Netflix’s inventory has been crushed this yr as administration was caught off guard after the pandemic and solely now appears to be adjusting the enterprise to raised compete with different streamers. bennymarty/iStock Editorial through Getty Pictures

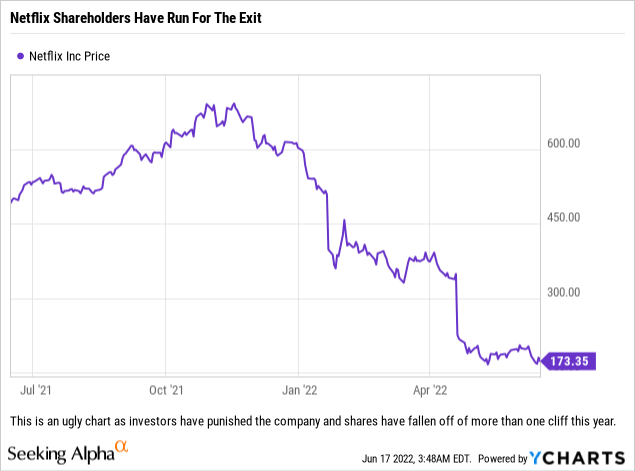

Buyers have taken Netflix (NASDAQ:NFLX) shares out to the woodshed, and rightfully so. Netflix’s administration workforce seems to have made some tactical errors on account of their perception that their enterprise was nice due to the consumer development through the pandemic. Administration now realizes their errors and on their final convention name mentioned implementing some plans that they’d beforehand vehemently opposed. We predict that a few of these proposals have advantage, however are upset with the timeline offered on the decision.

Ending account and password sharing needs to be a straightforward repair for Netflix to implement. Advertisements needs to be comparatively simple as effectively, however when discussing implementation timelines, administration spoke when it comes to years, not months. It looks like they’ll take their time to implement a few of these plans, however we do suppose administration’s new perspective and openness to handle the corporate’s income development points transferring ahead is moderately refreshing and a welcome change from years previous.

Beneath we’ve got highlighted 5 strikes we imagine administration might (and undoubtedly ought to) implement that would result in the inventory doubling. We state how tough we predict it could be to implement the concept and supply a conservative estimate of the potential influence on income.

Finish Account/Password Sharing

Issue To Implement: Straightforward

Potential Income Affect: $2 billion to $4 billion+ yearly

Reducing down on piracy, particularly account and password sharing, needs to be the simplest merchandise to implement as practically all of Netflix’s opponents already implement insurance policies to chop down on individuals utilizing accounts in several households. Disney’s (DIS) Hulu service has for years used your location to confirm that you simply had been utilizing their service in your house and never sharing it with somebody elsewhere (you could have 5 sign-ins from exterior your own home on a set system every year for the Hulu Reside service). Warner Bros. Discovery’s (WBD) HBO cracked down on account sharing when it was owned by AT&T (T), forcing fairly just a few individuals we knew to join accounts to proceed to observe their favourite reveals as soon as they not had entry to accounts belonging to relations.

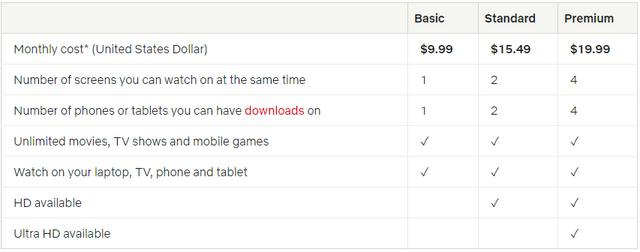

In the course of the firm’s Q1 2022 convention name, Netflix executives lastly admitted that this difficulty was having an influence on income and subscriber/member development – estimated to be to the tune of 100 million individuals globally piggybacking off of a paying buyer. Within the UCAN area (US and Canada), Netflix estimates that 30 million persons are accessing their content material with out paying. If Netflix ended the flexibility to share passwords and transformed these 30 million to the essential plan, that might create slightly below $300 million in income monthly! That’s nearly $900 million per quarter, or a doable enhance of practically 27% for the corporate’s UCAN regional revenues. Assume that you simply solely are in a position to convert 30% of these individuals and the numbers are nonetheless compelling. Have in mind, these numbers solely take a look at the USA and Canada. The remainder of the world has the identical difficulty, and this income would principally stream proper right down to the revenue assertion to income (which means it could assist the corporate’s margins and profitability). That is low-hanging fruit. Why the corporate has beforehand refused to reap it’s befuddling.

Netflix’s present pricing on the three tiers of service they provide. (Netflix)

Administration did announce that they had been taking a look at this merchandise however the plan didn’t appear full and it actually sounded as in the event that they deliberate to supply entry for a small charge. Why administration wouldn’t simply pressure individuals onto the essential plan is a headscratcher, particularly when it appears like they are going to be including a less expensive choice to convert this group.

Present Advertisements On A Decrease Priced Tier

Issue To Implement: Regular

Potential Income Affect: between $500 million and $1 billion+ yearly

We discover this subject to be irritating as a result of lots of Netflix’s opponents have already got ad-supported tiers and do fairly effectively with these choices.

On the corporate’s convention name, co-CEO Reed Hastings principally signed off on including an ad-supported tier to Netflix’s providing because it expands the alternatives for customers and he feels that may be a good factor. Whereas fairly just a few analysts bought enthusiastic about this remark, we predict the entire power being spent discussing adverts on the service is being wasted as a result of Mr. Hastings went on to say, “that is one thing we’re taking a look at now. We’re attempting to determine over the following yr or two.” Whereas it’s excellent news that the corporate is now considering together with adverts on their service, it’s a bit irritating that that is one other merchandise which they’ve just lately pivoted on and seem to have accomplished little work to implement the change.

That is extra low-hanging fruit for the corporate, and if one suspects that 10% of present subscribers would swap to an advert supported plan, and people plans can generate early on throughout implementation simply $2.00 further in ARM (common income per member) then these 20 million subs alone might get you to only underneath $500 million in advert revenues. As a consequence of Netflix’s subscriber base, we suspect that the extra ARM created by together with adverts can be larger due to Netflix’s giant markets in North America and Europe. If Netflix regarded to promote a whole lot of advert content material for the advert supported plan, then the income generated per family could possibly be considerably larger, with some analysts saying the entire potential/addressable market can be price as much as $2 billion within the subsequent few years however with the consensus principally round $1.2 billion to $1.8 billion. All of it boils right down to what number of adverts you’re going to pressure these prospects to observe, and till administration broadcasts their intentions, we’ve got to be conservative in guesstimating what the income era could possibly be since we’ve got no particulars or a benchmark reference.

We’d level out that in latest days there have been tales popping out concerning Netflix assembly with corporations reminiscent of Comcast (CMCSA) and Roku (ROKU) about serving to roll out adverts. Our guess is that that is the place the rumors about Netflix shopping for Roku originated from, so that’s excellent news in that Netflix may not be available in the market for a dilutive transaction.

Put Motion pictures Into Theaters

Issue To Implement: Straightforward

Potential Income Affect: at the very least $1-2 billion yearly

As Netflix ventures into dearer productions and spends just like the Hollywood studios to make its newest motion pictures, we imagine that the corporate ought to take a look at placing its blockbusters, at a minimal, into film theaters for longer than every week previous to releasing the flicks on the Netflix service. This sounds counterintuitive, however we imagine that Netflix might use the ‘Prompt For You’ space on the streaming service, or its house display screen, to run focused adverts for motion pictures it would present in theaters. This could take pleasure in doubtlessly driving visitors to the movie show to herald roughly 4x the income (for a household of 4) {that a} month-to-month sub earns, whereas additionally getting individuals to connect with your motion pictures in a manner that would drive extra loyalty to the streaming product as individuals would possibly wish to return and watch that film afterward.

One large film can generate $1 billion+ from the worldwide field workplace, and these added revenues will help create extra FCF for the corporate to pay down debt, purchase shares, or spend money on higher content material. Additionally, one large film in theaters can create a franchise, which may be costly to create and a motive why Netflix ought to use film theaters to assist de-risk their excessive spend on content material.

If Netflix ever thought of this merchandise significantly, we imagine that $1-2 billion in extra revenues can be simply attainable, and almost definitely a gross underestimate.

Change Launch Schedule To Embody Extra Staggered Releases

Issue To Implement: Straightforward

Potential Income Affect: TBD, however would decrease buyer churn charges

Netflix continues to launch the overwhelming majority of their content material in “binge bundles” – which means they launch all episodes directly so as to permit individuals to binge the complete bundle of content material shortly (some seasons can simply be accomplished in a day). We suspect that the corporate discovered from releasing seasons in elements, out of necessity on account of COVID-19 shutting down manufacturing, and can use that information to investigate the way to launch its largest franchises sooner or later so as to hold customers blissful and in a position to binge whereas additionally searching for to chop down on buyer churn charges.

Engagement is essential, and if the one or two reveals somebody watches get dropped in back-to-back months, then there are at the very least 10 months they will cancel their subscription for whereas ready till the following season of these reveals are launched. This used to occur with HBO again within the day, and we predict Netflix should behave just a little extra like its competitors if it desires to have a comparable churn fee whereas additionally not enabling prospects to abuse it in that method.

Rivals Disney, Warner Bros. Discovery and Comcast have all utilized the technique of releasing reveals weekly so as to hold customers engaged with content material over longer durations of time, construct up followings weekly if phrase of the present permeates popular culture and use the weekly content material drops to masks the truth that none of those corporations tends to drop as many new content material gadgets as Netflix. The entire high quality vs. amount argument (which we are going to keep away from for this text).

Have interaction In Opportunistic M&A Exercise For Content material

Issue To Implement: Laborious

Potential Income Affect: TBD

This could be essentially the most tough merchandise for Netflix’s administration workforce to efficiently pull off. Whereas the corporate has introduced a few acquisitions round gaming, we predict that the corporate may be higher suited specializing in buying corporations that management content material, have property which can be complimentary to the Netflix product and supply some synergies that would generate financial savings by way of value chopping after a merger. After the entire M&A exercise that has occurred over the previous couple of years inside the business, lots of the premier targets have been wolfed up, nonetheless, there are some attention-grabbing names nonetheless on the market.

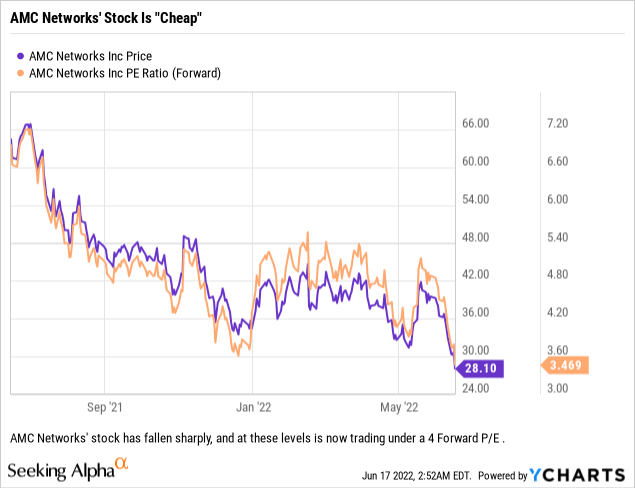

Lionsgate Leisure (LGF.A) (LGF.B) and AMC Networks (AMCX) can be two attention-grabbing names that Netflix might take a look at. Lionsgate has a library approaching 17,000 titles, and if Netflix had been to noticeably put their motion pictures in theaters (as we talked about earlier), then Lionsgate may be buy for its titles which might crank out extra prequels and sequels. In truth, one among Netflix’s large film releases this yr, Knives Out 2 (with a 3rd film within the sequence to return out subsequent yr), was a title that Netflix stole from Lionsgate. The library and studio are pluses for Netflix, however the firm must deal with what to do with Starz and whether or not it made sense to maintain that streaming app separate, roll it into Netflix’s present service, or create a brand new premium service inside the Netflix app.

AMC is filth low cost however is within the linear TV enterprise, a declining enterprise for positive, however one which generates money and income for now. Netflix already has offers for lots of the reveals that AMC has, however we predict that is the kind of M&A that would make a whole lot of sense. First you would need to get the Dolan household to conform to a takeover, however if you happen to might purchase the corporate for lower than $3 billion (accounting for a wholesome premium and the truth that you would need to buy the publicly traded A shares in addition to the B shares that don’t commerce) there may be an honest return in your cash contemplating a few of their extra precious content material properties’ streaming rights are arising for renewal quickly sufficient and the corporate is including new content material round ‘The Strolling Lifeless’ to doubtlessly monetize that bundle in just a few years. Throw within the IFC and Sundance Channels and there’s some respectable content material right here, however once more it’s a must to take care of operating a linear TV firm until you may workforce up with a personal fairness agency to take over that portion of the enterprise.

Shopping for corporations which management content material that your opponents at the moment have, so that you could personal it transferring ahead can be prudent. Amazon (AMZN) bought MGM’s studio enterprise from traders for a motive, principally for the library of content material, but additionally for entry to the IP for future content material. Netflix has the identical alternative right here, and each offers might doubtlessly be accretive to earnings transferring ahead, relying after all on deal construction, financing and the amount of money and/or inventory utilized in any transaction.

Abstract

If Netflix can implement just a few of those concepts over the following few years, and so they have dedicated to addressing two of them, then we predict that the inventory could possibly be poised to double. The conservative income figures we offered might enhance revenues by 10-20%, however the large story is how that income would stream down the revenue assertion. It’s our perception that this low-hanging fruit would profit Netflix’s margins as a big proportion of the revenues might doubtlessly hit the revenue line as none of those concepts dramatically enhance the corporate’s bills to implement them.

Netflix must cease attempting to be so totally different from its opponents so as to higher compete in opposition to its ‘Outdated Hollywood’ rival studios, in addition to the Huge Tech names, and their streaming companies. Wanting down at multi-billion greenback income streams, which all your opponents partake in by the way in which, is foolish and in no way in the perfect curiosity of the corporate’s shareholders. Now that the corporate is at the very least trying to implement 2 out of the 5 gadgets, has us considering Netflix, nonetheless, we’re not patrons till we’ve got extra readability on when this stuff will probably be carried out. When we’ve got readability on the timeline, or timelines, then we would very effectively be patrons. Till then, we watch for Q2 outcomes and the convention name in mid-July.