Michael Vi/iStock Editorial via Getty Images

We encouraged retail value investors over the past few difficult years to consider companies specializing in food, tech, energy, defense, home improvement, and healthcare. Add insurance to the list, especially MetLife, Inc., the holding company for Metropolitan Life Insurance Company (NYSE:MET). Hold MetLife shares for the long term if your guiding motto is “safety first.”

A Seraphic Service

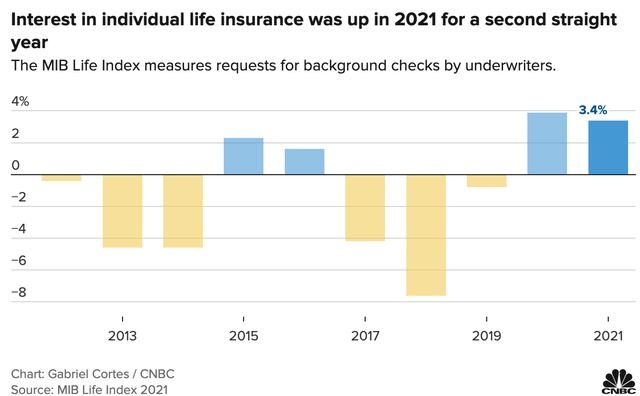

The pandemic sparked a windfall in insurance companies’ profits in the first half of 2021. According to a CNBC report, “Individual U.S life insurance application activity increased by 3.4% in 2021, following a record-breaking year-over-year growth of 3.9% in 2020.”

Subsequently, there was a steady decline. MetLife’s shares collapsed to about $23 in March ’20. The pandemic forced businesses to close cutting into property and casualty revenue. Payouts for health and death benefits jumped. 2020 payouts to beneficiaries popped 15.4% in 2020 over 2019 and another 11% in 2021 over 2020.

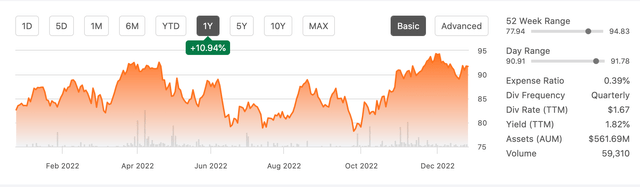

The industry’s finances improved in 2022. We forecast continued growth and better balance sheets continuing on the path to recovery. For example, the largest insurance ETF is iShares U.S. Insurance (NYSE:IAK). Seeking Alpha’s Quant Rating is now a strong buy for IAK.

IAK share price (seekingalpha.com/symbol/IAK)

Demand is Strong

The industry is essential to capitalism and seraphic, as Mark Twain characterized insurance. Owning it mitigates risk. In Jewish Law, a beneficiary recites a blessing when one receives an inheritance including a policy payout.

Property and casualty insurance account for 53% of the $1.4T total U. S. insurance premiums paid in 2021. Life insurance and annuities are 47%, according to S&P Global Market Intelligence.

One industry analyst firm expects new all-time premium collection records.

Demand for insurance (cnbc.com/2022/12/01/how-covid-has-changed-life-insurance-underwriting.html)

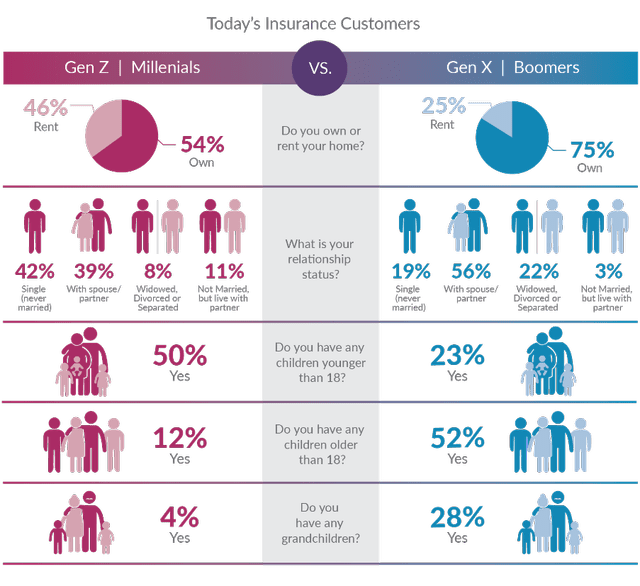

Denise Garth, writing in the Insurance Innovation Reporter, expects to see more interest in insurance coverage from

Gen Z and Millennials. They are now the dominant buyers for both life and non-life insurance products with a focus on five specific segments: life/health/accident, employee/voluntary benefits, auto, mobility, and homeowners/renter’s insurance…Millennial and Gen Z life journeys have not followed the traditional path set by older generations, with high percentages remaining single and not married but with partners. They have made other significant lifestyle shifts from older generations that result in different risk needs that require different insurance needs.

Who owns insurance (/iireporter.com/big-changes-for-insurance-gen-z-millennials-make-bold-moves/#:~:text=The%20Gen%20Z%20and%20Millennial%20Lens&text=They%20are%20now%20the%20dominant,%2C%20and%20homeowners%2Frenter’s%20insurance )

Legacy Company

MetLife is a 150-year-old legacy American insurance company. It is the 10th largest in the world. It is in the top 50 biggest U. S. businesses. It is the third largest life insurer with a +7% market share. It is the largest in the country based on life insurance in force. MetLife offers financial products for individuals and businesses, savings and retirement instruments, property and casualty insurance.

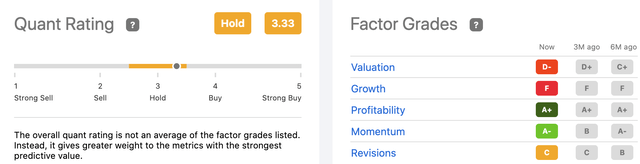

Rating agencies give MetLife and its subsidiaries high marks for financial strength and credit. MetLife gets high Seeking Alpha Factor Grades from an investment perspective for its profitability and momentum. It is a perpetually slow growth operation and the share price potentially undervalued because of weaker earnings.

Quant/Factor Grades MET (seekingalpha.com/symbol/MET/ratings/quant-ratings)

MetLife is big with a $56.3B market cap. It is profitable and offers a safe and consistent dividend. The forward yield of 2.77% is attractive. The stock enjoys +40K followers on Seeking Alpha. It is a bulwark in any portfolio against the whims that recently struck other industries of late.

The company is well-capitalized and liquid. It held $5.2B in cash and equivalents in September ‘22. At the end of Q3, the company announced it is on target to complete its authorized $3B repurchase of stock. MetLife also made 14 acquisitions, 5 in the last 5 years, and 56 investments primarily in insurance and financial services. Short interest is a low 1.43%. The price-to-earnings is 10.

MET shares are +14.3% YTD, up 17% for the last year, and 42.4% for the past five years. The high-low pattern of its share price almost mirrors that of IAK. The share price spent years meandering in the $40s and low $50s. During the past 12 months, the stock dived three times to around $61. On July 14 ’22 to its 52-week low of $57.91. In November, when the company reported third-quarter results, the share price nearly hit its 52-week high ($77.36) but tumbled the next three weeks to close recently at a monthly low at ~$71.

Headwinds

SA’s transcript of the last shareholder meeting quotes management telling shareholders its greatest headwind going forward is “variable investment income.” MetLife’s Q3 reported revenue of $22.27B that beat estimates by $1.69B, but on the whole the picture is not so good per a statement in the transcript:

Excluding notable items, adjusted earnings in the quarter were $1.16 per share. Net income in the third quarter was $331 million compared to $1.5 billion a year ago, primarily driven by lower adjusted earnings and derivative losses from hedges we hold to protect our balance sheet as well as investment losses from standard investment activity. In the third quarter, variable investment income was a loss of $53 million. Private equity is the largest contributor to VII and generated a negative 1.3% return in the quarter.

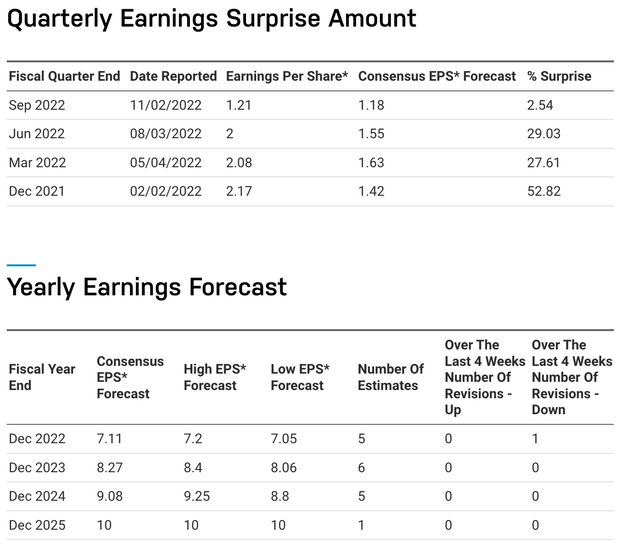

The company next reports on February 1, 2023.

MetLife Earnings (nasdaq.com/market-activity/stocks/met/earnings)

In addition to the S A Quant Rating hold recommendation, a Jefferies analyst downgraded MET earlier this month to hold. The analyst fears lower returns from an impending recession. 40 hedge funds owned MET shares in Q3 ’21 but 36 owned shares at the close of this third-quarter; funds sold $1.7M worth of shares in the last quarter. Corporate insiders sold nearly $600K worth of shares in the last three months.

We want to call attention to two other headwinds. Baby boomers are approaching the end-of-life stage. There are already pressures for payouts, since our generation is heavily insured. As customers, boomers will have to be replaced. The last time MetLife revamped its image was in 2016 (after 30 years). It is time to do it again.

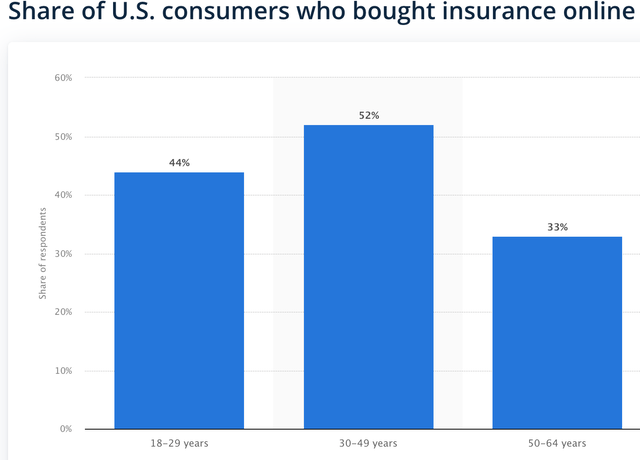

The other headwind is to create brand awareness among Millennials and Gen Zers. That requires having a digital-first, social media marketing program. We have not heard much about this from management. In our opinion, the company does not adequately address the challenge. Its home website and social media placements are not attractively interactive. This headwind is worrisome because AgentSync claims that studies show most beneficiaries of inheritances are not going to stick with the financial planners of their parents.

The insuretech market’s annual CAGR is forecast to be 51.7% over the next 8 years. The number of people buying insurance online in 2021 reflects the changing trends suggesting these companies will be stiffer competition for MetLife in the life and property and casualty insurance sectors.

Insurance consumers (.statista.com/statistics/228672/consumers-who-bought-insurance-online-in-the-last-12-months-usa/)

The Takeaway

MetLife, Inc. is a safe investment to have in a retail value investor’s portfolio. The company is one the nation’s biggest operating in an industry essential for business security and personal financial safety. Bearish signals put the stock on hold. Over the long-term, MET shares can potentially achieve an average price target into the mid-$80s with better, more consistent earnings. Meanwhile, an investor collects a safe and consistent dividend with an excellent yield.

There are headwinds. Premium rates are under pressure from online competitors. Payouts for claims are up due to inflation. Claim numbers is up from turbulent weather conditions and deaths from COVID and more cases of influenza. On a positive note, demand for insurance coverage is ticking up. Despite a healthy cash stash and buybacks of shares, the stock volatility is worrisome to some investors. Management might want to acquire a business that will take MetLife more aggressively into the social media sphere to build brand awareness among the next two generations.

In the meantime, investors are advised to hold shares and watch for dips in the share price for a worthwhile long-term investment. Perhaps that is what hedge fund managers and corporate insiders are doing.