Printed on July fifteenth, 2025 by Aristofanis Papadatos

Cardinal Vitality (CRLFF) has two interesting funding traits:

#1: It’s providing an above-average dividend yield of 10.4%, which is greater than eight instances the typical dividend yield of the S&P 500.

#2: It pays dividends month-to-month as an alternative of quarterly.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink under:

Cardinal Vitality’s mixture of an above-average dividend yield and a month-to-month dividend makes it a beautiful possibility for particular person traders.

However there’s extra to the corporate than simply these components. Preserve studying this text to be taught extra about Cardinal Vitality.

Enterprise Overview

Cardinal Vitality is a Canadian oil and gasoline producer that has operations primarily in Alberta and Saskatchewan, with a robust concentrate on typical gentle and medium oil.

Its operations are centered on mature, low-decline fields the place enhanced oil restoration strategies, equivalent to water flooding and CO₂ injection, are actively used to keep up secure manufacturing. The corporate was fashioned in 2010 and is headquartered in Calgary, Canada.

Cardinal Vitality manages a big stock of vertical and horizontal wells tied into company-owned infrastructure, which helps environment friendly discipline operations and value management.

With over 90% of manufacturing weighted to grease and pure gasoline liquids (NGLs), Cardinal’s day-to-day operations are closely oil-driven, with ongoing upkeep, re-completions, and focused infill drilling forming the spine of its growth exercise.

As an virtually pure oil producer, Cardinal Vitality is very delicate to the dramatic cycles of the oil business. It has reported losses in 5 of the final 10 years and has exhibited a extremely risky efficiency document. The corporate initiated a dividend in 2014.

Then again, Cardinal Vitality has some benefits in comparison with well-known oil producers. Most oil and gasoline producers have been struggling to replenish their reserves because of the pure decline of their producing wells.

Supply: Investor Presentation

Cardinal Vitality is the standard producer with the bottom decline price in Canada. It is a main aggressive benefit, as the corporate must spend decrease quantities on capital bills than most of its friends to replenish its reserves.

It is usually outstanding that Cardinal Vitality grew its complete proved plus possible reserves by 30% final yr. This actually bodes properly for future manufacturing progress.

Within the first quarter of this yr, Cardinal Vitality maintained basically flat manufacturing vs. the prior yr’s quarter however its earnings per share dipped 20%, from $0.15 to $0.12, primarily resulting from a lower in realized oil costs.

OPEC supplied sturdy assist to the value of oil by way of deep manufacturing cuts lately however this technique reached its limits final yr. The U.S., Canada and Brazil, which don’t belong to the cartel, have been boosting their manufacturing and thus they’ve been greedy market share from OPEC.

This has led many OPEC members to change into dissatisfied with their decreased manufacturing quotas.

Angola exited the cartel early final yr. Consequently, OPEC lately started to extend its manufacturing, with a purpose to boost it by 2.2 million barrels per day till the top of subsequent yr.

As this strategic shift of OPEC is more likely to lead to a world surplus of oil, the value of oil has declined this yr. Nonetheless, it has remained above common and thus Cardinal Vitality is more likely to keep sturdy profitability this yr.

Progress Prospects

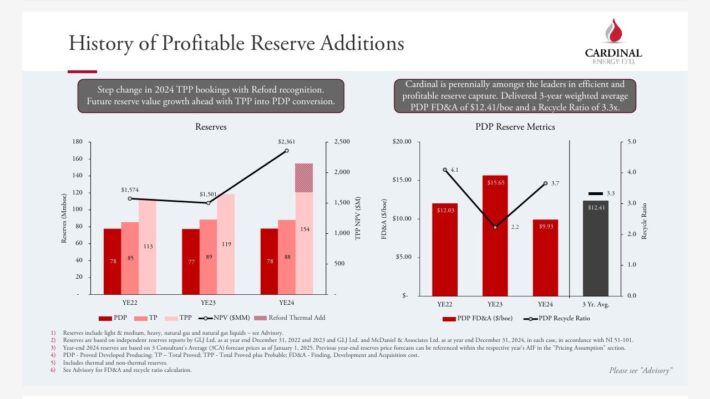

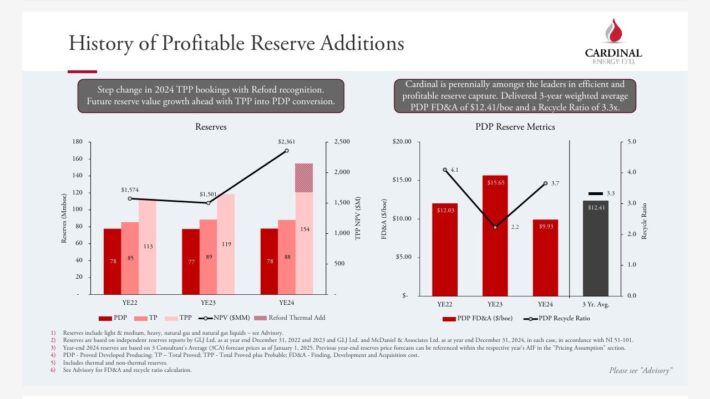

Cardinal Vitality has posted one of many highest reserve progress charges in its peer group lately.

Supply: Investor Presentation

Even higher, the corporate has ample room for future progress due to some progress tasks.

Cardinal Vitality has supplied steering for common manufacturing of 21,300-21,700 barrels per day this yr. If it meets its steering, it would publish basically flat output in comparison with final yr.

Nonetheless, when the continued progress tasks start to contribute to the output of the corporate, they’re more likely to lead to significant manufacturing progress.

Total, within the absence of a serious downturn, Cardinal Vitality can develop its earnings per share by 5% per yr on common over the subsequent 5 years.

Then again, as an oil producer, Cardinal Vitality is very delicate to the fluctuations within the value of oil. The corporate posted document earnings per share in 2021 and 2022 due to the restoration of worldwide oil consumption, which led the value of oil to surge to a 13-year excessive.

Nonetheless, now that the worldwide oil market has absorbed the influence of the Ukrainian disaster and OPEC has begun to revive its output, the value of oil has moderated.

Consequently, the earnings per share of Cardinal Vitality have decreased from an all-time excessive of $1.46 in 2021 and $1.42 in 2022 to $0.47 in 2024. We count on earnings per share of roughly $0.50 this yr.

Notably, Cardinal Vitality has a rock-solid stability sheet. Its curiosity expense consumes simply 3% of its working earnings whereas its internet debt is barely $262 million, which is 32% of the market capitalization of the inventory.

A robust stability sheet is paramount within the oil business, as it’s seemingly to assist the corporate endure future downturns in its enterprise.

Dividend & Valuation Evaluation

Cardinal Vitality is at present providing an above-average dividend yield of 10.4%, which is greater than eight instances the 1.2% yield of the S&P 500. The inventory is an fascinating candidate for earnings traders, however they need to bear in mind that the dividend is way from protected because of the dramatic cycles of the value of oil.

Cardinal Vitality has a excessive payout ratio of 106%, which is unsustainable over the long term. Nonetheless, due to the stable monetary place of the corporate, its dividend will not be more likely to be decreased dramatically underneath present oil costs.

In reference to the valuation, Cardinal Vitality is at present buying and selling for 10.2 instances its anticipated earnings per share this yr. Given the excessive cyclicality of the corporate, we assume a good price-to-earnings ratio of 9.0, which is a typical mid-cycle valuation degree for oil producers.

Subsequently, the present earnings a number of is greater than our assumed honest price-to-earnings ratio. If the inventory trades at its honest valuation degree in 5 years, it would incur a 2.5% annualized drag in its returns.

Bearing in mind the 5.0% annual progress of earnings per share, the ten.4% present dividend yield but in addition a 2.5% annualized headwind of valuation degree, Cardinal Vitality may supply a ten.5% common annual complete return over the subsequent 5 years.

The anticipated return indicators that the inventory is an efficient long-term funding, though we’ve handed the height of the oil business’s cycle.

Remaining Ideas

Cardinal Vitality has been thriving since 2021 due to a super surroundings of above-average oil costs. The inventory is providing an above-average dividend yield of 10.4%, albeit with a excessive payout ratio of 106%. Given its first rate progress prospects and its affordable valuation, the inventory seems engaging.

Then again, the corporate has confirmed extremely weak to the fluctuations within the value of oil. Consequently, it’s not appropriate for traders who can’t abdomen excessive inventory value volatility.

Furthermore, Cardinal Vitality is characterised by low buying and selling quantity. Which means it’s laborious to ascertain or promote a big place on this inventory.

Further Studying

Don’t miss the sources under for extra month-to-month dividend inventory investing analysis.

And see the sources under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].