It was late January and Elon Musk had simply introduced a change of substances at Tesla, the world’s largest electrical automotive firm. Within the tooth of a worldwide provide chain disaster, the agency wouldn’t be releasing any new fashions till a minimum of 2023. However America’s $230bn (£194bn) tech tycoon had discovered one other focus for his consideration. Inside days, he had begun investing giant sums in Twitter shares, to construct a stake that ultimately reached greater than 9%.

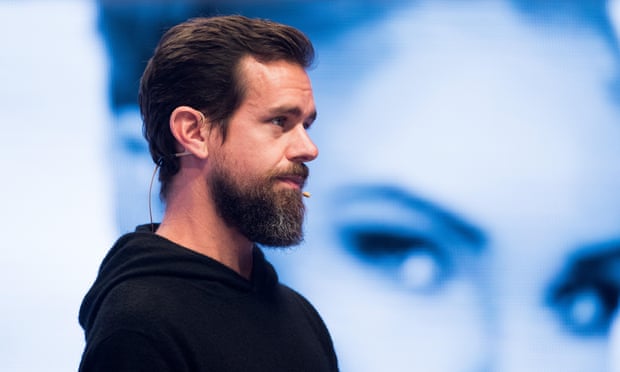

On 26 March, Musk held a dialog along with his outdated pal Jack Dorsey. However this wasn’t a casual catch-up: Dorsey, who co-founded Twitter, had retained a seat on its board and the 2 males, together with one other board member, mentioned whether or not Musk also needs to grow to be a director.

The opposite matter of dialog was the way forward for social media.

It’s a future that now, a minimum of for Twitter, hangs within the steadiness. The platform final week launched a multibillion-dollar lawsuit in opposition to Musk after the entrepreneur walked away from a $44bn settlement to purchase the corporate. In a submitting outlining its declare, Twitter’s authorized crew has given a blow-by-blow account of the occasions that led to the collapse of the deal.

Twitter is asking a courtroom in Delaware to compel Musk to finish the takeover he agreed to in April at $54.20 per share. Within the authorized jargon, it’s in search of “particular efficiency” – a requirement that he full the deal as agreed – and a consensus is forming that Twitter has a powerful case. It’s pushing for a fast listening to in September, with the hope {that a} verdict will come earlier than a deadline to finish the deal on 24 October. On Friday, Musk filed a movement opposing Twitter’s request to fast-track a trial and is as an alternative in search of a date in February subsequent 12 months.

Twitter’s legal professionals haven’t minced their phrases. Their scathing account of occasions provides an inside view of how an unlikely company dalliance between a tweet-from-the-hip multibillionaire and the platform he most likely spends an excessive amount of time on descended into vicious acrimony. The primary paragraph of their lawsuit states: “Having mounted a public spectacle to place Twitter in play, and having proposed after which signed a seller-friendly merger settlement, Musk apparently believes that he – not like each different occasion topic to Delaware contract regulation – is free to vary his thoughts, trash the corporate, disrupt its operations, destroy stockholder worth, and stroll away.”

The doc particulars how, a minimum of from Twitter’s perspective, the connection was difficult from the beginning. After the Dorsey dialog, Musk let Twitter know he was minded to both be part of the board, purchase the corporate or take it personal. Musk then mentioned becoming a member of the board with Twitter’s chief govt, Parag Agrawal, its chairman, Bret Taylor, and a board member – Martha Lane Fox, the British co-founder of Lastminute.com.

Musk was provided a place and accepted in early April. However simply days later, he advised Twitter he wouldn’t be becoming a member of the board. As a substitute, he needed to purchase the corporate. Agrawal revealed the about-turn on 11 April.

On 13 April, Musk outlined his provide to the board and introduced it publicly a day later. In an indication Twitter was not totally joyful about this, it adopted a “poison capsule” defence, designed to cease an undesirable suitor from accumulating a major stake.

It’s at this level within the lawsuit’s account of occasions that Musk’s tweets begin to seem. This string of messages to his 100 million-plus followers is unlikely to assist his case. The doc refers to repeated hints from Musk {that a} “tender provide” – or hostile bid – for the corporate is imminent, together with a tweet that states “Love Me Tender”.

After extra back-and-forth, a deal settlement was drawn up and the board beneficial the provide to shareholders regardless of, because the lawsuit states, misgivings: “Twitter had been buffeted by Musk’s reversals earlier than.” There have been extra side-winds to return.

Musk started to get chilly toes, the lawsuit claims, because the markets turned in opposition to tech shares. Their provide of losses now however excessive returns sooner or later started wanting much less engaging as the worldwide financial system wobbled and rates of interest rose. The ensuing selloff drove down share costs, affecting the worth of not simply Twitter however Tesla, whose inventory was a key supply of deal financing for Musk.

Presently, Musk started asking questions in regards to the variety of spam accounts on Twitter, which the corporate has all the time insisted symbolize lower than 5% of a each day energetic consumer base that stands at 229 million folks.

Within the lawsuit, Twitter claims that the tanking markets dovetail with the sudden emergence of a stumbling block on Musk’s facet in early Might. “Because the market (and Tesla’s inventory value) declined, Musk’s advisers started to demand detailed details about Twitter’s strategies of calculating mDAU [monetisable daily active users] and estimating the prevalence of false or spam accounts.” Not lengthy after, on 13 Might, Musk tweeted that the deal was “temporarily on hold” over the spam concern, and his willingness to finish the transaction nosedived after that.

Twitter deal quickly on maintain pending particulars supporting calculation that spam/faux accounts do certainly symbolize lower than 5% of usershttps://t.co/Y2t0QMuuyn

— Elon Musk (@elonmusk) May 13, 2022

Twitter says it was stunned by Musk’s declaration the deal was quickly on maintain however had an inkling within the days operating as much as it when his bankers at Morgan Stanley had circulated an agenda for a gathering with Twitter that included the query: “How do you estimate that fewer than 5% of mDAU are false or spam accounts?”

After the shock tweet went up, there was a authorized scramble: Twitter’s deal counsel referred to as Musk’s deal counsel. Two hours later, Musk belatedly tweeted that he was nonetheless “dedicated” to the deal. However he couldn’t assist himself. Days later he tweeted a poo emoji at Agrawal in response to an extended Twitter thread by the chief govt explaining the spam concern. The tweet inevitably seems within the lawsuit as a part of Twitter’s argument that Musk himself breached the settlement by repeatedly disparaging the corporate and its staff.

From there it appeared inevitable that on 8 July, Musk’s legal professionals would write to Twitter declaring that he was terminating the deal. Within the lawsuit, Twitter particulars “a number of” makes an attempt to satisfy Musk and clear up the spam concern. A gathering by no means occurred.

Howard Fischer, a accomplice at New York regulation agency Moses & Singer, says Twitter’s case has a powerful probability of succeeding, partially due to Musk’s behaviour. “Whereas courts are usually reluctant to order particular efficiency in these contexts, this is perhaps one of many uncommon situations to justify that treatment.”

Within the termination letter, Musk put ahead three broad arguments: that Twitter had breached the settlement by failing to offer sufficient data on spam accounts; that it had misrepresented the variety of spam accounts in its disclosures to the US monetary watchdog; and that it had breached the settlement by failing to seek the advice of with him when firing senior staff just lately.

The lawsuit rebuts these one after the other, arguing that Twitter “bent over backwards” to reply to all data requests; that there isn’t any proof it has misstated spam numbers; and that it contacted Musk’s legal professionals in regards to the firings, which had been within the regular run of enterprise anyway and acquired no objection.

Anat Alon-Beck, a regulation professor at Case Western Reserve College in Ohio, says Delaware case regulation signifies Twitter has a powerful hand. She says considered one of Musk’s key arguments, that Twitter’s spam concern represents a “firm materials opposed impact” that considerably alters the corporate’s worth, can be exhausting to substantiate. “I feel that Twitter has the higher hand right here, in response to Delaware case regulation,” says Alon-Beck.

Twitter’s shares rose 9% final week to $37.74, reflecting traders’ perception that it has a superb case. But it surely nonetheless leaves the prospect of an organization forcing a suitor it doesn’t like to purchase an organization he doesn’t need.

Timeline

Elon Musk’s bid for Twitter

Present

Key dates within the Tesla billionaire’s marketing campaign to realize management of the social media large

Stake-building

Elon Musk begins shopping for shares in Twitter

Preliminary talks

Musk discusses becoming a member of the Twitter board with two administrators, together with co-founder Jack Dorsey

The stake revealed

Musk discloses a stake of greater than 9% in Twitter

Engagement with the board

Twitter says Musk will be part of the corporate’s board

First indicators of a bid

Twitter says Musk won’t be becoming a member of its board, because the Tesla boss prepares a takeover

The bid

Musk provides $54.20 a share for Twitter, a 38% premium to Twitter’s 1 April closing value

‘Poison capsule’

Twitter adopts a “poison capsule” defence, which prevents a suitor from build up a major shareholding, to guard the corporate from an unsolicited takeover

Funding

Musk publicizes he has lined up $46.5bn in financing for the deal

Acceptance

The Twitter board accepts Musk’s provide

Tesla belongings

Musk sells Tesla shares value greater than $8bn to finance the takeover

Backers be part of the bid

Musk discloses that he has secured $7.1bn in funding for the bid from a bunch of traders, together with the tech tycoon Larry Ellison

Dorsey mulls stepping down

Dorsey says he won’t return as chief govt after the takeover

Deal on maintain

The slide in the direction of termination begins. Musk says the Twitter deal is on maintain pending assessment of spam and faux accounts. He later tweets that he stays dedicated to the deal.

Boardroom stress

Twitter traders vote in opposition to re-electing a Musk ally to the board

Twitter traders get indignant

Musk is sued by Twitter traders for inventory ‘manipulation’

Musk alleges ‘materials breach’

Musk threatens to stroll away from the deal if Twitter fails to offer knowledge on spam and faux accounts, accusing the corporate of a ‘materials breach’ of the deal settlement

Deal is off

Musk says he’s terminating the deal

Twitter sues

Twitter sues Musk over his termination of the deal and asks a courtroom to implement the transaction

Musk objects to trial date

Musk recordsdata a movement in Delaware opposing Twitter’s request to fast-track a trial over his termination transfer

Based on one observer, Twitter’s board is being compelled by its obligation to shareholders and the truth that it’s unlikely to discover a higher provide elsewhere. Drew Pascarella, a senior lecturer on finance at Cornell College, says: “Twitter shareholders, as with all proprietor of any firm, are entitled to obtain the utmost worth for his or her shares. The cope with Elon was for $54.20, which is, in July of 2022, an outrageous value.”

The US monetary watchdog can be wanting on the state of affairs. Final week Musk’s legal professionals revealed that the Securities and Alternate Fee (SEC), which has already requested questions on how Musk disclosed his Twitter shareholding, has come again with additional questions on his disclosures associated to the deal.

Robert Frenchman, a accomplice at New York regulation agency Mukasey Frenchman, says strain from a extra aggressive SEC is clearly constructing.

“The SEC has been taking a look at this since Musk began accumulating his place and didn’t do all the things proper. They’ve their toehold and I feel they may proceed to have a look at whether or not his regulatory disclosures are in line with the general public statements he has been making about Twitter,” he says.

He provides {that a} nice is the most probably punishment if Musk is discovered to have made errors in submitting and amending his 13D – a type that an investor is required to file once they take a shareholding of greater than 5% in a listed enterprise – or is discovered to have violated different SEC rules.

However, as Frenchman says: “I don’t suppose Elon Musk lies awake at evening worrying about SEC fines.”