Kannan D

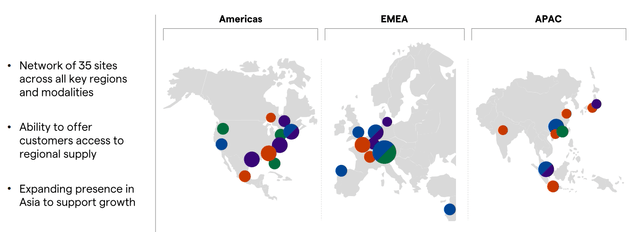

Our most devoted readers know that on the Mare Lab now we have a candy spot for the pharmaceutical sector. The healthcare earnings season seems constructive and up to now has proven strong and resilient numbers. We already commented on Roche and Novartis’ Q2 efficiency, in the present day we provoke protection on Lonza Group AG (OTCPK:LZAGY). The corporate delivers its merchandise because of 4 divisions within the pharmaceutical, vitamin, and biotech markets throughout the globe. The corporate operates its actions because of 35 manufacturing websites and its gross sales are break up into three areas: EMEA, APAC and AMER respectively representing 40%, 13%, and 47%. Lonza is headquartered in Switzerland and was based in 1897.

Lonza manufacturing websites

Supply: Lonza Capital Market Day 2021

Earlier than shifting on with the particular firm feedback, our inner workforce believes that healthcare valuations stay engaging within the medium time period with earnings development at double-digits. The pharmaceutical sector is defensive and never cyclical and can be one of many best-positioned because of the secular alternative development traits. Lonza’s exercise in genetic applied sciences is solely a unbelievable instance of that.

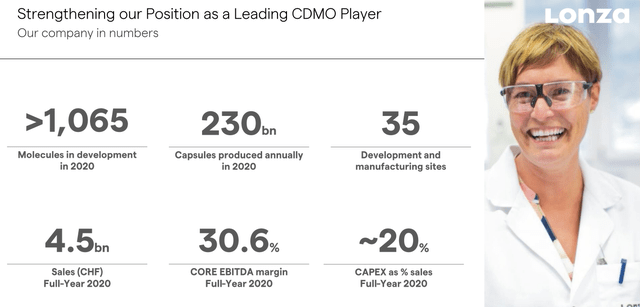

Lonza at a Look

Supply: Lonza Capital Market Day 2021

Why are we constructive?

- New pharmaceutical merchandise and better analysis and growth funding will help income development for contract growth and manufacturing (‘CDMO’). After having analyzed an important pharmaceutical corporations in Europe and within the USA, we consider that the robust pipeline actions will additional increase Lonza’s earnings over the short-medium time period;

- CDMO settlement construction normally mitigate inflationary strain traits, extra intimately, third-party inputs are immediately delivered to Lonza’s facility and are expensed by the identical shopper;

- Lonza has a restricted COVID-19 publicity. Wanting on the 2021 outcomes, we see that annualized prime line gross sales had been at CHF 100m, roughly 2% of the whole income;

- APAC income traits and future funding within the area,

- We appreciated the truth that Lonza has a diversified clientele and product base. Wanting on the capital market day, we see that the highest 10 prospects signify 38% of the corporate’s top-line gross sales.

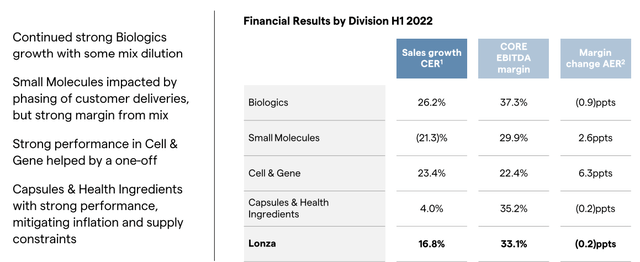

Feedback on Q2 Outcomes

Lonza’s half-year outcomes had been impacted by some confusion associated to a CDMO contract termination. In the course of the name, this was quantified in CHF 90 million in gross sales with an EBITDA influence of just about CHF 60 million. Our inner workforce believes that this was because of the unfavorable consequence of lirentelimab’s late-stage growth. Fee termination is just not information throughout the sector, however extra importantly, Lonza defined that has no concern in re-sell the manufacturing facility given the numerous demand within the sector. In the course of the Q&A, a selected query on EPS development was raised, however Lonza’s administration affirm the non-financial influence. Wanting on the unfavorable information, within the first half-year, the corporate misplaced nearly CHF 20 million in EBITDA stage within the Small Molecules division. This was as a consequence of provide chain constraints however it’s anticipated to be offset within the second half of the 12 months.

In regards to the Q2 outcomes, the Swiss CDMO big delivered a strong set of numbers. Income was up by nearly 17% at CER with a 4% outperformance in comparison with Wall Road analyst expectations. This was pushed by biologics and Cell & Gene division. The core EBITDA grew by 16.5% to CHF 987 million with a margin of 33.1% in comparison with the 33.3% recorded within the 2021 first half 12 months. There was a one-off influence because of the LSI disinvestment that was recorded within the company revenues.

Lonza Q2 Outcomes

Supply: Lonza Q2 Outcomes

Conclusion and Valuation

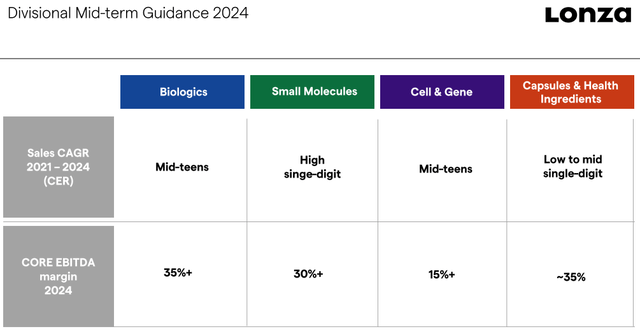

As already talked about, there was a distraction over the CDMO contract termination, however the firm affords constructive fundamentals and the CEO reaffirmed the corporate’s steerage. Our inner workforce forecast a powerful business demand particularly within the biologics division, coupled with an outstanding marginality. In comparison with the worldwide CDMO opponents, the Swiss firm is presently buying and selling in step with the 2023 worth/earnings ratio, however with a 20% low cost on EV/EBITDA. We consider that this isn’t justified and primarily based on the P/E, we’re valuing Lonza at CHF 650 per share versus the present inventory worth of CHF 538. Dangers to our goal worth are: LSI proceeds, foreign money results, greater value of capsules, and the continued fuel emergency in Europe that may translate into much less pharmaceutical manufacturing from Lonza’s prospects.

Lonza Steering

Supply: Lonza Capital Market Day 2021

Mare Proof Lab’s newest EU Pharma protection:

- Sanofi: Count on worth appreciation going ahead

- AstraZeneca: Our subsequent worth choose

- Grifols: Quick-Time period Turbulence However Lengthy-Time period Upside