Images By Tang Ming Tung

Necessity Retail (NASDAQ:RTL) is a real estate investment trust which operates diversified retail and office real estate; since its inception in 2013, the company has acquired substantial properties over the period. It currently owns 1056 properties, accounting for about 28.9 million rentable square feet, which includes 944 single-tenant net-leased commercial properties and 112 multi-tenant retail properties. Currently, about 90.8% of the company’s portfolio is leased. The company is managed by a third-party advisor and over the period, management has taken many vital decisions which have created good value for the shareholders.

RTL is financially stable and has a substantially diversified tenant base, which provides consistent solid rental income. Along with that, it has substantial liquidity with no significant near-term debt maturity except $289 million due in FY2023, which according to management, will be reduced soon through the strategic disposition of the company’s underperforming properties. The investor should also note that RTL has a strong cash flow and consistent dividend payment history. Even in the adverse condition of FY2020, the company paid substantial dividends.

Even in the current adverse economic conditions for REITs, where some REIT operators, such as Pennsylvania Real Estate Investment Trust (PEI), have filed for bankruptcy, RTL has been producing record-high revenue and FFO. But due to the inflationary environment and the trouble faced by retail REITs, the company’s stock has been dropping and over time has become substantially undervalued; I believe the stock has a substantial upward potential at this price.

Historical performance

Since its inception, management has focused on acquiring primarily net leased and single-tenant service retail properties, but in December 2021, management changed its focus towards multi-tenant retail centers and signed a purchase agreement to acquire 79 multi-tenant retail centers and two single-tenant properties (CIM portfolio) for $1.3 billion; as a result, over the last few quarters debt levels have increased significantly with substantial equity dilution.

As a REIT company has to pay over 90% of its taxable income through dividends, therefore debt and equity dilutions remain a significant source for the REIT to grow its operations during adverse economic conditions; if REIT fails to generate adequate cash, then it has to rely on debt and equity dilution to maintain its operations and during those periods raising funds becomes so expensive and challenging which further puts significant pressure on the company’s financials, hence to analyze company’s past performance in various economic conditions becomes so important to assess the overall risk.

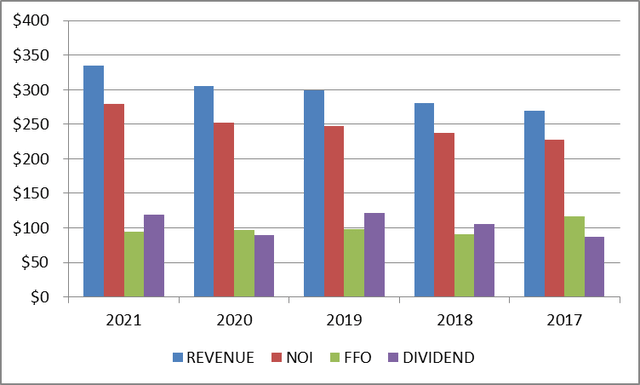

Financials (in million dollars) (Author)

Due to consistent acquisitions, over the period, the company’s revenue has increased substantially, it is appreciated that even in the adverse condition of FY2020, the company could generate substantial FFO and has been paying out significant cash flow as a dividend, which reflects that the company could sustain its FFO even in adverse economic conditions, also note that the company has a strong record of dividend payments.

Debt and equity financing

Historically, the company had substantially high-interest rates on its debt facilities, but with time, due to its strong balance sheet and a well-diversified portfolio, RTL could obtain financial debt at a reasonable cost.

Over the last two years, debt has increased significantly, primarily due to strategic acquisitions to expand the property base and add high-yielding rental properties. Also, note that recently borrowed debt has more attractive interest rates than the historical level.

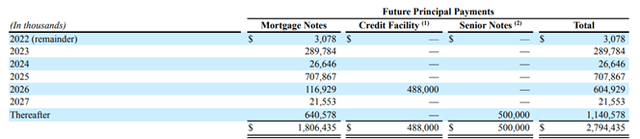

Debt Maturity (Annual Report)

In the current adverse economic environment, many retail REIT operators are facing considerable problems in renewing debt facilities. Some REIT operators have filed for bankruptcy because of their inability to comply with debt maturities, but in the case of Necessity Retail, there is no significant debt maturity till 2025, except for $289 million due in FY2023, which according to management will be reduced soon through the strategic disposition of the company’s underperforming properties. Investors should also consider that management has strategically reduced the effect of interest rate fluctuation by locking interest rates at reasonable levels; currently, about 83% of the company’s total debt has fixed interest rates, which has enabled the company to keep interest rates at moderate levels when the overall interest rates in the United States are hiked due to an inflationary environment.

Strength in the business model

Having a much stronger customer base and a well-diversified tenant portfolio gives the business model substantial strength even in adverse economic conditions.

Diversified tenant base

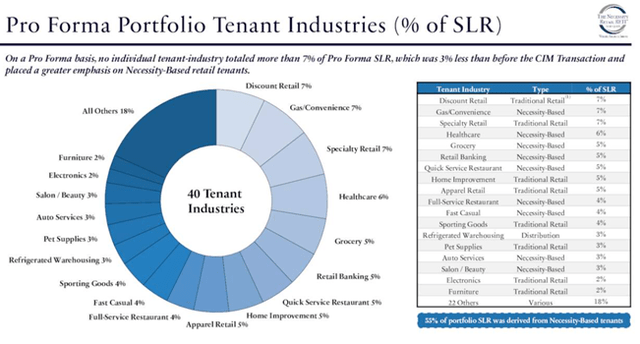

Tenant Portfolio (Investor Presentation)

The significant risk for REITs lies in their customer concentration; if these high revenue contributing leases goes bankrupt, REIT’s ability to comply with financial obligations affects severely, which leads to significant deterioration in shareholder value, but in the case of RTL, the tenant base is substantially diversified amongst the various industries, which helps the company to earn stable rental earnings even in adverse economic conditions.

Well-balanced lease maturity

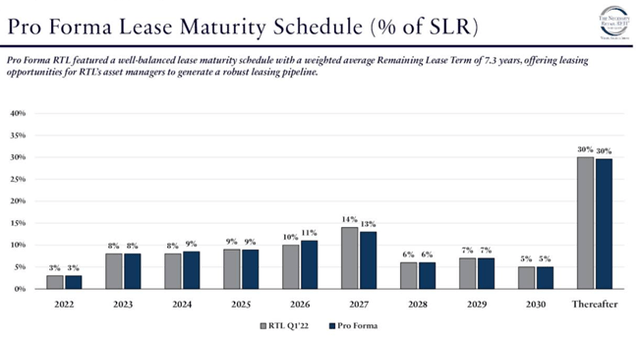

Lease Maturity Schedule (Investor Presentation)

RTL has a well-balanced lease maturity with a weighted average remaining term of 7.3 years, which will produce significant rental income for a more extended period. Also, RTL doesn’t have any considerable lease expiry in the next two years, majority of the company’s contracts are for the much longer term, which will help the company produce good cash flows even if the current economic situation takes longer time to recover, but the investor must concern that, during recessionary environment, many retailers can go bankrupt, which might affect the company’s rental income and cash flows.

Strong customer base

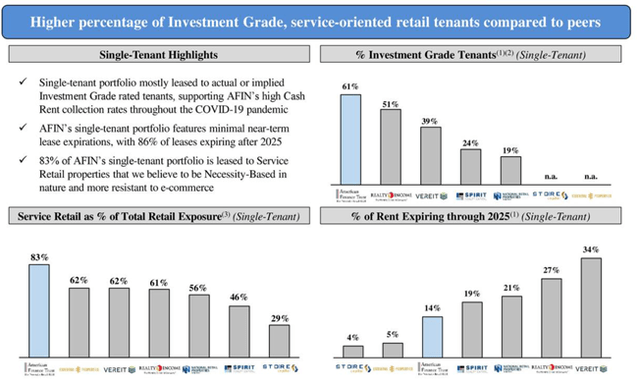

Investment Grade Tenant (Investor Presentation)

RTL has a strong and solvent customer base with substantially good investment ratings by Moody’s; approximately 57.9% of tenants in the single-tenant portfolio were considered “investment grade,” and about 30.0% of the anchor tenants in the multi-tenant portfolio were considered “investment grade.” Along with it, the company has a higher percentage of investment grade, service-oriented tenets compared to its peers, reflecting that the management’s approach towards selecting tenets is extremely conservative compared to its peers.

Due to management’s conservative approach in selecting tenets, the company’s portfolio remains free of tenant bankruptcies even when the other retail property owners are facing a lot of trouble.

Second quarter highlights

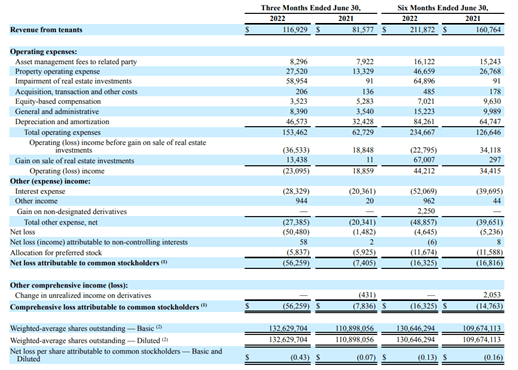

Quarterly Income Statement (Annual Report)

- Due to the acquisition of the CIM portfolio which has completed in this quarter, the company could record one of the best quarters ever, led by significantly increased revenue and FFO.

- In the second quarter of FY2022, revenue grew 43% year-over-year to $116.9 million. Along with that, the company’s year-over-year AFFO grew 11%.

- Recently the company has disposed of 13 properties totaling nearly $300 million of aggregate price and has ten more properties for disposition which accounts for almost $100 million, as per the management generated cash will be used to pay the outstanding debt.

- Management is planning to dispose of some of its underperforming properties to repay the debt and consistently seeking new and attractive opportunities for potential acquisition.

Risk

If the current inflationary environment lasts for a longer period of time, then the company’s tenants might face substantial losses which might affect the company’s ability to collect the rent and if the company’s cash flow gets affected, its financial strength might deteriorate. Currently, I am not seeing any major risk of permanent capital loss at the current stock price.

Conclusion

Management’s conservative approach towards selecting tenants and their careful acquisition strategy provide the company with a substantial margin of safety, and with the sale of underperforming assets, the company could comply with recent debt maturity.

From the above-all discussion, it seems that the company is financially in a very strong position and the recent acquisition will bring huge value to the company.

The recent market capitalization of the company is about $773 million, and the company is going to produce about $200 million in CFO at the end of the year. Along with that, the estimated FFO for year-end 2022 is about $1, and the stock is trading at $6; accordingly, the stock is trading for just 6 times its expected FFO, whereas its peers like Urstadt Biddle Properties Inc. (UBA), NETSTREIT Corp. (NTST) are trading at more than ten times its FFO.

Shares are down more than 56% from their IPO price; at this valuation, RTL offers significant upside potential; in my view, RTL is a strong buy.