bymuratdeniz/iStock through Getty Pictures

Low Valuation and Smaller Caps: A Well timed Alternative

The market restoration that started in early April continued all through the third quarter. Whereas progress and momentum shares remained sturdy, producing double-digit returns, {the marketplace} started to broaden out. Small and micro-cap worth shares posted their strongest quarterly returns since This autumn 2023. After a four-year pause, small caps resumed their upward momentum, lastly reaching a brand new excessive and breaking the worth degree peak of 2021. We imagine we’re nonetheless within the early innings of a multi-year outperformance cycle for low valuation equities and smaller market caps.

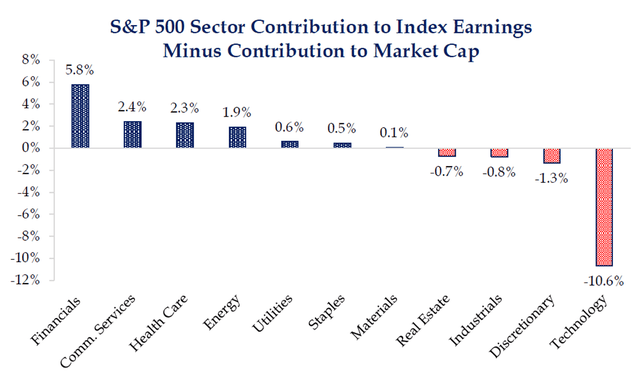

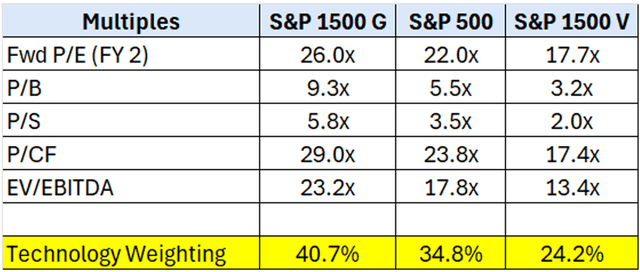

Market individuals have been enamored with the longest period equities, a large portion of that are Know-how and AI-related corporations. Whereas it’s all the time arduous to know the precise peak in optimism, having invested by the late Nineties and early 2000s time-period we’re seeing comparable extreme exuberance constructing in that portion of the market. Crowded possession in know-how corporations has led to important possession overlaps throughout funding classifications together with market valuation growth. However, the chart under is telling concerning the sector’s contribution. At quarter finish, the S&P 500 ((SP500), (SPX)) Know-how sector weighting elevated to 34.8% of the S&P 500 Index – greater than 1,000 bps above the sector’s earnings contribution!

The Know-how sector is rapidly approaching its all-time excessive weighting of 34.9%, achieved on 3/27/2000 (Dot Com peak). Investor FOMO (worry of lacking out) in longer period equities is taking priority over valuation and prudent margin of security. Nevertheless, historical past reminds us how market views can transfer from extreme optimism to pessimism in brief order. We noticed a quick instance of this throughout 2022 when longer period equities noticed a big pullback. The Dot com bubble in know-how shares within the late Nineties was adopted by a higher worth correction from 2000 to 2002. From the highs in early 2000, the S&P 500 Know-how sector weighting fell from 34.9% to 14.3% by the top of 2002 (solely 21 months later).

Whereas it’s potential for Mr. Market to proceed to push longer period and know-how share costs increased within the close to time period, we’re reaching the upper finish of historic ranges. The Know-how sector ahead price-to-earnings a number of is above 30x, considerably increased than the 20-year (US20Y) historic common of 18.3x. Greater share costs will ultimately turn out to be extra weak to any disappointment with elevated future market expectations.

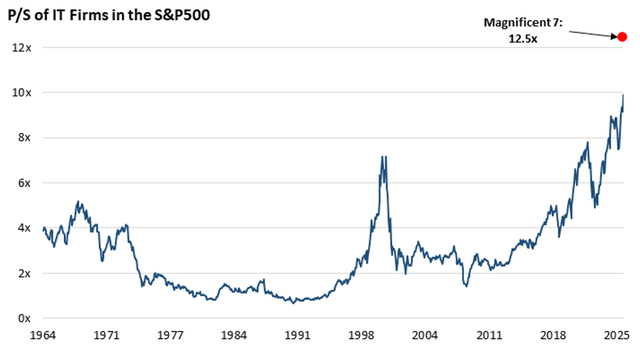

Given the Know-how sector is close to traditionally peak margins, you will need to additionally spotlight the sector’s worth to gross sales a number of. Because the chart under highlights, it’s effectively above the 2000 peak of 7x, approaching 10x income, with the Magnificent 7 approaching 13x! Lengthy period equities mixed weighting within the S&P 500 can be at an all-time excessive – practically 35% of the index weighting has a price-to-sales above 10x.

Supply: Kailash Capital Analysis, LLC. Information for 4/30/1964-9/30/2025

Supply: S&P Tear Sheets 9/30/2025 and Bloomberg

It’s shocking to see that Apple (AAPL) and Microsoft (MSFT) at the moment are the 2 largest holdings within the S&P 1500 Worth Index. Each corporations are above 30x earnings, with an earnings yield effectively under 10-year treasury bond yield!

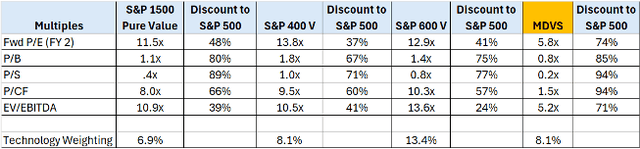

Nevertheless, as you progress in the direction of the bottom valuation equities and decrease market cap Indexes you’ll discover the Know-how illustration falls with these extra diversified Indexes (high 10 weight between 10.7% and 11.7%).Valuation measures of those subsets of the market are at a big low cost to the S&P 500 Index. There are very vast valuation spreads between low valuation and longer period/know-how equities at the moment. We additionally spotlight Deep Worth Choose technique’s valuation multiples at higher than a 70% low cost to the S&P 500 Index. There are extraordinarily enticing valued equities nonetheless within the market with low market expectations and enticing uneven return potential!

Supply: S&P Tear Sheets 9/30/2025 and Bloomberg

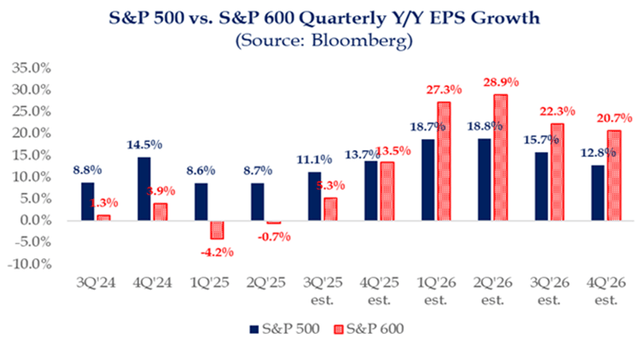

The small cap sector is rising from a multi-year earnings recession. Future rate of interest cuts, ongoing deregulation and anticipated $150M of incremental tax financial savings in early spring from the current tax invoice gives extra tailwinds to smaller firm profitability. Throughout 2026, small cap earnings progress is predicted to be forward of bigger corporations. 12 months-to-date, bigger corporations’ earnings have seen advantages from incremental stock construct as corporations seemed to get forward of upper tariffs.

We imagine this will create some more difficult comparisons and margin pressures over the approaching 12 months. Whereas {the marketplace} is targeted on Know-how and AI corporations, smaller corporations could find yourself being the largest long-term beneficiaries from using AI and different technological developments to boost their enterprise’ productiveness and profitability over the approaching years.

We imagine low valuation and smaller market cap equities are being missed and are a really well timed alternative at the moment!

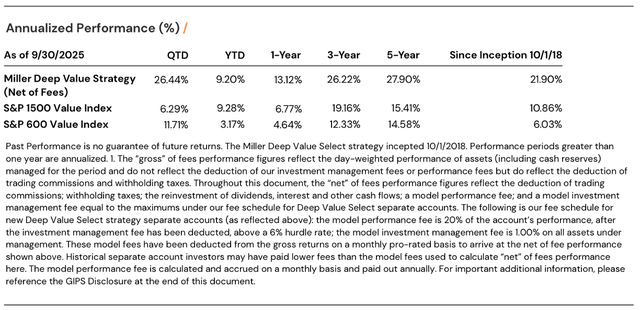

Miller Deep Worth Technique Highlights

Through the quarter, the Deep Worth Choose technique was +26.50%, versus the S&P 1500 Worth Index +6.29% and the S&P 600 Worth Index at +11.71%. 12 months-to-date, Deep Worth Choose Technique internet returns are +9.20%, barely behind the S&P 1500 Worth Index at +9.28% and forward of the S&P 600 Worth Index at +3.17%. The broadening of the market in the course of the quarter was a tailwind for technique efficiency. We proceed to see important embedded worth in our holdings as their present valuation is a big low cost versus business friends and personal market transactions.

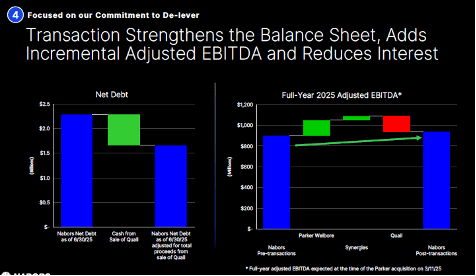

Through the quarter, ten of our twelve holdings delivered optimistic double-digit returns. The most important optimistic contributor was Nabors Industries (NBR) (NBR), whose market share worth was up 46%. Nabors Industries has undertaken a multi-year transformation centered on leveraging their business’s main know-how. The corporate has over 450 patents, and has developed business main drilling automation/robotics, Rig Cloud platform and sensible apps, rolling out globally, not solely on Nabors rigs but additionally on third get together rigs. Through the quarter, Nabors offered their Quail Instruments enterprise phase for $600M. Sale proceeds might be used to speed up debt discount, enhancing the corporate stability sheet and liquidity.

Supply: Nabors, September 2025 Investor Conferences Presentation

Administration reaching 2025 steerage and ongoing debt discount would result in Enterprise Worth to EBITDA (ahead 1-year) approaching 2.5x, an all-time low and a big low cost to Nabors 15-year common of 5.9x.

Nabors share worth appears to be like extraordinarily enticing, at lower than one occasions ahead money circulation – the one different interval it has traded at a decrease ratio was a quick time in the course of the Covid 2020 outbreak. Present market fears seem attributable to falling commodity costs, and expectations for extra rig cancellations. Whereas oil costs falling in the direction of $50/barrel is a possible threat, we imagine this market worry is well-known and considerably discounted in Nabors present share worth at the moment. We imagine Nabors long-term normalized EBITDA might be nearer to $1.5B, and the corporate has debt discount potential of $1B+ over the subsequent 5 years. Nabors long-term upside potential is multiples of the present share worth with the shares at present buying and selling at higher than 50% normalized free money circulation yield.

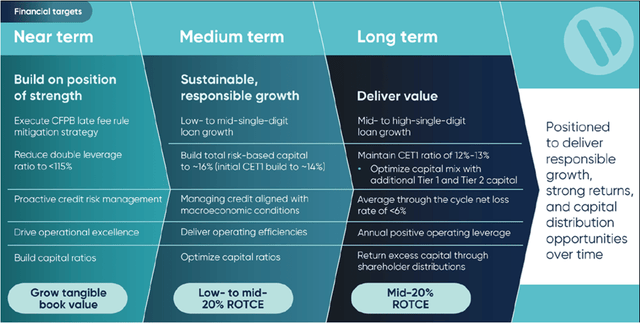

Our solely detrimental holding in the course of the quarter was Bread Monetary (BFH) (BFH), with a market share worth down 2%. The corporate gives proprietary direct-to-consumer bank cards and deposits together with digitally enabled private-label, co-branded bank cards, installment loans and purchase now, pay later (“BNPL”). New administration has accomplished a multi-year transformation to streamline its enterprise mannequin, improve their underwriting course of, develop differentiated merchandise, and broaden model partnerships. An skilled and succesful CFO joined couple years in the past and has additional enhanced the stability sheet and transformation plan. Since, the start of the transformation plan in early 2020, capital ratios have improved by greater than 3x, debt diminished by $2B and elevated direct to shopper deposits by greater than $6B. Market current issues on weaker business bank card knowledge seem over discounted within the present share worth, as Bread administration enhanced their underwriting over the previous couple of years and elevated their credit score reserves to 13%. With firm delinquency charges at half of reserve ranges we see the potential for the corporate to see a big reserve launch over the subsequent couple of years. Administration appears to be like effectively positioned to transition to their long-term monetary targets, which might assist normalized ROTCE within the Mid-20% and normalized earnings above $15 per share. BFH shares stay enticing in our view, buying and selling at greater than 25% normalized earnings yield.

Deep Worth Choose not too long ago reached its seventh anniversary, producing near 22% annual returns since inception. The technique has considerably outperformed the general market even with weaker small cap market returns. Historic holdings have generated practically 80% of our efficiency since 2018, as we have now recycled capital from largely profitable historic investments into new investments or elevated holdings which have lagged the technique’s historic returns. Our holdings have sizable income (>$3B) and asset bases and a short lived small/micro-cap market cap. Our concentrated turnaround/transformation conditions all present a number of long-term worth drivers (margin enchancment, returning to normalized earnings/free money circulation, non-core asset monetization, capital allocation and/or valuation growth potential) to unlock important fairness worth over time. Any enchancment in small cap returns has the potential to supply incremental tailwind to technique long-term returns.

We thank our purchasers for his or her long-term partnership and stay enthusiastic about our potential to ship enticing long-term returns.

View Deep Worth Choose GIPS Disclosure References to particular securities are for illustrative functions solely. Portfolio composition is proven as of a cut-off date and is topic to vary with out discover. Contributors and Detractors talked about above are these holdings that had the best impact on the Technique’s composite efficiency for the quarter. For info on how Contributor/Detractor knowledge are calculated and their impact on composite efficiency, contact us. For extra details about Miller Worth administration charges, please contact us. Previous efficiency can’t predict future outcomes. It’s not potential to take a position immediately in an index. Unmanaged index returns don’t replicate any charges, bills, or gross sales fees. Free money circulation is earnings earlier than depreciation, amortization, and non-cash fees minus upkeep capital expenditures. Return on tangible Frequent Fairness is computed by dividing internet earnings relevant to frequent shareholders by common month-to-month tangible frequent shareholders’ fairness and is commonly used to evaluate an organization’s efficiency. Earnings Yield is a valuation metric that refers back to the earnings per share for the latest 12-month interval divided by the present worth per share. Earnings per share (EPS) is the portion of an organization’s revenue allotted to every excellent share of frequent inventory and serves as an indicator of an organization’s profitability. Free money circulation yield is an general return analysis ratio of a inventory, which standardizes the free money circulation per share an organization is predicted to earn towards its market worth per share. The ratio is calculated by taking the free money circulation per share divided by the share worth. EBITDA is earnings earlier than curiosity, taxes, depreciation and amortization and is a calculation of an organization’s monetary well being. Enterprise Worth to Earnings Earlier than Revenue, Taxes, Depreciation, and Amortization (EV/EBITDA) is the enterprise a number of and is used to find out the worth of an organization. The S&P 1500 Pure Worth Index attracts constituents from the S&P 1500 Index. Worth is measured on three elements: the ratios of guide worth, earnings, and gross sales to cost. S&P Pure Worth Indices embrace solely these elements of the dad or mum index that exhibit sturdy worth traits, and weights them by worth rating. The S&P MidCap 400® Worth measures constituents from the S&P MidCap 400 which are categorized as worth shares based mostly on three elements: the ratios of guide worth, earnings and gross sales to cost. The S&P 600 SmallCap Worth Index tracks the worth shares within the S&P 600 SmallCap Index, recognized by three elements: guide worth, earnings and gross sales to cost. An investor can’t make investments immediately in an index. Unmanaged index returns don’t replicate any charges, bills or gross sales fees. Value to earnings is the market worth per share divided by earnings per share. The Magazine 7 or Magnificent 7 are a gaggle of corporations within the U.S. inventory market: Alphabet ((GOOG) (GOOGL)), Amazon (AMZN), Apple, Meta Platforms (META), Microsoft, NVIDIA, and Tesla (TSLA). Value to gross sales ratio is a software for calculating a inventory’s valuation relative to different corporations. It’s calculated by dividing a inventory’s present worth by its income per share. Foundation level is one hundredth of 1 %. The S&P 500 Index is a market capitalization-weighted index of 500 broadly held frequent shares. Adviser believes that the content material offered by third events and/or linked content material in all fairness dependable and doesn’t comprise unfaithful statements of fabric reality, or deceptive info. Any views expressed are topic to vary at any time, and Miller Worth Companions disclaims any accountability to replace such views. The knowledge offered shouldn’t be thought of a suggestion to buy or promote any safety and shouldn’t be relied upon as funding recommendation. It shouldn’t be assumed that any buy or sale selections might be worthwhile or will equal the efficiency of any safety talked about. Previous efficiency isn’t any assure of future outcomes, and there’s no assure dividends might be paid or continued. ©2025 Miller Worth Companions, LLC |

Unique Put up

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.