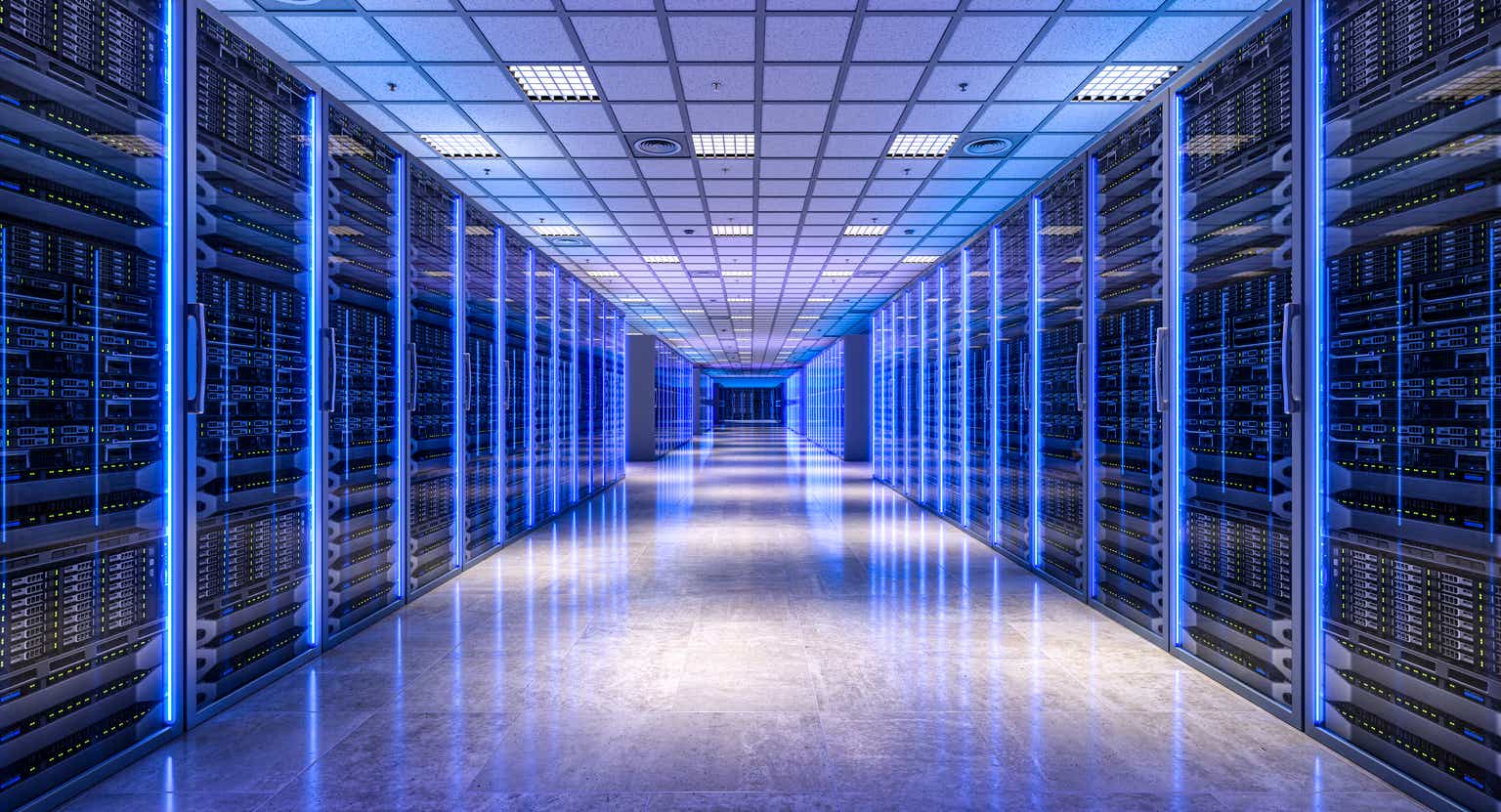

iQoncept/iStock through Getty Pictures

Hear right here or on the go through Apple Podcasts and Spotify

The Pragmatic Investor, James Foord, talks macro flows and dynamics available in the market (0:40). Attention-grabbing worldwide image – has one thing basically shifted? (6:20) Valuation can solely take you to this point (11:00). Robinhood, HIMS and different favourite shares proper now (13:45). Power Switch and choosing oil gamers (16:15). Proudly owning bitcoin and/or bitcoin proxies (20:40). CoreWeave, Nebius and AI (25:00). Bearish on Tremendous Micro Pc (26:25). Nonetheless a Tesla bull (28:30).

Transcript

Rena Sherbill: James Foord, welcome again to Investing Specialists. Welcome again to In search of Alpha. You run The Pragmatic Investor.

For many who forgot, we had you on a number of instances in earlier years. It is nice to speak to you once more. Welcome again to the present.

James Foord: Thanks very a lot, it is nice to be again.

RS: It is good to have you ever. As a refresher, should you might share with buyers, you performed some interviews on this podcast; you have been an interviewee on some episodes. I feel it could be nice as a refresher for listeners to share the way you method the markets, what you particularly give attention to in your evaluation of shares and the broader markets.

JF: After all. Anybody who follows In search of Alpha commonly could be aware of a few of my work. I have been writing for In search of Alpha for, I feel, coming in on six, seven years. And my method is, I feel it is shifted a bit of bit because the starting.

Undoubtedly began being a bit extra worth centered. And I feel with time, I’ve positively leaned a bit of bit extra into the macro evaluation. I feel positively in the previous few years, it is simply change into a a way more vital piece of the equation actually. However I try to type of have a holistic method.

I’ve this factor that I tentatively name the pragmatic investing pyramid, which is mainly macro on the backside, fundamentals within the center, and simply to prime it off, a bit of little bit of technical evaluation.

I feel every thing helps. That is the purpose of pragmatic buyers being open to something, not dismissing something simply due to a stigma or something like that. Attempt to contact on a little bit of every thing, however positively extra of the macro focus.

RS: I would have an interest to listen to why you determined or what made you determine that macro was such a vital a part of specializing in the markets and inventory choosing.

Evidently on this day that we’re in, this time that we’re in, macro appears very, essential when it comes to navigating the inventory market with the tariff conversations, with the geopolitical conversations, with all of the adjustments occurring so typically and so rapidly. How did you make that call, and what would you say about this present second vis a vis specializing in the macro image a bit greater than than possibly others do?

JF: For me, I feel it was simply after a number of years available in the market, type of realizing that quite a lot of the flows and dynamics available in the market appear to revolve round some vital macro indicators. I imply, for good or for unhealthy, we’re in a world which is possibly closely dependent, some would say, too closely dependent, on assist from central banks, worldwide flows, and these these type of dynamics, I feel, are actually shaping markets.

And I feel you’ll be able to positively see it. We had fairly risky markets in the previous few years. I imply, we had COVID the place every thing crashed, then we had that large type of nearly, I suppose you possibly can say that bubble going to 2021.

I feel a part of it’s the cause why I’ve type of shifted extra to the macro is as a result of it is vital to grasp these issues. I imply, from a purely worth perspective, you may need missed quite a lot of the a quite a lot of upside lately.

There’s quite a lot of shares, quite a lot of issues that transfer, however not essentially a lot to do with worth though I feel worth is vital. It’d change into extra vital in coming years.

Finally, I feel that is shaping issues extra. And, you understand, by no means has that been extra true than now, with President Trump again within the White Home, creating some risky eventualities.

And, once more, lot of shifts occurring when it comes to geopolitics even on the financial facet of issues each right here and overseas.

Europe additionally going via some attention-grabbing instances. After all, China. Principally we have seen a really basic shift available in the market. I suppose the market’s interpretation of Trump and Trump’s insurance policies.

So when he got here into workplace, there was that large rally going into that promote the information occasion, shortly after, we have been hit with all of the volatility, all of the stuff about tariffs. Trump kinda got here in with these large concepts threatening, quote, unquote, to placed on large tariffs and likewise DOGE mainly attempting to stability the funds.

So type of type of very radical concepts now, proper, of truly maybe attempting to stability the funds, which, some individuals would have mentioned is sweet. However, from a macro perspective, possibly some buyers pondering that is not so good when it comes to wanting to chop spending and austerity.

Tariffs, after all, not so good for international commerce. However, there was this concept. You recognize, Trump was very clear, and it appeared for some time that he was keen to cope with the ache. Keen to cope with this type of quick time period time period ache in an effort to put the US again in a path of reindustrialization and possibly catching up with the remainder of the world in a number of the areas the place possibly it is fallen behind.

However, extra just lately, I feel it was simply final week the place the time period TACO Tuesday was coined, which is this concept that at any time when Trump comes out and says one thing about tariffs, you purchase that.

You purchase that dip as a result of then he’ll come out on Tuesday and reverse all that.

And that is what we have seen and I feel that is type of what the market is pricing in now could be that possibly both there is not any political will or simply the assist for these type of insurance policies. On the one hand, DOGE, I feel it is type of fallen in need of quite a lot of its authentic goals. They have been speaking about slicing within the trillions and clearly, that is by no means gonna occur. Simply due to the quantity of precise spending that they will lower, it is simply probably not gonna occur.

We’ve got the brand new spending invoice that Trump’s proposed, which as soon as we dig into it and have a look at all of the tax cuts, it is probably not very austere, for example. It’s the large lovely spending invoice as he calls it.

After which on the tariffs, we’re type of seeing that raise up once more. However, once more, it looks like widespread sense, you would possibly say, would prevail. And China’s a little bit of a maintain out, so I feel positively we are able to anticipate some extra volatility.

However I feel now the market is pricing in that continuation of the established order, so to talk.

And this can be a dynamic we have seen occurring for the final twenty years, which is excessive spending, in all probability with Jerome Powell leaving the Fed and Trump getting somebody new in there, in all probability rather more lenient on financial coverage and finally, fairly bullish backdrop usually for monetary property.

RS: Internationally, there’s been quite a lot of speak about not over investing in the US proper now. What would you say concerning the worldwide image?

JF: Undoubtedly very attention-grabbing. Like, we noticed that outperformance in overseas markets, particularly Europe. Query is, is {that a} quick time period pattern?

In the event you look again traditionally, the US tends to simply outperform, this stuff type of stability out.

Is it the type of commerce that you just wanna fade, or is it one thing basically shifting? And what’s very attention-grabbing, I do assume there may be some long run tailwinds.

You’ve got seen for instance in Europe particularly, spending actually shift up, that fiscal spending with Germany growing their spending, different nations within the space.

After all, you’ll be able to’t examine Europe and the US when it comes to expertise, however, I feel there’s some concept that possibly they will lastly catch up a bit of bit. I feel that is being represented in a number of the flows that we have gotten into different nations.

Then I feel rising markets, I personally assume they’re very attention-grabbing, proper now. China, clearly, is tough to spend money on proper now, however, we have really seen a little bit of a reversal.

However I feel quite a lot of different nations, particularly should you have a look at locations in South America and even Southeast Asia, some very some very attention-grabbing dynamics occurring there and particularly I feel within the face of what has been a really weak greenback.

So, should you consider the greenback goes to maintain weakening, which I do consider to an extent, I feel, clearly, it is superb to get some diversification away from the US.

Forex is a really explicit topic. I do not actually give attention to currencies notably, however, there’s sure economies I like. I feel, you understand, South America.

I feel should you have a look at Argentina has had an awesome turnaround. Mexico is doing very effectively from this type of breakup of US and China. And there is positively some attention-grabbing place in Southeast Asia.

RS: Do you get into nation ETFs in any respect? Is that one thing that you just dabble in?

JF: Yeah. Completely. I’ve a macro ETF portfolio, I name it, which is mainly thematic. We give attention to totally different areas. We did fairly effectively to spend money on Argentina (ARGT) some time again once they had that complete, large political transition. We’ve got some publicity to Brazil.

Mexico (EWW) just lately obtained some publicity to Korea, which I feel might additionally South Korea (EWY) positively might be an attention-grabbing choice. So, once more, simply, it is clearly a case by case, however it’s attention-grabbing in the previous few months.

We have positively seen a pattern of investing away from the US. Now I do not assume that’s essentially gonna proceed. I am not some type of US defeatist.

I do not assume that the empire is over or something like that. I imply, should you have a look at the US, they nonetheless command a really giant a part of the economic system. I do assume the US goes to proceed being the reserve foreign money, the greenback.

And, when it comes to firms, I feel, clearly, it is only a utterly totally different story whenever you have a look at precise tech firm and innovation. I feel the US nonetheless has wonderful alternatives. However, I feel the phrase is diversifying. It is hedging its choices, and it is good to remain diversified. It is also one in every of my tenants.

RS: A little bit of pragmatism. I’d say diversification actually a vital a part of pragmatism. You talked about Jerome Powell earlier, and there is been rumors that he is gonna resign imminently.

How are you excited about that, navigating that? How would you encourage buyers to consider that if he does resign, if he does go away workplace, if he would not resign, if he would not go away workplace so quickly? What what are your ideas there?

JF: It is arduous to know. I imply, it is fairly speculative at this level, however, finally, I feel he is as a consequence of go away subsequent 12 months anyway. I feel so. That is finally the play right here is you kinda have to grasp that he’s going to ultimately go away, in all probability going to get a extra dovish Fed chair.

And in any case, I feel the Federal Reserve will probably be slicing charges in some unspecified time in the future within the not too distant future.

However, when it comes to really speculating on Jerome Powell leaving, I imply, he would possibly go away. He would possibly, it is arduous to know. A part of the pragmatism as effectively comes from, you’ll be able to’t commerce each headline, which I feel has been confirmed by the latest volatility and every thing that occurs round Trump.

You simply should see issues within the greater image and take a look at to not focus a lot on the each day.

RS: You talked about that you just cowl various totally different sectors. I feel one of many locations I wish to begin when it comes to assessing the way you’re shares and and the way you determine which shares to get into and which shares to not get into.

One thing that we have been speaking about and one thing I feel that is deserving of being talked about is the valuation dialog in the case of a few of these greater names, I feel particularly within the tech sector, however not simply within the tech sector.

It appears harder than ever to correctly worth a few of these shares. Palantir (PLTR) is is a particular instance that I do know that you just cowl that involves thoughts. NVIDIA’s (NVDA) one other one.

How would you finest describe the way you worth these shares, particularly on this second, the place there’s quite a lot of promise, however not but every thing has been delivered?

JF: I feel that is that is the problem. And, once more, that is the place the pragmatism is available in as a result of valuation can solely take you to this point.

In the event you checked out valuation and possibly caught simply to valuation, I’d have missed quite a lot of positive factors on Palantir, which has been an awesome performer.

I wrote the opposite day, it is essentially the most, arguably, essentially the most overvalued mega cap in historical past. However there’s methods to justify it. I made the instance there. Is Palantir, for instance, the subsequent Tesla (TSLA), or is it the subsequent Nvidia?

As a result of, once more, these are two firms. Tesla’s an awesome instance of an organization that basically obtained forward of itself with the entire EV factor and just about gone nowhere during the last 5 years. I haven’t got the chart in entrance of me. I imply, it is not essentially about purchase and maintain, however issues can get forward of themselves.

With Palantir particularly I argue that there’s, in case you are an AI bull and also you assume that this expertise might be transformative, which I actually assume is an enormous chance, then Palantir, I feel might be nearer to an instance of an early stage NVIDIA, the place you began began to see revenues all of a sudden respect thirty, forty, 50 p.c, one thing which, on the time with NVIDIA, nobody noticed coming.

And I feel now with Palantir, it is like, effectively, individuals type of seeing you understand, they’re attempting to preempt this and and see this and see this coming with Palantir.

I imply, it is potential. You recognize, I feel I’ve made, you understand, precise valuations the place, you understand, you you’ll be able to justify, you understand, hundred and $20 on Palantir.

I feel, you understand, once more, it takes it takes some very bullish valuations, clearly, a lot above analyst estimates, however, once more, that these are issues which you can’t all the time value in.

Proper? I imply, the app nobody knew what was gonna occur with Nvidia was it was arduous for them to know. And, you understand, to that in that regard, sure, Palantir is objectively overvalued, however, once more, you you’ll be able to’t all the time value in every thing.

And, yeah, clearly, there’s different issues to consider. I imply, at this level, Palantir can be type of it is it is nearly a little bit of a meme inventory.

So, once more, you understand, trades trades with the market that means. However, now you might have Nvidia. I imply, to me, Nvidia at this level is, you understand, I do not assume NVIDIA is that overvalued actually. I imply, that is what occurred.

Proper? It type of grew into its valuation, and I am fairly bullish on like I mentioned, I am fairly bullish on AI. You recognize, each time I hear Jensen converse, I I might see I I can see why NVIDIA is the market chief.

I consider they’ll preserve that management. And I do not assume NVIDIA is that overvalued actually whenever you really see, what the remainder of the market is is buying and selling like.

So, you understand, NVIDIA really might be justified from a valuation perspective. Yeah. For Palantir, you should consider much more within the within the progress story, however not with NVIDIA a lot.

RS: Possibly share with listeners what your favourite shares are proper now and and why they’re your favourite shares.

JF: A few of my favourite shares proper now. I imply, positively a number of the the expansion names proper now, have executed very effectively.

Shares which have executed very effectively in latest weeks, Robinhood (HOOD), after all, I feel is one which I have never written about quite a bit, however I did write about it. I known as it the trillion greenback alternative, with this large shift in wealth going from Gen x boomers to millennials and, this type of being the the app of alternative, stuff like Robinhood has executed very effectively.

Hims (HIMS) is a really attention-grabbing one, which clearly has simply completely exploded. I even have that in my portfolio. Query is, do you wanna purchase these shares proper now? That is a a lot more durable query to reply, however I feel there’s nonetheless quite a lot of progress in AI.

I nonetheless assume markets are gonna preserve going up. So to that extent, one thing like Robinhood is superb.

However, on the similar time, I’d say, on a extra contrarian, I am now additionally beginning to look a bit of bit at oil performs, one thing that possibly might act as a bit extra of an inflation hedge as a result of I feel that might be the subsequent subsequent stage now when it comes to macro might be a bit of little bit of extra elevated inflation than possibly individuals anticipate and the market is anticipating.

And I feel that is already priced in should you have a look at Bitcoin (BTC-USD). Clearly, I’ve all the time talked quite a bit about Bitcoin. Very attention-grabbing what’s occurring with Bitcoin. I identified in my final article that we have really seen Bitcoin respect as yields have gone up.

So not appearing as a threat asset a lot, however really as a financial hedge, extra according to gold. For long term perspective, I nonetheless assume that Bitcoin’s very bullish. I nonetheless have MicroStrategy (MSTR). I feel that is inventory to carry long run, but additionally, clearly, a number of the miners.

I feel miners carried out fairly effectively in Q1, do not quote me, however I feel it was the very best performing sector possibly in Q1. And, yeah, I feel there’s positively some worth there long run. And, I used to be oil.

Simply I simply wrote at the moment about Power Switch (ET), so I feel some publicity to grease might be good as we transfer into what might be fairly a distinct type of totally different situation from a macro perspective over the subsequent few years even, which I feel is gonna be possibly much more inflationary and to that extent, I do assume progress shares might maybe take a bit of little bit of a step again, so we’ll see.

It might be a really fairly large shift. I nonetheless haven’t got fairly have all of the items collectively. There’s quite a lot of issues to place collectively right here like AI, after all, which, is gonna actually change issues. Clearly, historical past would not repeat, nevertheless it’s positively gonna be attention-grabbing.

RS: When it comes to the oil gamers, how do you determine which of them to get into at this second?

JF: Counting on the on the pyramid, simply trying a bit of bit on the valuation and, clearly, the basics.

After which additionally technical evaluation helps. I feel it is vital to take a look at how the chart is transferring and simply try to decide good good ranges.

I imply with Power Switch, I feel I like the concept that they do not have an excessive amount of publicity to the commodity value, however, on the similar time, just about concerned in the entire infrastructure story, which once more, I feel is an AI story.

One thing I’ve talked about earlier than is that the concept that if AI goes to take off, one of many large bottlenecks goes to be power and maybe power distribution.

And, that is one thing that Power Switch is already benefiting from with a number of the latest offers they’ve made. And, they’ve, I feel, 5,000,000,000 in capital expenditures earmarked for subsequent 12 months.

So type of actually displaying that they consider within the progress story. After which, once more, I crunch the numbers a bit of bit. And to me, it simply seems undervalued, actually, on the present value. In order that’s kinda what I search for.

RS: And when it comes to the basics, are there explicit metrics that you just give attention to greater than others?

JF: Yeah. And that is going to type of rely a bit of bit on the inventory. I imply, for instance, if I used to be tech and progress locations, the value earnings progress is clearly all the time one of the attention-grabbing ones as a result of that is pricing within the expectations of the longer term.

Typically you’ll be able to have a look at the PE and it seems type of outrageous, however, once more, when you account for the expansion, one thing like value dynamics progress is essential.

With one thing like an revenue inventory or one thing a bit extra conservative worth, you’d wanna have a look at different metrics, clearly, value to that regard, possibly one thing like money stream. Clearly, value to money stream, clearly, essential as effectively.

With one thing like Power Switch, I am one thing like value to money stream with excessive progress shares, clearly, one thing like the value earnings progress, if there are earnings, after all.

RS: And there instances the place the basics do not match up with the technicals? In different phrases, the basics look good to you, however then the technicals present you one thing totally different?

JF: Yeah. That occurs quite a bit, mainly, whenever you get large promote offs, UnitedHealth Group (UNH) is an attention-grabbing one there the place you’ll be able to have a look at the basics and quite a lot of this has been occurring there.

Clearly, the inventory simply plummeted. And from a technical perspective, you are catching a falling knife.

And I feel, effectively, that occurs quite a bit. Every time there is a large unload, you all the time have this type of opposition of technicals and fundamentals as a result of, clearly, after an enormous unload, fundamentals can look fairly good.

However then the technicals misplaced assist. In order that’s why I all the time speak about this concept of, the pattern is your good friend.

So when it comes to technicals, catching a falling knife is dangerous. It is extra like playing actually than simply attempting to select the underside. That is extra like playing than investing. I feel with technical evaluation, the great thing about it’s you’ll be able to try to possibly spot these reversals as quickly as they occur.

So, fundamentals are trying good, however the technicals are in type of wait a bit of bit for that value to stabilize and possibly get a greater threat reward entry.

Once more, you would possibly lose some upside, however you achieve by mainly having a bit of bit much less threat.

RS: So when it comes to the UnitedHealth instance, you’d say that the basics simply look so compelling to you that that is what has you staying so bullish on them?

JF: Once more, it is a advanced story and I am positive it is gonna preserve evolving. However, I imply, you have a look at the valuation, it seems very compelling.

Finally, I am very bullish on healthcare. And, once more, I feel that is additionally a little bit of a narrative of, there’s quite a lot of stuff unfolding.

That they had accusations coming via. Clearly, the CEO quits. So, once more, that is positively going ahead, this is without doubt one of the conditions the place, once more, fundamentals are a bit restricted when it comes to you’ll be able to’t know every thing. However, from the valuation perspective, it seems nice.

It seems very low cost. Healthcare is a long run story, which I feel has long run secular progress in there. I feel it is all the time gonna preserve being essential.

Though I do assume the US might do with some adjustments to their healthcare system, I do not assume it’ll occur from someday to a different.

And, I feel that is positively an attention-grabbing alternative.

RS: And also you talked about MicroStrategy and Bitcoin and your bullishness there. I am curious should you might clarify to buyers. There’s quite a lot of dialogue why get into firms which can be into Bitcoin, why not simply get into Bitcoin.

Might you share with listeners concerning the distinction between moving into gamers like technique versus, for example, Bitcoin ETFs or simply Bitcoin normally?

JF: Yeah. I imply, clearly, there’s there’s sure sensible variations.

Clearly, should you’re shopping for Bitcoin, one of many nice issues about simply proudly owning the Bitcoin is you’ll be able to preserve it your self. You may have it in your pockets. It is type of insulated.

Bitcoin ETFs, pure publicity to Bitcoin, however in a maybe easier means, if maybe not as a safe means, however nonetheless, then you definately transfer into the realm of miners or, one thing like a MicroStrategy.

Bitcoin miners, the story is just not that totally different from gold miners. Proper? I imply, what is the distinction between shopping for gold and gold miners?

What’s a enterprise? What is not? MicroStrategy, after all, is the innovation, for example, as a result of mainly, they’re simply type of utilizing fairness, utilizing totally different types of funding to mainly simply accumulate Bitcoin.

Finally, it is a levered play on Bitcoin. As a result of, that is type of what they’re doing there. What MicroStrategy calls their Bitcoin yield, which is when each time you purchase a share of a little bit of a MicroStrategy, it is such as you purchase a share of Bitcoin, however as a result of they preserve accumulating, it is nearly like you might have a yield on that, nearly like you might have a Bitcoin yielding.

So it is also attention-grabbing. I imply, you might have now a pair new firms coming in doing an analogous factor to MicroStrategy. So to that extent, it is attention-grabbing as a result of clearly their premium won’t maintain up, however on the similar time, I nonetheless assume there is a premium to it, and it is type of like a levered Bitcoin plan.

To that extent, it makes a little bit of sense should you’re bullish on Bitcoin and also you possibly wanna squeeze a bit of additional juice out of it.

Bitcoin ETFs, if that is the easiest way so that you can purchase Bitcoin, that is high quality. It has quite a lot of benefits. It might probably have some tax benefits. In the event you purchase an ETF, I feel you’ll be able to put it in sure tax benefit accounts. In order that’s actually one thing value enjoying with, and it is nonetheless automobile to achieve publicity to Bitcoin.

RS: And something that might flip you bearish on Bitcoin alongside the best way?

JF: Effectively, I imply, it must be like I mentioned, a really basic shift. The macro framework that I am working with proper now could be that we mainly have a debt stage that has reached wartime ranges.

And we have not seen this type of debt to GDP since World Battle II. And to attract that down, you might have two choices. You may both default and mainly, there’s two other ways to default. You may really default or you’ll be able to default by depreciating the foreign money and inflating the money owed away.

That is what’s occurred the previous few instances. That is what I anticipate goes to – is a dynamic that I feel goes to play out over the subsequent 5, ten, possibly even longer, years.

So I’ve talked concerning the similarities between what we’re seeing at the moment and possibly a type of nineteen seventies interval, which was stagflationary, however, after all, there’s sure equities, some equities did not do effectively, however quite a lot of equities did very effectively.

After all, commodities did effectively. Gold (XAUUSD:CUR) did effectively. And to that extent the place I put Bitcoin in the identical basket as gold, and I feel, like I discussed earlier than, it is starting to commerce that means, and that makes you bullish on Bitcoin.

Something reverse to that, which might be, once more, type of what Trump got here in with the intentions of doing possibly, which might be balancing the budgets, actually slicing down on austerity and returning to extra sound cash ideas, that might positively be extra bearish for Bitcoin.

However, that isn’t the thesis that I am working with proper now. I do not assume that is the best way issues are going.

RS: And in the case of being bearish on shares, what are some examples of promote shares that you’ve that you’d encourage buyers to assume twice about going lengthy on?

JF: I usually do not quick shares. I haven’t got quite a lot of shares that I actively quick. I imply, there’s positively some some names out within the tech sector that look overvalued. Undoubtedly quite a lot of attention-grabbing shares.

I wrote the opposite day about Utilized Digital Company (APLD), went up 50% yesterday, and I did advocate mainly promoting that inventory as a result of I feel there was quite a lot of hype across the the brand new deal they’d with CoreWeave (CRWV), however I feel that is type of a promote the information type of occasion as a result of basically, I do not assume that the corporate is doing so effectively.

RS: Something to say about CoreWeave out of curiosity? It is a inventory that we have been following a bit on this podcast from its IPO. Something that you’d say there for buyers?

JF: It is up about 20% at the moment, and I am not precisely positive why. I do not see any information on that, however I feel it is an attention-grabbing inventory.

I feel in case you are bullish on AI, one thing like a CoreWeave is smart. I’m bullish on AI. Personally, my tackle CoreWeave is, I’d somewhat purchase (NBIS), Nebius Group.

I wrote a comparative on them, and, mainly I feel Nebius has a stronger stability sheet, so it would not actually have a lot debt on its stability sheet which can be level.

Then it does even have some fairness investments in some type of you would possibly name AI agent adjoining firms. So in a means it is type of vertically integrating a bit of bit extra. It is not simply doing the GPUs and constructing the info facilities.

It is type of integrating a bit extra, and it additionally has a bit extra publicity to Europe, which I kinda like a little bit of a diversifier.

Principally, for these fundamental causes, and I feel from a valuation perspective, it’s a little bit extra undervalued.

However you must be pragmatic evaluating it with CoreWeave, clearly, buyers appear to favor CoreWeave extra as a result of I feel that is up a few 100% within the final month whereas Nebius is up 55%.

So, once more, a type of issues went effectively. I suppose will the market ultimately catch as much as the concept? I am kinda betting on that.

RS: An article that you just had a promote ranking on just lately was on Tremendous Micro Pc (SMCI). I am curious should you might share with listeners your ideas there. It is a inventory that is typically talked about when it pertains to the AI dialog.

What would you say that you just’re so bearish on with Tremendous Micro Pc and what do the bullish analysts have that you just assume that they’ve mistaken there?

JF: SMCI grew to become a really fairly adopted story that had that complete, they have been as soon as a AI darling, rising quick, vital companions to NVIDIA.

And, then they’d that complete debacle with their financials type of not fairly being proper, 10k, their annual report being delayed.

This created quite a lot of uncertainty across the inventory. And my newest take I imply, I have been bullish, bearish on it, relying on the second. Main as much as the rerelease of the 10k, I assumed there was positively some thought that might on the very least, there might be some good quick time period swings.

Now, for me, it is just like the mud is settled on on SMCI. And we we obtained the most recent outcomes. And to me, they weren’t nice. I imply, yeah, steering was lowered. And, when it comes to progress, it is not displaying that type of progress that was so thrilling possibly a 12 months in the past. The margins are getting a bit of bit squeezed.

I feel there’s simply this type of fallout from a little bit of a the reputational loss as effectively, in spite of everything the problems that they’d with administration.

My fundamental take is I feel it is possibly a good firm, however, once more, as soon as now that we’re via the issues, I do not actually see any catalysts, any imminent catalysts with the inventory.

And once more, from a technical perspective, it has been going nowhere and I feel it is underneath some vital resistance areas. So I do not see the enchantment proper now.

RS: And so long as we’re speaking about well timed shares, one other well timed inventory that you have lined a bunch previously has been Tesla (TSLA). Something to say there when it comes to Musk and DOGE and Tesla and what your ideas are there now?

JF: Effectively, we might do an entire episode about it, however, I’ve all the time been a Tesla bull to an extent.

Clearly, it is changing into quite a bit more durable based mostly on the most recent, Musk has been a controversial determine and that is clearly taken a toll on on Tesla, its legacy auto enterprise is mainly, it is not performing how bullish buyers would have anticipated.

And now, Tesla now could be extra of a wager on the AI initiatives it has on the robotics.

However to me, finally, it is also a wager on Elon Musk. Though he is a controversial determine, I feel he is had quite a lot of success previously and there is a cause for that.

If anybody can flip the ship round, it is him. And, once more, an instance of a inventory that basically simply stupidly overvalued, however buyers are gonna purchase what they wanna purchase. Once more, there’s one thing unquantifiable typically, and I feel Tesla has that it issue to me. I feel it is nonetheless value a little bit of a wager.

Like I mentioned, we might be on the verge of some revolutionary adjustments with AI, and I feel Tesla nonetheless has – there’s an argument to be made that Tesla’s nonetheless gonna take part in that.

So, it is value a wager, simply possibly not a really large wager at this level.

RS: The revolution will probably be stay streamed, possibly.

James, I respect this dialog. I respect you coming again on. As a reminder, you run The Pragmatic Investor. In the event you wanna share with listeners what you speak about or in the event that they subscribe, what they will get from The Pragmatic Investor, glad so that you can share that.

Comfortable so that you can share something that you just really feel like is worthy of being on this dialog that we left off or wherever else buyers can get in contact with you in the event that they wanna discover out extra. However thanks once more for this dialog. Respect it very a lot.

JF: Yeah. Thanks. You may comply with me on In search of Alpha, The Pragmatic Investor, comply with the the mannequin, the concepts that I laid out right here, macro fundamentals, technicals.

So each week we cowl the macro stuff. We’ve got a macro ETF the place we, like I mentioned, macro ETF portfolio the place we place in response to macro developments, sure commodities, nations, ETFs, that type of factor.

I even have totally different inventory portfolios. I even have two separate inventory portfolios, what I name my YOLO portfolio. In order that’s all of your excessive progress names, that is your HIMS, your HOOD, your Palantir.

After which I really run a extra conservative finish of what I name the tip of the world portfolio, which is, clearly rather more defensive.

So attempting to cowl quite a lot of issues. Some would possibly say an excessive amount of, however, once more, it is arduous for me to give attention to one factor, and on the finish of the day, if I am not having enjoyable, what is the level? For some, I would sound a bit of bit over the place, so I’ve obtained the macro, obtained the basics, after which we even have a swing portfolio once more utilizing the concepts behind technical evaluation.

Mac each each week, you get some macro insights. You get some in-depth inventory stories, fundamentals, and a few technical evaluation on indexes and different extra quick time period alternatives. And then you definately simply get to affix the neighborhood and discuss to us.

You may comply with me on In search of Alpha. I am additionally on Twitter, not as a lot as I ought to be, however I am gonna try to decide that up a bit of bit so you’ll be able to comply with me there, James C Foord.