IvelinRadkov

Technical Analysis

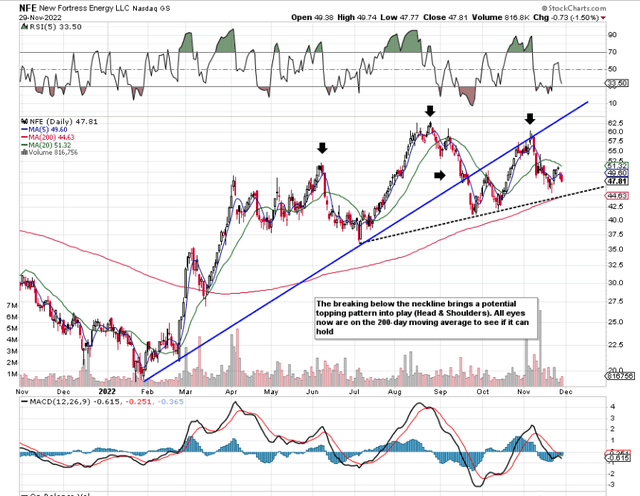

When we are sizing up short candidates, timing the entry is crucial. If we pull up a chart of New Fortress Energy Inc. (NASDAQ:NFE) for example, we certainly have the conditions that could materialize into a short position in time. We state this because of the potential head & shoulders topping formation which currently is in process. These patterns invariably take place after an uptrend and now we potentially have the two shoulders and the head which formed above $60 a share in August of this year.

Putting short positions in a long/short portfolio is a sound risk management strategy for the following reason. If markets were to move sizably in any direction, having a delta-neutral portfolio (or as close to this as possible) protects the investor from sizable drawdowns because of the opposing positions within the portfolio. Therefore, for every long position we put on, we like to find just as attractive short positions to balance out our deltas. Although companies with very different fundamentals should trade very differently over time, there usually is a high correlation (Between fundamentally sound players & fundamentally weak players) in times of significant market moves. We further diversify the portfolio by using options that bring volatility into the picture. Suffice it to say, we believe it is good risk management to have one’s portfolio diversified across a whole host of different strategies and setups. Short strategies (Where one can also use puts or put spreads to control risk) should always have some part to play.

Furthermore, short interest in New Fortress has jumped aggressively in recent months (9.5%) and we also have had that breaking of that upcycle trendline in September of this year. These trends are only shots across the bow at this stage because we would need to see an aggressive move below the pattern’s neckline which more or less corresponds with the company’s 200-day moving average ($44.63) at this juncture. Any move below this support level would confirm the commencement of a downward move.

NFE Technical Chart (Stockcharts.com)

High Growth Rates Expected

Bulls will undoubtedly be surprised by the potential for a downswing in New Fortress in the near term. The company is just off the back of a strong third quarter where the reported $291 million in EBITDA kept the company on track to achieve its earnings goal for the fiscal year. Furthermore, management talked up how New Fortress’ liquidity would be transformed over the next few years. In fact, even if one was to take into account the cash needed to terminate the FLNG units plus other smaller outgoings, management is still estimating sizable operating cash-flow generation (of up to $5+ billion) before the end of fiscal 2025.

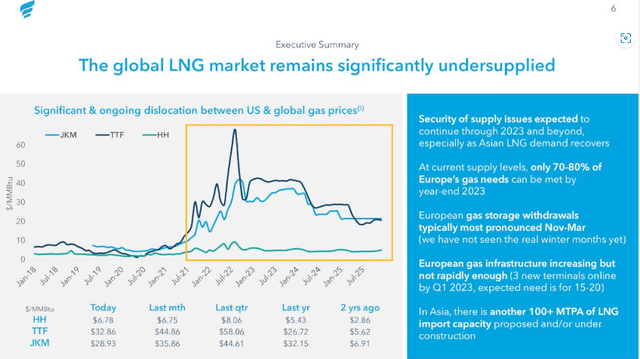

Then you have the state of the global LNG market where we see how prices have been extremely volatile in recent times, especially concerning the TTF index in Europe & the JKM counterpart in Asia. As we see below, prices especially in these two indices increased sharply last year and remain well above their pre-2020 prices. Pricing is a factor of demand which mean companies that can secure a growing supply of LNG will continue to be in an advantageous position. Furthermore, the long-term nature with respect to how customers essentially secure their power from energy companies should bring stability & predictability to New Fortress’ financials over time.

New Fortress: Global LNG Market Fundamentals (Seeking Alpha)

Valuation & Earnings Revisions

All of the above however is known by the market at this stage and a company’s fundamentals always have to be measured against its valuation and earnings projections. As we stand, New Fortress trades with a trailing GAAP earnings multiple of 36.6, a trailing book multiple of 5.4, and a trailing sales multiples of 4.05. This is where we are at the moment (High multiples) despite the bullish fundamentals with respect to LNG supply & deployment. Furthermore, the recent Q3 earnings miss means bottom-line earnings for the full year are expected to now come in at $2.01 per share. Although this estimate if met would be almost a 180% increase over fiscal 2021, $2.01 per share is still roughly 18% down on what was originally expected per the third quarter report.

These trends matter more in a company such as New Fortress because shares are priced to perfection from the growth it has enjoyed up to now. Any more deviation from this growth path (Despite how much cash flow will be generated going forward) and the market will be swift to price shares lower once more.

Conclusion

Therefore, to sum up, New Fortress’ recent growth metrics in areas such as its EBITDA growth, in particular, have been stellar, to say the least. However, that Q3 earnings miss may have prompted some short-term weakness in the share price which the technicals may be insinuating. All eyes now point to the stock’s 200-day moving average to see if it can hold in upcoming sessions. We look forward to continued coverage.