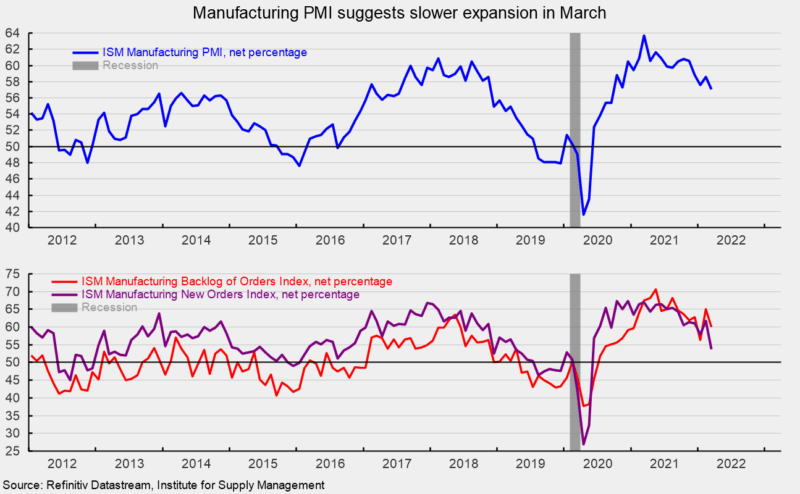

The Institute for Provide Administration’s Manufacturing Buying Managers’ Index fell to 57.1 in March, off 1.5 factors from 58.6 p.c in February (50 is impartial). March is the twenty second consecutive studying above the impartial threshold however the stage continues to development decrease from the March 2021 peak (see prime of first chart). The survey outcomes point out that the manufacturing sector continues to develop however worth pressures worsened. The report additionally suggests labor shortages from quits and retirements stay a major headwind although maybe barely lower than final month. General, survey respondents stay optimistic about future demand.

The brand new orders index fell sharply, dropping 7.9 factors to 53.8 p.c in March. It has been above 50 for 22 consecutive months however is on the lowest stage because the post-lockdown plunge (see backside of first chart). The brand new export orders index, a separate measure from new orders, fell to 53.2 versus 57.1 in February. The brand new export orders index has been above 50 for 21 consecutive months. The Backlog-of-Orders Index got here in at 60.0 versus 65.0 in February, a 5-point decline (see backside of first chart). This measure has pulled again from the record-high 70.6 end in Could 2021 however has been above 50 for 21 consecutive months. The index suggests producers’ backlogs proceed to rise however that the tempo decelerated in March.

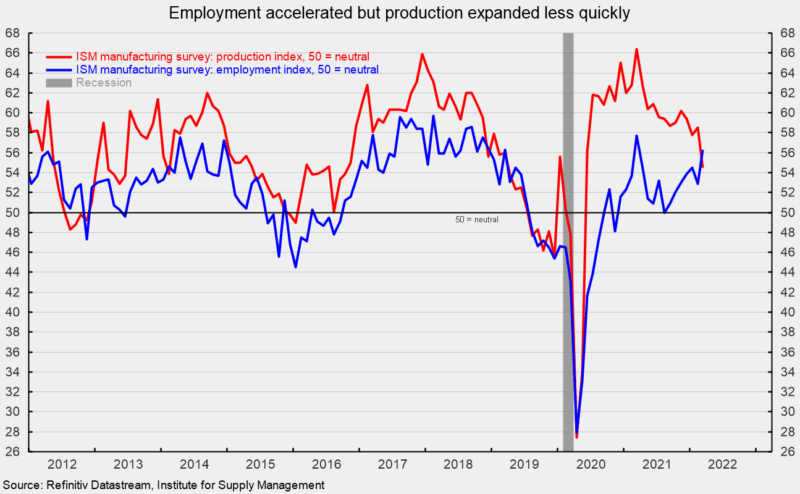

The Manufacturing Index registered a 54.5 p.c end in March, a drop of 4.0 factors from February. The index has been above 50 for 22 months however is at its lowest stage because the plunge in early 2020 (see second chart).

The Employment Index confirmed a stable achieve in March holding above impartial for the seventh consecutive month and sixteenth consecutive studying at or above the impartial 50 stage, coming in at 56.3 p.c (see second chart). The run of outcomes at or above impartial is a sign that a few of the labor points plaguing manufacturing might begin to ease in coming months. The Bureau of Labor Statistics’ Employment State of affairs report for March confirmed a achieve of 431,000 nonfarm payroll jobs together with the addition of 38,000 jobs in manufacturing.

Buyer inventories in March are nonetheless thought-about too low, with the index coming in at 34.1, up 2.3 factors from February (index outcomes beneath 50 point out clients’ inventories are too low). The index has been beneath 50 for 66 consecutive months. Inadequate stock is a optimistic signal for future manufacturing.

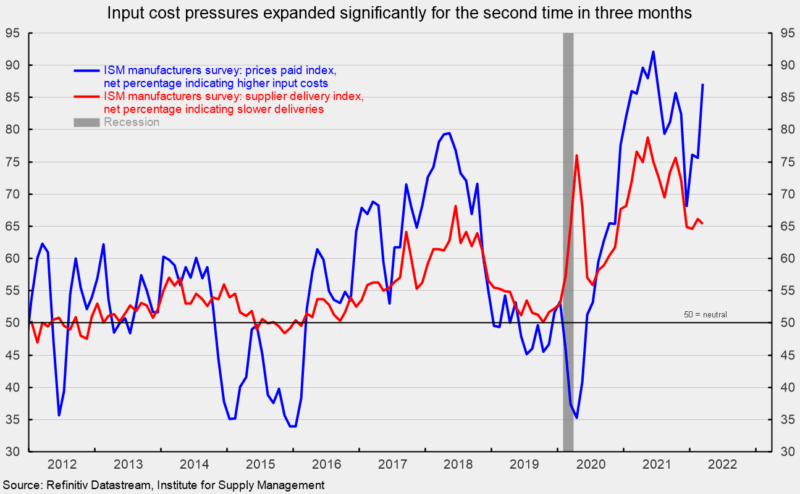

The index for costs for enter supplies jumped in March, up 11.5 factors to 87.1 p.c versus 75.6 p.c in February (see third chart). The index is transferring again in direction of the current peak of 92.1 in June 2021 and suggests worth pressures are reaccelerating. In the meantime, the provider deliveries index registered a 65.4 end in March, down 0.7 factors from the February consequence. The rise suggests deliveries slowed once more in March and that the tempo decelerated barely.

Demand for the manufacturing sector expanded once more however the breadth of growth has narrowed, suggesting a slower tempo. Labor difficulties, supplies shortages, and logistical issues proceed to hamper the flexibility to satisfy that demand. Whereas there was some modest progress, the interval of normalization has been prolonged by recurring waves of Covid, labor turnover, and employee retirement. The delayed return to normalcy is sustaining upward strain on costs. Latest occasions in Ukraine could also be yet one more supply of disruption and additional delay the return to normalcy.