JHVEPhoto

We Take Our Own Advice

We own and keep buying shares of Merck & Co., Inc. (NYSE:MRK). We also grow our holdings through the dividend reinvestment plan.

We rated the stock a Buy to Strong Buy in our August ’21 article for Seeking Alpha. The stock flatlined between April 2020 and March ’22 at ~$76 each. More shares were added to our portfolio. We reiterate the Buy rating at present; the price hit $88 last October and kept rising to over $111 each. A recent dip of Merck & Co shares has it at about $105 closing out March ’23. This dip offers a potential opportunity for retail value investors, in our opinion.

Over the past 5 years, the share price is +105.37%. It is up 28.5% over the past 12 months. Being -4.7% YTD offers an opportunity. Reasons to doubt Merck’s potential abound when weighing one’s investment strategy. Keep in mind this is a humongous company with a market cap of $268.9B. There are always going to be nay-sayers. Most recently, for instance,

- Societe Generale downgraded Merck & Co to a Hold rating in March, because of its assessment that the company’s life-cycle management strategies for Keytruda are too little and too late to protect sales of the drug after its patents expire at the end of the decade.

- Merck’s cardiovascular drug pipeline will not be pumping revenue and profits for a while, according to one analyst.

- Wells Fargo & Co (WFC) analyst Mohit Bansal claims Merck is “priced to perfection” around $105 after generating 40% in returns from the 2021-year end.

- Merck announced in March ’23 its combination therapy in lung cancer fails its Phase 2 clinical trial.

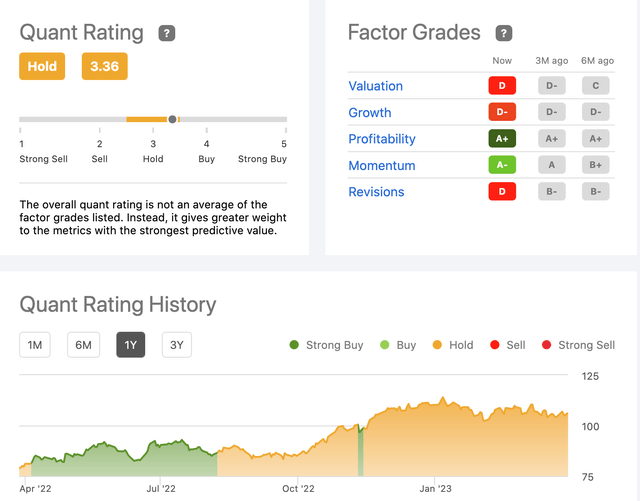

- Seeking Alpha’s Quant assessment of Buy ended last August ’22; Seeking Alpha’s Quant rating reassessment to Hold has been nearly consistent since then, despite the concomitant rise in the share price and admirable Factor Grades for profitability and momentum:

Ratings (seekingalpha.com)

Merck’s Market Power

Merck & Co ranks third as the largest biotech, medical equipment, human, and animal pharmaceutical company based on net income. While Merck shares show strength, the SPDR S&P Pharmaceuticals ETF (XPH) moved lower by 10.8% this past year and S A’s Quant Rating is assessed at a Sell rating. Merck’s PE is 15.12. Short interest is at a meager 0.77%. The Merck dividend yield forward is 2.7% and rates high in all categories for safety, growth, and consistency. The company’s total market power further underpins our investing confidence in Merck & Co shares.

Pharma operations focus on oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, diabetes, and preventive pediatric, adolescent, and adult vaccines.

Animal Health develops and markets veterinary pharmaceuticals, vaccines, and health management solutions and services as digitally connected identification, traceability, and monitoring products. The company collaborates with public and private companies in R&D and marketing since 1891. For instance, in March ’23, Merck and Opko Health Inc (OPK) announced signing a deal potentially worth almost $1B to research, produce, and market a vaccine for Epstein-Barr virus prevention.

Other positive factors that we consider to complement our position include the 7.6% CAGR annual growth projected for the animal health market through 2030. Revenue in the human pharmaceutical market is projected to reach $1.16 in 2023. Oncology is the market’s largest segment. We forecast revenue growth will be in the range of 5.4% by 2027 with most revenue generated in the U S.

The greatest number in years of hedge funds invested in Merck & Co was 89 in Q1 ’22 when the share price was ~$78. Only a few sold shares with the rise in price; by Q4 ’22, 77 owned shares.

Downsides

Corporate insider selling might be a flag for downside risk to investing at the current high price. They have been selling shares as the price moved up. There was a spurt of buying at the close of 2022 and more selling last quarter when insiders sold ~$10M worth. Another is our estimate that the next EPS, to be reported on April 27, 2023, will likely be $1.37 compared to $2.14 for the same quarter last year and $1.53 in Q4 ’22. However, we note that Merck & Co beat analysts’ EPS estimates for the last 7 consecutive quarters and in 12 of the last 14 quarters.

62% of news coverage about the pharma industry is positive. News sentiment for Merck & Co is slightly more inimical with 57% characterized as positive.

S A analysts evenly split between rating the stock a Buy or Hold. Wall Street analysts rating the stock a Buy or Strong Buy outnumber those rating it a Hold or Sell 2-to-1. Yet S A’s Quant assessment for valuation is a D grade low. By most metrics, Merck enjoys a B grade. Price-to-book gets a D; PEG GAAP and price-to-sales get a C+. The grades are relative to the health sector.

A Stock We Value

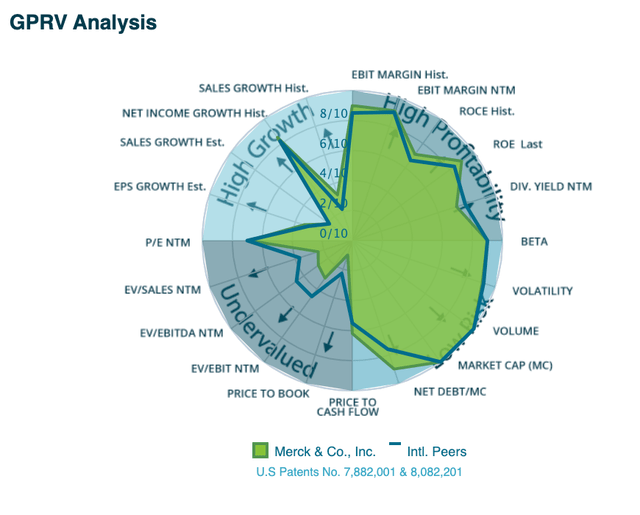

We believe Merck & Co shares are undervalued and deserve a better rating for fair value. Its Beta is a slight 0.4 meaning the stock price is stable and steady, less volatile than the market, and other measures are equally reassuring this is a potentially good investment:

Analysis of Merck & Co (infrontanalytics.com)

Merck’s PE Ratio suggests to us that this is one of the better pharma investments compared to the PE Ratio of its giant pharma competitors. The stock is high-priced compared to the industry using the PE Ratio metric, but the industry has a plethora of small companies comprising the industry average.

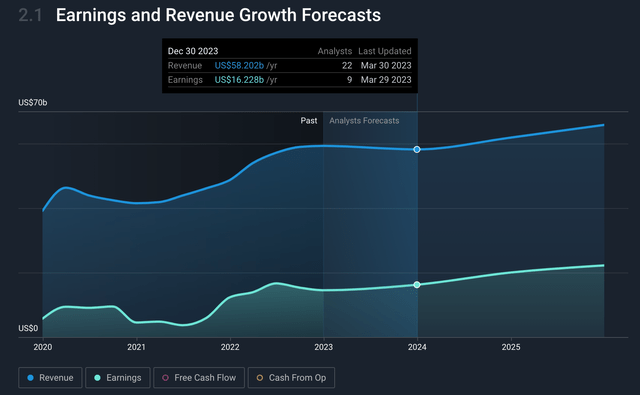

Merck’s forecast earnings growth, profit margins, and other factors make Merck & Co a fair value at the current price and better on any dip. The average price target we suggest as reasonable is a high of $150 per share over the next year. We might be conservative in our estimate if revenue and earnings grow +11% and EPS beats the estimate once again.

Earnings & Revenue (simplywall.st)

Merck & Co continues to impress us. Its Keytruda drug has 5 more years before it comes off patent. There is no reason to expect sales or profits of the drug to dramatically fall for many years after the patent ends because the drug has wide applications and a solid reputation. The company has more than 60 others in clinical development, a robust balance sheet, and free cash flow. One of management’s greatest strengths is transparency leaving it open to partnering with others and deal-making from a position of market power. This can only make Merck & Co healthier in the future.

:max_bytes(150000):strip_icc()/Beans-a5fd4ef5f4ca4b36a7e28f419c487bb3.jpg)