peterspiro

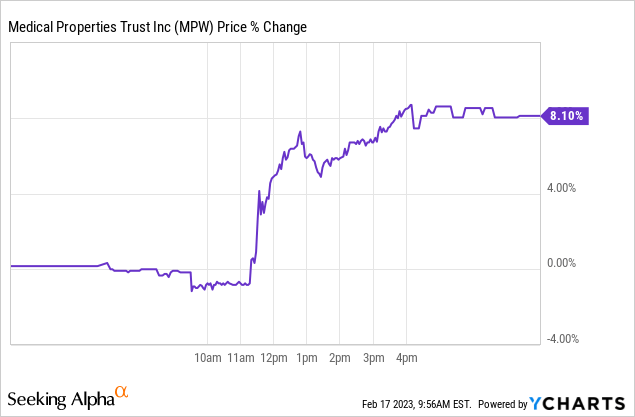

On 15 February, Medical Properties Trust (NYSE:MPW) announced that its largest tenant – Steward Health Care System has sold its Utah business to CommonSpirit Health. The announcement was interpreted by the market as very positive as share prices of MPW jumped more than 8% on the news. Read our previous coverage on MPW here.

However, after looking closely at the deal and examining it from different angles, I think that the implications are mixed. On the surface, the transaction will indeed reduce the exposure to Steward and bring in a tenant with an investment grade credit rating on board. The liquidity that Steward receives as a result of the deal should strengthen its financials and help it repay its debt to MPW from Q2’22. However, it appears that the new tenant will pay approximately 13% lower rent for the property. Also, the price of the deal is a considerable reduction to what HCA Healthcare (HCA) has agreed upon in 2021.

The positive

More diverse tenant base

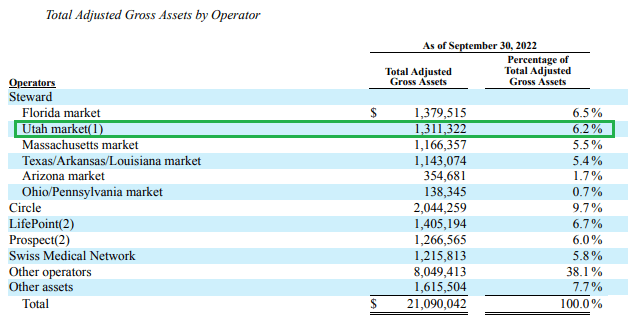

One of the areas of criticism towards MPW has been the high concentration to Stewards, which was allegedly in financial trouble. With the deal at Utah, the exposure to Steward will fall from 26.0% to 19.8% of assets, according to the mix published in the latest financial report.

MPW’s tenant mix as of Q3’22 (MPW)

Improved transparency

Unlike Steward, which as a private company doesn’t have an obligation to publish its financials, CommonSpirit Health reports its results on a quarterly basis. Also, the company has an assigned investment grade credit rating by all three main rating agencies. With this level of superior transparency and better oversight, CommonSpirit’s addition to the tenant mix should do a good job in derisking the overall profile of MPW.

Liquidity improvement

According to the MPW’s news release, Steward is expected to use part of the proceeds from the sale of its Utah business to repay early some of its liabilities, including the loan extended by MPW in Q2’22, which was due in 5 years. As a result, Steward will shore up its own balance sheet, which will in turn improve the liquidity position of MPW as well.

The negative

Rent reduction

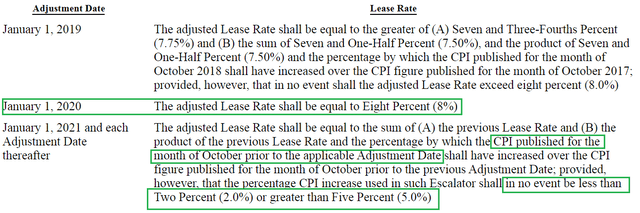

By the news release of MPW it seems that CommonSpirit will begin paying approximately 7.8% of MPW’s US$1.2B gross investment in the Utah’s portfolio subject to the deal. However, the news release doesn’t state anything about the current rate that Steward is paying for the properties. So I went and checked the master lease terms with Steward for the properties.

The master lease terms with Steward (SEC fillings)

So according to the master lease terms, the lease rate that Steward is paying for the properties in question should be the 8%, subjected to increases of 2% from 1 January 2021 (Oct’22 CPI less than the 2% lower band of the escalator), and 5% from the beginning of 2022 and 2023, since the Oct CPI in both years was above the upper escalator threshold.

| Date | Lease rate | Increase |

| 01-Jan-20 | 8% | 2% |

| 01-Jan-21 | 8.2% | 5% |

| 01-Jan-22 | 8.6% | 5% |

| 01-Jan-23 | 9.0% | – |

* Author’s calculations based of CPI data

As a result, the 2023 lease rate should be around 9%, which implies more than 13% reduction based on the 7.8% CommonSpirit should initially be paying.

Inferior rent escalator

According to the master lease terms with Stewards, the escalators embedded in the agreement were corresponding to the CPI, but could’ve varied in the 2%-5% range. However, the terms with CommonSpirit state a fixed escalator of 3%. While such a change could be beneficial in a low inflation environment (CPI<3%), it’s exactly the opposite in a high inflation environment (CPI>3%), since in such case the Steward’s escalator is better for MPW.

The CommonSpirit deal seems a downgrade for Steward

While MPW’s release stated that the amount of the deal between Steward and CommonSpirit Health was not disclosed, this is not entirely true. In CommonSpirit’s Q4’22 release it’s stated that:

In February 2023, CommonSpirit entered into an asset purchase agreement to acquire a regional health system, including five hospitals, over 40 clinics, and other ambulatory services in Utah for a gross purchase price of $685 million

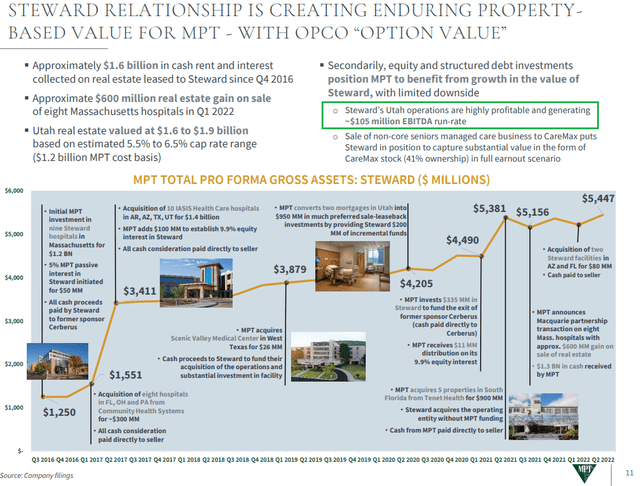

However, the same assets were to be purchased for US$850M in 2021 by HCA Healthcare, according to the Q3’22 earnings call of MPW. So this implies that Stewards sold its Utah business for 19.4% less that it was to receive in 2021. According to MPW’s presentation, Steward’s Utah operations are “highly profitable”, generating US$105M of run-rate EBITDA.

Steward’s relationship with MPW (MPW)

This should put the implied EBITDA multiple on the CommonSpirit transaction at 6.5x, which seems quite low. For reference, HCA Healthcare – also a healthcare facilities operator is trading at 9.5x EBITDA multiple.

Utah operations were one of the best for Steward

Keeping the US$105M EBITDA number from the Utah operations as reference, according to MPW’s earnings call Steward is projecting US$350M of EBITDA in 2023, while the 2022 number would be around US$50-US$80M:

Fiscal year 2022 unadjusted EBITDA is projected to be between $50 million and $80 million. Contract labor in Q3 fiscal year 2022 has decreased 30% from Q1 FY 2022 run rate and is expected to decline an incremental 20% in Q4, resulting in a 50% decline since the first quarter of this year. Steward is also forecasting unadjusted EBITDA of more than $350 million for fiscal year 2023.

At the same time, the Utah operations are below 24% of Steward’s operations that are leased from MPW. This indicates that the Utah operations should’ve been amongst the best performing assets of Steward. Without them, the company’s overall results may deteriorate.

Conclusion

The deal for the Utah properties has mixed implications for MPW. It indeed reduces the exposure to Steward, while at the same time the new tenant is a company with investment grade credit rating and transparent financials. The liquidity that Steward receives from the transaction should improve the balance sheet and some of the money should end up repaying the US$150M debt facility extended by MPW in Q2’22. On the other hand, the lease rate that MPW will charge CommonSpirit appears to be more than 13% lower than what Steward should’ve been paying. Also, the Utah properties appear to be one of the best in Steward’s portfolio and were sold at alleged EBITDA multiple of only 6.5x.