Wolterk

The one sector which is not particularly cheap in this market is healthcare. Viewed as a safety trade, many health insurers and large pharma/biotech are flirting with 52-week highs. One exception is the health care equipment industry, which includes Medtronic (NYSE:MDT).

So why are equipment/devices down, while insurers and drug companies up? The former were seen as a Covid reopening play. Elective and deferred surgeries were expected to boom. They did, but not to the degree expected.

Some also experienced busts in certain product segments as Covid hospitalizations largely subsided. It was a double-whammy for Abbott Labs (ABT) with their BinaxNOW at-home antigen test, whose demand has largely waned.

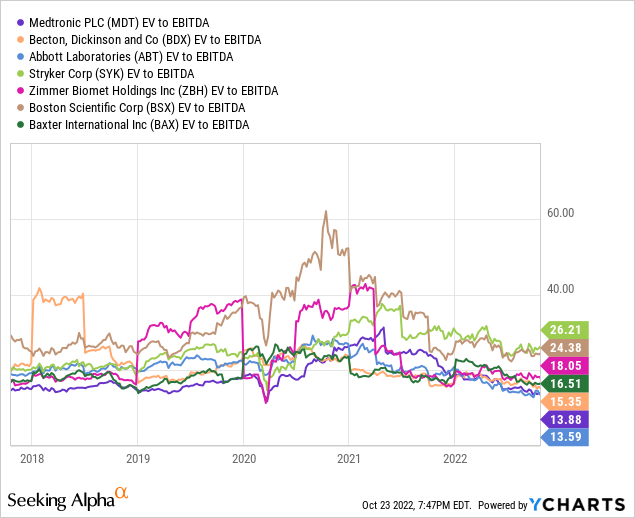

In addition to MDT and ABT, other peers such as Stryker (SYK), Becton, Dickinson (BDX), Boston Scientific (BSX), and Intuitive Surgical (ISRG) have also experienced sharp selloffs. Yet among these stalwarts, I’d argue MDT may be the most interesting.

It has something for everyone; a stellar dividend history, cheaper valuation than peers, and growth potential which is being ignored.

Let’s look at the dividend first

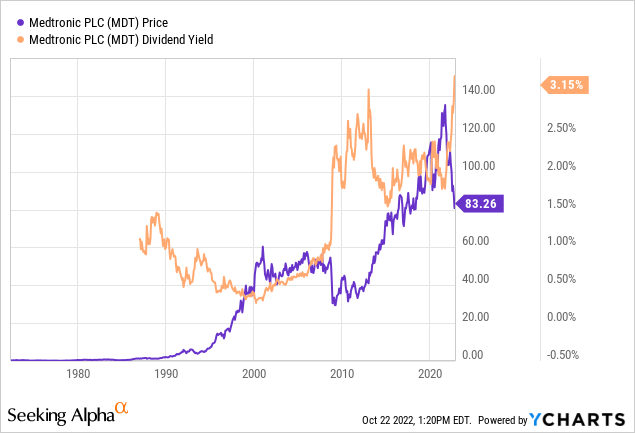

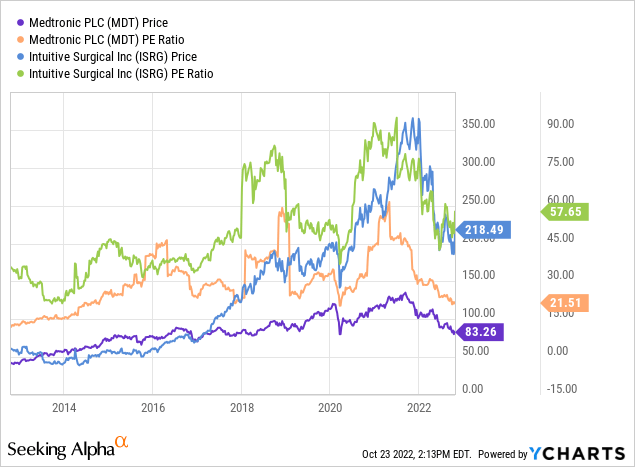

Unlike Intuitive Surgical, which is a high-growth, no-yield Nasdaq-100 name, Medtronic is boring. Boring is good though when it comes to dividends and this company has consecutively increased theirs for 45 years.

As you probably know, most financial websites only provide charting going back 10 or 20 years. The earliest dividend charting I can pull up only goes to the late 1980s (approximately 35 years). That’s probably because the dividend before that was less than one penny, when adjusted for splits.

Unless it was higher during its first ten years of paying dividends, today Medtronic trades at or near an all-time high yield north of 3%. That may not sound all that exciting with 10-year Treasuries back above 4% but amongst the major health care equipment manufacturers, this is high.

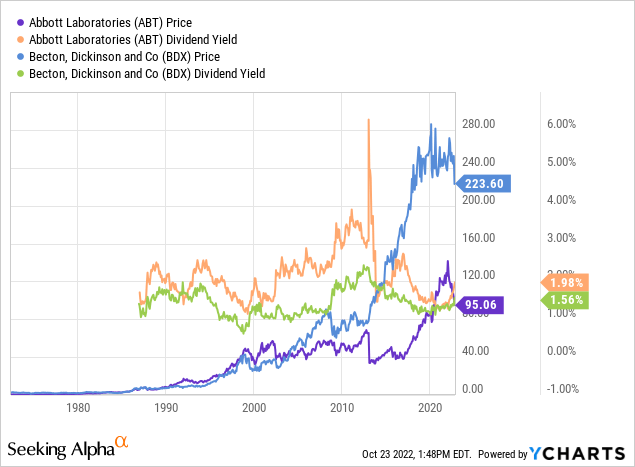

The closest rivals in terms of dividend quality and track record would probably be Abbott Labs and Becton Dickinson, each having 50 years of increases. Here’s how their yield history looks:

Ignore that spike in 2014 for Abbott. You may recall they spun-off AbbVie (ABBV) that year, which apparently is messing up the chart. The takeaway is that at 2% or even slightly below, Abbott’s current yield isn’t a deal. Its average % would be closer to the mid 2s. Similar for Becton, Dickinson.

Stryker is a dividend aristocrat with 28 years under its belt, but at 1.3%, it’s even less exciting for income.

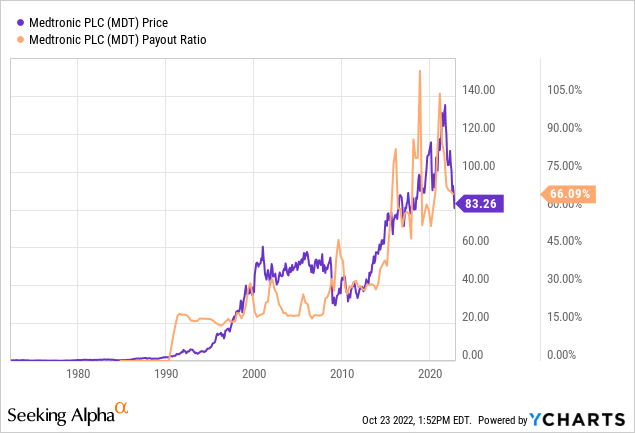

At 66%, Medtronic doesn’t have the most flattering payout ratio. However, they’re going through a tough couple years. Even if you revise down earnings estimates, that ratio should decrease moving forward, as long as they stick to modest dividend increases.

For the years ending April 2023 and April 2024, current consensus EPS estimates are $5.53 and $5.87, respectively. Those represent a P/E of 15 and 14, versus the current 21. The current dividend is $2.72 annually.

A boring business with high growth potential

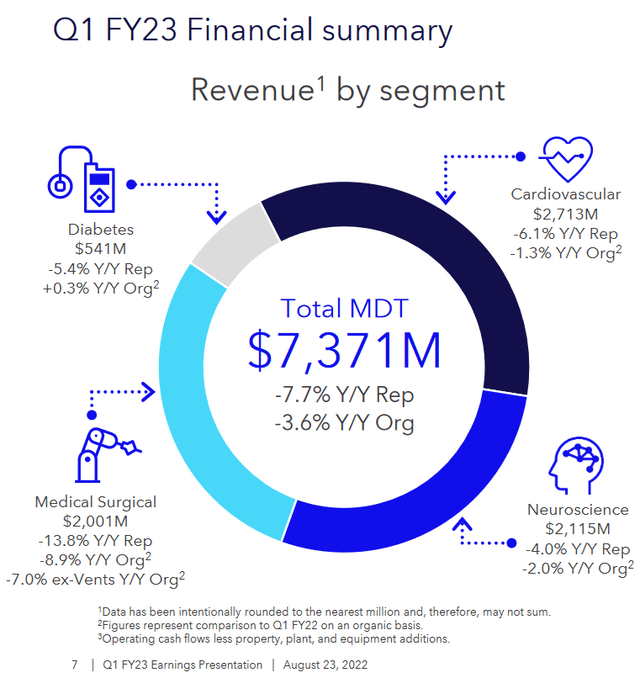

Medtronic is an S&P 100 component with over 95,000 employees worldwide. Below is their revenue breakdown as of the most recent quarter (Q1 FY23) which was reported August 23rd.

Medtronic

Their diabetes division has been garnering plenty of negative headlines lately, which has also further weighed on the stock. The FDA required them to recall their MiniMed insulin pumps. Subsequent quality control warnings were issued for their Northridge, CA manufacturing facility. Not good, but context is important; notice how small the segment is.

The bigger picture is this; Medtronic is one of the largest, most diversified medical device companies in the world. Their products are used for treating over 70 diseases and conditions relating to cardiac, renal, neuro, GI, and more. They have over 49,000 patents.

My favorite stocks are those which have a large and stable business (i.e. Medtronic), along with exciting prospect(s) for growth which are not being given much value by the market. In the case of Medtronic, this would be their robotic surgery division. Compare to Intuitive Surgical:

Intuitive Surgical has what is essentially a monopoly in the space at 80% and to be frank, that won’t change much this decade. The approval process for this equipment is even slower than drug development. Even after approval, the time it takes for widespread adoption is many years.

Robotic-assisted surgeries represent only a small single-digit percentage of all operations performed in the US (and even less abroad). Only some types of operations are approved. Once they are, adaption tends to grow rapidly.

One cohort study of 169,404 patients at 73 Michigan hospitals found the penetration went from just 1.8% to 15.1% in 6.5 years. Even though that’s 8x, there’s still growth ahead. Is 30% possible, which would be 2x? How about 50%, which would be 3x?

Intuitive’s da Vinci system costs around $1.5 mil but the real money comes in the consumables which must be purchased for every surgery. That recurring revenue, combined with early days of penetration (and no penetration for many surgery types) means that ISRG is not necessarily expensive today. In fact, I added at $188 a couple weeks ago.

How will Medtronic compete?

They got into the space in 2014 with their acquisition of Covidien. This led to the launch of the Hugo robot-assisted surgery (RAS) system. Medtronic’s VP of Marketing for Surgical Robotics, Mike Stow, said this in a May interview:

We looked at the current state of robotics going back 10-plus years, and we realized there was an opportunity for us to come in. Customers were saying, ‘Hey, could you make something more flexible that fits better into our rooms and into our hospital setting?’

What he means by that is the da Vinci systems are massive. You really build the space around the machine, rather than use a standard-sized operating room.

Medtronic

Hugo is less complex and less costly; about 20-25% cheaper. Both systems are well suited for urological and gynecological procedures. One expert who actually founded a school for teaching robotic surgery has said that Hugo’s four independent arms may work better for colorectal and general surgery, as well as abdominal access. There are pros and cons of each, which you can read using the aforementioned link.

To be clear, in no way am I suggesting Hugo will supplant da Vinci. Even to become a distant 2nd place contender will take many years. With over 10 million surgeries performed and most doctors in the space trained on da Vinci, it will be a slow conversion, even if Hugo were to become a superior alternative.

In fact, Hugo is not even approved in the US yet. However just in the last year or so it has been approved for some surgeries in the European Union, Canada, and Japan. It appears the game plan is to demonstrate success overseas first, then go for the most lucrative market… the US.

The dumb man’s take

My background is not in this space. With the exception of touching on the diabetic drama, you will notice I have intentionally left out heresy about mismanagement or alleged product inferiorities in their cardiovascular portfolio. I’m not qualified to opine.

Some of my best investments have been in big boring companies like this, of which I only have a 30,000-foot view, rather than intimate knowledge of the management and products/services. While analysts and industry insiders focus on the nitty-gritty, it often obscures them from seeing the big picture.

In the case of Medtronic, the big picture is this; 45 years of dividend increases with an acceptable payout ratio, a valuation lower than large cap peers, and a large diversified portfolio of essential healthcare products.