AntonioSolano

MELI’s Funding Thesis Stays Strong – With Raised Double Digit Progress Prospects

We beforehand lined MercadoLibre, Inc. (NASDAQ:MELI) in April 2024, discussing how our really useful entry level had materialized then, with the inventory charting the predictable buying and selling sample since the June 2022 backside because the administration constantly delivered on its worthwhile progress initiatives.

Mixed with the double-digit progress recorded within the promoting phase, we imagine that it’d stay a long-term winner with a superb upside potential over the following few years.

Since then, MELI has already rallied by +14.8%, nicely outperforming the broader market at +8.6%. Even so, we’re reiterating our Purchase score, as a result of double beat FQ1’24 earnings name, rising market share in Latam, and sturdy efficiency metrics.

We will even be highlighting a couple of metrics to look out for within the upcoming earnings name on August 02, 2024, with it underscoring the well being of MELI’s companies together with near-term prospects.

1. Competitors From Shopee & Amazon

Based mostly on Statista, MELI reviews 15.4% in e-commerce market share in Mexico in 2023 (inline YoY), with the opposite competitor being Amazon.com, Inc. (AMZN) at 11.2% (-2 factors YoY).

The identical market management has additionally been noticed in Brazil, with MELI main at 28.9% (+4.5 factors YoY) and AMZN inserting second at 23.2% (+5.6 factors YoY).

These two areas are essential certainly since MELI reviews 22.4% of its revenues from Mexico (+3.3 factors YoY) and 59.3% from Brazil in FQ1’24 (+8.1 factors YoY).

On the identical time, the corporate has needed to deal with a brand new competitor, Sea Restricted’s (SE) Shopee, which has been aggressively increasing their investments and e-commerce/ fintech choices within the Latam area.

This naturally explains why Shopee’s market share in Brazil has additionally expanded to 9.2% by 2023 (+0.5 factors YoY), constructing upon the immense progress noticed since late 2019.

As of Could 2024, Shopee at 201M visits in Brazil (+10.8% MoM) has additionally crushed Amazon at 195M visits (+3.4% MoM). Whereas MELI stays the undisputed market chief at 363M visits (+6.6% MoM), SE’s double-digit growths cannot be ignored certainly.

Due to this fact, whereas market analysts nonetheless anticipate Latam’s e-commerce GMV to develop tremendously from $182.7B in 2023 to $269.8B in 2028 at a CAGR of +8.1%, with the market sufficiently big to accommodate a number of gamers, the intensifying market competitors might probably set off the deceleration of MELI’s worthwhile progress pattern.

Readers might need to take note of MELI’s execution and the administration’s commentary within the upcoming earnings name certainly, regardless of the sturdy QoQ/ YoY progress in its efficiency metrics in FQ1’24.

2. Argentina Devaluation & Increasing Credit score Dangers

For reference, Argentina continues to face eye-watering inflation of 276.4% in Could 2024, in comparison with the US at 3.37% and the worldwide common of 5.9%.

With the federal government nonetheless printing cash and Pesos dropping worth, it’s unsurprising that the continuing concern within the nation has triggered headwinds to MELI’s operations for the reason that nation contains 14.1% of the corporate’s revenues in FQ1’24 (-9.6 factors YoY).

The YoY decline isn’t a surprise as nicely, because the Argentine Pesos misplaced a lot of its worth over the previous few years – resulting in a a lot weaker macro surroundings and client spending developments.

Even so, readers should word that the hyperinflation in Argentina has been considerably easing from the 292.2% reported in April 2024, with issues prone to additional enhance transferring ahead if the brand new authorities’s devaluation course of continues as anticipated.

Whereas MELI continues to report blended efficiency within the e-commerce phase in Argentina, the administration has already doubled down on its fintech enlargement. This has led to the sturdy progress noticed within the lively consumer base and belongings underneath administration, well-balancing the e-commerce headwinds.

The identical optimism has already been guided from FQ2’24 onwards, with the FX headwinds normalizing relative to different Latam nations.

However, readers might need to monitor MELI’s non-performing loans in Argentina together with Brazil and Mexico, for the reason that administration’s fintech efforts have additionally led to the expansion in its mortgage originations to $4.44B (+7.2% QoQ/ +71.2% YoY) and early delinquencies < 90 days at 9.3% (+1.1 factors QoQ/ +1.5 YoY) in FQ1’24.

Whereas the administration has highlighted that the credit score dangers stay inside limits, it’s unsure what the long-term impression could also be, regardless of the nonetheless increasing Internet Curiosity Margin of 31.5% (-8.3 factors QoQ/ +0.9 YoY).

With the Latam inflation nonetheless typically larger than pre-pandemic ranges, we imagine that readers might need to take note of MELI’s intermediate-term fintech execution for the reason that phase contains 42.2% of its general FQ1’24 revenues (-5.2 factors YoY).

3. MELI Stays Extraordinarily Low cost For Its Accelerated Progress Prospects

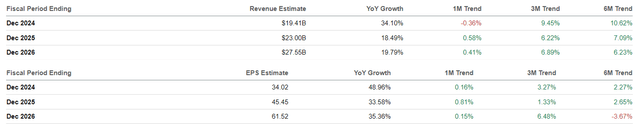

The Consensus Ahead Estimates

In search of Alpha

For now, given the sturdy FQ1’24 efficiency and the administration’s hiring blitz in 2024, it’s unsurprising that the consensus is more and more optimistic about MELI’s prospects, as noticed within the accelerated prime/ bottom-line progress projections at a CAGR of +23.9%/ +39.1% by FY2026.

That is in comparison with the earlier estimates of +18.8%/ +26% and historic progress at +50.1%/ +31.7% between FY2016 and FY2023, respectively, implying its capacity to constantly generate excessive double-digit progress.

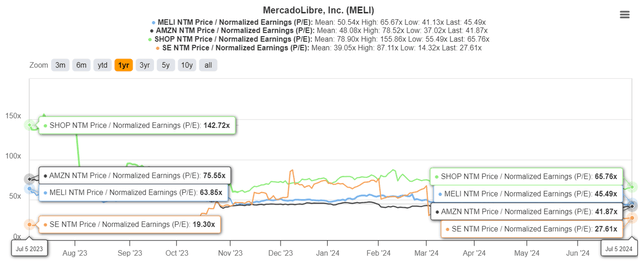

MELI Valuations

In search of Alpha

Because of the accelerated progress prospects, we imagine that MELI seems to be very low cost at FWD P/E valuations of 45.49x, in comparison with its 1Y imply of fifty.54x and 3Y P/E imply of 115.18x.

It’s because the inventory continues to commerce close to to its well-diversified e-commerce/fintech/logistics friends, equivalent to AMZN at FWD P/E valuations of 41.87x, Shopify Inc. (SHOP) at 65.76x, and SE at 27.61x.

That is very true after evaluating MELI’s prime/ bottom-line progress prospects by FY2026, to AMZN at +11.1%/ +37.3%, SHOP at +21.1%/ +32.4%, and SE at +14.1%/ +93.2%, respectively, implying that the previous is buying and selling at comparatively low cost valuations given the accelerated worthwhile progress prospects, apart from SE in fact.

So, Is MELI Inventory A Purchase, Promote, or Maintain?

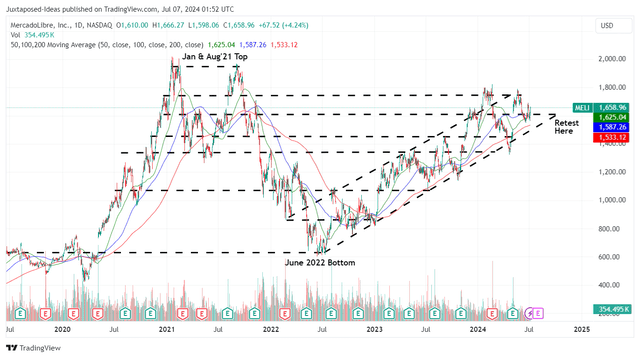

MELI 5Y Inventory Worth

TradingView

For now, MELI’s buying and selling sample has materialized as anticipated, with the inventory’s uptrend nonetheless nicely supported for the reason that June 2022 backside and our really useful entry level of $1.45K in December 2023.

On the identical time, with the consensus lately upgrading their FY2026 adj EPS estimates from $58.41 to $61.52, we will even be updating our long-term value goal from $2.62K to $2.76K – primarily based on the steady FWD P/E of ~45x, with it providing a superb upside potential of +66% from present ranges.

With the Argentina devaluation already behind us and issues normalizing from Q2 onwards, we imagine that MELI might simply beat the consensus FQ2’24 estimates, considerably aided by the administration’s intensified fintech enlargement in Brazil and Mexico as extra customers undertake its vertically built-in choices.

Mixed with the sturdy progress in its promoting phase and its rising market share throughout the e-commerce/ logistics phase, we’re reiterating our Purchase score.

traders might take into account monitoring MELI’s inventory motion for just a little longer, earlier than including in accordance with their greenback value averages and danger urge for food, ideally at $1.52K primarily based on the established buying and selling sample, with these ranges naturally triggering an improved margin of security.