jetcityimage

Amid very volatile markets, investors should be on their toes and remember that prudent stock-picking will dramatically outperform simply following indices. The major indices have barely gone anywhere so far this year with continued macro turmoil that now includes a developing banking crisis – but individual stocks, particularly in the tech sector, have seen massive shakeups.

It’s a good time, in my view, to re-assess the bull case for Lyft (NASDAQ:LYFT). The #2 player in the ridesharing space in the U.S., Lyft has seen its share price tumble more than 10% year to date, with losses accelerating after the company’s recent Q4 earnings print.

Investors’ key gripe with Lyft, of course, was a rather sour Q1 outlook that showcased much weaker than expected growth. We do have to take a step back and ask ourselves, however: was the negative reaction too much? In my view, a good deal of risk is already baked into Lyft’s decimated share price.

I remain bullish on LYFT stock and am holding onto the stock in my portfolio. Here is my full long-term bull case for Lyft:

- Ridership trends continue to grow. By now, we should recognize that the rideshare market is a “Coke and Pepsi” situation. Most riders don’t have a preferred app, switching between Uber (UBER) and Lyft depending on wait times and prices. Lyft continues to grow active riders as well as revenue per rider; so even if its scale is dwarfed by Uber, it still has a place in the market.

- Rideshare will continue to be the way of the future as car ownership declines. I view the “sharing economy” as a trend that will continue to dominate the next several decades. Especially as supply-demand dynamics shot up the prices of cars during the late pandemic, and as the hassles of car maintenance and parking detract from the appeal of owning a car, more and more younger consumers will opt to forego car ownership and rely on transit or rideshare.

- Diversified modes of transport. Lyft also has Lyft Bikes and Lyft Scooters under its brand, as well as full-on car rentals, diversifying its revenue stream beyond simply rideshare and making Lyft a leader in last-mile transport.

- Focus on profitability. Lyft has boosted its contribution margins (it is known for often being more expensive than Uber; and that shows up in its bottom line), while a focus on opex reductions in the post-pandemic world has also led to tremendous EBITDA gains.

We also can’t ignore the fact that Lyft has sunk to a very cheap valuation. At current share prices just below $10, Lyft trades at a market cap of just $3.73 billion (which is an incredibly low nominal value if we think about the national reach of Lyft’s brand). Note as well that Lyft is down roughly 90% from post-IPO highs above $75.

After we net off the $1.80 billion of cash and $0.80 billion of debt on Lyft’s most recent balance sheet, the company’s resulting enterprise value is $2.73 billion.

Meanwhile, for the current fiscal year, Wall Street analysts are projecting Lyft to generate $4.47 billion in revenue, representing 9% y/y growth. This puts Lyft’s valuation at just 0.6x EV/FY23 revenue.

The market is essentially treating Lyft as a business that can’t continue operating as a going concern – but if we can continue to see upward momentum in adjusted EBITDA, I find it difficult to believe that Lyft can’t recapture a good chunk of its lost value. Stay long here and wait patiently on the rebound.

Despite pessimism, Lyft ridership is still growing

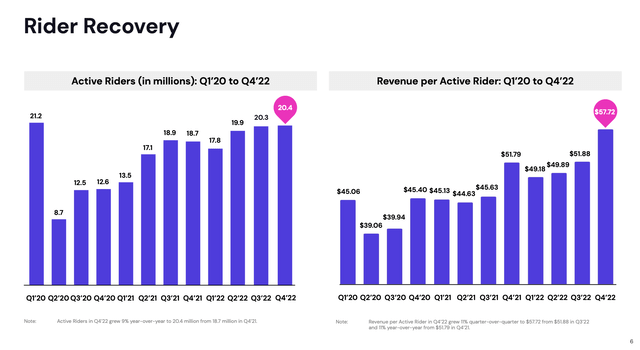

Let’s now dig into Lyft’s latest results and outlook in greater detail. First, take a look at the company’s ridership metrics through Q4.

Lyft rider metrics (Lyft Q4 earnings deck)

The first thing to note: Lyft’s active ridership is not in decline. The company held active riders essentially flat to Q3 at 20.4 million, up 9% y/y. Revenue per active rider also increased to an all-time high of $57.72, up 11% y/y driven by recent price increases.

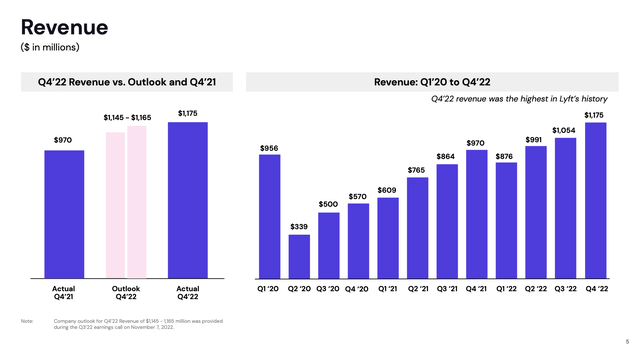

Lyft also hit an all-time revenue record in Q4 at $1.175 billion, up 21% y/y and beating Wall Street’s expectations of $1.15 billion (+19% y/y) by a two-point margin.

Lyft revenue (Lyft Q4 earnings deck)

The issue here is Lyft’s guidance for Q1, which calls for just $975 million in revenue, representing a -17% sequential decay and a deceleration to 11% y/y growth. We note that a sequential decay from Q4 to Q1 also occurred last year, albeit to a smaller -10% degree.

The company is attributing the deceleration in part to a strategic decision to lower prices to remain competitive. Per CEO Logan Green’s remarks on the Q4 earnings call:

Next, I’m going to address our Q1 guidance. There are three factors putting pressure on both revenue and adjusted EBITDA relative to Q4. First, seasonality. As we’ve shared before, our business faces pressures in the first quarter of the year, both in terms of ride share as well as bikes and scooters related to colder weather. Second, prime time is coming down dramatically quarter-over-quarter because of increased driver supply. This reduction in prime time is good for our service levels, but will reduce our Q1 revenue and adjusted EBITDA. Third, base price. In January, we slightly reduced base pricing to remain competitive with the industry. Given the combination of these factors, we anticipate Q1 revenues of roughly $975 million, relative to Q4, this is a decline of approximately $200 million. About one third of the sequential decline is due to seasonality, while the remainder is due to less prime time and lower base prices.

We expect this will result in Q1 adjusted EBITDA between $5 million and $15 million. This is obviously not the level of growth or profitability we are aiming for or capable of, and we are laser focused on driving additional growth and managing costs. Relative to three months ago, the competitive dynamics changed. And the better marketplace balance we see today creates significant opportunities for long term growth. To take advantage of this opportunity and grow the market, we must prioritize competitive service levels. This will impact our 2024 adjusted EBITDA and free cash flow targets. We are assessing the impacts of these changes and are actively reviewing adjustments to the business, including cost cutting measures.”

To me, there’s a good deal of conservatism baked into this forecast. A lot of riders don’t have particular brand loyalty between Uber and Lyft and price-compare between the two apps before taking a ride (myself included). On a personal note, I’ve noticed Lyft prices coming closer to parity or even undercut Uber more often (and have taken more Lyfts as a result) than in the past. There may be a boost in ridership to offset the price decreases in Q1. Note as well that with Lyft’s Q1 guidance at 11% y/y, consensus forecast calling for further deceleration to 9% y/y for the full year feels tremendously light.

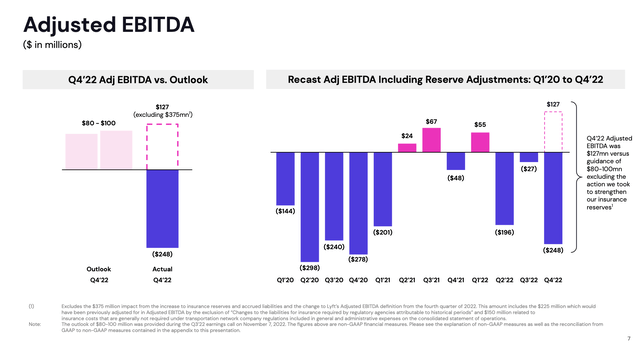

We also shouldn’t ignore Lyft’s improvements in profitability. The company made a decision to boost its insurance reserves this quarter, muddying its profitability metrics, but if we exclude these reserve actions, Lyft’s Q4 adjusted EBITDA was $127 million – well ahead of the company’s guidance range of $80-100 million, and a loss in the prior-year period.

Lyft adjusted EBITDA (Lyft Q4 earnings deck)

Q1 guidance also calls for positive adjusted EBITDA in the $5-$15 million range (which again may prove conservative if ride volumes increase as a result of price drops).

Key takeaways

The opportunity to buy Lyft at <1x revenue is incredibly appealing. I continue to see Lyft as a viable competitor to Uber that will at least continue to retain similar market share while improving profitability. Stay long here.