Tramino

Nikola Firm (NASDAQ:NKLA) has wiped tens of thousands and thousands of {{dollars}}’ value of investor money since its market debut in June 2020. The company has misplaced better than 95% of its market price as a result of the IPO (adjusted for the reverse break up), and way more concerning, stays uninvestable as we communicate even at beaten-down stock prices.

Closing September, when Nikola stock was shopping for and promoting for a split-adjusted price of spherical $43, I claimed merchants might be burned. I’m not shocked about how points have turned out since then, with Nikola persevering with to show its incapacity to inch nearer to profitability. Beneath are a variety of the elemental causes I highlighted in my bear report on Nikola ultimate yr.

- The continued self-inflicted reputational harm arising from Nikola’s failure to fulfill vehicle provide milestones.

- The extreme cash-burn ratio of the company, which was pointing to additional possession dilution.

- The low energy effectivity of fuel cell electrical autos (“FCEVs”) compared with battery-powered electrical autos (“EVs” and “BEVs”).

- Lack of infrastructure to help elevated adoption of FCEVs.

Fast-forward to as we communicate, Nikola seems to have made some progress in its commercialization plans with the company delivering 72 Class 8 hydrogen fuel vans in Q2, beating the steering for product sales of 60 vans. After years of producing delays and missed steering, it will come off as music to the ears of Nikola bulls, nonetheless a deeper dive into the company’s fundamentals reveals Nikola will most likely proceed to hurt merchants over the long run.

There May Not Be Gentle At The End Of The Tunnel

All of us love turnaround corporations. The reality is, determining troubled corporations that may finally see larger days eventually is a worthwhile funding method. Nikola, sadly, is simply not one.

Nikola restructured the enterprise since 2023 by lowering its workforce, liquidating its curiosity in troubled battery pack maker Romeo Vitality, and divesting its curiosity in Nikola Iveco Europe GmbH, a European three method partnership, to take care of the house market. The company has moreover provide you with a way centered on growing its scale to indicate worthwhile.

Exhibit 1: Nikola’s profitability flywheel

Q1 presentation

Nikola’s challenges stem from the extreme manufacturing costs of fuel cell vans. The company is making losses from every truck it sells, which isn’t the place that you must be, given that the demand for FCEVs may under no circumstances attain the highs associated to BEVs. Based mostly on Hydrogen Notion, in This fall 2023, the widespread manufacturing worth of a Nikola truck was $679,000 whereas that they had been purchased for a median price of merely $351,000.

Beneath common circumstances, I may not be alarmed by a youthful agency selling a product at a loss to realize market share. Nonetheless, regarding Nikola, it’s a better downside than it seems.

Nikola’s aim market is simply not as massive as we initially thought. This is usually a direct outcomes of the related charge disadvantages associated to FCEVs. Based mostly on IDTechEx, solely 4% of zero-emission autos will probably be powered by hydrogen by 2044. The outlook for fuel cell vans is rather a lot higher, as anticipated, given that BEVs are perceived to have a downside on this part due to the load of lithium batteries required to permit long-distance journeys for vans. IDTechEx expects fuel cell vans to account for about 20% of all zero-emission vans by 2044.

Although this part offers a chance for Nikola, the unit economics picture stays disappointing. Nikola CFO Thomas Okray, who joined the company in March, acknowledged this downside via the Q1 earnings identify and talked about:

As well-known beforehand, absent vital amount, profitability will probably be beneath our expectations.

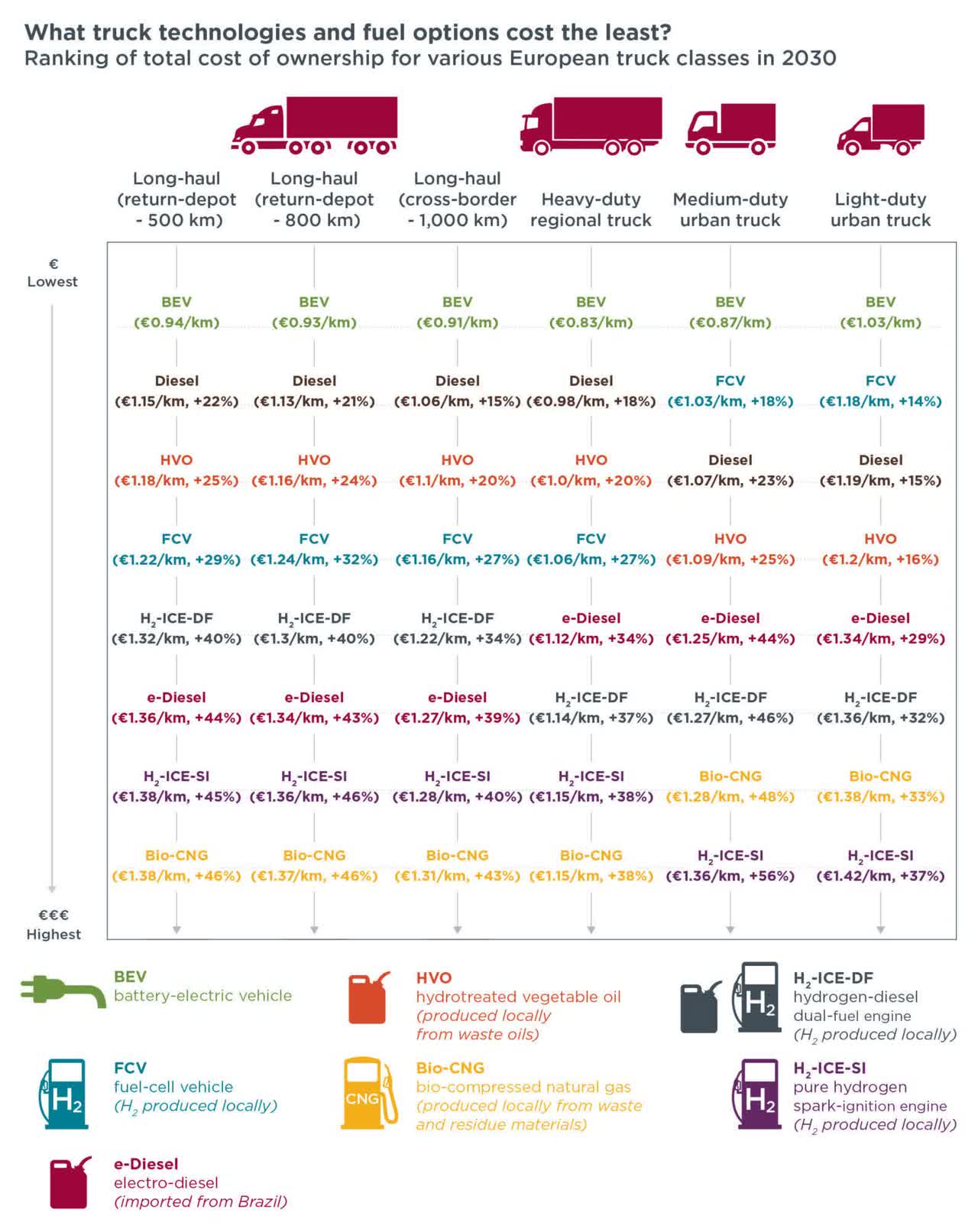

The company moreover revealed that widespread selling prices elevated to $381,000 in Q1, a $30K improve from the sooner quarter. This can probably improve the profitability profile throughout the temporary time interval, nonetheless I think about rising prices for FCEVs will dampen the demand finally when developments in BEV experience and infrastructure put FCEVs at a downside. Based mostly on the Worldwide Council on Clear Transportation, fuel cell vans powered by hydrogen isn’t going to be cost-competitive with diesel vans until 2035. The beneath illustration reveals that battery electrical vans worth the least to perform amongst all varied energy types.

Exhibit 2: Comparability of fuel decisions for a number of sorts of vans in Europe

The Worldwide Council on Clear Transportation

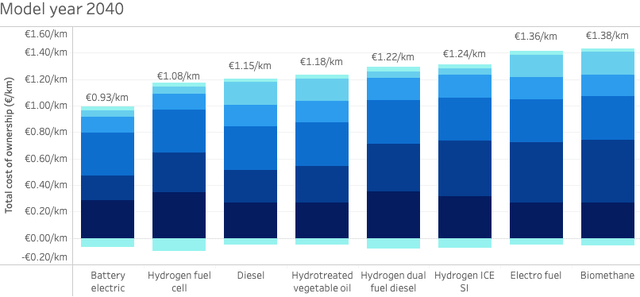

With fuel cell experience advancing, the general worth of possession of a fuel cell truck is anticipated to say no sharply throughout the subsequent decade. This is usually a good sign. Nonetheless, even by 2040, hydrogen fuel cell-powered vans are projected to worth additional to perform in distinction with battery electrical vans.

Exhibit 3: Full worth of possession comparability for model yr 2040 long-haul vans

The Worldwide Council on Clear Transportation

Then comes the infrastructure challenges. Charging infrastructure for BEVs has seen important enhancements throughout the ultimate decade, with important automakers along with Tesla, Inc. (TSLA) investing billions of {{dollars}} to develop charging networks. Gasoline cell charging infrastructure, alternatively, stays to be at an toddler stage. Nikola’s makes an try to technique nationwide trucking carriers with huge vehicle fleets isn’t going to realize success as long as infrastructure is lacking. Nikola has already understood this downside, which is why the company is aggressively investing in its Hyla refueling neighborhood. CFO Thomas Okray talked about:

Going to these massive nationwide accounts, it’s a must to have the fuel in place, or else that dialogue wouldn’t go as simply as you’ll have to.

No matter aggressive investments, it will take a couple of years for hydrogen refueling networks to be as expansive as EV charging networks, which leaves ample room for technological developments throughout the BEV space to drive the demand away from FCEVs. The rising energy density of lithium-ion batteries utilized in BEVs, sooner charging events in distinction to a few years previously, and the continued low cost in battery pack costs paint a promising picture for BEVs.

Nikola’s BEV division, which is already struggling to meet purchasers, may additionally face stiff rivals eventually with important automakers drawing plans to aggressively spend cash on long-haul autos. For instance, Mercedes is investing throughout the eActros LongHaul truck, which was launched ultimate October, whereas MAN is rising the MAN eTruck which is scheduled for launch this yr. EV chief Tesla has already captured the curiosity of enterprise purchasers with its Semi truck.

Takeaway

Nikola’s enterprise is in larger type in distinction to a few years previously, with the company specializing in its strengths throughout the U.S. market. Nonetheless, the going will get robust eventually. Its BEV division is anticipated to face stiff rivals, whereas the inherent disadvantages of fuel cell experience will proceed to be a barrier to mass adoption of fuel cell vans. That’s needed for the company to realize a breakeven stage. Selling 400-500 vans, which is what the company is hoping for this yr, isn’t going to make any vital enchancment to Nikola’s financial effectivity. Based mostly totally on the tough outlook for mass adoption of FCEV vans, I think about merchants must keep away from Nikola Firm stock.