inakiantonana

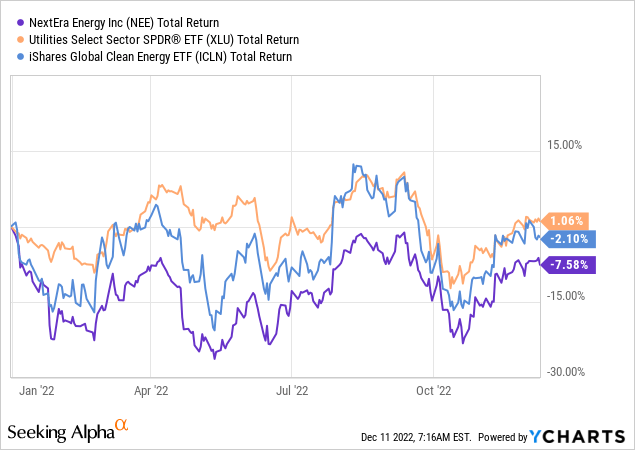

NextEra Energy (NYSE:NEE) is the largest wind and solar energy producer in the world. The company currently has 63 GW in energy-generating assets and is the owner of Florida Power & Light Company, a regulated electric utility and the largest in the US. I’ve been a long-time shareholder in smaller competitors Clearway Energy (CWEN.A) and Atlantica Yield (AY) but had never considered NextEra until now. The company has performed relatively well in 2022, down only 7.58% on a total return basis against a fall of around 17% for the S&P 500. However, it performed worse than the wider utility sector (XLU) which is up around 1% year-to-date.

NextEra Energy is a clean energy titan going all in on the transition to lower carbon energy. The company plans to spend between $85 billion to $95 billion on capital investments between 2022 and 2025, an ambitious plan that will see NextEra increase its storage capacity by 8x from 1 GW currently with new investments in renewable natural gas and offshore wind planned.

NextEra’s Dividends And EPS Are Attractive

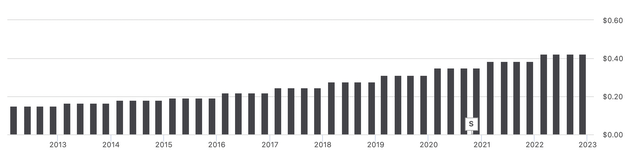

NextEra pays out quarterly cash dividends which currently have an annual yield of 2.01%. The last quarterly cash dividend payment of $0.425 was in line with the prior payout with NextEra being adept at maintaining and growing this on the back of EPS growth.

Seeking Alpha

Quarterly cash dividends have grown by a compound annual growth rate of around 11% since 2013, a rate of growth that has far outpaced inflation over the same time period. The dividend is also fully covered with a payout ratio of 59% and with consistent raises and no cuts since 1995.

The company last reported earnings for its fiscal 2022 third quarter saw adjusted EPS grow to $0.85, a 13% increase over its year-ago quarter with the ongoing rollout of renewables being a key driver of this. Growth is set to continue with 2,345 MW of new renewables and storage developed during the third quarter.

NextEra expects full fiscal year adjusted EPS to be in the range of $2.80 to $2.90 versus the consensus of $2.88. For fiscal 2023 and fiscal 2024 adjusted EPS is expected not to be lower than $2.98 and $3.23 respectively with dividends per share guided to grow at roughly a 10% rate per year to 2024.

The Growth Landscape Ahead

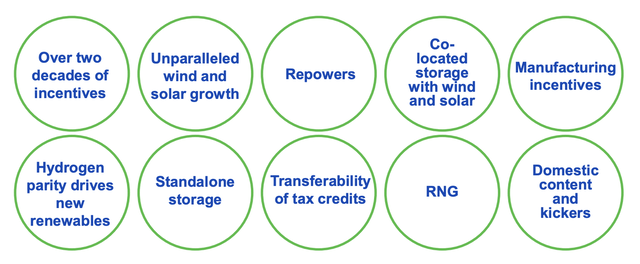

Just like its peers, NextEra stands to benefit immensely from the Inflation Reduction Act. During the earnings call for their last reported fiscal 2022 third quarter, the company’s executives referenced the IRA 24 times in discussion with analysts. It’s important current shareholders understand the scale and scope of the IRA as it touches multiple tranches of clean energy growth in the decade ahead that will ramp up NextEra to a new level of growth.

NextEra Energy

The IRA is a $370 billion piece of legislation designed explicitly to turbocharge the US transition to low-carbon technologies. Its passing will likely become a watershed moment in the history of US decarbonization.

Credit Suisse published a research note on the IRA in October that sheds more light on the depth and breadth of its fiscal impact. The IRA will essentially spend 2x as much as the currently earmarked $370 billion figure because its important provisions including subsidies for solar, wind, and utility-scale battery storage systems come in the form of uncapped tax credits. For example, the company’s FPL unit filed with the Florida utility regulator estimates that the solar production tax credits in the IRA will save customers nearly $400 million over the course of their current rate agreement.

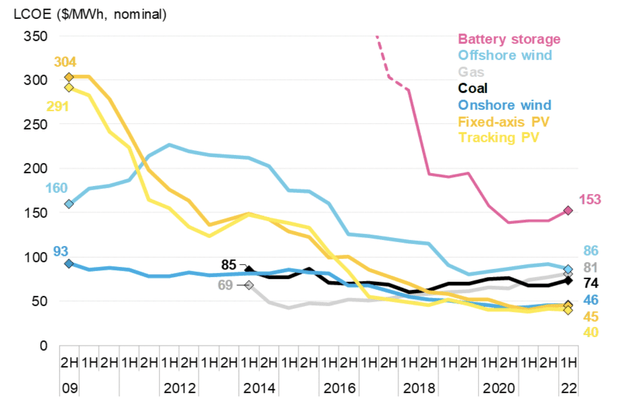

The IRA at its core is a blank check to the low-emissions industries that will accelerate their rollout even faster than the pre-IRA trendline that was being driven up by the fast-falling renewable levelized cost of electricity

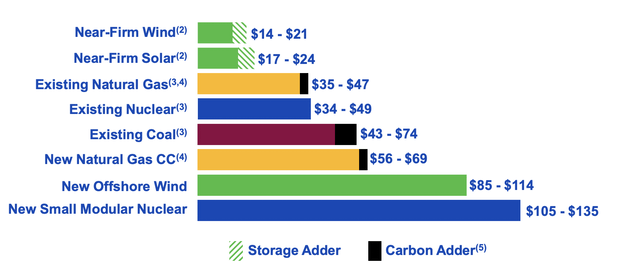

BloombergNEF

Solar and wind energy now both form the lowest LCOE versus other sources of power. This gap materially widened on the back of Russia’s invasion of Ukraine and the subsequent energy crisis. Elevated natural gas prices will likely be here for longer than desired, providing a huge fiscal boost for renewables whose cost of generation is set to keep on dropping with the IRA as a leading catalyst for this fall.

NextEra Energy

The cost of generation for near-firm wind is set for a drop to between $14 and $21. NextEra defines near-firm as battery-backed renewables able to produce less intermittent electricity to the power grid. When compared to the rising costs of fossil fuels, it’s not hard to imagine the level of displacement that stands to happen due to the IRA.

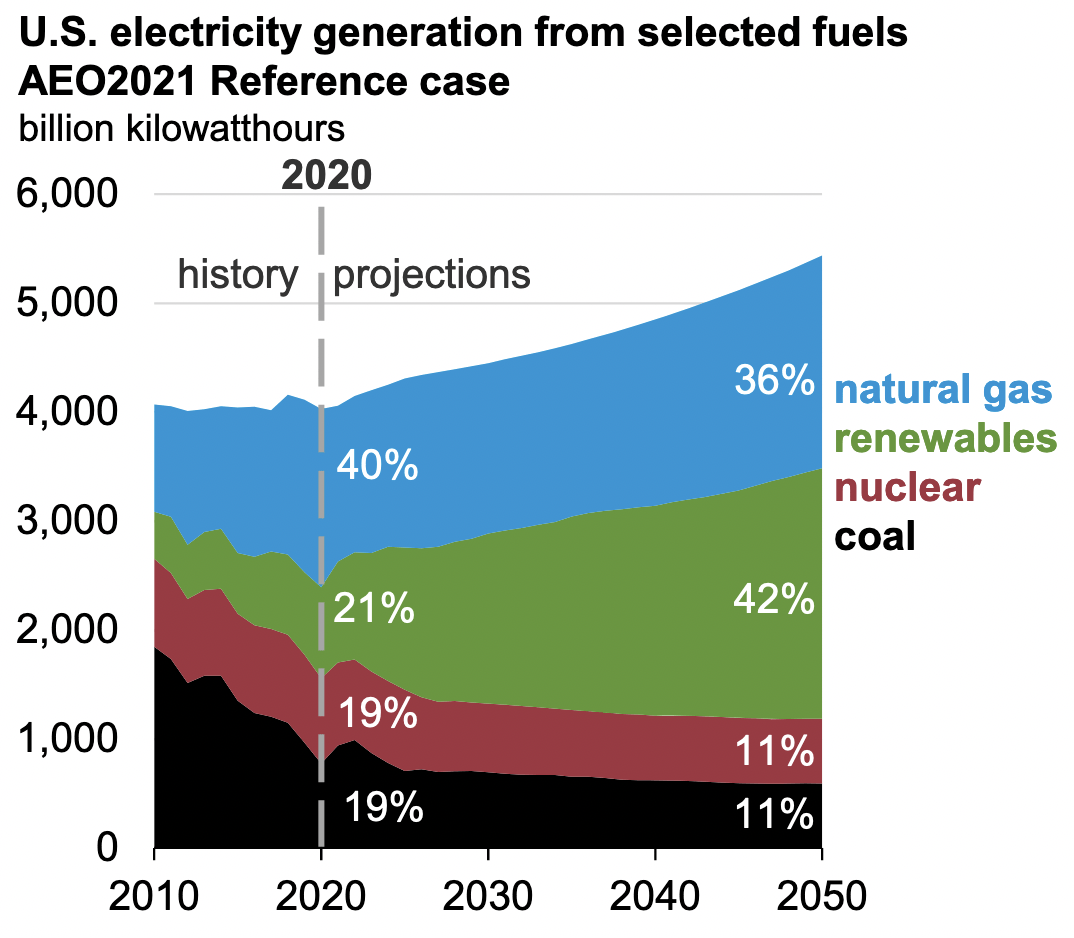

The IRA will award tax credits as long as a development meets its terms. There is no budget, no restrictions, and no upper ceiling. Hence, total spending is likely to be more than $800 billion, 2x more than the frequently cited figure. In an extremely bullish and optimistic research note, Boston Consulting Group has estimated that the credits included in the IRA could see the deployment of zero-carbon energy grow up to 80% of electricity production as soon as 2030 with US solar and wind potentially set to be the cheapest in the world.

Energy Information Association

NextEra is set to defy broader economic malaise to ride the IRA to new highs over the next decade with planned investments likely set to push what was 63 GW in operations over the 100 GW mark.

The company of course faces the same market-level risks with continued Fed rate hikes and a weakening economy expected to weigh down on stocks. This is a hold for current owners, but prospective investors might want to keep waiting, likely in vain, for a better entry point as NextEra continues to defy gravity.