman Power Infrastructure and Earnings Fund invests in corporations that earn their income by transferring, storing, or processing power. As we’ve got mentioned in varied earlier articles, that is the overall description of a midstream power firm. The Williams Corporations (WMB) gives this definition of midstream power:

Midstream corporations function the pipeline and gathering or transmission amenities that transfer the gasoline from the nicely (upstream) to our properties and companies (downstream). Midstream operations additionally deal with the product, take away water or waste merchandise, compress it and get it prepared for varied markets downstream.

The Williams Corporations additionally gives this useful graphic that initially got here from the U.S. Power Data Administration:

The Williams Corporations/U.S. Power Data Administration

Thus, the Neuberger Berman Power Infrastructure and Earnings Fund is usually going to be investing in midstream corporations, in response to the outline that was offered on the web site.

It’s value noting although that the web site’s description doesn’t explicitly state that the fund will solely be investing in corporations that present infrastructure for the oil and gasoline trade. The fund’s assertion that it “focuses on corporations that present important providers to maneuver, retailer, and course of power” may be utilized to electrical utilities. In spite of everything, the first enterprise operate of an electrical utility is to maneuver electrical energy from a era facility to our properties and companies. The semi-annual report seems to concur with electrical utilities, becoming with the fund’s technique. The portfolio commentary part even consists of the next paragraph:

Utilities, following a difficult earlier yr, have carried out nicely to date in 2024 and have bolstered the Fund’s efficiency. Electrical energy producers have been more and more shifting from coal to pure gasoline and renewable power sources, which decrease general CO2 emissions, a development we consider is enjoying out globally. Since 2010, the pure gasoline portion of the facility combine has risen steadily from 24% to 43% of all home electrical energy consumed in 2023.

There isn’t a cause for the fund’s commentary to incorporate something in regards to the efficiency of utilities until it invests in these corporations. Nonetheless, this paragraph might be taken in one other manner. The fund’s administration makes point out of the rising proportion of pure gasoline within the nation’s power combine. In contrast to with coal, utilities don’t hold a considerable quantity of pure gasoline in on-site storage at their era crops. Moderately, midstream corporations comparable to The Williams Corporations or Kinder Morgan (KMI) ship it to the electrical era plant on a continuing foundation. Thus, the development away from coal and in the direction of pure gasoline has resulted in conventional oil and gasoline midstream corporations transporting extra pure gasoline, which causes their money flows to extend.

Whereas that assertion could not essentially imply that the fund goes to spend money on utilities, this fund does, the truth is, have a couple of holdings within the sector. The semi-annual report lists the next:

Trade Sector | % of Internet Property |

Electrical Utilities | 4.0% |

Unbiased Energy and Renewable Power Producers | 6.1% |

Multi-Utilities | 10.4% |

Renewable Electrical energy Partnerships | 1.7% |

This totals 22.2% of the fund’s internet property being invested in electrical mills or utilities of some kind. That is, admittedly, probably not that a lot for an power infrastructure fund. In spite of everything, the First Belief funds regularly had a a lot bigger allocation to electrical utilities than this. Nonetheless, it’s nonetheless a big sufficient allocation to supply this fund with restricted publicity to the basics of electrical utilities. This might be a superb factor, as issues comparable to synthetic intelligence and electrical autos will nearly definitely trigger electrical consumption to extend considerably within the coming years (see right here). This fund is just not pretty much as good a method to play this dynamic as a pure utility fund, although, because it solely has 22.2% of its property invested in electrical producers.

As is likely to be anticipated, then, nearly all of the fund’s internet property are invested in conventional oil and gasoline midstream performs. The semi-annual report reveals the next asset allocation as of Could 31, 2024:

Trade Sector | % of Internet Property |

Capital Markets | 1.5% |

Electrical Utilities | 4.0% |

Unbiased Energy and Renewable Power Producers | 6.1% |

Multi-Utilities | 10.4% |

Oil, Gasoline & Consumable Fuels | 62.8% |

Oil, Gasoline & Consumable Gas Partnerships | 2.4% |

Oil & Gasoline Storage & Transportation | 35.0% |

Renewable Electrical energy Partnerships | 1.7% |

Cash Market Fund | 0.3% |

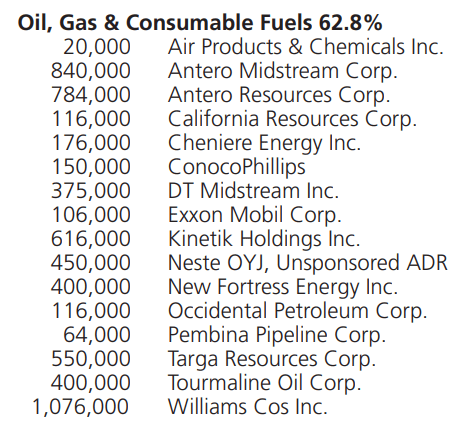

The 2 “Oil, Gasoline & Consumable Fuels” classes all consist largely of corporations that might be thought of a midstream company or a midstream partnership. For instance, listed below are the businesses which might be listed because the fund’s holdings beneath the “Frequent Shares” section of the portfolio:

Fund Semi-Annual Report

Of those corporations, Air Merchandise and Chemical compounds (APD), Antero Sources (AR), California Sources Corp. (CRC), ConocoPhillips (COP), Exxon Mobil (XOM), Neste Oyj (OTCPK:NTOIF), New Fortress Power (NFE), Occidental Petroleum (OXY), and Tourmaline Oil Corp. (OTCPK:TRMLF) will not be, strictly talking, midstream corporations. Some readers may debate whether or not Cheniere Power (LNG) is definitely a midstream firm or not, however most sources contemplate it to be related sufficient to 1 to incorporate it on this class. The rest of those are all pipeline operators of varied sorts.

The only real firm listed beneath “Oil, Gasoline & Consumable Fuels Partnerships” is Sunoco LP (SUN), which has operations within the midstream and downstream segments of the power trade.

Thus, we will clearly see that this fund is closely invested in midstream power, which is what many traders on this fund would count on. That is good as a result of these corporations usually have steady money flows over time and pay out a big proportion of their money flows to their traders as dividends or distributions. The fund’s description on the web site does state that it expects a big proportion of its complete return to come back within the type of dividends and distributions. This additionally suits completely with what traders seemingly count on the fund to have.

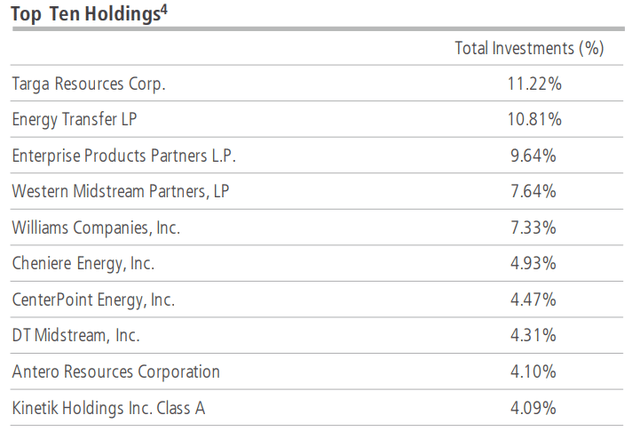

A lot of the fund’s largest holdings are midstream corporations. The very fact sheet gives this checklist of its largest positions as of June 30, 2024:

Fund Reality Sheet

Of the businesses on the checklist, CenterPoint Power (CNP) and Antero Sources are the one corporations that aren’t midstream corporations. This, due to this fact, reinforces the truth that this fund is primarily targeted on midstream corporations, regardless that it has different issues included within the portfolio.

The one vital change that we see right here in comparison with the fund’s largest positions on the time of our final dialogue is that Sempra (SRE) was faraway from the checklist and changed with DT Midstream (DTM). Sempra was nonetheless within the fund’s portfolio as of Could 31, 2024, although, so this transformation could have been merely because of the firm’s inventory not performing in addition to some others. If that’s the case, then the stronger performing corporations might have merely seen their place measurement enhance sufficient to knock it off the checklist. Nonetheless, Sempra’s inventory worth elevated 6.59% throughout the second quarter, in order that appears unlikely:

In search of Alpha

Thus, what we’re most likely seeing right here is one among two prospects:

- The fund took a few of its positive aspects in Sempra, decreasing its place measurement however maintaining some publicity to the corporate, or

- The fund offered out of Sempra utterly in June.

There isn’t a method to know for certain what occurred right here till the fund releases its third-quarter 2024 holdings report in a couple of months. Nonetheless, for now, we will clearly see the change.

Leverage

As is the case with most closed-end funds, the Neuberger Berman Power Infrastructure and Earnings Fund employs leverage as a technique of boosting the efficient yield and complete return that it earns from the property in its portfolio. I defined how this works in my earlier article on this fund:

In brief, the fund borrows cash after which makes use of that borrowed cash to buy widespread models of midstream partnerships or firms. So long as the bought property have the next yield than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly nicely to spice up the efficient yield of the portfolio. This fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges. As such, this can often be the case. With that stated although, the useful results of leverage will not be as nice as we speak with rates of interest at 6% as they had been three years in the past when rates of interest had been at 0%. Thankfully, most midstream partnerships have yields above 6% so this technique nonetheless works to spice up the efficient portfolio yield.

Sadly, the usage of debt on this vogue is a double-edged sword as a result of leverage boosts each positive aspects and losses. As such, we need to be certain that the fund is just not utilizing an excessive amount of leverage as a result of that might expose us to an extreme quantity of threat. I don’t often like a fund’s leverage to exceed a 3rd as a share of its property for that reason.

As of the time of writing, the Neuberger Berman Power Infrastructure and Earnings Fund has leveraged property comprising 17.07% of its portfolio. It is a slight enchancment over the 17.45% leverage that the fund had the final time that we mentioned it. I’ll admit that I anticipated it to have seen its leverage decline a bit extra based mostly on the share worth efficiency.

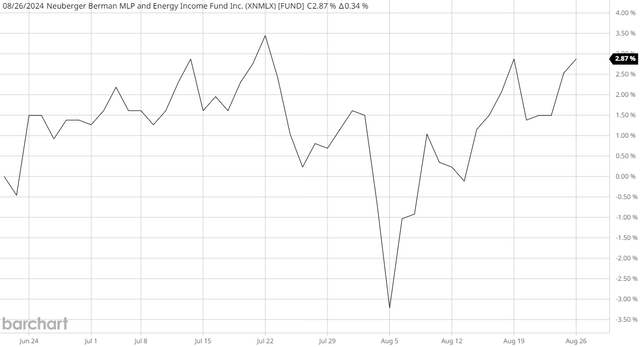

Nonetheless, the fund’s internet asset worth is simply up 2.86% for the reason that time of our earlier dialogue:

Barchart

That is, clearly, a lot lower than the fund’s share worth appreciated over the identical interval, a development that has been one thing of a typical theme these days, as many closed-end funds have seen their share worth outperform their precise portfolios. This has a noticeable impact on the fund’s valuation, which we’ll focus on later on this article. For now, the takeaway is that the fund’s internet asset worth elevated barely over the interval, so it is sensible for its leverage to say no barely. In spite of everything, that may sometimes be the case until the fund goes out and borrows extra money. This fund didn’t try this.

The fund’s leverage is nicely under the one-third of property most that we’d ordinarily need to see. That alone is an effective factor for any risk-averse investor, however allow us to evaluate the fund to its friends to ensure that its leverage is acceptable for its technique. This desk gives a abstract:

Fund Identify | Leverage Ratio |

Neuberger Berman Power Infrastructure and Earnings Fund | 17.07% |

ClearBridge Power Midstream Alternative Fund | 29.34% |

Kayne Anderson Power Infrastructure Fund | 22.27% |

NXG Cushing Midstream Power Fund | 29.23% |

Tortoise Power Infrastructure Corp. | 21.00% |

(All figures from CEF Information.)

As we will see, the Neuberger Berman Power Infrastructure and Earnings Fund has the bottom degree of leverage of its friends. This principally reveals that this fund’s leverage is fairly cheap given its present technique. General, traders should have no outsized dangers relating to the fund’s leverage right here.

Distribution Evaluation

The first goal of the Neuberger Berman Power Infrastructure and Earnings Fund is to supply its traders with a excessive degree of complete return. Nonetheless, the fund’s web site particularly states that it expects a lot of its complete return to come back within the type of distributions paid to its shareholders. To this finish, the fund pays a daily month-to-month distribution of $0.0584 per share ($0.7008 per share yearly). This offers the fund a fairly engaging 8.75% yield on the present share worth.

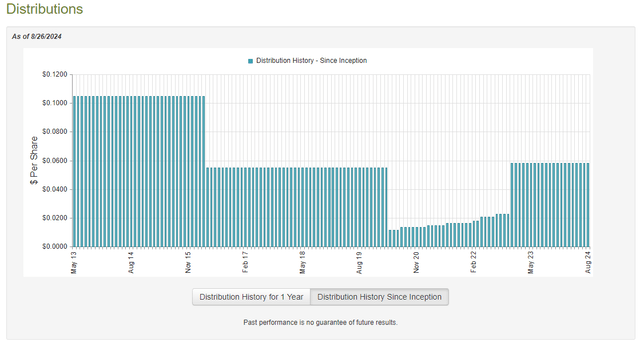

Nonetheless, the fund has not been particularly constant relating to its distribution through the years:

CEF Join

From the earlier article:

As we will see right here, the fund needed to lower its distribution dramatically in response to each the occasions of 2015 and 2020. This isn’t precisely shocking since each years noticed just about every thing associated to the standard oil and gasoline trade collapse in worth. The trade was usually struggling to acquire capital and lots of corporations modified their enterprise fashions or general technique. For instance, we noticed quite a few midstream corporations scale back their distributions in an effort to develop into much less depending on the capital markets for financing. This naturally resulted within the fund taking substantial realized and unrealized losses and it needed to scale back its distributions with the intention to protect its internet asset worth. The Neuberger Berman Power Infrastructure and Earnings Fund was not alone on this. In reality, each closed-end fund that invests on this sector needed to make related distribution cuts. This one has carried out a greater job of restoring it than lots of its friends since that point although, as the present payout is definitely barely greater than the fund was paying out previous to the COVID-19 pandemic. As such, whereas its historical past is likely to be a little bit of a turn-off for some, this fund nonetheless seems higher than most on this respect.

As of the time of writing, the latest monetary report that’s accessible is the semi-annual report for the six-month interval that ended on Could 31, 2024. A hyperlink to this report was offered earlier on this article. As that is newer than the one which accessible the final time that we mentioned NML, it ought to suffice for replace functions as nicely, contemplating how nicely NML did at protecting its distribution over the primary half of this yr.

For the six-month interval that ended on Could 31, 2024, the Neuberger Berman Power Infrastructure and Earnings Fund obtained dividends and distributions totaling $14,648,694 and curiosity revenue of $140,438. Nonetheless, a few of this cash got here from grasp restricted partnerships and so is just not thought of to be funding revenue for tax or accounting functions. As such, the fund solely reported a complete funding revenue of $7,759,536 for the six-month interval. This was not sufficient to cowl the fund’s bills, and so the fund ended up reporting a $1,271,802 internet funding loss. Clearly, that was not ample to cowl the $19,853,288 that the fund paid out in distributions over the six-month interval.

Thankfully, this fund was in a position to make up the distinction by capital positive aspects. For the six-month interval that ended on Could 31, 2024, the fund reported internet realized positive aspects of $33,927,799 together with internet unrealized positive aspects of $31,970,887. General, the fund’s internet property elevated by $44,773,596 after accounting for all inflows and outflows throughout the interval.

The fund’s complete annual distributions had been $39,706,576 in the latest full-year interval. Thus, we will see that merely the surplus funding earnings earned within the six-month interval lined by this report had been sufficient to hold the fund by a minimum of one other yr. General, then, it doesn’t seem to be we have to fear an excessive amount of about this distribution proper now. This fund is in stable monetary form.

Valuation

Shares of the Neuberger Berman Power Infrastructure and Earnings Fund are at present buying and selling at a ten.49% low cost to internet asset worth. It is a very engaging low cost, and it’s higher than the 9.27% low cost that this fund’s shares have averaged over the previous month. Thus, the present worth seems to be an affordable entry level.

Conclusion

In conclusion, the Neuberger Berman Power Infrastructure and Earnings Fund is likely one of the higher power infrastructure closed-end funds. This fund has utterly recovered from all of the losses that it suffered throughout the pandemic, and certainly seems to be incomes sufficiently excessive returns to finance its distribution for a minimum of the following yr. The fund additionally ought to be a bit safer than many others on account of its low leverage. General, this fund seems to be a superb manner so as to add a portfolio of midstream firms and grasp restricted partnerships to a portfolio.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.