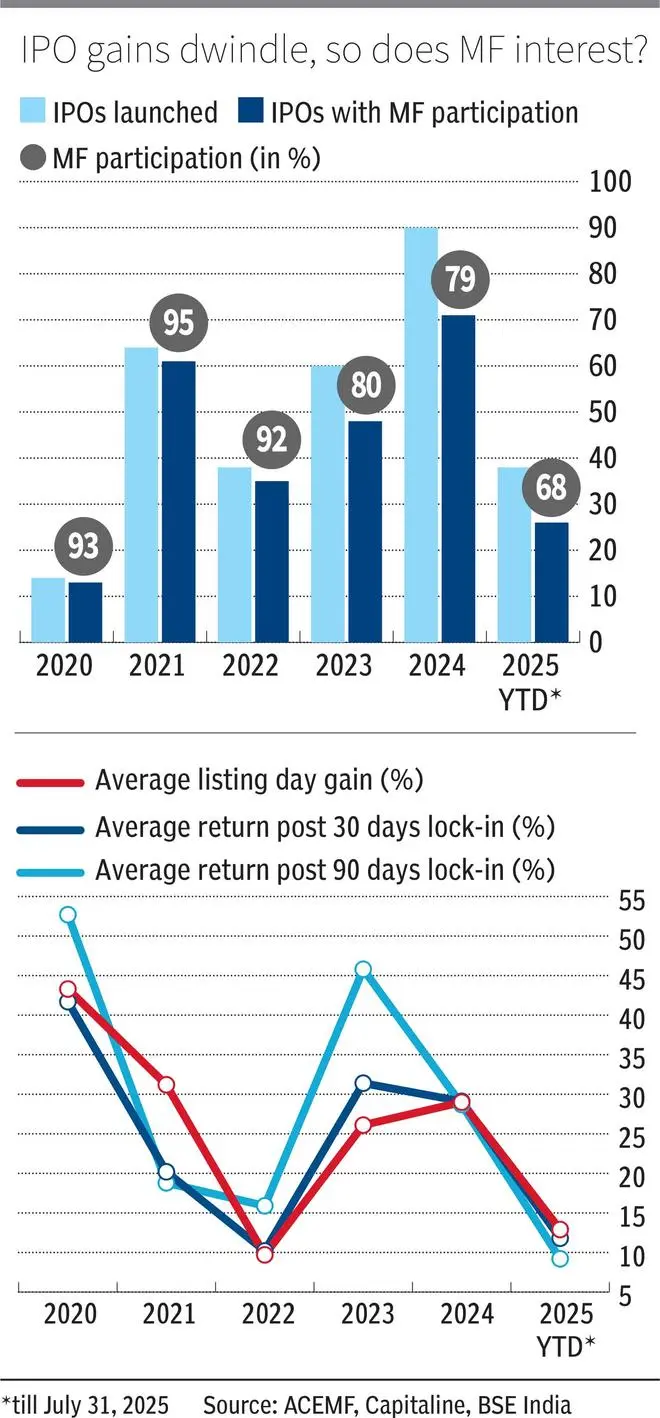

Mutual funds have change into more and more selective of their IPO participation in 2025, a pointy distinction to their earlier aggressive stance. A bl.portfolio research reveals their involvement dropped from 96% in 2021 to 68% as much as July 2025.

Mutual funds have turned more and more selective in IPO allocations in 2025, a shift from their earlier aggressive stance. A bl.portfolio research reveals the proportion of IPOs the place funds took half, both as anchor traders or via post-listing buys, has fallen from 96 per cent in 2021 to 68 per cent yr to this point as much as July 31.

Mutual funds spend money on IPOs both via important guide allocations (anchor and non-anchor parts) or by way of secondary market purchases post-listing. As a consequence of restricted visibility on non-anchor allocations, this research makes use of month-end MF disclosures to seize first-month holdings in 304 IPOs between CY2020 and CY2025 YTD.

Small isn’t stunning

SIPs now usher in ₹25,000 crore a month and MF belongings hold swelling, so why the selective stance on IPOs? The reply lies within the surge of smaller points with insufficient market capitalisation (m-cap).

Bharat Lahoti, Co-Head, Issue Investing, Edelweiss MF, says: “Many current IPOs have been small, with m-cap beneath ₹1,000 crore, making it tough for mutual funds to construct significant positions. Usually, funds want a free-float m-cap of at the very least ₹2,000-3,000 crore to justify allocation.” Actually, 33 per cent of the 38 IPOs launched until July 2025 had m-cap beneath ₹2,000 crore.

Mutual funds prevented choices comparable to Shanti Gold (₹1,652 crore), Arisinfra Options (₹1,411 crore) and Stallion India (₹999 crore). Then again, shares with greater m-cap comparable to HDB Monetary (₹69,758 crore), Hexaware (₹46,419 crore) and Anthem Biosciences (₹41,017 crore) drew sturdy MF curiosity, with 58, 56, and 81 schemes, respectively, collaborating throughout the IPO interval.

In the meantime, shares with sizeable market-cap however average MF participation included NSDL (₹18,720 crore), Schloss Bangalore (₹14,546 crore), and Dr Agarwal’s Well being (₹12,684 crore), which attracted 22, 26, and 14 schemes, respectively.

Funding choices aren’t nearly valuations. Funds additionally verify if an IPO suits their funding mandate, sector choice and whether or not the problem is massive sufficient for significant allocations. MF belongings have practically tripled, from ₹27 lakh crore in July 2020 to ₹75 lakh crore in July 2025. When funds had been smaller, they may enter modest IPOs. At the moment, 42 fairness schemes every handle over ₹30,000 crore. For them, even a 1 per cent publicity means ₹300 crore, successfully forcing an over-sized place that funds keep away from.

Valuation verify

IPO markets transfer in cycles. Early phases provide engaging valuations, however as cycles mature, they stretch, lowering participation, Lahoti explains. Exercise additionally flattens throughout downturns, as seen in January-March 2025. With the present beneficial section anticipated to final one other 3-6 months, valuations might ultimately attain frothy ranges just like these of 2021 and 2024, he provides.

Deepak Jasani, market veteran and former Head of Retail Analysis at HDFC Securities, feels, “it (selective IPO participation) might additionally sign that their total expertise with IPOs in recent times has not been very encouraging.” Certainly, returns from IPOs launched since 2023 present that only one in 6 changed into wealth multiplier for mutual funds. Whereas winners included IREDA (+365 per cent), Netweb Tech. (+310 per cent), and KRN Warmth Exchanger (+308 per cent), distinguished laggards included Widespread Autos (-60 per cent), Credo Manufacturers (-56 per cent), and ESAF SFB (- 50 per cent).

IPOs’ listing-day in addition to publish 30-day and 90-day lock-in positive aspects look removed from encouraging, with common itemizing positive aspects at simply 12.9 per cent (YTD2025). It is a sharp decline from wholesome positive aspects of, for example, 29 per cent (2024) and 43.3 per cent (2020). Put up lock-in returns additionally stay subdued, averaging 11.8 per cent after 30 days and solely 9.2 per cent after 90. Anchor traders face a 30-day lock-in for half their allotment, with the remaining locked for 90.

But, SEBI’s 2024 research reveals MFs bought barely 3.3 per cent inside every week of itemizing and exited lower than one-third even after a yr, highlighting their function as long-term traders.

Revealed on August 30, 2025