NYCstock/iStock Editorial through Getty Pictures

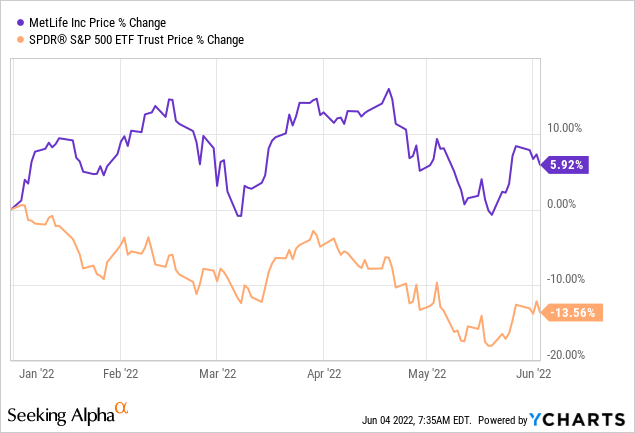

MetLife, Inc.’s (NYSE:MET) inventory has carried out extraordinarily nicely these days, because it has outperformed the broader market by virtually 20bps on a YTD foundation.

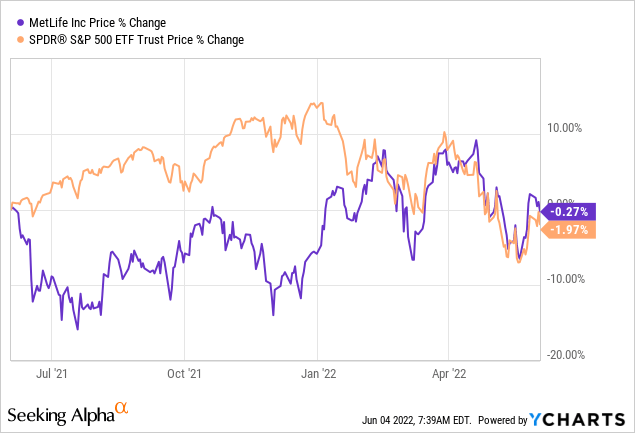

Nonetheless, trying additional again, MET shares have solely barely outperformed the broader market during the last 12 months.

I imagine the sturdy YTD inventory efficiency for this firm is a direct results of investor’s viewpoint that MetLife is in a fantastic place for the present market dynamics however, in my view, it helps that the corporate’s Q1 2022 outcomes present that the funding thesis for this international insurer stays intact.

The Newest, MetLife is Properly-Positioned for 2022

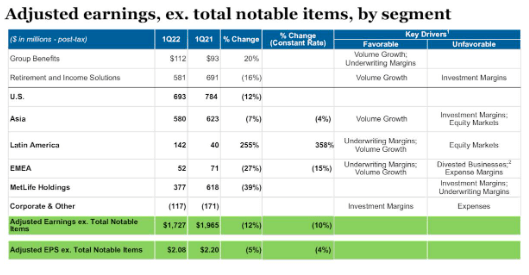

MetLife has reported sturdy working outcomes over the previous few quarters, and Q1 2022 was no exception as the corporate reported Q1 2022 outcomes that beat the consensus top- and bottom-line estimates. The corporate reported adjusted Q1 2022 EPS of $2.08 (beat by $0.45) on income of $17.7bn (beat by $910mm).

MetLife’s Q1 2022 Earnings Slides

The highlights:

- Quarterly adjusted premium, charges, and different income elevated by 12% YoY (to $12.7bn).

- Quarterly adjusted internet funding revenue decreased by 19% YoY (to $4.3bn) that was largely pushed by decrease variable funding revenue.

- Adjusted Guide Worth per share was $57.12 at Q1 2022 (in comparison with $53.16 at Q1 2021).

- Repurchased $915mm price of shares through the quarter, and the board approved a rise of $3bn to the corporate’s complete buyback program.

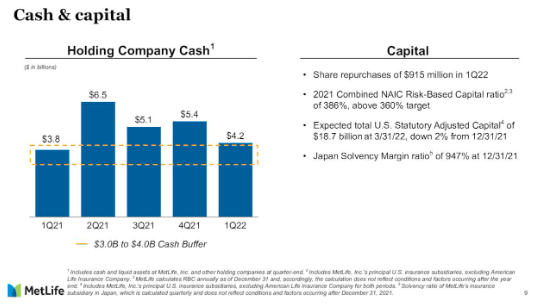

The corporate’s sturdy Q1 2022 outcomes had been well-received by the market, however buyers did appear to be extra considering administration’s commentary on how MetLife is positioned for the second half of 2022, and rightfully so. Administration was ready for the dialogue, they usually did a fantastic job highlighting the steps which have already been taken to cope with the financial uncertainty, beginning with sustaining extra money and constructing liquidity.

MetLife’s Q1 2022 Earnings Slides

Moreover, the administration workforce famous that MetLife will obtain proceeds from the sale of its Poland enterprise (~$700mm) in Q2 2022, which is able to add to the corporate’s already stable money place.

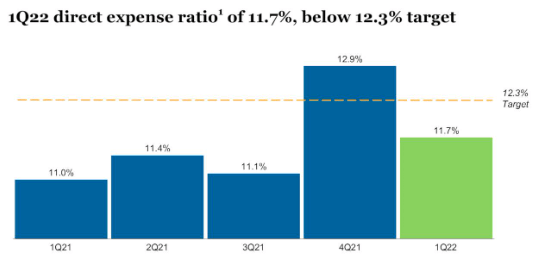

As well as, through the convention name, the insurer’s right-sized expense base was highlighted, which got here on account of administration’s multi-year give attention to streamlining operations and chopping out pointless bills.

MetLife’s Q1 2022 Earnings Slides

As proven, direct bills had been nicely beneath the corporate’s goal ratio for the latest quarter, and administration totally expects extra of the identical all through the quarters forward.

The corporate’s money/liquidity place and bettering expense base are good causes to be considering MetLife, however I’d contend that the corporate’s capital return prospects must be seen as one of many principal causes to love this international insurer in at this time’s market.

A Capital Return Story

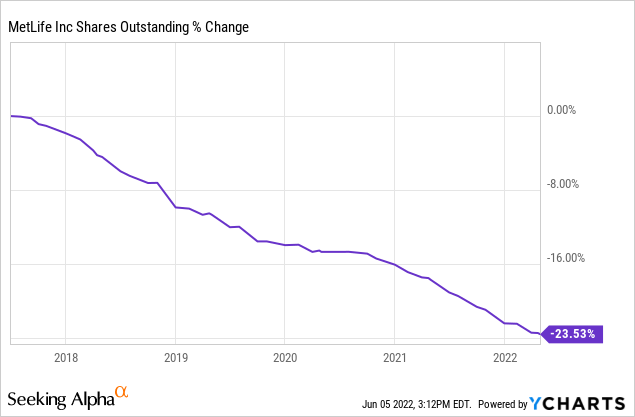

MetLife has been an especially shareholder-friendly firm. This firm has drastically lowered its share depend during the last 5 years.

It was an identical story in the latest quarter, as administration repurchased roughly $1bn price of the shares excellent throughout Q1 2022 and, as talked about above, the corporate continues to be flush with extra money. Due to this fact, buyers ought to start to bake in expectations for extra shares to be repurchased by the following few years.

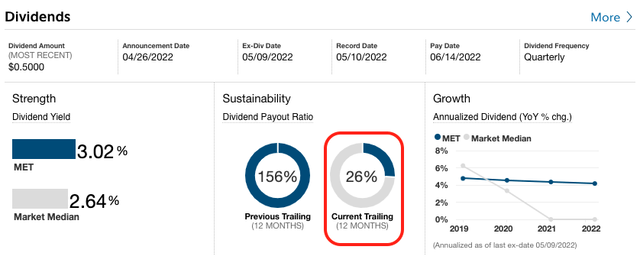

Plus, let’s not overlook that MetLife has an above-average dividend, and it has sufficient wiggle room to develop the payout within the years forward.

Constancy

Word: The earlier 12-month dividend payout ratio elements in quite a lot of noise, so buyers ought to pay much less consideration to it.

On the finish of the day, buyers ought to anticipate for this capital return story to proceed nicely previous 2022.

Make no mistake about it, MetLife’s near-term enterprise prospects will largely rely on administration’s capacity to squeeze out different funding returns, capitalize on the rising rate of interest setting, and correctly handle the corporate’s expense base, however in my view, returning capital is (and can proceed to be) a significant factor of the long-term funding thesis. And to this particular level, I imagine MetLife is well-positioned for 2022 and past.

Valuation

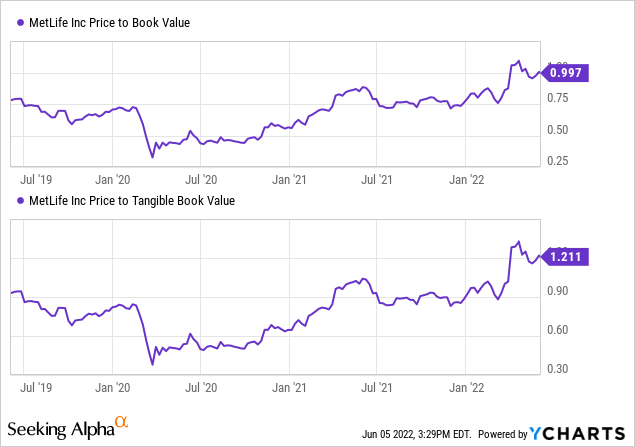

MetLife’s inventory is at present trending above its personal historic valuation metrics.

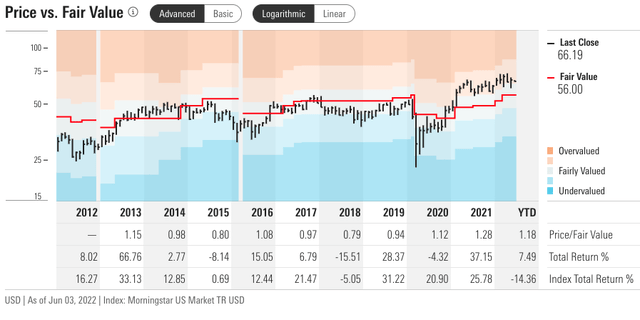

Moreover, the inventory is buying and selling well-above Morningstar’s honest worth estimate.

Morningstar

Whereas MetLife will not be as attractively valued because it was a couple of years in the past, I imagine that buyers are being paid to be affected person as the corporate’s capital return story performs out. Plus, it is a case of you get what you pay for – MetLife is richly valued, however for good motive.

Dangers

The largest danger for any insurer, together with MetLife, is the sufficiency of the corporate’s reserves. The corporate will doubtless have immaterial one-off reserve costs on a considerably constant foundation, however any materials adjustment may negatively affect the inventory worth.

The COVID-19-related impacts must be monitored, however buyers ought to now not view this as a significant danger issue, a minimum of in the meanwhile.

Lastly, buyers must additionally contemplate what’s shaping as much as be a difficult macro setting. A deteriorating financial system would finally negatively affect the monetary sector. As such, MetLife’s inventory would doubtless be beneath strain if the US entered a recession.

Backside Line

The corporate’s Q1 2022 outcomes had been sturdy virtually throughout the board, and most significantly, the earnings materials and administration commentary confirmed that the long-term funding thesis for MetLife stays intact.

Merely put, it seems that MetLife’s administration workforce has the corporate correctly positioned from each an operational and monetary standpoint. The inventory could expertise volatility over the following few quarters attributable to broader market considerations, however in my view, buyers with a long-term perspective ought to contemplate including MET shares on any vital pullbacks.

Disclaimer: This text will not be a suggestion to purchase or promote any inventory talked about. These are solely my private opinions. Each investor should do his/her personal due diligence earlier than making any funding resolution.