Nikola Corp. filed for chapter, culminating a protracted slide for the onetime darling of the electric-vehicle trade, which struggled with weak gross sales and cycled by CEOs within the wake of a fraud scandal.

The corporate plans to liquidate its belongings after getting into Chapter 11 in Delaware on Wednesday. In courtroom paperwork, it listed belongings between $500 million and $1 billion, and liabilities between $1 billion and $10 billion.

The submitting caps a battle by the maker of electrical and hydrogen-powered semi vans get a deal with on dwindling money, gradual gross sales and a collapsing inventory worth. Bloomberg reported earlier this month that Nikola was exploring a doable chapter submitting as the corporate acknowledged it was “relentlessly working to boost capital.”

Nikola’s shares plunged 54% as of 8 a.m. Wednesday earlier than common buying and selling in New York. The inventory misplaced 97% of its worth over the previous 12 months by Tuesday.

The corporate has been on a tumultuous journey because it went public in 2020 by a take care of a particular function acquisition firm, with its inventory surging in its early days. Shortly after, Bloomberg Information reported that founder Trevor Milton had overstated the aptitude of Nikola’s debut truck. These allegations, coupled with a subsequent short-seller marketing campaign concentrating on the corporate, led to Milton’s ouster and later conviction on fraud fees.

Lately, the corporate has endured cash-flow points, gradual demand and govt turnover. Nikola additionally recalled its battery-electric vans after battery fires in 2023 prompted it to quickly halt gross sales.

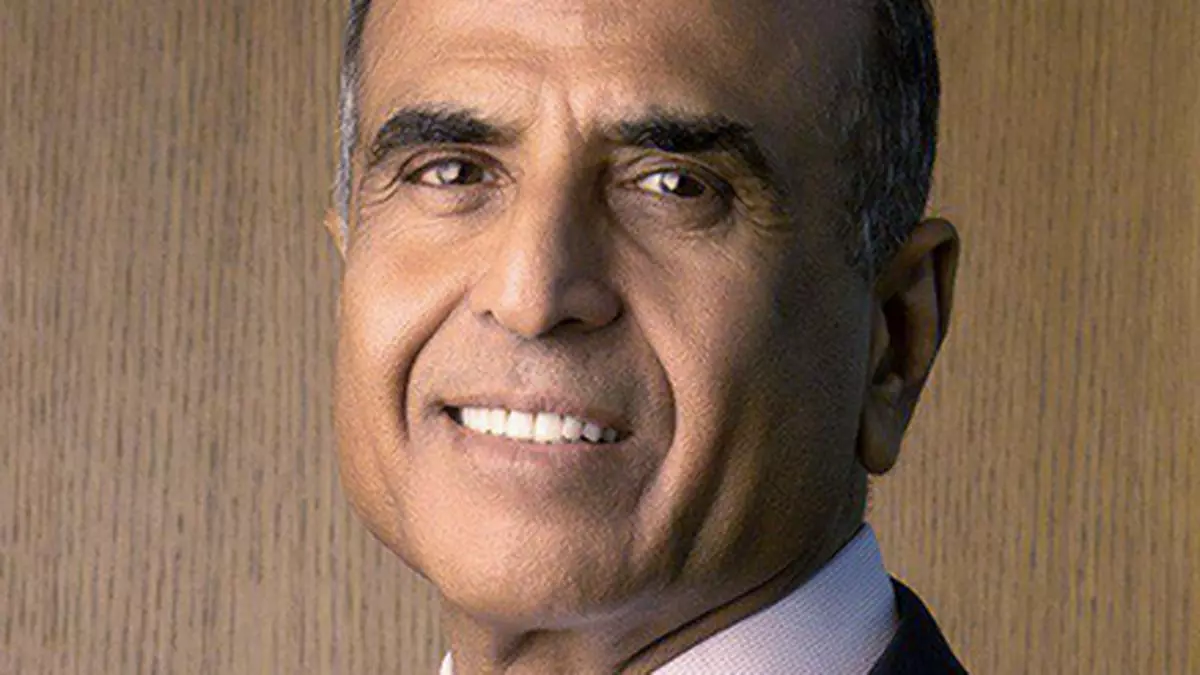

Chief Govt Officer Steve Girsky, a former Morgan Stanley analyst and Basic Motors Co. govt, had been main a latest effort to boost cash or discover strategic options, Bloomberg reported.