alvarez

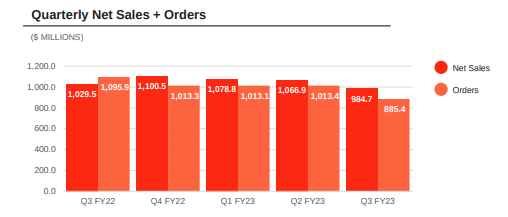

Just when MillerKnoll (NASDAQ:MLKN) appeared to be making progress in restoring its profit margins after the enormous impact from inflation and supply chain issues, it is now facing an additional headwind from demand cooling off. While third quarter net sales decreased ~4.4%, orders were down a troubling ~19% compared to the previous year.

Results for the quarter were actually not that bad, with the company delivering adjusted earnings of $0.54 per share, with net sales of $984.7 million. The big issue was the severe decline in orders, which signals that demand is significantly weakening. There are numerous reasons that explain this weakness in demand, including higher interest rates that have slowed home buying. Consumers are also shifting spending towards travel and services, and away from products. Perhaps one of the biggest headwinds, however, is the work-from-home trend that is making many companies much more hesitant to make investments to refurbish their offices.

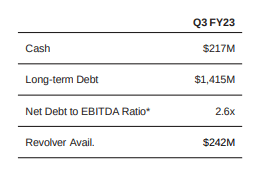

There were some good news shared during the most recent earnings call too. For example, MillerKnoll continues to capture cost synergies, with ~$123 million of implemented savings to date. Previous price increases are also now reaching the bottom line and delivering margin expansion. The company is generating decent amounts of cash flow from operations, roughly $75 million in the third quarter. MillerKnoll used ~$18 million to reduce debt, but leverage remains high at 2.6x net debt to EBITDA. Overall, we would say results for the quarter were decent, except for the low order intake which could signal that demand is quickly weakening.

Financials

We had been very focused on the recovery of profit margins after inflation, supply chain issues, and rising commodity costs had severely affected the company’s profitability. While MillerKnoll implemented price increases, it took them some time to start having an effect. In the third quarter the company delivered a disappointing adjusted gross margin considering that it used to be much closer to 40%, but thanks to cost savings initiatives the adjusted operating margin is now looking relatively decent.

MillerKnoll Investor Presentation

Orders

If there was something that scared investors this quarter, it was probably the low order intake. While there is some normal variation from quarter to quarter, orders usually exceed $1 billion per quarter. The more than $100 million shortfall is definitely a cause for concern for investors, especially if this is the start of a downward trend.

MillerKnoll Investor Presentation

During the Q&A session of the earnings call an analyst asked if the company had seen any improvement on this trend recently. The reply is somewhat reassuring in that it seems that at least things have gotten somewhat less bad. This is what CFO Jeff Stutz replied to the analyst:

So the good news is we did see improved trends as we made our way through the quarter, really across each of our three business segments. So while we ended the quarter in the organic numbers that I gave you in my prepared remarks, order entry levels in the month of February, for example, were actually better than the full quarter trend in each of the three segments. So we did see some improvement. And in the first couple of weeks of Q4, I would say, generally, that’s continued.

Management also shared that from a funnel perspective they are seeing significant growth in the over $1 million size projects, and there has been quarter over quarter growth in the funnel. In other words, the company seems to have a lot of opportunities identified, but it would appear they are taking time to close. This would be another reason for optimism that there could be a change in the order trend if more of those opportunities start materializing. Still, investors will no doubt be looking at orders next quarter very closely.

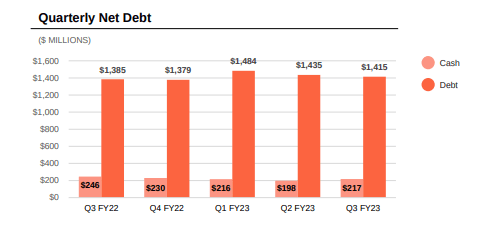

Balance Sheet

The balance sheet remains another big concern for investors, with the company making little progress on the deleveraging despite the company paying down a small amount of debt in the quarter.

MillerKnoll Investor Presentation

Net debt to EBITDA remains around 2.6x, and with neither significant debt repayments nor meaningful EBITDA growth likely in the short term, it would seem that leverage will remain elevated for still some time.

MillerKnoll Investor Presentation

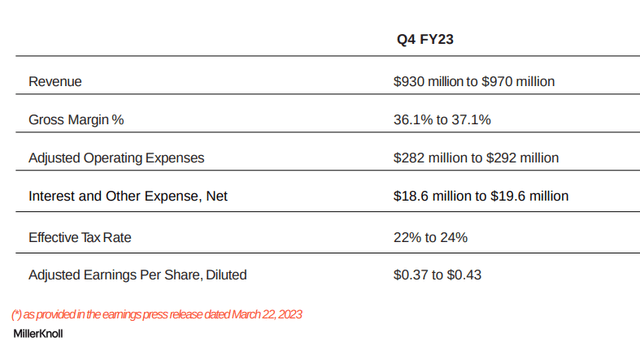

Guidance

Guidance for the next quarter calls for revenue to make a sequential decline, but given how low order intake was, guidance could have been much worse. It seems the company is taking into consideration the recent improvements it described to order intake, as well as the number of active opportunities it is pursuing from the sales funnel.

MillerKnoll Investor Presentation

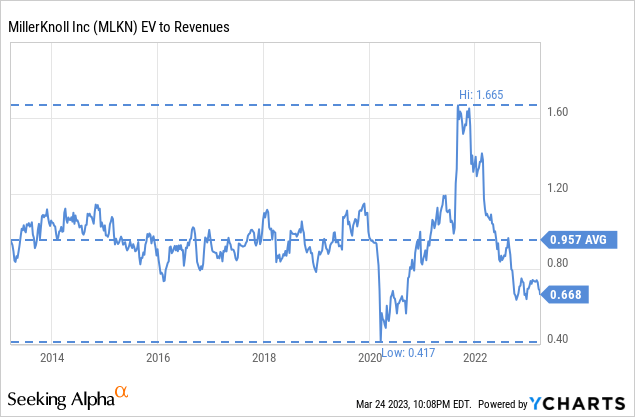

Valuation

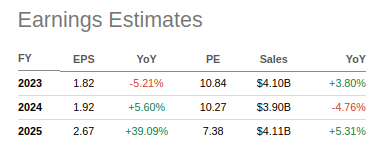

The main reason we remain optimistic on MillerKnoll is that it trades with a very undemanding valuation. Its EV/Revenues multiple is barely higher compared to the levels from the 2020 Covid crash, and roughly a third less compared to the ten year average. In other words, significant headwinds are already priced into the shares.

Analysts are optimistic that earnings will improve in the next couple of years, forecasting EPS of $2.67 by FY2025. This puts the fiscal year 2025 price/earnings ratio at a very undemanding ~7.3x. We believe that if the current headwinds dissipate MillerKnoll will impress with the level of earnings it can deliver, possibly much higher than what analysts are forecasting. That said, we are particularly concerned with the work-from-home trend and the severe deterioration it is causing in the office real estate sector.

Seeking Alpha

Risks

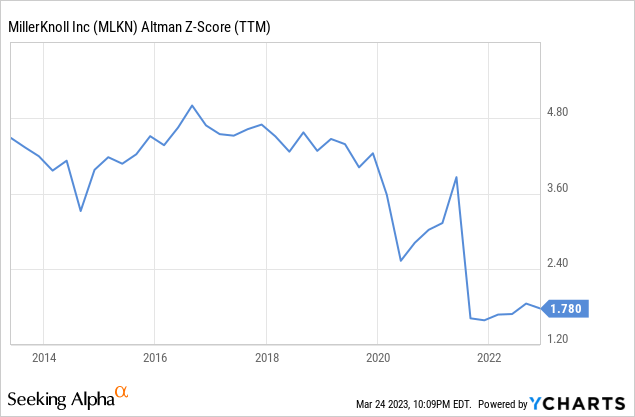

There are numerous important risks that MillerKnoll investors should consider. There is the impact that work-from-home is having on the willingness of companies to invest in refurbishing their offices if they are going to be underutilized. There are also headwinds related to the housing sector, which is seeing a significant slowdown, further reducing demand for new furniture. The company has also seen its profit margins come under pressure from rising input prices and supply chain issues, although things have been improving in this respect lately. The biggest risk that we see, however, is the significant debt the company carries and the relatively high leverage ratio. This is also reflected in an Altman Z-score that is below the critical 3.0 threshold. Further adding risk is the disappointing order intake in the third quarter, and the risk of a recession arriving soon.

Conclusion

While the results for the third quarter were relatively decent, we believe investors should be concerned with the weak guidance for next quarter, and in particular the significant drop in the order intake. On the positive side, the company has made progress improving profit margins after they suffered significantly from inflation and supply chain impacts. Given the extremely low valuation we are maintaining our ‘Buy’ rating, but do note that risks have increased. We are particularly worried about the effect that the work-from-home trend is having on demand. Combined with the weakening of the housing sector, and consumers shifting their spending to services, it appears investors will have to be patient for a rebound in demand to arrive.