hannurama

Over the last year Mercer International Inc. (NASDAQ:MERC) has outperformed the sector median as measured by profitability, but over the last five years, has underperformed it.

The company really hasn’t made any improvement on its share price over the long term, but for patient investors that wait for a low entry point, it does provide opportunity for predictable returns based on its historical price movement and demand for its products.

I don’t think the company is going to do as well over the next year as it has in 2022, as demand is probably going to be subdued and pricing power limited. Costs and expenses are likely to be higher in 2023, and the bottom line under more pressure than it has been in the recent past.

In this article we’ll look at some of the numbers, how demand looks over the next year, and why the share price probably has further to drop before it finds a bottom.

TradingView

Some of the numbers

Revenue in the fourth quarter of 2022 was $583.06 million, up 12.35 percent year-over-year, and beating by $87.12 million. In the third quarter of 2022 revenue was $66.7 million, or $1.01 per share. Revenue for full year 2022 was $2.28 billion, compared to revenue of $1.8 billion for full year 2021.

Operating EBITDA in the reporting period was $96.1 million, compared to operating EBITDA of $164.9 million in the fourth quarter of 2021, down 42 percent year-over-year. Operating EBITDA for the third quarter of 2022 was $140.8 million. For full year 2022, operating EBITDA was $536.5 million, compared to operating EBITDA of $478.8 million for full year 2021.

Net income in the fourth quarter of 2022 was $20.00 million, or $0.30 per diluted share, compared to net income of $74.5 million, or $1.13 per diluted share in the fourth quarter of 2021. Net income in the third quarter of 2022 was $66.7 million, or $1.01 per share. Net income for full year 2022 was $247.00 million, or $3.71 per diluted share, compared to net income of $171.00 million, or $2.58 per diluted share in full year 2021.

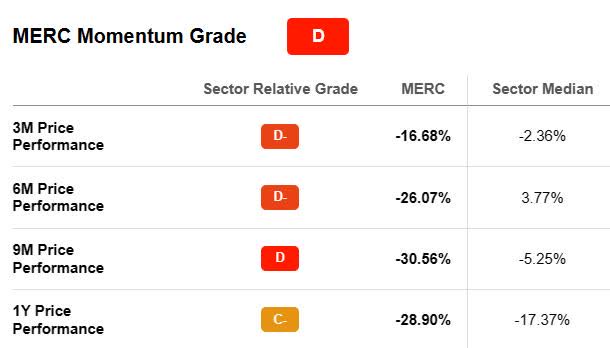

Normally I don’t include sequential numbers in my articles, but this was an exception because I wanted to point out the declining momentum of the company during this period of time. Measured against the sector median, it’s significantly underperforming over the last year. That’s likely to continue in 2023 because of lower demand and rising costs.

Seeking Alpha

Costs and expenses were of particular concern in the reporting period, as they jumped from $323.00 million in the fourth quarter of 2021 to $394.3 million in the fourth quarter of 2022. The increase in costs and expenses was attributed to an increase in chemical costs, unit per fiber costs, and maintenance costs.

At the end of calendar 2022 the company had cash and cash equivalents of $354.00 million, compared to cash and cash equivalents of $345.6 million at the end of calendar 2021. The company also had $281.6 million available under its revolving credit facilities at the end of calendar 2022.

The company had long-term debt of $1.35 billion at the end of calendar 2022.

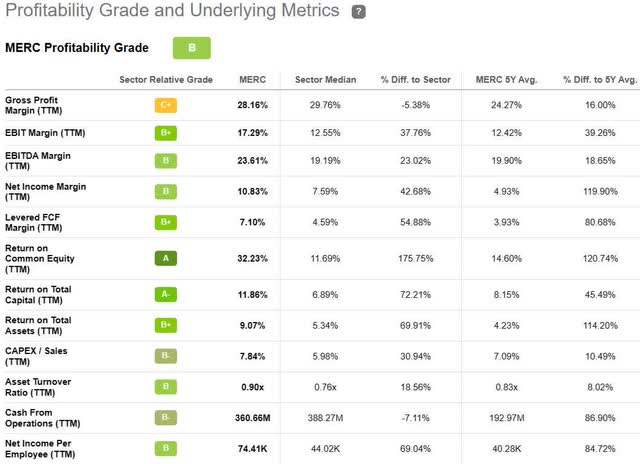

Profitability

Even though MERC has recently been outperforming the sector in most profitability metrics, it has been declining rapidly, and it appears things are going to get worse before they get better because of slowing demand and rising costs.

It should also be taken into consideration that over an average of five years, the company has, in many profitability metrics, underperformed its competitors.

Seeking Alpha

Gross margin (TTM) has been one of a couple of underperforming metrics for the company, coming in at 28.16 percent, with the second median being 29.76 percent, lower by 5.38 percent. But the more important net income margin (TTM) was 10.83 percent, compared to the sector median of 7.59 percent, higher by 42.68 percent.

Return on equity (TTM) was 32.23 percent, compared to return on equity of 11.69 percent for the sector median, higher by 175.57 percent.

The other metric it underperformed the sector in was cash from operations (TTM), which was $360.00 million, compared to the sector median of $388.27 million, down by 7.11 percent.

I think the numbers are going to be lower going forward for these reasons.

Unit fiber costs in the fourth quarter of 2022 were up 43 percent year-over-year, with higher per unit fiber costs occurring at all its mills. In the first quarter of 2023 management expects fiber costs per unit to be slightly down in Germany and flat in Canada, primarily from falling demand for wood and energy uses.

Pulp prices in Europe and North America are expected to drop in the first half of 2023, with NBSK pulp prices in China rising modestly in the first half of 2023. It remains to be seen what those offsetting factors will be, primarily from not knowing how much demand from China will increase, along with the expected increase in prices in that market.

In the fourth quarter of 2022 the NBSK net price in China was $920.00 per ton, down $49.00 per ton from the third quarter of 2022. If the company is going to benefit from an increase in demand from China, NBSK prices per ton are going to have to jump higher.

On the lumber side of the market, the U.S. and European markets were soft in Q4 2022, with the benchmark for Western SPF 2 and Better average $410.00 per 1,000 board feet, down $170.00 sequentially. That has improved, with the benchmark U.S. lumber price climbing to $455.00 per board foot. While better, it still has a long way to go before returning to prior levels.

What this suggests is, MERC could continue to increase revenue, but under current market conditions, it appears it’s going to do so at the expense of the bottom line.

Conclusion

The pulp markets continued to weaken in the reporting period, with lumber markets weakening even more in Q4 2022. Shipping palette and heating palette prices were also depressed in the quarter.

Going forward, it looks like the U.S. and European markets are going to remain weak, while the Chinese market, because of it opening up more, could be a catalyst to offset some of the expected underperformance in Europe and the U.S.

Based upon the numbers, it seems pulp and lumber prices are going to remain subdued for at least the first half of 2023, and I think it’s too early to draw the conclusion they will improve in the second half. That’s especially true when considering we have no idea what the condition of the global economy will be at that time.

MERC recently hit its 52-week low of $9.44 per share on March 16, 2022, and while bouncing modestly off that level, I believe current market conditions, higher costs, and lower demand point to the stock having a higher percentage chance of falling further than sustainably moving higher.

That said, it is starting to reach interesting levels, and if there is another downward push in the share price of MERC, it may be worth taking a serious look at if the entry point is attractive enough.

Looking at 2-year and 5-year charts, it requires a good entry point and low costs basis to offer a chance at decent returns. The high for the company over the last five years was slightly above $19.00 per share, which it reached on October 1, 2018, and since then its highs have been a little over $17.00 per share. That’s why it’s imperative to get in low on this cyclical stock.

On the low end of the play, the share price has dropped several times to approximately $6.00 per share, but hasn’t been to that level since October 26, 2020.

The bottom line is, MERC isn’t a buy-and-hold stock, but a stock that must be acquired at the low end of a cycle and held for a relatively short period of time, by which I mean under a year. Historically it has recovered every time after a significant correction, and I see no reason why it won’t do so again.

I don’t see any immediate reason to take a position in MERC stock, but if it does correct further, it could provide a nice opportunity to generate some decent returns over the next year or two.