Revealed on October 1st, 2024 by Felix Martinez

Diversified Royalty Company (BEVFF) has two interesting funding traits:

#1: It’s a excessive yield inventory based mostly on its 8.4% dividend yield.

Associated: Checklist of 5%+ yielding shares.

#2: It pays dividends month-to-month as an alternative of quarterly.

Associated: Checklist of month-to-month dividend shares.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

The above traits of Diversified Royalty Company, particularly its excessive yield and its month-to-month dividend funds, make it a lovely candidate for income-oriented traders.

However there’s extra to the corporate than simply these elements. Maintain studying this text to study extra about Diversified Royalty Company.

Enterprise Overview

Diversified Royalty Company, which is predicated in Canada, is a multi-royalty company that engages within the acquisition of royalties from multi-location companies and franchisors in North America. The corporate owns the Mr. Lube, AIR MILES, Sutton, Mr. Mikes, Nurse Subsequent Door, and Oxford Studying Facilities emblems.

The corporate was previously referred to as BENEV Capital and altered its title to Diversified Royalty Company in September 2014. Its goal is to accumulate predictable, rising royalty streams from a various group of multi-location companies and franchisors.

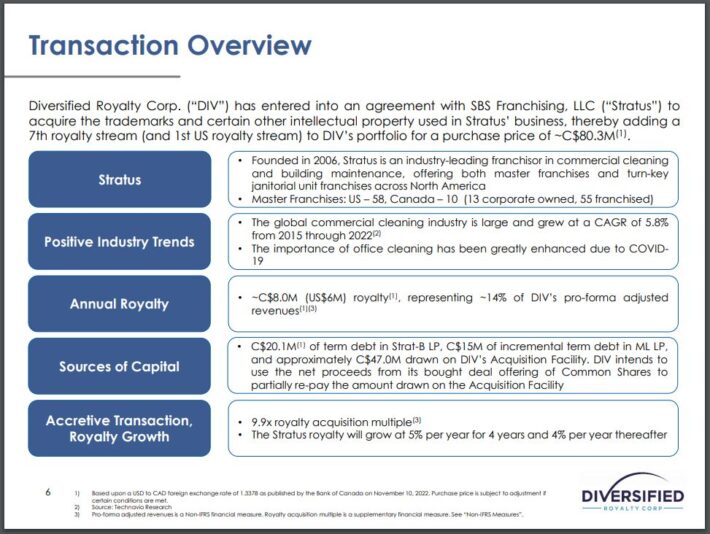

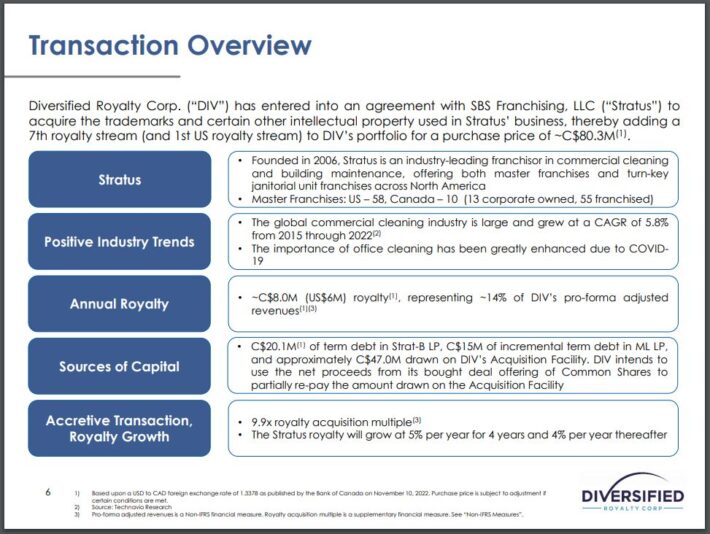

Diversified Royalty Company has been constructing a diversified portfolio of royalties from multi-location and franchisors in Canada. It additionally intends to develop its enterprise mannequin within the U.S. To this finish, the corporate has been selling its enterprise mannequin at numerous Worldwide Franchise Affiliation occasions within the U.S. Its growth efforts bore fruit with Stratus, the primary royalty transaction of the corporate within the U.S.

Stratus is an industry-leading franchisor in business cleansing and constructing upkeep, providing each grasp franchises and turn-key janitorial unit franchisees throughout North America. The worldwide business cleansing {industry} is immense and grew by 5.8% yearly between 2015 and 2022. It’s anticipated to develop 6.7% per 12 months from 2023 to 2030.

Supply: Investor Presentation

Development Prospects

Diversified Royalty Company has exhibited a considerably risky and inconsistent efficiency document, partly as a result of impact of the gyrations of the trade price between the Canadian greenback and the U.S. greenback. However, the corporate has grown its earnings per share by 4.7% per 12 months on common, from $0.08 in 2015 to $0.16 in 2023.

Furthermore, the aforementioned royalty acquisition of Stratus is more likely to show a serious development driver for the corporate. Stratus expects to develop from 68 Grasp Franchisees as much as 150 throughout the U.S. and Canada over the subsequent 5-10 years.

Supply: Investor Presentation

Stratus has grown its system gross sales by 21% per 12 months on common during the last 5 years. As its enterprise has ample room for future development, one can fairly anticipate the corporate to satisfy or exceed its above development goal over the subsequent decade.

Given the historic development document of Diversified Royalty Company and anticipated enterprise acceleration because of its main current acquisition, we anticipate 5.0% common annual development of earnings per share over the subsequent 5 years.

Dividend & Valuation Evaluation

In distinction to many corporations that reduce their dividends in 2020-2021 as a result of coronavirus disaster, Diversified Royalty Company defended its dividend throughout that downturn. As well as, the corporate lately raised its dividend by 2% and thus it’s now providing an exceptionally excessive dividend yield of 8.4%.

Nevertheless, it is very important be aware that the corporate has saved its dividend basically flat during the last six years. Throughout this era, it has marginally raised its dividend in CAD just a few occasions, however the strengthening of the USD versus CAD has offset these raises.

Furthermore, Diversified Royalty Company presently has a proforma payout ratio of 100%, which could be very excessive. The corporate additionally has an curiosity protection ratio of three.7 occasions. General, as a result of remarkably excessive payout ratio and the fabric debt load of Diversified Royalty Company, the dividend has a skinny margin of security and could also be reduce at any time when the subsequent recession reveals up.

In reference to the valuation, Diversified Royalty Company is presently buying and selling for 15 occasions its earnings per share within the final 12 months. Given the promising development prospects of the corporate, we assume a good price-to-earnings ratio of 18.0 for the inventory. Subsequently, the present price-to-earnings ratio is decrease than our assumed honest price-to-earnings ratio. If the inventory trades at its honest valuation stage in 5 years, it’s going to incur a -2.5% annualized in its returns.

Bearing in mind the 5% annual development of earnings per share, the 8.4% dividend and a 2.5% annualized tail wind from valuation, Diversified Royalty Company may provide a 15.9% common annual complete return over the subsequent 5 years. It is a pretty engaging anticipated return for income-oriented traders, who could think about buying the inventory round its present worth.

Last Ideas

Diversified Royalty Company has a lovely enterprise mannequin, because it does its greatest so as to add dependable and rising royalty revenues in its earnings stream. On this approach, the corporate goals to supply a rising earnings stream to its shareholders.

Furthermore, the corporate has promising development prospects forward. Its current royalty acquisition of Stratus is the primary transaction of the corporate within the U.S., which is more likely to be a serious development driver within the upcoming years because of the promising development potential of Stratus and the mid-single digit annual development of royalties from this deal. Furthermore, traders ought to anticipate extra comparable transactions within the U.S. within the upcoming years.

The one caveats are the sensitivity of Diversified Royalty Company to recessions and the exceptionally low buying and selling quantity of the inventory. This makes it laborious to buy or promote a big place on this inventory.

Don’t miss the sources beneath for extra month-to-month dividend inventory investing analysis.

And see the sources beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].