gionnixxx/iStock Unreleased via Getty Images

Writing about a stock pick of the following year is quite difficult as the time span is short and yet a lot of unpredictable things can happen.

However, MGM Resorts’ (NYSE:MGM) headwind in China is about to become one of their biggest tailwinds in the following year. China’s COVID-19 policies have drastically changed in the last couple of weeks and the virus is now running rampant in the country. My thoughts are with the victims that got the bad end of the virus, nonetheless through this way China can finally reach herd immunity. Arrivals in Macau are no longer required to undergo PCR testing and China is considering to scrap hotel quarantine for overseas travelers next month.

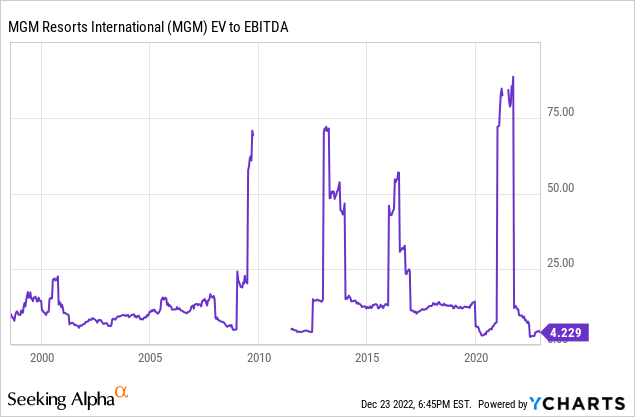

Further, the CES (consumer technology association) event and the long awaited Formula 1 spectacle are bound to happen in 2023. Though none of this seems to be priced in at 4.2x EV to EBITDA.

Third quarter earnings

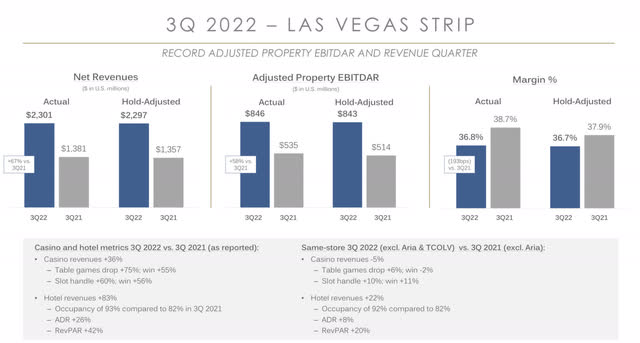

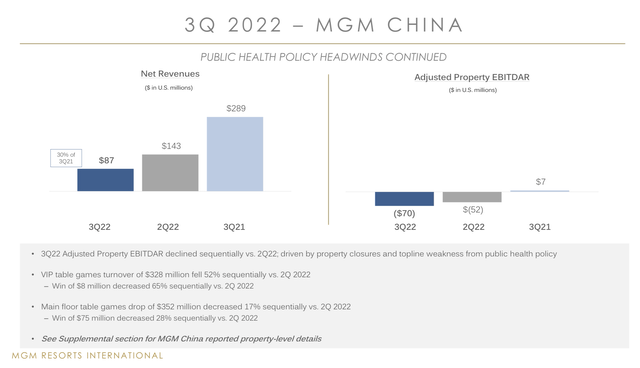

MGM’s revenues have been recovering quarter over quarter the past year, Q2 and Q3 were even record revenue quarters in Las Vegas. The business is back to rivalling the top performing year of 2019. In Q3 2019 total revenue was $3.3 billion compared to Q3 2022 total revenue of $3.4 billion. Even so, the company is still missing a crucial part of their business. In Q3 2019, MGM China accounted for 23% of revenue, which has now evaporated to 2.5% of revenue. As a result, the company is performing exceptional in areas they have an impact on.

Investor Relations Q3 22 Investor Relations Q3 22

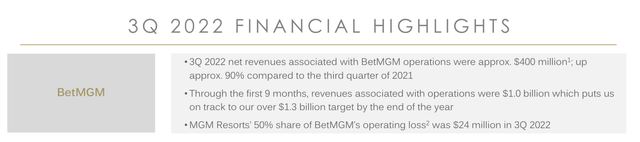

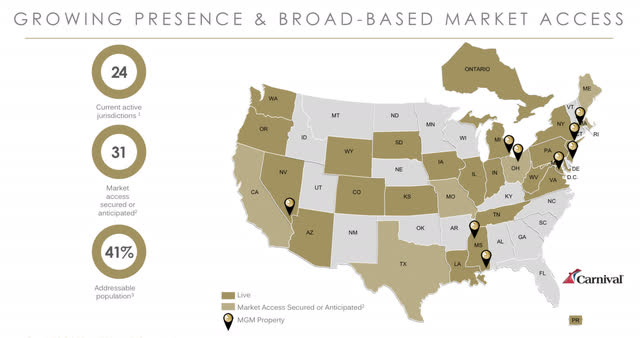

Up to now, BetMGM has been more or less unseen and concealed. Nevertheless, it is growing at an incredible rate, that by now it should be on every investor’s radar. BetMGM accounted for approximately $400 million or 11.7% of revenue. The new segment grew by at least 90% year over year. For the time being, the online betting operation is yet to be profitable.

Investor Relations Q3 22

Future estimates

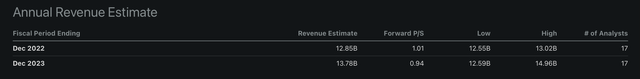

The reason for me to pick MGM as a top pick is all in the future estimate numbers. I argue that the revenue for Q4 2022 will surprise to the upside, therefore it would also beat the full year 2022 estimates. In addition, I argue that revenue for fiscal 2023 could surprise by a long shot.

Seeking Alpha

1. FIFA World Cup

Anyone that watched can agree that the 2022 FIFA World Cup has been one of the most exciting, if not the most exciting sport event ever in history. Since MGM owns one of the most popular sport’s betting platforms in America, there could have been a ‘little’ bit more traffic on there. I estimate that BetMGM will crush the numbers in Q4 and that we could see revenues above $600 million. Analysts expect Q4 revenue to be $3,314 million, which is lower than the Q3 revenue. I assume Q4 revenue could reach $3,500 million and that would align my year estimate with one analyst that estimated $13 billion for FY2022. I would not be surprised if BetMGM manages to be profitable in Q4, though they have probably spent more on marketing, which could offset margins.

BetMGM is still growing its market access across America. The online platform has recently been fully launched in Kansas. Massachusetts, Ohio, and Maryland have been added to the online sports betting portfolio. North America is still full of growth opportunities with only 41% access to the population.

The acquisition of LeoVegas will give exposure to the European online betting market. LeoVegas has presence in the United Kingdom, Nordic countries, Spain, and Italy.

Investor Relations Q3 22

2. Fast paced recovery China and major events in Las Vegas

Furthermore, I would like to debunk the FY2023 revenue estimates, in my opinion the numbers are conservative considering the reopening of Macau and major events hitting Las Vegas in 2023.

China’s policies have changed drastically in December and herd immunity seems to be the target of the government. Arrivals in Macau are no longer required to undergo PCR testing and China is considering to scrap hotel quarantine for overseas travelers next month. As we have seen in the U.S. the leisure business has recovered extremely well from the COVID pandemic. I do not think it will be any different in China. I have contact persons in China and all of them got COVID in a matter of days after some restrictions were lifted. Everyone is posting positive tests on WeChat. Even if, China turns back on the lifted restrictions, I argue that most have already been in contact with the virus. Therefore, a three-month period should be enough to re-start the Chinese economy. In 2019, MGM China brought in revenue of $2.9 billion. In 2022, $500 million is not even reached in the last 9 months. For 2023, Q1 and Q2 should still be rough for MGM China, but in Q3 and Q4 some clear recovery should come.

Additionally, major events are coming to Las Vegas in 2023. CES (consumer technology association) is the first one I want to discuss. CES is one of the most respected technology events in the world. AMD CEO, Dr. Lisa Su will be the keynote speaker of this year. The attendance numbers for 2019, 2020, 2021 and 2022 were respectively 182k, 171k, online and 45k. 2023 could break the trend again exponentially and receive an attendance of more than 100k.

Formula 1 is the second major event in November 2023. Demand is expected to exceed the 100,000 official tickets. It has been since 1982, that a race in Las Vegas was organized, therefore not many fans want to miss out this exceptional experience. Since Las Vegas has a maximum hotel capacity, high demand causes prices of hospitality to rise, which results into better margins and profitability for MGM. During the race, fans can experience it all on the Bellagio grandstands.

MGM Resorts IR

Valuation

Historically, MGM traded only a few times lower than 4.2x EV to EBITDA. In 2008 and 2020, the worst crisis of this decade, the stock went crashing down. All in all, in good times MGM never traded cheaply. 2017 and 2019 were record years, where the stock traded around 12x EV to EBITDA. Yet, MGM is valued at a crisis level of 4.2x EV to EBITDA.

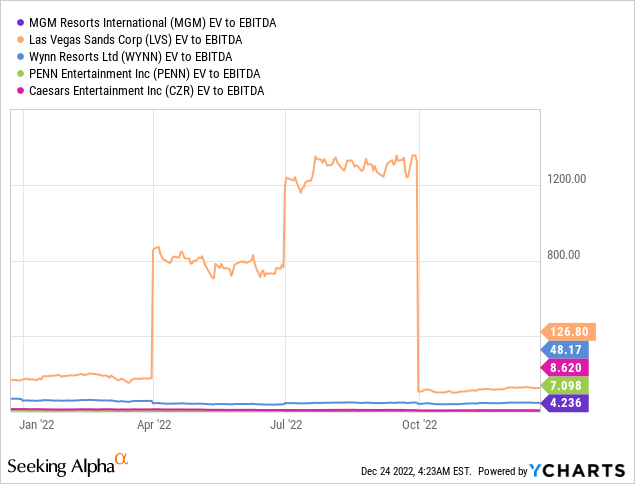

Moreover, in the hospitality sector MGM is trading valuation-wise way below peers. The stock has not been rewarded at all for their executing and well-managed business. Las Vegas Sands (LVS) and Wynn Resorts (WYNN) are struggling to make any meaningful profit.

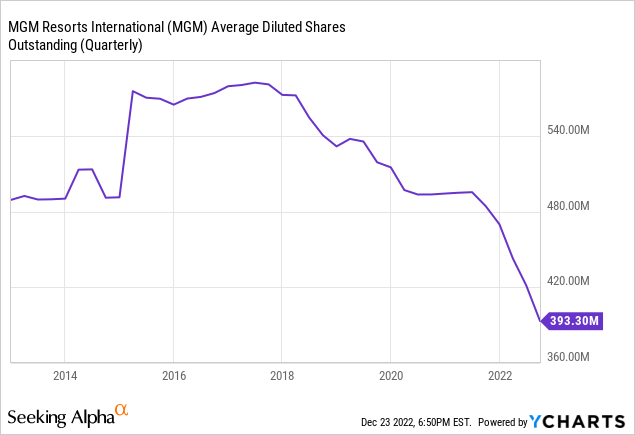

While the management agrees with me that their business is undervalued, they have repurchased 115 million shares since the beginning of 2021 for $4.4 billion or 32% of the market cap.

MGM’s balance sheet is a fortress with $5.3 billion in cash and cash equivalents or 40% of the current market cap ($13.5 per share).

Takeaway

A recession in the beginning of 2023 might have an impact on my investment thesis today. In spite of a possible softer start to the year, the second half of the year is set up well for earnings beats. The recovery of MGM China, the growth of BetMGM and the major upcoming events make 2023 a promising year. Personally, I do not expect the U.S. to face a major recession, as a result spending for middle and high class will still be present. Furthermore, MGM seems to be valued at a discount compared to the rest of the sector, while having the best balance sheet compared to peers.

In November 2022, the Chinese government announced that it has renewed the casino license of MGM Resorts in China. This makes MGM an excellent bet on the China recovering without worrying about delistings.

Development areas in Japan and New York create growth opportunities outside of 2023. Japan is expected to announce in 2023 the location of its first casino resort, which can be a catalyst for MGM Resorts.

Finally, at $33 a share the downside risk is rather low, knowing that the company holds $13.5 cash per share and can repurchase shares to balance any selling pressure. The company’s business performance and management execution led to a great recovery after the pandemic. At the current price, long-term investors are likely to get rewarded. I rate MGM Resorts a Strong Buy, as I see a mispricing in the market.

Thank you for reading and happy holidays!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!