Hispanolistic/E+ through Getty Photographs

The development business is actually massive and numerous. There are such a lot of completely different items and companies required with a view to produce the infrastructure that makes up our houses, workplaces, and different associated constructions. Some buyers could also be drawn to the bigger gamers which have their palms in plenty of various things. However there’s a sure stage of attractiveness to purchasing up shares in area of interest operators with a really slim focus. One such prospect that’s positively price consideration is Masonite Worldwide Company (NYSE:DOOR). Though the market is nervous a few possible recession, this operator has performed effectively to develop its enterprise lately. Profitability has been somewhat unstable, however money move metrics have been typically constructive. Add on prime of this how low-cost shares are right now, and it isn’t troublesome for me to price the enterprise a stable ‘purchase’ presently.

Open The Door On Masonite Worldwide

As its ticker image suggests, Masonite Worldwide focuses on producing and distributing doorways which can be utilized in new development tasks, in addition to restore, renovation, and reworking actions. These embody each inside and exterior doorways geared towards the residential and non-residential constructing development markets. The corporate at present has a large portfolio of manufacturers, together with Masonite, Premdor, USA Wooden Door, Nicedor, Nationwide Hickman, and others. Along with promoting its merchandise to a wide range of prospects via the agency’s direct distribution channels, it additionally sells its merchandise via well-established wholesale and retail companions.

As an instance simply how massive a participant this enterprise is, administration stated that within the firm’s 2021 fiscal yr, it offered roughly 32 million doorways to greater than 7,000 prospects worldwide. 75% of the corporate’s gross sales got here from the North American residential market. An additional 13% of gross sales have been attributable to European prospects, whereas 11% fell below the architectural class. The latter of those facilities on extremely specified merchandise which can be designed, constructed, and examined by the corporate to make sure regulatory compliance and environmental certifications the place vital. Examples embody fire-rated doorways, lead-lined doorways, attack-resistant doorways, bullet-resistant doorways, and others. The remaining 1% of gross sales fell below miscellaneous company actions. Digging down a bit additional, the corporate stated that 89% of all gross sales fell below the residential class, with 54% devoted to residential restore, renovation, and reworking end-users, whereas 35% of gross sales went to residential new development prospects. The opposite 11% of gross sales fell below the non-residential development market.

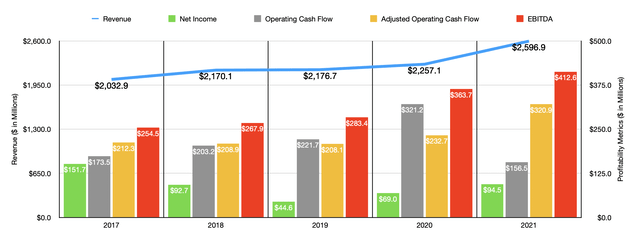

Creator – SEC EDGAR Knowledge

Over the previous few years, the administration group at Masonite Worldwide has performed a superb job rising the corporate’s prime line. Income elevated from $2.03 billion in 2017 to $2.26 billion in 2020. On Might 21, income jumped to almost $2.60 billion. Apparently, most of this development was not pushed by a rise within the variety of doorways offered. Sure, the corporate did see the variety of models shipped rise from 31 million in 2020 to 32 million in 2021. Nonetheless, gross sales are nonetheless down from the 35 million doorways offered in 2017. From 2020 to 2021, a big contributor to the corporate’s rising income within the North American residential market was a 12.2% improve in common unit value. By comparability, increased base quantity elevated web income by simply 4.8%. In Europe, the corporate skilled a 12.1% improve in common unit value and benefited from an 11.6% rise in increased base quantity. Sadly, the corporate noticed the architectural class report a 15.1% lower in income, pushed largely by a 17.5% drop in base quantity.

From a profitability perspective, the image for the corporate has been somewhat combined. Internet earnings decreased within the three years ending in 2019, falling from $151.7 million to $44.6 million. Earnings then ticked as much as $69 million in 2020 earlier than rising additional to $94.5 million in 2021. Working money move has been a bit extra constant. From 2017 via 2020, this metric rose from $173.5 million to $321.2 million. It then dropped to $156.5 million final yr. If, nonetheless, we have been to regulate for modifications in working capital, it will have risen from $232.7 million in 2020 to $320.9 million in 2021. In the meantime, EBITDA for the corporate additionally improved, climbing from $254.5 million in 2017 to $412.6 million final yr.

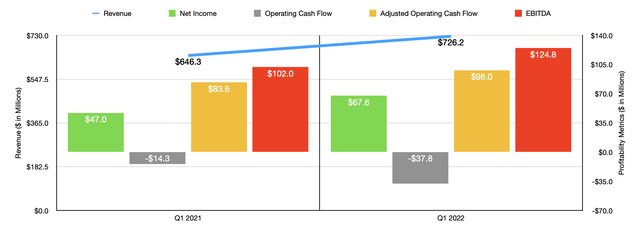

Creator – SEC EDGAR Knowledge

Though buyers are rightfully involved concerning the development market as we look like heading right into a recession, Masonite Worldwide has began the yr off proper. For the primary quarter of its 2022 fiscal yr, the corporate generated gross sales of $726.2 million. This represents a rise of 12.4% in comparison with the $646.3 million reported one yr earlier. Internet earnings for the corporate additionally rose, climbing from $47 million to $67.6 million. Sadly, working money move did worsen, dropping from detrimental $14.3 million to detrimental $37.8 million. But when we regulate for modifications in working capital, it will have risen from $83.6 million to $98 million. In the meantime, EBITDA for the corporate additionally improved, rising from $102 million to $124.8 million.

Regardless of the broader financial considerations, the administration group at Masonite Worldwide is somewhat bullish concerning the present fiscal yr. At current, they anticipate gross sales to return in increased than in 2021 to the tune of between 6% and 10%. On the midpoint, that might translate to income of $2.80 billion. The corporate additionally anticipates earnings per share of between $9.10 and $10.05. On the midpoint, this could translate to web earnings of $216.1 million. As well as, the corporate additionally thinks that EBITDA will likely be between $445 million and $475 million. No steerage was given when it got here to working money move. But when we assume that the primary quarter of this yr was indicative of what the remainder of the yr will appear to be, we will anticipate an adjusted studying for the enterprise of $376.2 million.

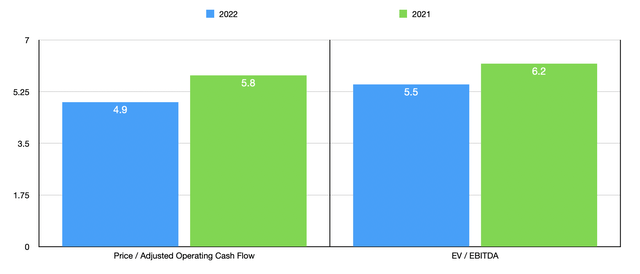

Creator – SEC EDGAR Knowledge

Utilizing information from 2021, shares of Masonite Worldwide look extremely low-cost. The worth to working money move a number of is available in at 5.8. This drops to 4.9 if we depend on 2022 estimates. In the meantime, the EV to EBITDA a number of, utilizing 2021 outcomes, ought to be 6.2. This could drop to only 5.5 if we use administration’s steerage for 2022. To place the pricing of the corporate into perspective, I made a decision to match it to 5 related corporations. On a value to working money move foundation, these corporations ranged from a low of 16.5 to a excessive of 75.3. Utilizing the EV to EBITDA method, the vary was from 7.2 to fifteen.3. In each circumstances, Masonite Worldwide was the most affordable of the group.

| Firm | Worth / Working Money Move | EV / EBITDA |

| Masonite Worldwide | 5.8 | 6.2 |

| Griffon Company (GFF) | 75.3 | 12.1 |

| CSW Industrials (CSWI) | 22.2 | 13.3 |

| Janus Worldwide Group (JBI) | 16.5 | 15.3 |

| Gibraltar Industries (ROCK) | 72.5 | 9.3 |

| JELD-WEN Holding (JELD) | 23.4 | 7.2 |

Takeaway

Primarily based on the info offered, Masonite Worldwide strikes me as an interesting firm with nice upside potential. Shares look very low-cost on each an absolute foundation and relative to related corporations. Money flows are notably sturdy, although web earnings have been everywhere in the map. Sure, the corporate could also be damage within the close to time period by financial points. However for these targeted on the lengthy haul, now could be a good time to contemplate shopping for in. Due to this, I’ve determined to price the enterprise a ‘purchase’. But when it weren’t for the broader financial considerations, I will surely price it a ‘sturdy purchase’.