Key Takeaways

- Webus secured a $100 million fairness line of credit score from Ripple Technique Holdings to fund its XRP reserve technique.

- The capital will help Webus’s enlargement of crypto-enabled funds, blockchain loyalty packages, and worldwide progress.

Share this text

Nasdaq-listed Webus Worldwide Restricted introduced as we speak it has signed a conditional Securities Buy Settlement with Ripple Technique Holdings to entry as much as $100 million in funding by way of a senior fairness line of credit score.

There’s restricted public details about Ripple Technique Holdings. Nonetheless, its identify means that it operates as a monetary automobile backing XRP-related ventures and blockchain-based corporations. The entity has no official affiliation with Ripple Labs, the developer of the XRP Ledger and issuer of the XRP token.

Underneath the settlement, which continues to be pending regulatory clearance and underwriter approval, Webus can draw between $250,000 and $3 million per tranche over 24 months, topic to market situations and capital wants.

The corporate acknowledged it plans to make use of the proceeds to help its XRP treasury technique, together with crypto-enabled funds, blockchain-based loyalty packages, and world enlargement initiatives.

In keeping with Nan Zheng, CEO of Webus, the $100 million dedication demonstrates Ripple Technique Holdings’ confidence in its XRP-focused technique. The deal, which permits Webus to lift capital effectively and solely as wanted, permits the corporate to attenuate shareholder dilution, he famous.

“We imagine this may assist us speed up progress throughout North America and Asia-Pacific, and strengthen our management in crypto-powered premium mobility,” mentioned Zheng.

The Nasdaq-listed firm, which offers AI-driven mobility options and premium chauffeur providers, has beforehand established a Delegated Digital-Asset Administration Settlement with a mandate cap of as much as $300 million for potential XRP treasury operations.

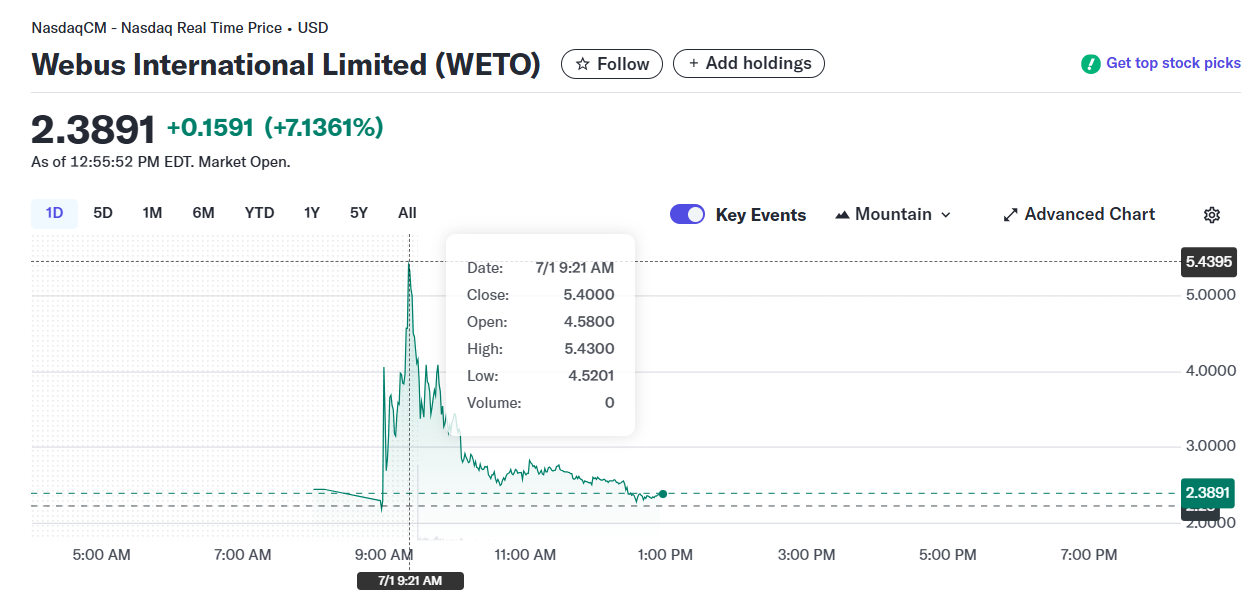

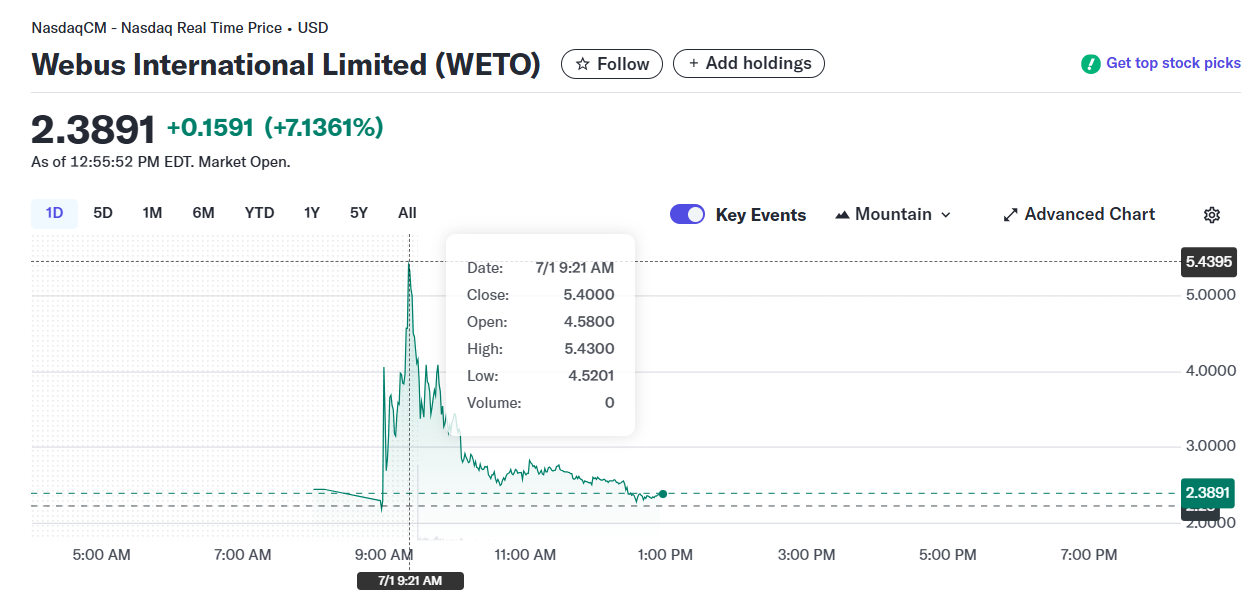

Webus shares spiked 130% intraday however shortly gave up their features, per Yahoo Finance knowledge. The inventory traded at roughly $2.4 at press time.

Share this text