designer491/iStock via Getty Images

Molina Healthcare (NYSE:MOH) is a FORTUNE 500 company that provides managed healthcare services to low-income individuals and families, including those who are eligible for Medicaid. It continues to remain attractive with its growth initiatives, expanding into new states and increasing its member base. Today, MOH serves over 5.2 million members in 19 states. Despite the regulatory headwinds faced by the company, which negatively affected its membership growth forecast to 5.1 million in FY’23, management remains firm that they will continue to attempt to protect their margins from falling. In fact, they provided an outstanding (YoY) growth in earnings per share and they also managed to hit their total medical care ratio goal. Overall, MOH remains profitable and trades attractively near its logical support.

Company Overview

The pandemic and today’s macro uncertainties should lead to an increased demand for affordable healthcare options, such as Medicaid, that Molina Healthcare provides. In fact, MOH managed to grow its membership base to over 5.2 million, up from its pre-pandemic levels of 4.03 million in FY’20. MOH faces challenges from its slowing membership outlook for FY’23, however, which is expected to be around 5.1 million due to regulatory changes regarding California MediCal Awards and Medicaid redeterminations starting April this year. Interestingly, despite this, the Medicaid segment’s medical care ratio (“MCR”) is expected to rise to 88.5% in FY’23, up from 88% in FY’22, which remains in line with management’s long-term target, as quoted below.

Medicaid, 80% of our revenue, we are forecasting a reversion to the mean, considering all the impacts of flu, RSV, COVID, any potential nuanced reaction to retermination process puts us in the middle of the range at 88.5%, our long-term range being 88% to 89%. So that’s the line of business tail of the tape for MCR projection into 2023. Source: Q4’22 Earnings Call Transcript

Despite the slowing membership forecast, management provided a positive outlook for total premium revenue amounting to $32 billion which is an improvement from $30.883 billion in FY’22. This is thanks to MOH’s strong competitive advantage in the market, as shown by its continued growth in multi-year state contracts.

Our performance on Medicaid RFPs in the year was exceptional. We renewed our contract in Mississippi, doubled the size of our California contract for 2024 and won two new contracts: first in Iowa and then Nebraska for a 100% win rate on RFP responses submitted. In total, we project that these RFP wins for the year will add $4.4 billion in run rate premium revenue. Source: Q4’22 Earnings Call Transcript

Additionally, MOH provided a controlled overall medical care ratio of 88% in FY’23 flat compared to its FY’22. These operating efficiencies snowballed into the company’s growing (GAAP) earnings per share of $18.53 in FY’23, up from $13.55 and $11.25 recorded in FY’22 and FY’21, respectively.

At A Logical Support Zone

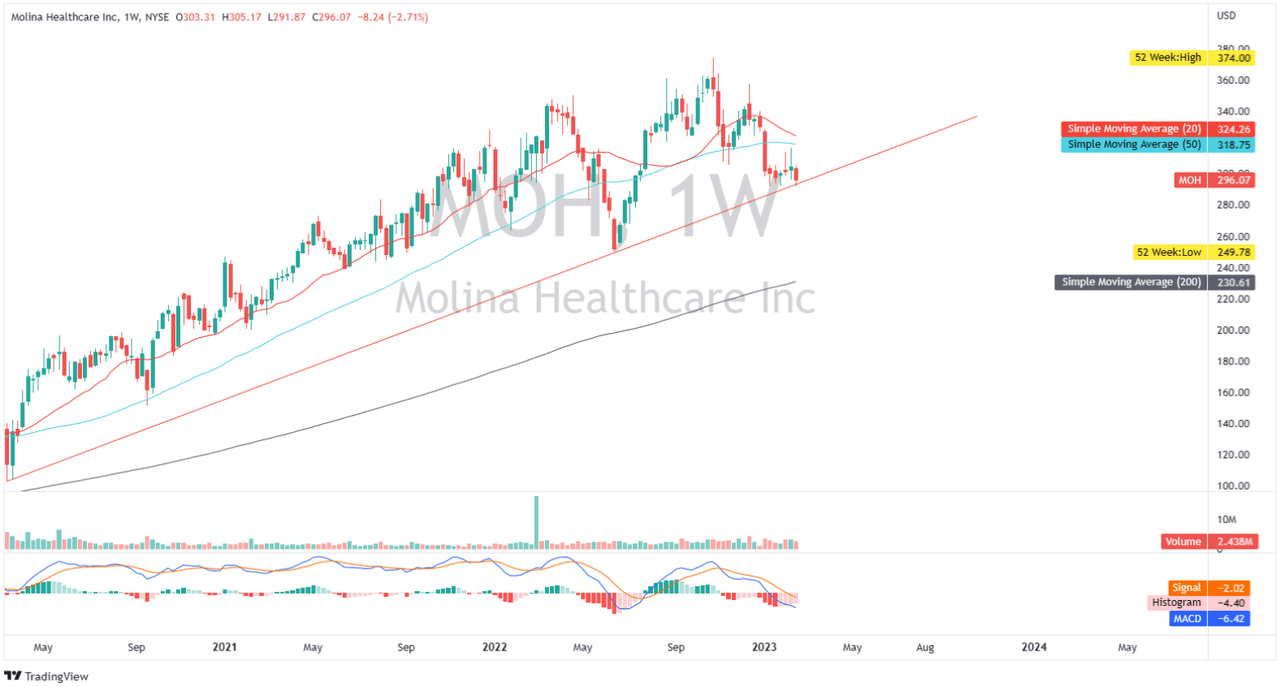

MOH: Weekly Chart (Source: Author’s TradingView Account)

As shown in the above chart, after reaching its 52-week high and being rejected by the market, MOH reached a logical support level. Indeed, a potential consolidation in today’s area could be a sign of weakness in the downward momentum. If this consolidation results in a bullish pullback, the stock price could move towards its previous resistance level around $374. On the other hand, if bearish pressure continues to outweigh today’s price action, the $250 support zone should hold, as it has historically served as a key support level and reinforces a bullish market structure over the long term. Readers can detect weakness in today’s negative momentum by looking at its MACD indicator. One potential positive catalyst to watch is a probable bullish crossover. This could be a sign of a shift in momentum from negative to bullish, indicating that the stock is likely to rise in the short term.

Priced Attractively

Despite the slowing total membership catalyst, MOH managed to control their growing margin. The positive outlook for earnings per share amounting to $26.49 in FY25 represents a 13.91% three-year CAGR. This is an attractive growth rate, and if Molina is able to achieve it, it could help to drive the stock price higher in the long term. Applying a terminal growth rate of 2.5% and 9% discount rate, we can arrive at a conservative fair price of $381.3. This is also considering management’s higher total revenue target of $42 billion in FY25, which is higher than analysts’ conservative estimate of $39.56 billion. This is further supported by the strong momentum MOH has demonstrated in its growth efforts, as detailed below.

Turning now to our growth strategy. We have taken major strides toward our $42 billion 2025 premium goal. At this early stage, we already have a clear line of sight to $35.5 billion in 2024. The key to our strategy is balanced, a stellar record of new contract wins, Kentucky, Nevada and now filling in the middle part of the country. The doubling of the size of our California business, including significant expansion in Los Angeles County, preserving and securing all of our incumbent state contracts and no large reprocurements in the near-term, continuing to build the M&A pipeline as this aspect of our strategy has already produced seven transactions for $10 billion. in revenue. Not to mention, organic growth, one member at a time by focusing on greater member attraction and retention and overcoming the regulatory headwinds of redeterminations and pharmacy carve outs. Source: Q4’22 Earnings Call Transcript

Conclusive Thoughts

Today, one of the visible slowing metrics of MOH is its slowing free cash flow (“FCF”) margin of 2.2%, down from its 6.6% three-year average. According to the management this is mainly due to timing of corridor payments, as quoted below.

2022 full year operating cash flow was lower compared to the prior year, primarily due to the cash settlement in 2022 of large prior year marketplace risk adjustment and Medicaid risk corridor payments. Normalizing for the timing of these payments, 2022 operating cash flow was $1.6 billion. Source: Q4’22 Earnings Call Transcript

Despite the regulatory headwinds mentioned earlier, MOH continues to strengthen its operational footprint in Texas, as shown by its acquisition of Cigna’s (CI) Texas Medicaid business. Additionally, management is expecting positive catalysts regarding potential new contract awards.

At the end of January, the Texas Health and Human Services Commission posted a notice on its website indicating that it was issuing a notice of intent to award our Texas Health Plan, a contract for all of our existing eight service areas in the state. We expect to be able to provide more of an update once these contracts have been finalized and signed. Source: Q4’22 Earnings Call Transcript

With its solid record on its M&A activities and strong share buyback activities, especially this FY’22, Molina Healthcare appears well positioned to weather out today’s short-term risks. In fact, it maintained a total debt of $2,531M, which translated to an improving debt-to-equity ratio of 0.81x, better than its ratios of 0.91x and 1.12x recorded in FY’21 and FY’20, respectively. This makes potential pullbacks attractive and MOH an attractive candidate for long positions.

Thank you for reading and good luck!

:max_bytes(150000):strip_icc()/Health-GettyImages-509121122-34b4f5360bf348ed93d30e7aebdb32a8.jpg)