Up to date on April twenty fourth, 2022 by Felix Martinez

Enterprise Improvement Firms – or BDCs, for brief – could be a nice supply of present yield for earnings buyers.

Important Avenue Capital Company (MAIN) is a superb instance of this. This BDC has a present dividend yield of 6.1%. Higher but, Important Avenue Capital Company pays month-to-month dividends.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

The inventory’s excessive dividend yield and month-to-month funds make it a stable selection for earnings buyers. However what in regards to the power of the underlying enterprise?

Luckily for buyers, Important Avenue Capital’s enterprise seems to be performing effectively. This text will focus on the funding prospects of Important Avenue Capital Company intimately.

Enterprise Overview

Important Avenue Capital Company is a Enterprise Improvement Firm, or BDC. You possibly can see our full BDC listing right here.

The corporate operates as a debt and fairness investor for decrease center market corporations (these with $10-$150 million of annual revenues) in search of to remodel their capital constructions. The BDC has the aptitude to put money into each debt and fairness, which supplies it a big benefit over corporations who put money into non-public debt or non-public fairness alone.

Important Avenue Capital Company additionally invests within the non-public debt of middle-market corporations (not decrease middle-market corporations) and has a budding asset administration advisory enterprise.

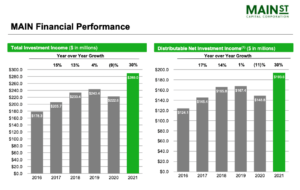

Supply: Investor Presentation

The BDC’s company construction is moderately easy. Important Avenue Capital Company operates three funds:

- The Important Avenue Mezzanine Fund

- The Important Avenue Capital II Fund

- The Important Avenue Capital III Fund

Since Important Avenue Capital Company is the operator of its personal funding funds, administration charges are stored to a minimal, which supplies it a cost-based aggressive benefit over its opponents who outsource their fund administration.

Important Avenue Capital Company’s holdings are extremely diversified by each transaction kind and geography. By transaction kind, the BDC acquires most of its offers through recapitalization and leveraged buyouts. Important Avenue Capital Company additionally has a really excessive diploma of diversification by trade.

Development Prospects

Important Avenue Capital Company’s development prospects come from its distinctive technique of driving funding returns. Traders who personal the inventory are rewarded because the BDC sustains its excessive month-to-month dividend and grows it over time.

On the enterprise stage, Important Avenue Capital Company’s development might be pushed by its experience within the decrease center market section of the economic system.

On February 24th, Important Avenue Capital launched fourth-quarter and full-year outcomes for 2021. Internet funding earnings of $39.8 million was a 9% enhance in comparison with $36.5 million a 12 months in the past. The company generated a web funding earnings of $182.7 million for 2021 a 32% enhance in comparison with $137.9 million in 2020. The company generated a web funding earnings per share of $2.65, up 26% from final 12 months’s earnings of $2.10 per share. Distributable web funding earnings per share totaled $2.81, up 24% from $2.26 in 2020.

Important Avenue’s web asset worth per share elevated in comparison with the tip of 2020, from $22.35 to $25.29. The company declared month-to-month dividends of $0.215, representing an annual dividend of $2.58 per share. As of the tip of the fourth quarter of 2021, the company had mixture liquidity of $567.6 million, consisting of $32.6 million in money and money equivalents, $535 million of unused capability underneath the revolving credit facility, which can preserve the help of its funding and working actions.

To conclude, Important Avenue Capital Company has experience within the decrease center market of its trade and has a budding asset administration enterprise that permits it to have robust operational leverage. These elements will drive the BDC’s development for the foreseeable future.

Supply: Investor Presentation

Dividend Evaluation

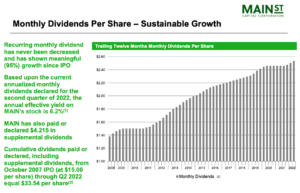

As talked about above, the corporate pays a month-to-month dividend. The corporate has been paying a month-to-month dividend for the reason that finish of 2008. Since that point, the dividend has been rising. During the last 14 years, the corporate dividend has had a compound annual development price of 12.3%. We don’t anticipate this sort of dividend development price to proceed into the long run, however we do anticipate the corporate to proceed to develop its dividend.

All through the years, the corporate has additionally paid supplemental dividends of $4.215. These are one-off particular dividends. We additionally anticipate the corporate to proceed this custom of particular dividends.

The dividend security is of concern. For instance, primarily based on earnings, the corporate had dividend payout ratios of over 100% for the final 9 years. Nevertheless, we anticipate the corporate to earn $2.75 per share in 2022, which can give us a dividend payout ratio of 94%. That is nonetheless excessive, however is sustainable.

So as to keep away from company earnings tax as a BDC, Important Avenue should distribute a minimum of 90% of its taxable earnings, leaving little wiggle room to fund development. Whereas this technique has labored extraordinarily effectively for the reason that final recession, we do warning that this methodology of funding turns into considerably much less enticing (and dearer) in lesser instances.

Supply: Investor Presentation

Closing Ideas

Though Important Avenue Capital Company is off-the-radar for many dividend development buyers, this BDC has a robust historical past of delivering substantial shareholder returns.

The agency’s robust monitor report of superior funding administration and experience within the decrease center market section offers it a robust aggressive benefit within the non-public fairness and debt trade.

Additional, Important Avenue Capital Company is shareholder-friendly with a excessive yield and month-to-month payouts. The inventory’s excessive yield and month-to-month dividend funds could be appropriate for earnings buyers, though the modest anticipated price of return of seven.4% over the subsequent 5 years coming largely from the excessive dividend yield of 6.2% retains the inventory as a maintain suggestion proper now.

Additional Studying: 5 No-Brainer BDCs Yielding Extra Than 5%

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].